Summary:

- GameStop’s financial results for Q2 2023 exceeded expectations, causing a 4% increase in share price in after-hours trading.

- The increase in revenue was driven by strong software sales, likely due to the release of The Legend of Zelda: Tears of the Kingdom.

- However, revenue from collectibles dropped by 23.9%, offsetting some of the positive performance.

- Problems still persist and it’s hard to imagine a scenario where the company becomes even fairly valued.

Scott Olson/Getty Images News

I am always amused when I see companies that have incredibly poor financial performance get rewarded from a share price appreciation perspective just for exceeding analysts’ forecasts. It would be a different story entirely if the firms in question were showing a true and sustained recovery. But for businesses that are almost certain to see their financial performance continue to worsen in the long run, it makes no sense to me why a temporary blip of good news should cause their stock to pop higher. One great example of this that I could point to involves video game retailer GameStop (NYSE:GME). After announcing financial results covering the second quarter of the firm’s 2023 fiscal year, results that exceeded forecasts on both the top and bottom lines, shares rose nearly 4% in after-hours trading. Although the development was positive on the whole, this does not change my view that the company is still in a great deal of pain.

Rewarded for a decent quarter

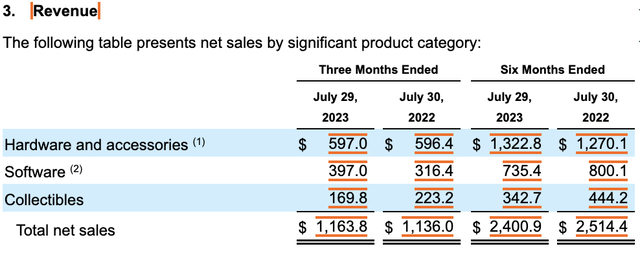

After the market closed on September 6th, the management team at GameStop reported financial results covering the second quarter of the company’s 2023 fiscal year. On the top line, revenue came in at $1.16 billion. This represents a year over year increase of 2.4% compared to the $1.14 billion the company reported one year earlier. In addition to this, it also exceeded analysts’ forecasts by $20 million.

This increase in revenue was driven mostly, according to management, to strong software revenue. Sales under this category jumped 25.5% from $316.4 million in the second quarter of last year to $397 million the same time this year. This rise was primarily caused by what management called a ‘significant software release’. However, they did not disclose what release that was. Initially, I thought it might have been Final Fantasy XVI, which came out in June of this year and quickly sold 3 million units. But upon digging deeper, the likely culprit is The Legend of Zelda: Tears of the Kingdom. A Nintendo based game, it came out earlier this year and has quickly sold 18.51 million units. Besides these two, I did not see any releases that were of the magnitude necessary to create this kind of sales jump. Realistically, the company probably benefited from both, with the latter leading the way.

Management also attributed some of the sales increase to high hardware revenue. It is true that hardware and accessories sales managed to increase year over year. But that increase was small, taking revenue from $596.4 million last year to $597 million this year. There does still seem to be some hype centered around some of the newer game consoles that are on the market. My concern, however, is that sales here will eventually decline once these devices hit market saturation. And because there can be many years between the release of one console and another, the temporary bump the company is enjoying on the hardware side is probably not going to be seen again for some time.

Offsetting a lot of the strength that GameStop enjoyed was a plunge in revenue associated with collectibles. This was once viewed as a bright spot for the company, serving as a way for the firm to differentiate its revenue stream. But recently, it has proven to be problematic. Revenue associated with collectibles in the most recent quarter was $169.8 million. That is 23.9% lower than the $223.2 million the company generated one year earlier. Unfortunately, I could not find any specific data that gives us more insight into this drop. Unlike in other quarters, the management team at the video game retailer elected not to have an investor call. And the company has been quite vague, even in its 10-Q filing.

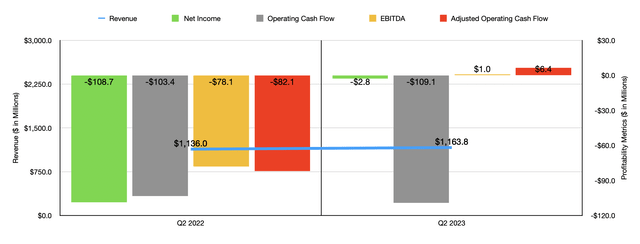

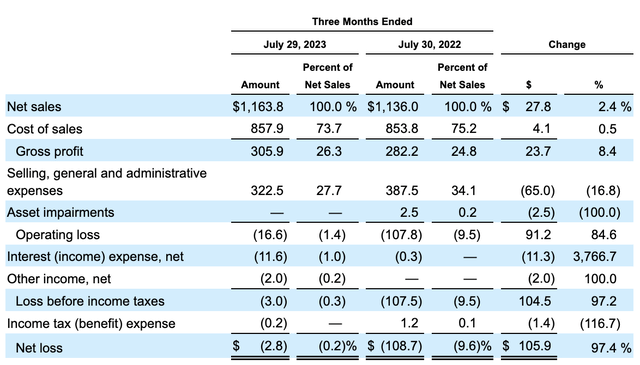

On the bottom line, management also exceeded expectations. The business generated a loss per share of $0.01. That ended up being $0.16 per share better than what analysts thought it would be. And it also dwarfed the $0.36 per share loss that the company reported for the second quarter of 2022. On an adjusted basis, the company had a loss of $0.03 per share, beating expectations by $0.11 per share. The loss the company reported on a per share basis translated to an overall net loss of $2.8 million. This was far better than the $108.7 million that the company lost in the second quarter of 2022. And what’s really interesting is that this came about even though the business booked a $4.3 million restructuring charge in the second quarter of this year that was associated with its European operations.

There ended up being three primary drivers behind this improvement besides just the increase in revenue. For starters, the company saw an $11.3 million swing in the positive in the form of interest income that it booked for the quarter. You see, the company has cash in excess of debt that totals $1.16 billion. So instead of having to pay interest on a net basis, it is putting that capital to use elsewhere. And with interest rates higher, that is bringing in nice chunk of capital for the enterprise. The other improvement came from the company’s gross profit. Its gross profit margin increased from 24.8% to 26.3%.

Even though this may not seem like a significant change, when applied to the revenue reported in the third quarter alone, it translates to an extra $17.5 million in pre-tax profits. Management chalked this up mostly to higher sales of hardware that bring with them higher margins. I would also wager that the margin on software is quite significant. The last improvement was even greater than this, with selling, general, and administrative costs falling from 34.1% of sales to 27.7%. This difference, when applied to the revenue generated in the second quarter alone, would have translated to $74.5 million of additional pre-tax profits for the company. That improvement was largely driven by a reduction in labor related and consulting service costs as the company worked to optimize its operations.

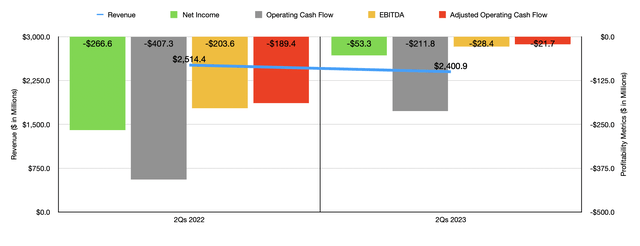

Investors who are bullish about the company can rightfully point out that this level of profits nearly gets us to break even. From a cash flow perspective, the picture is even better. During the quarter, GameStop went from generating operating cash flow of negative $103.4 million to negative $109.1 million. But if we adjust for changes in working capital, it went from negative $82.1 million to positive $6.4 million. Meanwhile, EBITDA for the company went from negative $78.1 million to positive $1 million. Also, for context, I included the chart above, which shows financial results for the first half of this year relative to the same time last year. Even though sales were strong in the second quarter relative to the same time last year, sales for the first half of the year in its entirety are still down 4.5%, while cash flows are still materially negative.

Even though GameStop is showing signs of improvement on both its top and bottom lines, the company looks far from being even close to fairly valued. In the table below, for instance, you can see a few hypothetical scenarios from both an adjusted operating cash flow perspective and from an EBITDA perspective. You can see what kind of cash flow the company needs to generate in order to trade at multiples over these metrics of between 10 and 30. Realistically, a retailer in an industry that is continuing to transition away from all things physical to all things digital probably should be trading at the lower end of this range. But even if the firm were to trade at a price to operating cash flow multiple of 30, it would need to see its cash flow come in at $190.5 million annually and it would need to see its EBITDA come in at around $151.8 million. If the company was investing in something cutting edge, maybe we could expect it to get back to that point. But even its crypto adventures have proven to be immaterial to the business. In fact, in November of this year, it is even closing its GameStop Wallet because of regulatory uncertainty in the cryptocurrency space.

| Multiple | 10x | 20x | 30x |

| Price / Adjusted Operating Cash Flow ($ in Millions) | $571.4 | $285.7 | $190.5 |

| EV / EBITDA ($ in Millions) | $455.4 | $227.7 | $151.8 |

Takeaway

Based on the data provided, I must say that GameStop did perform better than I expected it would. However, I continue to be perplexed by the market’s reaction to positive developments like this. With the exception of the tremendous amount of cash the company has on its books, it doesn’t have anything else materially going for it. And I don’t see that picture changing anytime soon. That is why, even though the stock has fallen 12.6% at a time when the S&P 500 has jumped 4% since the last time I wrote about it, I cannot help but to keep it rated a ‘sell’ at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!