Summary:

- The secular shift away from physical video games remains a headwind for GME.

- Meanwhile, video game console releases may start to be extended.

- The stock’s valuation looks way overdone at current levels.

Dennis Diatel Photography

GameStop (NYSE:GME) isn’t going the way of fellow meme stock Bed Bath & Beyond (BBBY) anytime soon, but it continues to face multiple headwinds.

Company Profile

GME is a retailer of video games, related hardware and accessories, and collectibles. It operates stores under the GameStop, EB Games, and Micromania brands. The company sells its products both through its retail stores as well as its e-commerce sites.

At the end of January, it had 4,413 stores, according to its 10-K. 2,949 stores were located in the United States, 216 in Canada, 419 in Australia, and 829 in Europe. It also has 52 pop culture themed stores selling collectibles, apparel, gadgets, electronics, and toys operating under the Zing Pop Culture brand in Australia and Europe.

The company sells both new and used video games, and allows its customers to trade-in their pre-owned games. This can be in exchange for cash or credit. The company also has a loyalty program, called PowerUp Rewards, with over 56.7 million members (source 10-K). However, only 15 million of these members bought or traded in a game in the last year. Of its loyalty members, it has 5.6 million that pay to be pro members.

Opportunities and Risks

GME is likely to forever be associated with the meme stock craze that ran from the spring of 2020 into early 2021. With the stock trading below a dollar, small investors managed to join together to help rally the stock to above $120 in January 2021, severely hurting short investors along the way.

While the meme stock craze has faded, the volatility in GME has not completely gone away. The stock surged over 30% the day after the company reported a surprise Q4 profit. It was its first quarterly profit in two years.

GME managed to generate a profit largely through store closures and layoffs, while keeping sales virtually flat (-1%). Gross margin also improved significantly, rising 570 basis points to 22.5%. The company did not get into the reasons behind the increase, although it likely stems from things like less discounting, lower freight costs, and mix. Notably, margins a year ago were very weak.

Discussing its improvements on its Q4 call, CEO Matthew Furlong said:

“Rather than standstill, we pivoted last year to cut costs, optimize inventory and focus on enhancing the customer experience. We found efficient ways to improve shipping times, integrate online and in-store shopping experiences and establish a culture of increased incentivization amongst store leaders and tenured associates. This pivot obviously included headcount reductions as we streamlined operations and cultivated a fast-paced intense operating environment geared toward cost containment, efficiency and profitability. Fortunately, the team we have in place today is embracing this culture and executing with effectiveness. The upshot of all this change is evidenced in our results this quarter. GameStop produced net income of $48.2 million compared to a net loss of $147.5 million in the fourth quarter of 2021. Looking ahead, we’re aggressively focused on year-over-year profitability improvement while still pursuing pragmatic long-term growth. We are taking a number of steps in fiscal year 2023 to improve our efficiency and support these overarching goals.

“These include continuing to cut excess costs, including in Europe, where we have already initiated exits and partial wind downs in certain countries; leveraging our strengthened financial position to continue obtaining improved terms from suppliers and vendors; getting full console allocations to help us meet customer demand during this extended cycle; assessing partnerships with gaming and retail companies that can enable us to capture cost-effective top line growth; leveraging our unique refurbishment capabilities to drive growth in pre-owned; and building a stronger presence in higher-margin categories like collectibles and toys where we have already seen pockets of growth.”

The meme stock craze allowed GME to use its high stock price to issue equity and improve its financial footing. Over the past two years, it’s sold about $1.7 billion in stock through ATM sales at an average price of $49.32. This has given it about $1.3 billion of next cash on the balance.

As a result, GME is not going bankrupt anytime soon. Growth, however, will likely be difficult. The industry has shifted more towards video game subscriptions and digital downloads than physical games. Both Xbox and PlayStation have various video game subscription offerings, as does Nintendo. Electronic Arts (EA) also has subscription offerings, and its EA Play membership is built into the Xbox Game Pass Ultimate.

When it comes to full game sales, EA estimates that for fiscal 2022 that 65% of its games were sold via digital download, compared to 49% in fiscal 2020. However, it’s notable that over 70% of its revenue comes from subscription and live services. This is just a big secular shift that is hurting GME.

Given the shift in how games are delivered, it may not be surprising that over half of GME’s sales are hardware and accessories. This puts more emphasis on console refresh cycles. However, the introduction of new consoles has typically been 6-7 years, and there is speculation that this could widen given hardware costs and other factors. This is another thing working against GEM.

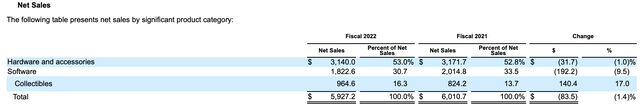

Now the company has moved more towards selling collectibles, toys, and pop culture merchandise. This has been one area of growth for the company, and typically has higher margins as well. As such, it’s one of the better opportunities for GME. Collectible sales were up 17% last year to nearly $965 million. However, this category is currently only a little over 16% of its total sales.

Conclusion

With a market cap of nearly $6 billion and an enterprise value of around $5 billion, the valuation of GME doesn’t make much sense. That values the company at over $1 million per store.

GME is projected to do about $6 billion in revenue, and it has pretty low gross margins of under 25%. It’s in a secularly declining business, and it can only cut costs so far. For comparison, Best Buy (BBY) trades at about 0.4x forward revenue versus 0.8x for GME. BBY is also profitable and has also consistently generated a lot of cash flow, unlike GME.

While collectibles are a nice opportunity, it’s not a big enough business to change GME’s fortunes. GME doesn’t look like it’s going away anytime soon, but it seems like a retailer that will just be hanging around more than anything else.

At the very least, GME’s stock should probably trade at half its current valuation, and that’s being generous giving it a BBY EV/revenue multiple. Given the meme volatility still in the stock, it’s best for the average investor to just stay away on both the long and short side.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.