Summary:

- GameStop’s quarterly earnings show a decrease in net loss and a slight decline in sales.

- The company’s fundamentals, including net losses and poor sales, raise concerns.

- GME stock is not undervalued and carries downside risks, but there is potential for strategic changes or market speculation.

Michael M. Santiago

GameStop (NYSE:GME) has just reported its quarterly earnings. I covered the company several times before. So, this can be viewed as an update of my analysis.

GameStop Q2 earnings and recent developments

On the surface, it looks like GameStop’s 2Q results were sound.

- Net sales were $1.164 billion for the period, compared to $1.136 billion in the prior year’s second quarter.

- Selling, general and administrative (“SG&A”) expenses were $322.5 million, or 27.7% of net sales for the period, compared to $387.5 million, or 34.1% of net sales, in the prior year’s second quarter.

- Net loss was $2.8 million for the period, compared to a net loss of $108.7 million for the prior year’s second quarter.

- Transition costs related to European restructuring efforts were $4.3 million for the second quarter.

- Cash, cash equivalents and marketable securities were $1.195 billion at the close of the quarter.

- Long-term debt remains limited to one low-interest, unsecured term loan associated with the French government’s response to COVID-19. The July 2023 results look like an improvement compared to the same period a year ago. However, let us have a look at the company’s quarterly earnings history to see how good or bad that set of results really is.

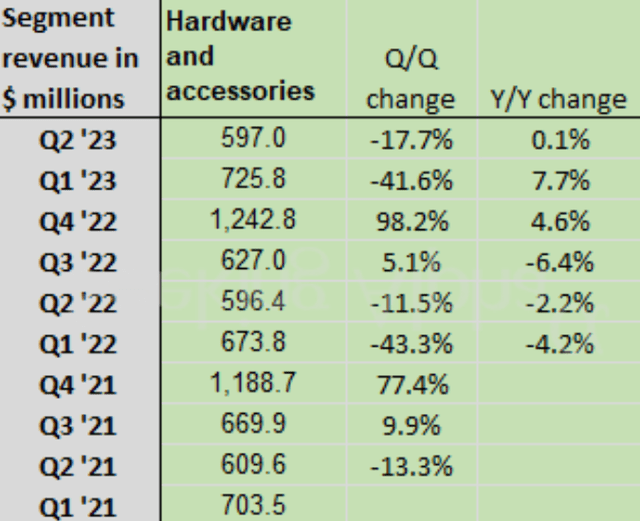

The table above presents GameStop’s quarterly earnings for the past couple of years. The recent revenue and net loss figures might look great compared to the same period a year ago. However, the recent earnings results were not brilliant compared to the previous quarters, most obviously January 2023. The demand for GME’s products is seasonal, of course. By this I mean that video games are normally sold during Christmas holidays. But even in the April 2023 quarter the sales were higher compared to the July quarter. One notable improvement, however, was the fact the quarterly net loss dropped to just $2.8 million.

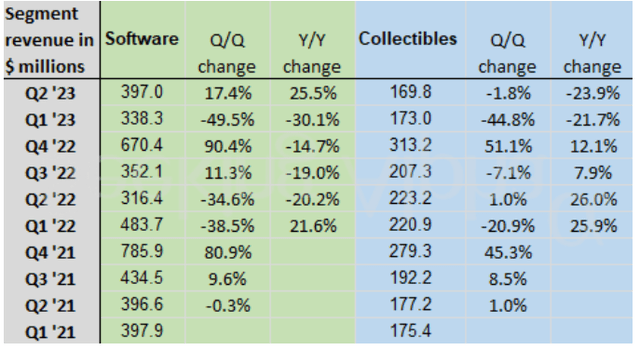

Also interesting was the sales breakdown. In fact, none of the divisions performed well in terms of sales. More or less resilient was only the software department because its sales even increased substantially compared to Q1 2023. But collectibles saw the biggest fall in revenues. This drop was not just quarter over quarter. It was also year over year. You can see the excerpts below.

So, to summarize: GameStop’s quarterly net losses are decreasing, whilst its sales are not improving.

GameStop fundamentals

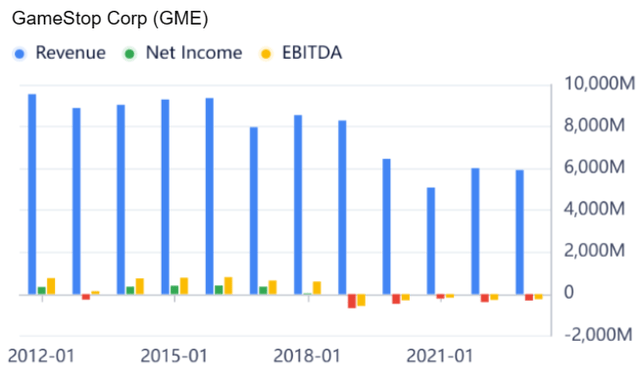

As I have mentioned many times before, GameStop is quite an unreliable company, especially in terms of annual earnings and sales.

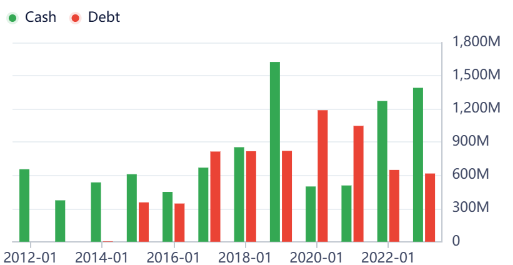

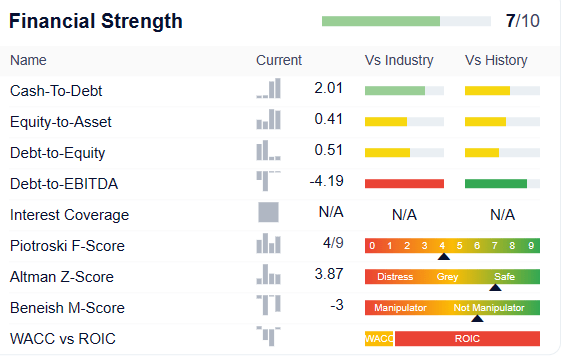

True, it is not running out of cash tomorrow. It has more cash than debt.

GuruFocus

The company also has reasonable equity-to-asset and debt-to-equity ratios.

GuruFocus

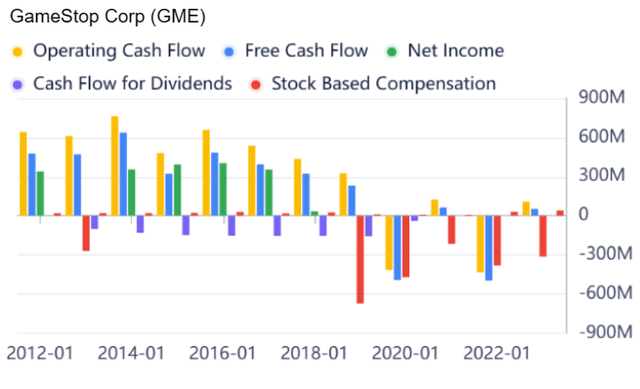

However, the most problematic thing is that the company has been loss-making for a while. Obviously, the free cash flows have been declining as well.

The most worrying thing is that there has been very little progress in the last several years in terms of free cash flows, EBITDA, and net profits.

In my view, Seeking Alpha very accurately summarizes the company’s fundamentals,

GameStop Corp. (GME) has characteristics that have been historically associated with poor future stock performance. GME has decelerating momentum and negative EPS revisions when compared to other Consumer Discretionary stocks, to the point that it gets a Sell rating from our Quant rating system. Stocks rated Sell or worse by our Quant rating system have massively underperformed the S&P 500.

I fully agree that the declining EPS is probably the biggest problem for GameStop.

But in spite of that fact, GME stock is still quite expensive.

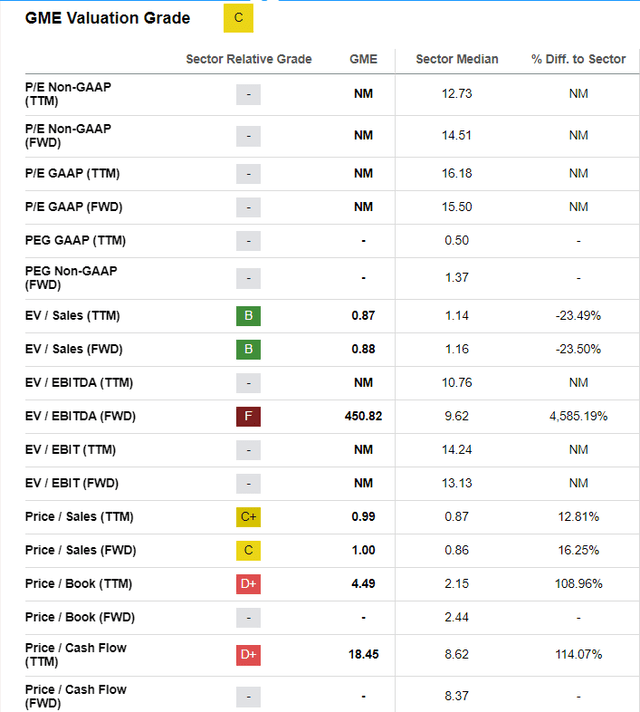

GME stock valuation

Below is a table that summarizes GameStop’s key valuation ratios. Overall, we can safely say that GME is not undervalued. Only its EV/Sales and Price/Sales ratios are reasonable compared to these of its peers. GME’s Price/Book, Price/Cash Flow and EV/EBITDA ratios, however, are much higher than most of its rivals. This is especially true of the EV/EBITDA ratio, which is a whopping 450.82.

Downside risks

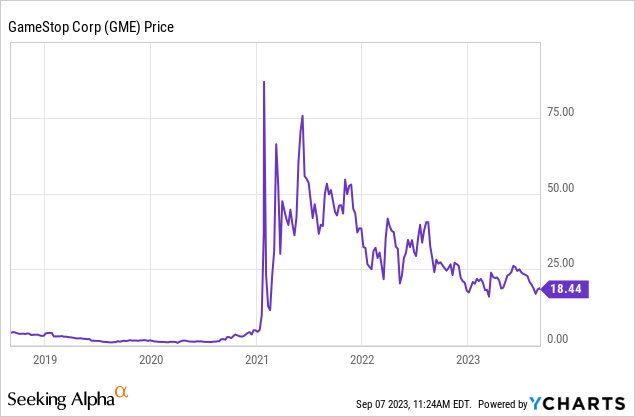

The downside risks are very clear. My fellow Seeking Alpha contributor noted that the company’s stock is unlikely to be sold short because it is already trading too low. Therefore, there will not be any short squeeze to drive the share price upwards. The stock might be technically cheap, indeed. However, it is still trading above the levels traded for before the meme stock mania.

Right now it is lingering near the $18 mark. Before the mania GME was trading for about $5 per share. Meanwhile, no positive fundamental changes have happened to the company during this time period. That is why the stock is not a bargain.

Obviously, the longer GameStop keeps recording negative earnings and free cash flows, the worse it is for its stockholders. Right now the only positive change I see is that the quarterly net loss declined somewhat. However, if this change was a one-off, then I feel sorry for GameStop’s stockholders.

Please bear in mind that the global economy as well as the US stock market are still doing relatively well. But GME stock is trading near its 52-week lows. Imagine what would happen if the central banks’ restrictive policies do indeed push the world’s economy into recession. Unprofitable companies like GameStop usually take a hit in these situations.

Upside risks

I would not short-sell the company’s stock either. After all, technically it makes sense to do so when a company’s stock is near its all-time or at least 52-week highs. Right now this is not the case. Plus, it is always hard to get the timing right when you try to short-sell a stock.

There is a risk GameStop’s management will succeed in implementing strategic changes to the company’s products. For example, the company can focus on producing software. It is relatively successful in this field and might do well if it does so. Then, GameStop can also manage to cut its costs, which will finally make the company profitable.

Finally, there might be market manipulations or better-said speculations the way it happened in the beginning of 2021 during the meme stock mania. This is rather unlikely. After all lightning never strikes twice in the same place. But all is possible.

Conclusion

GameStop’s quarterly results were reasonable but by no means excellent. The net loss decreased, whilst the sales declined somewhat. GameStop’s fundamentals are not excellent. Its EPS and sales track records are poor. But the stock is not good value for money either. So, I would neither buy nor sell the stock. My rating is therefore “Neutral”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.