GameStop: Progress Isn’t Enough To Justify Catching This Falling Knife

Summary:

- GameStop’s stock has plummeted 21.4% since September and 82.9% since January 2021, while the S&P 500 has risen.

- The company’s revenue has declined, with weakness across all major product categories, including hardware, accessories, and collectibles.

- Despite cost reductions and improved profitability metrics, GameStop’s cash flows are not enough to justify its current market value, warranting further downside.

Scott Olson

As an investor, it’s imperative to separate your own personal feelings and biases from objective reality. Let’s take, as an example, video game retailer GameStop (NYSE:GME). Although I no longer play video games, I have a long personal history with GameStop. I remember each year, for instance, waiting outside for the midnight release of the latest Call of Duty title. And I remember sifting through the games on its shelves to see what kind of fun opportunities the retailer offered up. Back in those days, before the rise of DLC (downloadable content), it looked as though the company would be the dominant player in the video game retail space forever.

Unfortunately, those days are long gone. And while I remain nostalgic about those fun times, I cannot for the life of me turn bullish on its stock. Since I last reiterated my ‘sell’ rating on the stock back in early September of this year, shares have plummeted 21.4% at a time when the S&P 500 has risen by 2.2%. But the picture is even worse. Since I first rated it a ‘strong sell’ in January of 2021, shares are down a whopping 82.9% while the S&P 500 has jumped 21.3%.

At first glance, you might think that my mind should change on the matter. After all, the stock has fallen significantly. The company has a significant amount of cash in excess of debt. And, in the third quarter earnings release for the company’s 2023 fiscal year that came out on December 6th, it became clear that the firm is now at a breakeven point. But for all the progress the firm has made on the cost side of the equation, it continues to struggle with revenue. Add on top of this just how much cash flow the company would need to generate to justify the $4.53 billion market value of the stock or the $3.35 billion enterprise value, and I do believe that further downside is warranted from here.

When improvements aren’t enough

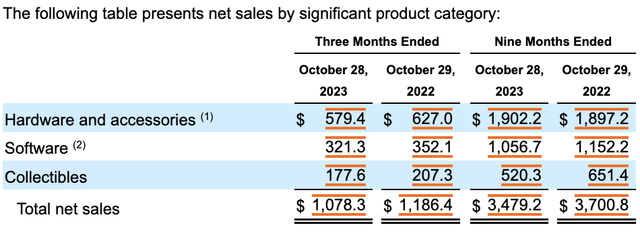

To start with, we should cover the most recent revenue data that management reported for the third quarter of the company’s 2023 fiscal year. During that quarter, sales came in at $1.08 billion. This represents a decline of $108.1 million, or 9.1%, compared to the $1.19 billion the company generated one-year earlier. It’s also, unfortunately, around $103 million lower than what analysts were expecting for the quarter. This drop in revenue came about because of weakness across all of its major product categories. For instance, hardware and accessories sales plummeted 7.6% from $627 million in the third quarter of last year to $579.4 million the same time this year.

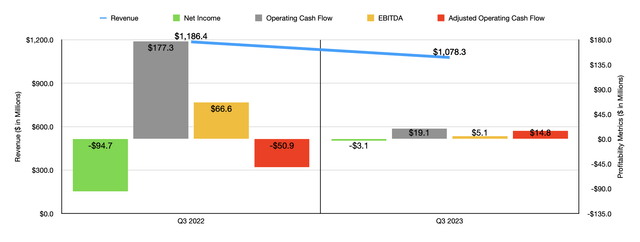

Author – SEC EDGAR Data

This wasn’t the only area where revenue weakened. Collectibles revenue, for instance, dropped a hefty 14.6% from $207.3 million to $177.6 million. To be honest with you, while I recognized the potential that the collectibles category offered, I never viewed it as a major initiative for the company. What I have viewed as its one hope for true success is the software side of the business. This includes sales not only of new and pre-owned gaming software, but also of other types of digital software and PC entertainment software. Not only are software sales typically higher margin, they also have the potential to continue growing even as the company’s physical footprint continues shrinking.

GameStop

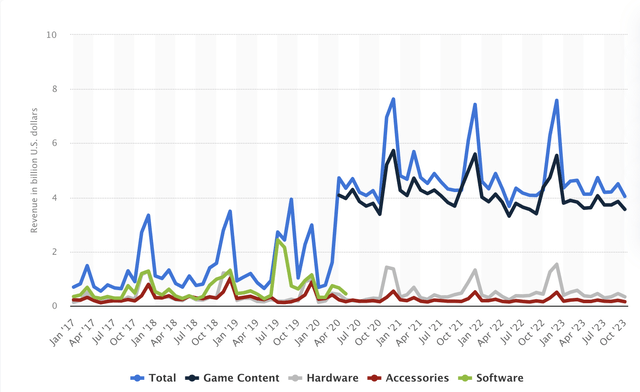

Sadly, software revenue was hit rather hard as well. During the quarter, it came in at $321.3 million. This is down 8.7% year over year. Of course, this is not something that is specific only to GameStop. The industry is currently experiencing some weakness. As an example, for the month of October, software sales in the US came in 18.5% lower than they did the same month last year. Meanwhile, hardware sales dropped 23.3% on a year-over-year basis. So relative to the industry more broadly, our prospect seems to have done alright.

Statista

Generally speaking, you would be right to expect a decline in revenue to bring with it a decline in profits. However, management has done really well in keeping costs down. This is evidenced by the fact that the company generated a net loss of only $0.01 per share. This compares to the $0.31 per share loss generated one year earlier, but it was below the $0.20 per share profit the analysts were hoping for. As of the end of the most recent quarter, the company’s gross profit margin was 26.1%. That’s up from the 24.6% seen one year earlier. Management attributed much of this improvement to a reduction in freight costs that it said were driven by cost optimization policies. Meanwhile, the companies selling, general, and administrative costs, dropped from 32.7% of revenue last year to 27.5% this year. That, management said, was driven by a plunge in marketing costs, as well as consulting service costs, labor related costs, and more. Store closures also resulted in $8.5 million in reduced expenses during the quarter.

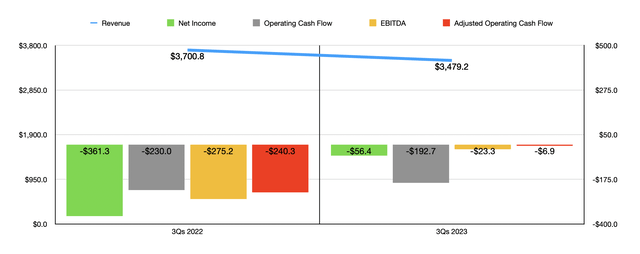

Author – SEC EDGAR Data

At the end of the day, these improvements resulted in a net loss of $3.1 million. That’s far better than the $94.7 million net loss generated in the same quarter of 2022. Other profitability metrics largely followed suit. The one exception was operating cash flow, which dropped from $177.3 million to $19.1 million. But if we adjust for changes in working capital, we get a jump from negative $50.9 million to positive $14.8 million. Meanwhile, EBITDA for the business went from negative $66.6 million to positive $5.1 million. As you can see in the chart above, this year as a whole is now looking up relative to last year as a whole, with the exception of course of revenue.

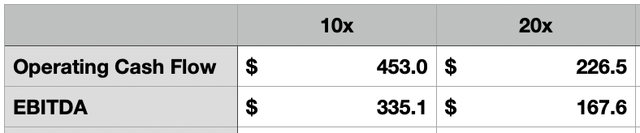

As for the rest of the year, we don’t really know what to expect. But even with the results seen so far in 2023, the company will be lucky to be cash flow neutral. This poses a problem because it makes it really impossible to truly value the enterprise. But what we can do is see what kind of cash flows would be needed in order for the company to be at least fairly valued. It’s difficult to imagine a retailer that is struggling justifying a price to operating cash flow multiple or an EV to EBITDA multiple of 10 or higher. But in the table below, you can see a scenario not only for that kind of multiple, but also for a multiple of 20. In both cases, you can see what kind of cash flows we would need in order for the business to be fairly valued at that point. All of these look to be quite a bit off compared to what the company is achieving right now.

Author – SEC EDGAR Data

Takeaway

Perhaps the only great thing going for GameStop besides the fact that earnings were virtually flat and cash flows were slightly positive is the fact that the company has cash in excess of debt that totals $1.18 billion. That does give it a great deal of wiggle room. Having said that, the retailer seems to still be struggling tremendously during these times and it’s unclear whether cash flows can ever truly stabilize. Absent some major improvement that pushes cash flows comfortably into positive territory, I would say we would need to experience downside of at least another 30% to 50% before an upgrade on the stock would be even remotely possible. So because of that, I have decided to keep it rated a ‘sell’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.