Summary:

- GameStop Corp. is a retail company that sells games and entertainment products through physical stores and e-commerce platforms.

- The company’s stock experienced a significant surge in early 2021 due to the influence of the Reddit group r/WallStreetBets.

- GameStop’s recent financial performance has shown improvements, but it has not yet achieved profitability and faces challenges in adapting to the changing gaming industry landscape.

Scott Olson

Thesis

GameStop Corp. (NYSE:GME) is a retail company that offers games and entertainment products through its physical stores and e-commerce platforms. As of Jan 28, 2023, it has over 4413 stores across its four geographical segments, the majority of which are in the U.S. (2949).

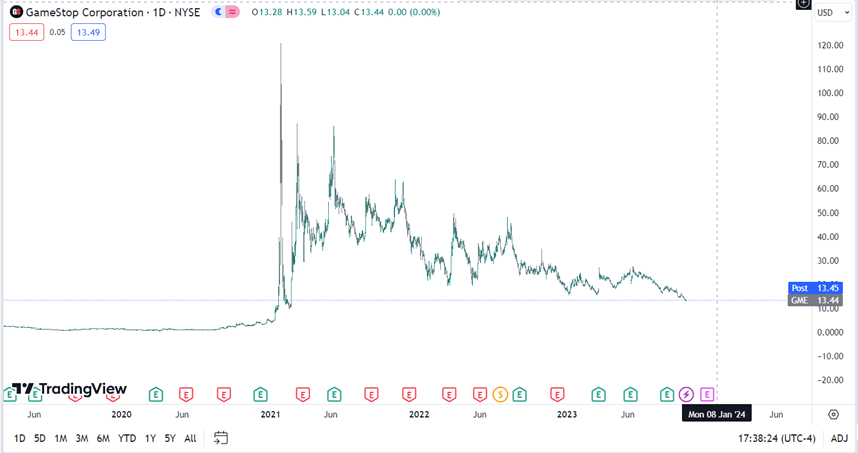

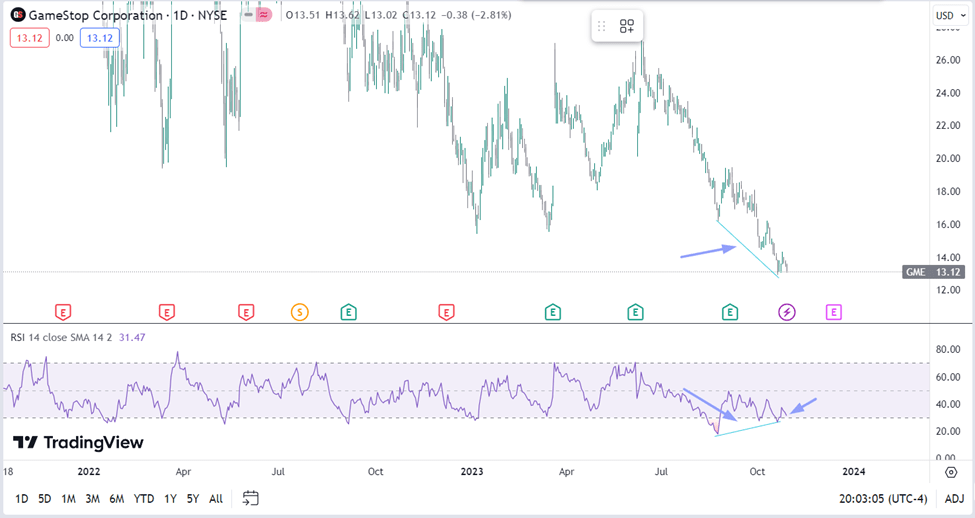

GME stock has been falling since 2021 due to several factors, including the decline of physical game sales, the rise of digital downloads, competition from other retailers, short selling, and the broader market decline. From the chart, this looks like dead money for a long time. Currently, the stock price is trading at $13.44 (including the stock split effect).

GameStop Corp. as a company does have some strengths, but the management’s wrong business decisions like focusing too heavily on physical game sales and failing to innovate, make it a SELL rating for me.

TradingView

Business Segments

Hardware and accessories:

This segment involves the sale of gaming platforms (consoles) from major manufacturers like Sony, Microsoft, and Nintendo, both new and pre-owned. It also includes a variety of gaming accessories such as controllers, headsets, and virtual reality products.

Software:

In this segment, GameStop sells new and pre-owned gaming software for current and prior-generation consoles. Additionally, they offer in-game digital currency, digital downloadable content, and full-game downloads.

Collectibles:

In this segment, GameStop offers a range of pop culture and tech-related merchandise, including apparel, toys, trading cards, gadgets, and other collectibles. They are also involved in digital asset wallet and NFT marketplace activities.

Strong retail footprint and good distribution centers

GameStop’s comprehensive retail network, coupled with a strategically positioned distribution network and an internal logistics system, grants the company several competitive advantages. The widespread physical presence offers customers convenient access to their desired gaming products and the opportunity to receive personalized assistance in-store. Additionally, the presence of strategically located distribution centers enhances inventory management and delivery efficiency, ultimately reducing lead times and ensuring that customers receive their purchases promptly. By managing logistics internally, GameStop gains greater control over its supply chain, which can lead to cost savings and improved quality control.

These advantages are particularly significant in the gaming industry, where the tangible experience of products and their timely availability are critical. Furthermore, GameStop can leverage its retail footprint to create a seamless omnichannel experience, allowing customers to order online and pick up in-store or have products shipped from nearby distribution centers. Overall, these assets support GameStop’s competitiveness in a dynamic and evolving market.

Change in leadership – Ryan Cohen takes over as new CEO

The recent appointment of Ryan Cohen as the CEO of GameStop holds the promise of ushering in much-needed changes for the company’s path to profitability. Ryan Cohen’s potential impact on GameStop lies in his deep e-commerce understanding, which is vital for enhancing the company’s online presence, and his customer-centric approach that can improve the customer experience.

GME stock fell following his appointment after initially popping due to investor concerns about GameStop’s challenges, profit-taking, and broader market declines. Looking ahead, Cohen, who plans for “extreme frugality,” may consider investments in cloud gaming and virtual reality, as well as partnerships with gaming industry players. It’s worth noting that his tenure is relatively brief, making it premature to gauge his full impact, but his e-commerce and customer service expertise positions him as a potential promising GameStop leader.

GameStop’s Cost Reduction and Profitability Strategy

In the past year, one of Matt Furlong’s key strategies has focused on cost reduction and enhancing the company’s operating margin. This strategy resulted in GameStop undergoing four rounds of layoffs in 2022, which notably included the departure of its CFO, Mike Recupero. The outcome of these strategic moves has proven to be successful for GameStop, leading to a surprising profit in the fourth quarter. This marked the company’s first quarterly profit since early 2021, as reduced expenses and workforce optimizations significantly bolstered the video game retailer’s financial performance. In response to this positive development, GameStop’s stock saw a substantial boost, with shares surging by nearly 50% during after-hours trading.

Financials

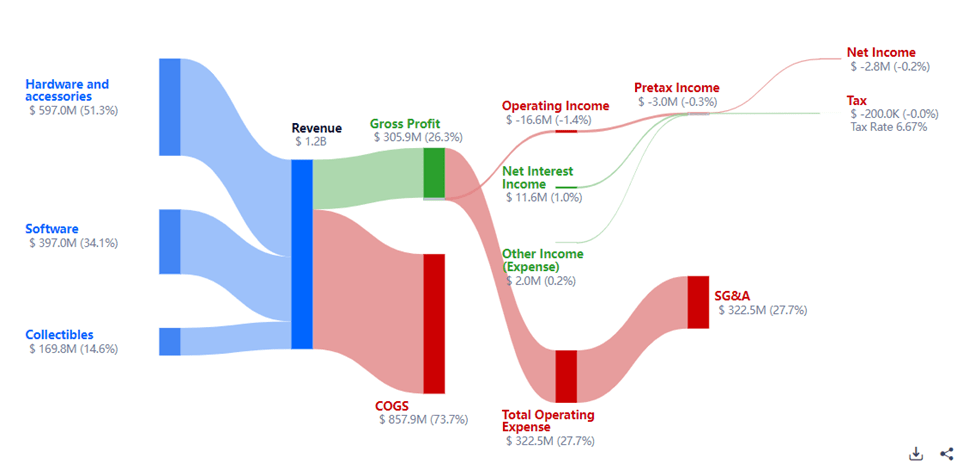

GameStop’s second-quarter performance showed notable developments, with revenue reaching $1.164 billion, surpassing analyst expectations. The software sales segment observed a considerable 25.5% revenue increase to $397 million, driven by strong demand for new releases and digital downloads. Hardware sales remained steady at $597 million. Efforts to curtail costs yielded a 14.3% reduction in SG&A expenses to $322.5 million. This decline resulted from factors such as lower labor costs, streamlined store operations, reduced marketing expenditures, and vendor contract adjustments. Consequently, GameStop’s net loss significantly decreased from $108.7 million in the previous year’s quarter to $2.8 million in the current quarter, signifying an enhanced profitability outlook.

GameStop’s fiscal second quarter performance reflects its ongoing transformation plan, with a focus on software sales, cost reduction, and omnichannel enhancements, showcasing notable developments in its financial outlook.

Gurufocus

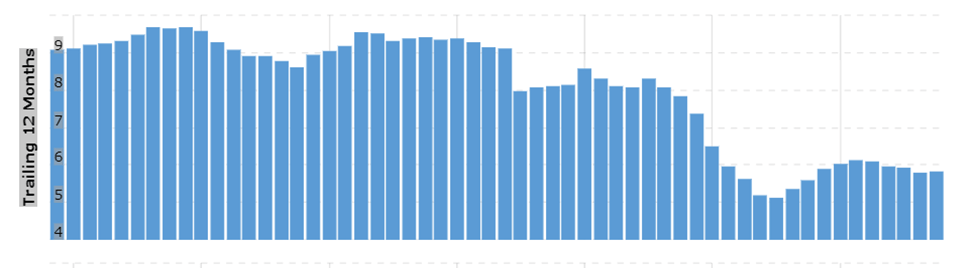

The company’s cost-cutting efforts have started to impact its financial performance. However, a full turnaround remains elusive at present. To gain a deeper understanding, let’s delve into the company’s historical performance. Beginning with an examination of its revenue history, we observe a consistent downward trend in trailing revenue growth since 2009. This indicates that the industry is contracting, and the company is struggling to maintain sales levels seen in the past.

Macrotrends

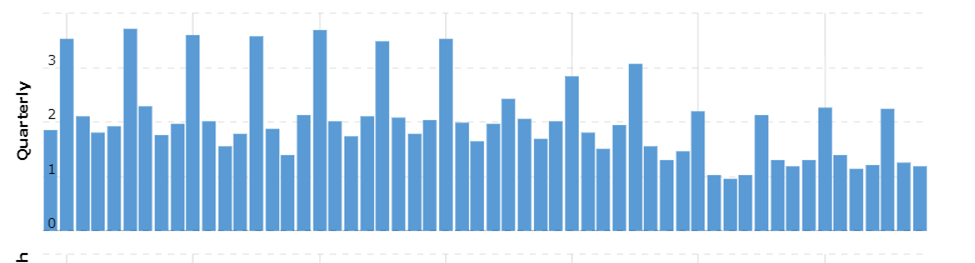

Analyzing quarterly revenue, a similar pattern emerges. Although revenue reaches its peak in the fourth quarter due to seasonal factors, it still follows a downward trajectory, reflecting the evolving dynamics in the gaming industry.

Macrotrends

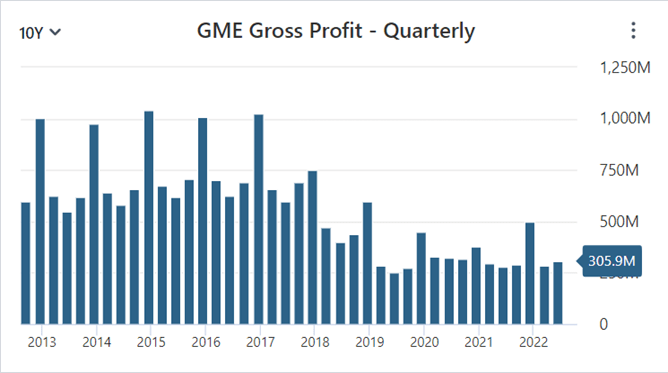

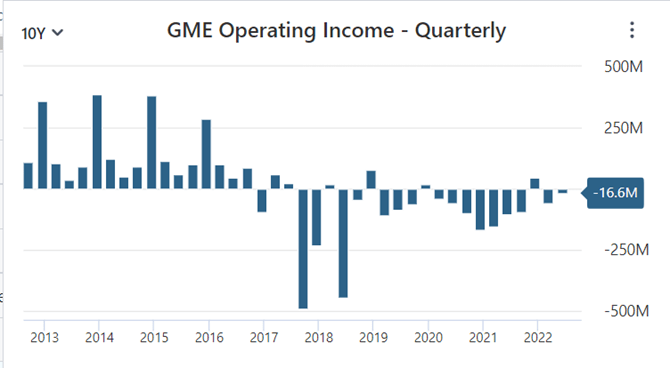

The analysis of gross profit reveals declining profit margins that have yet to recover to historical levels. Furthermore, the examination of operating income indicates that the company has been operating at a loss since late 2017.

Stockanalysis.com Stockanalysis.com

GameStop has experienced a decline in sales and a reduction in profitability, neither of which aligns with the characteristics of a growing business. Consequently, GameStop has a substantial journey ahead to adapt to the changing landscape of the gaming industry and achieve sustainable growth.

Valuation

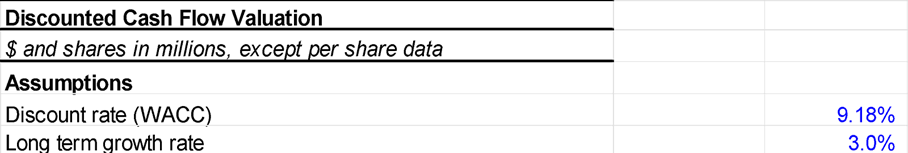

I’ve maintained a discount rate of 9.18%, in line with NYU’s estimates for the gaming industry, for the valuation. I’ve assumed a terminal growth rate of 3%.

Author’s Material

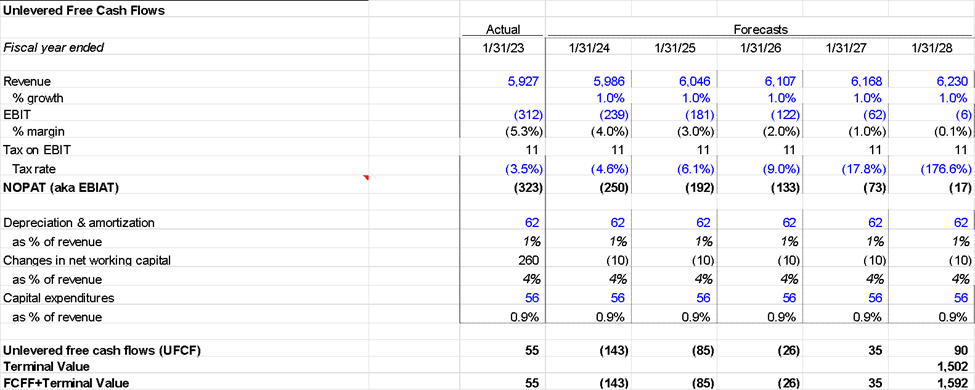

Regarding the company’s revenue growth projection, I’ve conservatively estimated it at 1%. This decision is based on the historical trend of declining revenue, which shows no signs of improvement. Rather than assuming a further decline, I’ve chosen to keep it steady.

Author’s Material

Upon forecasting the free cash flows, the enterprise value of the firm is calculated to be $810 million, with an equity value per share of $5.51.

Author’s Material

Technical Analysis

The technical analysis of GME stock is currently bearish. The stock price is below its 20-day, 50-day, and 200-day simple moving averages, which suggests that the downtrend is still in place. Additionally, the relative strength index (RSI) is below 30, which indicates that the stock is oversold.

However, there are some signs that the bearish trend may be coming to an end. The RSI is showing some signs of divergence. This means that the RSI is not falling as fast as the stock price, which could indicate that the downtrend is slowing.

TradingView

Overall, the technical analysis of GME stock is bearish, but there are some signs that the trend may be reversing. On its own, technical analysis means nothing and just deals in probabilities, and, therefore, investors should carefully monitor the stock price and understand different business aspects for making investment decisions.

Risk

Digital Distribution: The shift towards digital distribution of video games and content poses a significant risk to GameStop’s core physical retail model. As more players opt for digital downloads and streaming, the demand for physical game discs and cartridges may continue to decline.

Competition: GameStop faces intense competition not only from other video game retailers but also from digital platforms, online marketplaces, and direct sales by game developers and console manufacturers. This competition can pressure pricing and market share.

Conclusion

I believe GameStop is a solid company, but its current business model is not generating sufficient positive cash flows. The traditional in-store game purchase trend is in decline, and for GameStop to remain competitive in the industry, it must adapt to these changes. It will be intriguing to observe how the new management tackles this challenge to restore profitability.

However, it’s worth noting that this stock has a history of detaching from fundamental valuation metrics. Its sentimental value among retail investors introduces an element of unpredictability, resulting in a high level of volatility.

Therefore, from an investor’s perspective, I would recommend avoiding this company and instead focusing on other investment opportunities within a similar industry. Based solely on a discounted cash flow (DCF) valuation, a “SELL” rating for GameStop Corp. stock is advisable. Unless the business demonstrates signs of a revival and GameStop plays to its strengths, it’s prudent for investors to steer clear of this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.