Summary:

- GameStop is set to report 1Q 2023 earnings on 7 June, with analysts predicting somewhat better results compared to the same period a year ago due to cost-cutting measures.

- However, the company’s revenue is not expected to change substantially, and its current valuations are unlikely to be justified by the earnings report.

- Despite some positive developments, GameStop’s long-term prospects remain dubious, and its stock is considered overvalued.

jetcityimage/iStock Editorial via Getty Images

This article is an update of my earlier analysis of GameStop (NYSE:GME), the video game seller. Earlier on I wrote that its stock price surge had no fundamental reasons behind it. Now the company is set to report its 1Q 2023 earnings results on 7 June. Analysts expect GME to report results that are somewhat better compared to the same period a year ago. GameStop’s management cut the costs. So, the quarterly loss will be lower. But the company’s revenue will not change substantially, many analysts predict. Although there were some positive developments, GameStop is unlikely to report very good earnings so as to justify the current valuations.

Analysts’ expectations

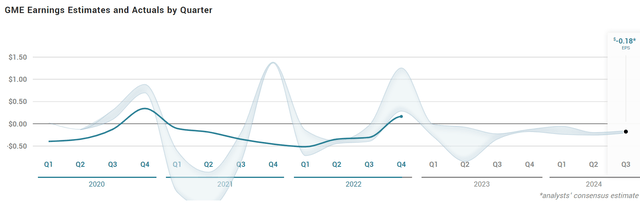

The table below shows analysts’ 1Q 2023 earnings estimates. On the surface GameStop’s expected earnings look quite poor but roughly in line with what the company usually reports.

On average many analysts think GME’s EPS will total ($0.16).

|

Quarter |

Number of estimates |

Low estimate |

High estimate |

Average estimate |

|

Q1 2023 |

2 |

($0.30) |

($0.02) |

($0.16) |

Prepared by the author based on Marketbeat’s data

The graph below shows the company’s forecasted EPS (in light blue) and actual EPS (in dark blue). Most of the time, however, the predictions were too far-fetched. But to be sure, GME has not been very profitable in the past 3 years. Only 4Q2020 and 4Q2022 were the company’s bright spots. The reason for the reasonably good 4Q results was the fact the demand for GameStop’s products is seasonal. It is particularly high just before Christmas when consumers rush to buy presents for their loved ones.

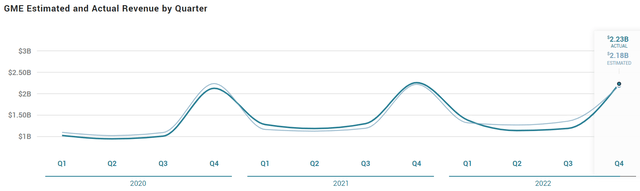

But still, on average, there has not been much revenue growth in the recent several years. The analysts’ sales estimates for GME were very accurate. According to some Wall Street players’ forecasts, the company would report a sales figure of $1.36 billion for the past quarter. This is quite an average result for GameStop and looks realistic.

Now let me talk to you about the recent developments and how likely GameStop would report the expected results. I will also go through my original thesis about the company.

Recent developments

Earlier on I wrote the company was able to meet its near-term financial conditions but its free cash flow and earnings indicators were not so brilliant. I also said it was irrational to buy GameStop’s shares just because of its meme stock reputation. Its stock was also far too expensive as of the time of writing. However, it was too dangerous to short-sell it as well simply because of some market players’ close attention to it. For example, when the 4Q 2022 earnings were released and GameStop managed to break even and make a profit, its stock price surged by almost 50% immediately after the results announcement. In other words, market moves can be irrational and unpredictable. And short-sellers are normally taking on too many risks.

My earlier thesis still remains intact but I would like to mark a few positive developments in GameStop’s business. When the company reported 4Q 2022 results, its costs fell. GME’s selling, general, and administrative expenses were $453.4 million compared to $538.9 million in the prior year’s fourth quarter. The inventory levels decreased as well, which is a substantial cost saving. At the close of 4Q 2022, the inventories were $682.9 million, compared to $915.0 million at the close of the previous year’s fourth quarter. As part of the cost-cutting initiative, GameStop also made some of its workers redundant. All that looks good on the surface. After all these changes will reflect positively on GameStop’s next earnings release. However, reducing its workforce and decreasing its inventory levels disallow the company to increase its revenues in the long term.

Moreover, cost reductions do not automatically lead to higher demand for GME’s products. According to the Q4 earnings call, the management “found efficient ways to improve shipping times, integrate online and in-store shopping experiences and establish a culture of increased incentivization amongst store leaders and tenured associates.” However, GameStop is still a traditional retailer in spite of its efforts to sell goods online. Brick-and-mortar retailers are struggling these days because most consumers play video games online. Just in case they need to buy a hard disc with video games, they would most probably order it on Amazon (AMZN) or another e-commerce platform. Not particularly successful was GameStop’s effort to expand into the NFT and digital currency space in 2021-2022. It even had to roll back such measures.

Anyway, it is likely GameStop would not report much better earnings than expected by analysts. First of all, there was no high seasonal demand for video games in the first quarter. After all, it was not a shopping season, unlike 4Q. The recent cost reductions would indeed stay in place. However, they are not so big as to make the net earnings soar. So, I do expect the results to be quite average for the company.

Risks

It is often a bad idea to speculate on a stock just because of its earnings forecasts. In the case of GameStop, the expectations are by no means capital. So, I do not personally think there will be a large stock price surge the way it was after the 4Q 2022 results announcement. Investors are often far better off investing for the long term. However, in the long term, the prospects for GameStop are dubious. The management’s cost-cutting initiatives and its business innovations should be taken with a grain of salt. The demand for video games has been declining for a few months already. This trend might well continue in the near term. The stock is also trading far above its pre-mania valuations.

Yet, short sellers might end up losing money for the following reasons:

- The management will come up with new ideas to make the sales soar.

- More cost-cutting measures will be taken.

- The demand for video games will surge.

- There will be no recession in the US. So, most asset prices will rise.

- Some speculators would actively start buying GME stock the way they did between 2020 and 2021.

Therefore, like most of my fellow Seeking Alpha contributors I am rather pessimistic about GameStop but see reasons why short-selling GME might not work well enough.

Valuations

Let me talk to you about the company’s current valuations as well.

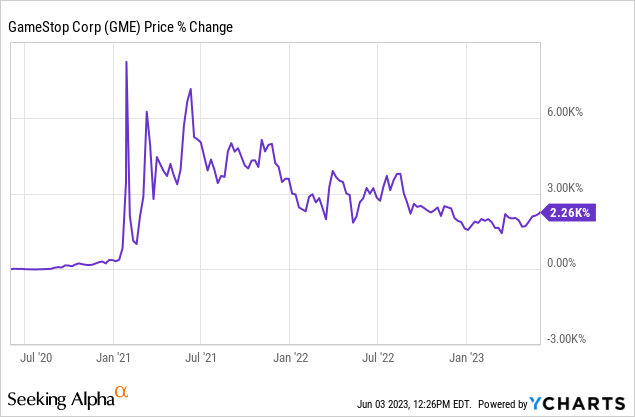

As I have mentioned before, the mania for meme stocks between 2020 and 2021 made the GME shares surge. Without going into too much detail, I decided to present GameStop’s stock price history. In the graph below you can see the percentage change for the past 3 years. It totaled 2,260%! No, it is not an exaggeration and the fundamental factors have not improved much. GameStop is still a loss-making company.

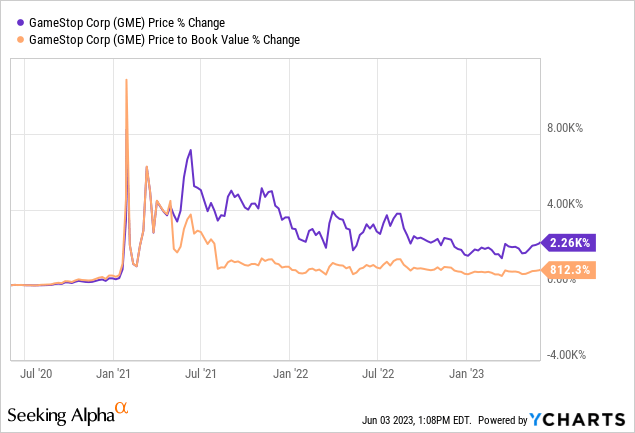

But let me also judge the company’s value according to some fundamental valuation multiples. Again, I decided to see how the valuation ratios changed in percentage points to make the whole picture look clearer. The price-to-earnings (P/E) ratio was not applied because the company is loss-making right now.

At the moment the price-to-book (P/B) ratio is off its all-time highs. But still, it is up more than 800% compared to where it was 3 years ago. Not very good value for money, indeed.

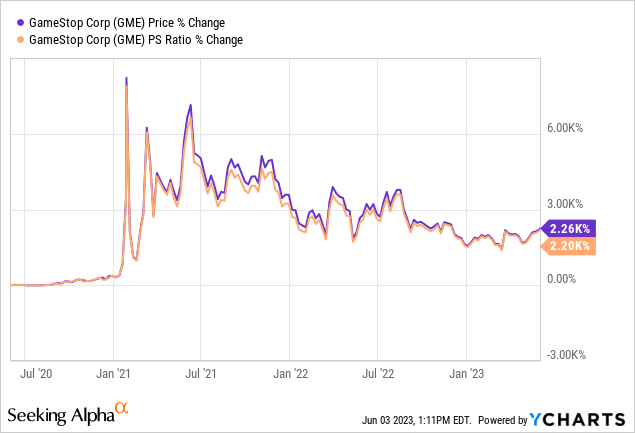

I also decided to use the price-to-sales (P/S) ratio and also to see how much it changed in percentage points.

The graph also shows the P/S change was incredible and absolutely proportional to its stock price.

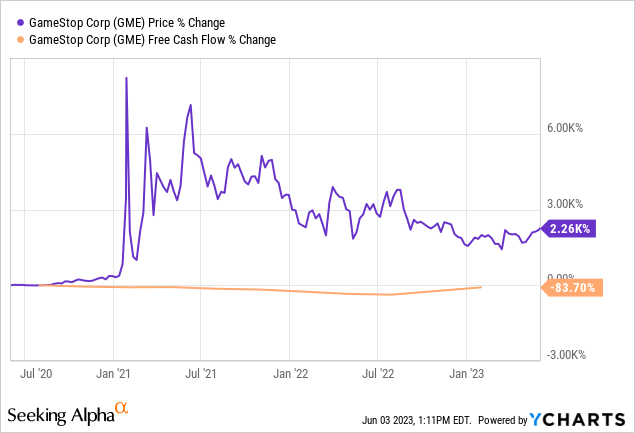

I also decided to compare the company’s free cash flow to its stock price. Funnily enough, the stock price surged incredibly in the past several years, whilst the free cash flow declined by more than 80%.

So, we can safely say GME stock is not good value for money.

Conclusion

GameStop is set to report its quarterly earnings results on 7 June. My base-case scenario is that the earnings results will not be impressive but rather average. The demand for video games was not very high in the past quarter and the management did not come up with any substantial innovations. But the cost cuts will not probably allow the company to come up with a very high loss. I would not personally recommend investors buy the stock just before the earnings report.

Overall, I am skeptical about GME stock but would not suggest short-selling it either because of its very high volatility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.