Summary:

- GameStop still faces sizable fundamental issues.

- Another short squeeze is unlikely due to the resistance levels that the stock would need to surpass.

- The stock is oversold and has strong seasonality tailwinds, which could potentially lead to a rally if the earnings report is well received.

Michael M. Santiago/Getty Images News

Former meme stock darling GameStop (NYSE:GME) is due to report earnings again. The last time I covered GameStop, the stock had plummeted into the Q3 earnings release, and I upgraded the stock from sell to hold. That was several months ago, and we’ve seen big rallies, but most recently, an enormous decline. Technically, there’s a relatively mixed picture, but fundamentally, I still think this company has a lot of issues. The rally we’ve seen in the past few days looks like an oversold bounce to me, so I’m leaving GameStop at a hold rating ahead of earnings next week.

There is still no short squeeze coming

Given the history with GameStop, and the still-large short interest of 19%, there are those who are looking for short squeeze round two. I’ll start the technical analysis part of this by saying I think another short squeeze is extremely unlikely. I’m not saying zero, but I’m saying extremely unlikely.

The reason is because the level that GME would need to hit in order to put most shorts underwater – and therefore potentially trigger panic buying – is likely above $28. That’s a very long way from here, and there are numerous resistance levels in between here and there. So, if you’re looking at GME, I wouldn’t bother with hoping for a short squeeze, as that seems like nothing more than a lottery ticket at this point.

Now that’s out of the way, let’s take a look at resistance levels.

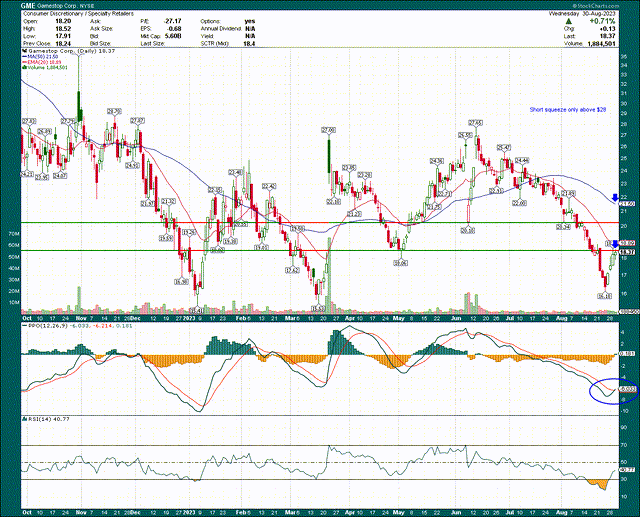

StockCharts

I’ve noted resistance at ~$18, ~$20, and the moving averages on the chart. The stock closed yesterday at both the declining 20-day exponential moving average and the May low that was set earlier this year. This is a consequential resistance level, and traders have a few trading days between now and the earnings report to either push through, or fail that level. Given the rapid ascent into $18 from the August bottom, I’m leaning towards the level failing. But whether that happens or not in the next few days, the important thing here is to mind the resistance levels. With the 20-day EMA and price resistance hitting the same level, it simply makes it more difficult to push through.

Above that, we have price resistance just above $20, and above that, the declining 50-day simple moving average, currently $21.50 but falling every day. This is a down trending stock so these are levels where, if you own it, you could consider taking profits. In other words, unless and until GME starts a new uptrend, which it has zero signs of doing at the moment, these are places to take risk off the table on the long side, and/or short if that’s your thing. I’m not suggesting anyone short this given the volatility, but that’s how I look at resistance levels in cases like this.

Now, the PPO and the 14-day RSI reached extremely oversold levels recently, and while that’s good for a bounce, this stock is a long way from being healthy. That’s why I’m inclined to see this as a bounce, not the start of a new rally. That said, earnings reports tend to produce big moves for GME, so anything is possible. That’s why we arm ourselves with resistance and support levels ahead of time so we can react effectively.

Before we get into the fundamental picture, there are very significant seasonality tailwinds on the horizon here to consider.

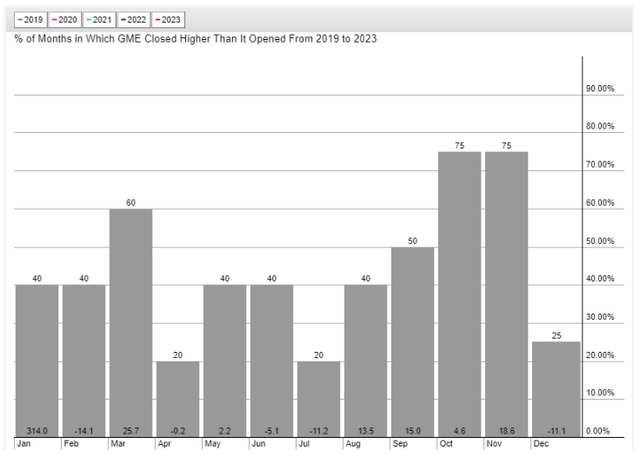

StockCharts

Seasonality in September, October, and November has been extremely bullish for the past few years. The stock closes higher most of the time during those months, and by annualized percentages of 15%, 5%, and 19%, respectively. Seasonality always is a secondary indicator to price support and resistance levels, but in this case, these are very bullish tendencies and I believe should play into decision making on the stock.

Now, let’s take a look at the fundamental case, which is still pretty murky from my point of view.

Revenue and margins remain in trouble

With GameStop being a retailer at its core, the fundamental case really is as simple as revenue and margins. Revenue trends have been pretty awful for several quarters, and there’s no respite in sight at the moment. And why should there be? GameStop is clinging to a version of retail that went digital years ago, so the long-term outlook isn’t exactly great. And as we see below, it isn’t like analysts are bullish on the top line.

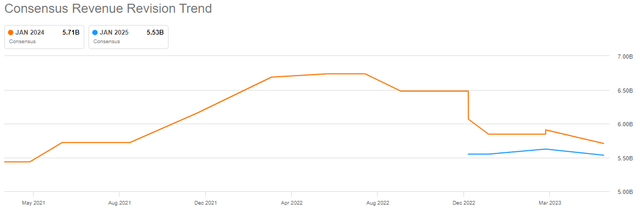

Seeking Alpha

Revenue estimates for this year peaked at roughly $6.7 billion in 2022, but have since fallen about a billion dollars to $5.7 billion currently. The problem – apart from constantly declining estimates – is that next year is slated to be worse. In fact, I wouldn’t be surprised if the year after that is worse still. As I said, GameStop’s core business of trading physical video games died out years ago, and while the company has tried to be innovative and diversify, the fact is it isn’t working.

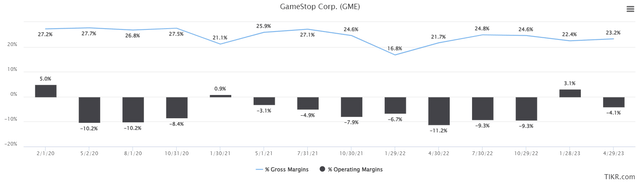

This has many implications, one of which is on profit margins. Or, in GameStop’s case, losses. Below are quarterly gross and operating margins for the past three years, and we can see that while there’s been some progress, GameStop continues to struggle mightily with profitability.

TIKR

We’ve seen some stabilization of gross margins recently, which has helped operating profits. In fact, the January quarter this year actually saw positive operating margins for the first time in two years. The problem is that, of course, that’s just not good enough, and no company can operate indefinitely while making losses.

Now, the reason I went through all of this is because when GameStop reports next week, investors should pay very close attention to the rate of revenue growth and both gross and operating margins. If there’s some sign of life in these metrics, we’re likely to see a potentially sizable rally into some of the resistance levels I noted above. If GameStop disappoints on revenue and/or margins, look out below. Remember that this stock is heavily shorted for some very good reasons.

Wrapping this up

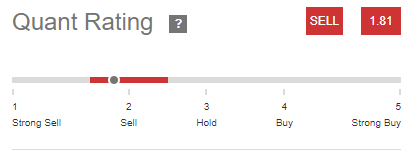

I always consult Seeking Alpha’s Quant Rating when looking at stocks, because it fits my desire to take the emotion out of investing decisions. Indeed, that’s why I like technical analysis. For GameStop, it’s not pretty.

Seeking Alpha

This speaks for itself, and it’s important to note that GameStop’s Quant Rating was downgraded earlier in August from hold to sell. We want stocks that are improving, not deteriorating.

Before I get to my rating, let’s take a look at the valuation, which we can use price-to-sales for given there are no earnings.

TIKR

The valuation is low once again at 1X forward sales. However, remember that any company with negative operating earnings is likely to see a low P/S ratio, in the same way that a company that’s growing quickly and has great margins will see a very high P/S ratio.

In other words, I don’t think GameStop is cheap; I think it has a low valuation because this business is slowly melting away. Ryan Cohen continues to boost his stake for reasons I don’t understand, and the bulls get really excited when he does. However, we can balance that with the fact that the company cannot keep a CEO for any meaningful period of time, which means constant directional changes from a strategy perspective as they try to right the ship.

The bottom line here is that GameStop will face a lot of challenges longer term. It has no viable business model for the future as far as I can tell, and as the losses pile up, it will eventually have to find some other way to generate cash, sell itself, or go out of business. You can decide if any of those things are likely to happen for yourself, and plan accordingly.

However, in the shorter term, the stock is very oversold and has strong seasonality tailwinds in September to November, so it’s possible we get a meaningful rally if the earnings report is well received. But as I stated above, I would use the noted resistance levels to consider taking profits because I don’t see a viable business here longer term. I’m keeping my hold rating for now because of these factors ahead of the earnings report next week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.