Summary:

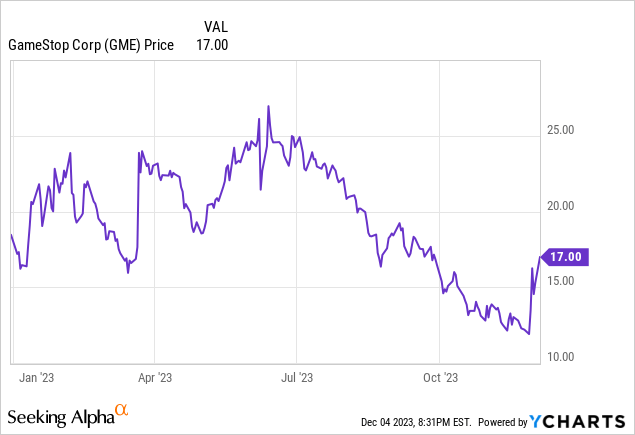

- GameStop’s stock has surged more than 40% off its late November lows, captivating investors.

- The upcoming Q3 earnings release on December 6th will provide insights into GME’s financial health and determine the sustainability of its current surge.

- The company is facing stagnant sales and thinning gross margins, raising concerns about its long-term sustainability.

- The odds of a short squeeze remain low. Shares sold short only represent around 22% of the equity float.

Massimo Giachetti

Overview

GameStop (NYSE:GME), along with many other meme stocks, has once again garnered Wall Street’s attention after a surprising end-of-year rally. Shares for the specialty retailer have soared more than +40% off their late November lows, recently closing at a share price of around $17/share. This rally has sent many investors on a rollercoaster ride as shares have bounced hard off YTD lows in the past month. However, beneath the surface of this meteoric rise lies a cautionary tale, with upcoming Q3 earnings on December 6th promising to shed light on the company’s financial health.

GME is set to report Q3 earnings on Wednesday, December 6th after the market close. Wall Street analysts are expecting revenue of $1.18 billion and EPS of -$0.08. Revenues are expected to be down slightly year-over-year and margins are also relatively unchanged.

Will This Meme Stock Rally Last?

In recent weeks, GameStop’s stock has defied expectations, experiencing a surge that has captivated both seasoned investors and newcomers alike. The surge, driven by a mix of speculative fervor and external factors, has created a sense of optimism around the company’s prospects. However, the reality of GameStop’s financials isn’t so great in my view:

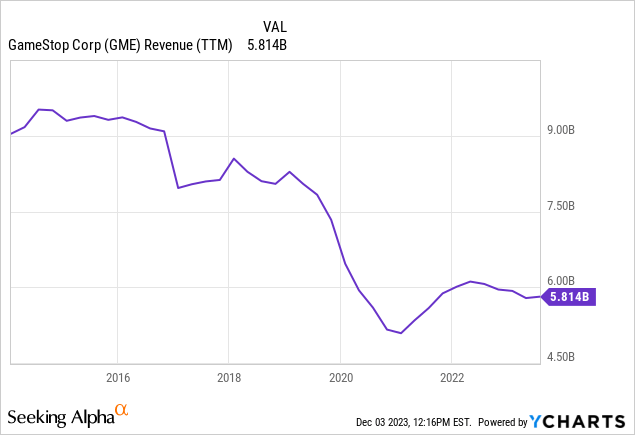

Stagnant Sales: While the stock has been scaling new heights recently, GameStop’s sales trajectory tells a different story. The company is grappling with flat/declining sales, indicating a potential struggle in a fiercely competitive gaming industry. Investors should take note of this fundamental aspect, as sales growth is often a key indicator of a company’s vitality.

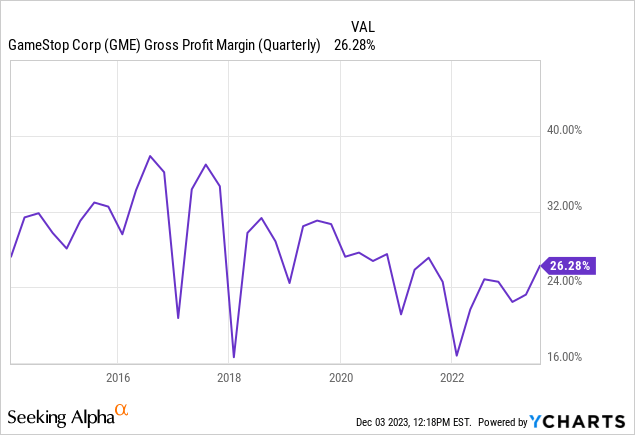

Declining Margins: Behind the scenes, GameStop faces another challenge – thin gross margins. Thin margins can erode a company’s financial health, leaving it vulnerable to economic downturns or industry shifts. Examining GameStop’s financial reports reveals a precarious balance that raises questions about its long-term sustainability. Over the past 5 years, GME’s gross profit margin has steadily declined to around 25% of revenue.

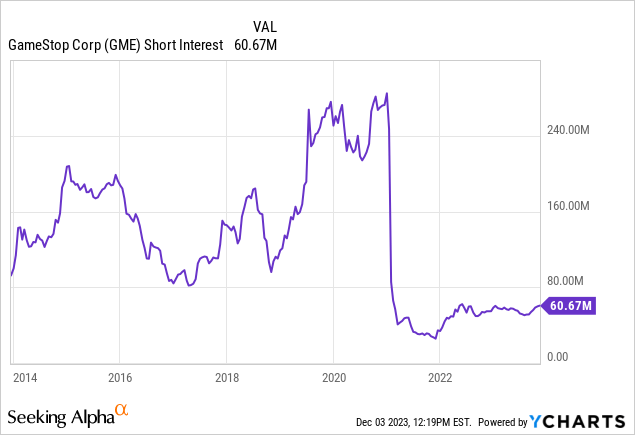

Fading Short Squeeze Odds: The stock’s ascent was once fueled by the short interest squeeze hysteria back in ’20-21, which saw GameStop become a poster child for a retail investor uprising against institutional short sellers. However, the fervor around the short squeeze appears to be fading, leaving investors wondering about the sustainability of the stock’s newfound highs. While short interest has climbed since its 2022 lows, it’s still well below the highs we saw a few years back.

The idea of another short squeeze doesn’t appear to be happening anytime soon. The ~60 million shares sold short only represent 22% of the equity float. This is well below 2020 highs which were reportedly more than >100%.

The Impending Q3 Earnings Release

All eyes are now on GameStop’s upcoming Q3 earnings release scheduled for December 6th after the market close. This pivotal moment is poised to reveal the true state of the company’s financials. Analysts and investors will closely scrutinize the reports, seeking insights into revenue streams, cost structures, and any strategic moves that might influence GameStop’s future trajectory. Investors should expect significant volatility after the release, regardless of management reports. In my view, I am not expecting any major surprises. There is a lot of evidence to support GME’s continued revenue decline as consumers transition away from brick-and-mortar shopping to e-commerce/digital copies of games. Competition is as fierce as it has ever been, and I don’t believe it will slow down.

Conclusion

As GameStop’s stock continues its exhilarating ascent, investors should exercise caution and approach the situation with a critical eye. The juxtaposition of soaring stocks and underlying financial challenges presents a complex picture. The upcoming Q3 earnings release will be a litmus test, offering a deeper understanding of GameStop’s financial health and determining whether the current surge is sustainable or merely a speculative bubble. In the dynamic landscape of the stock market, informed decision-making remains paramount, especially when navigating the high-stakes world of GameStop’s current market fervor.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.