Summary:

- GameStop stock has surged 164.9% since the ‘sell’ rating was reaffirmed earlier this year, handily outperforming the S&P 500.

- GameStop’s financial performance in the most recent quarter shows significant declines in revenue, particularly in hardware and software sales.

- Despite recent capital raises, GME’s long-term survival remains uncertain due to the changing landscape of the video game industry and the company’s core operations.

jetcityimage

Had you told me at the start of this year that we would be seeing another meme stock rally by now, I would have thought you were crazy. But here we are. At the center of this speculative flurry is video game retailer GameStop (NYSE:GME). To put in perspective just how wild the situation has become, consider the time from when I last wrote about the company in an article published in early April of this year. At that time, I acknowledged that operations for the company were stabilizing. But my overall assessment was that long-term pain would still occur.

Since reaffirming the ‘sell’ rating I had on the stock at that time, shares have skyrocketed to the tune of 164.9%. This easily surpasses the 5% increase seen by the S&P 500 over the same window of time. To be clear, I have stated in multiple instances that we could see extreme short-term fluctuations that send shares of GameStop higher, so I am not all that surprised by this movement. But at the end of the day, the picture for the company looks truly bleak.

This assessment remains true in my mind, especially after seeing financial performance that the company achieved in its most recent quarter. On the bottom line, there have been some improvements. But the top line has been decimated and, absent a material deviation from business, I see no true path for the company to survive in the long run. This doesn’t mean, however, that there isn’t a slim chance of this occurring. Management has made two very smart moves since I last wrote about the firm. Both of these were significant capital raises that diluted shareholders but will ultimately give the company plenty of fuel in order to make investments aimed at diversifying its business. Because of my overall view of the company and its condition, this is not enough to change my rating from what it currently is, but investors would be wise to continue watching what other moves might be made down the road.

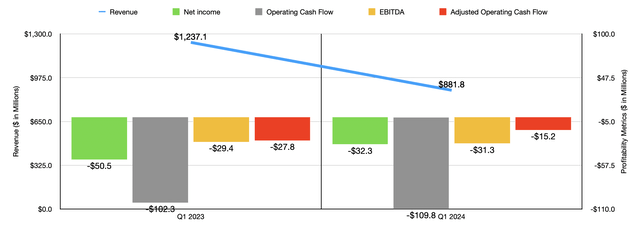

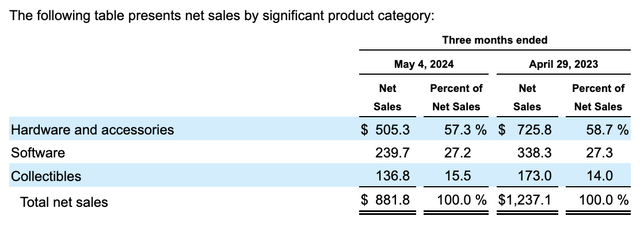

GameStop’s fundamentals look bad

When I last wrote about GameStop earlier this year, we had data covering through the end of 2023. Today, that data now extends through the first quarter of 2024. And a lot of it looks quite bad. Take revenue as an example. Sales during the first quarter totaled $881.8 million. That’s down 28.7% from the $1.24 billion the company generated the same time one year earlier. The company experienced weakness across the board during this time. But its biggest pain came from the sale of hardware and accessories. Revenue associated with these products dropped from $725.8 million last year to $505.3 million this year. That’s a 30.4% drop on a year-over-year basis.

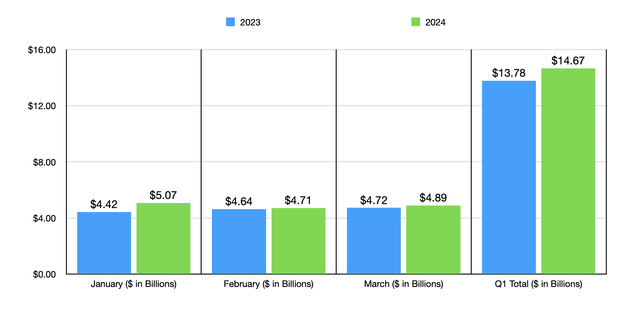

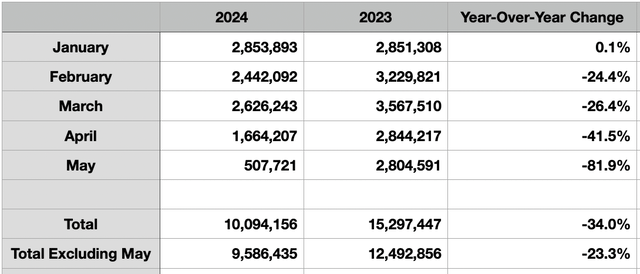

Management was not kind enough to provide much in the way of details regarding this. But we do know that hardware sales in the video game space have been suffering in recent months. As an example, for the first five months of 2024, global shipments for gaming consoles came in at 10.09 million. That’s 34% lower than what was seen for the same time of 2023. Even if we remove the month of May, since it does look like a true outlier, the drop would still be about 23.3%.

Author – With Data from VGChartz

*in Units

As much as I thought this might be a company-specific issue, it seems to be an industry one. In its latest quarterly filing, for instance, Microsoft announced that Xbox console sales are down around 31% because of a reduction in the number of units sold. PlayStation unit sales in the first three months of this year were down a more modest 16.2%. Meanwhile, sales of the famous Nintendo Switch are down about 20.1% year-over-year. As one source pointed out, this decline is almost certainly due, at least in large part, to the fact that new technologies and where big companies are investing (such as AI) make having a console less desirable than alternatives such as using a PC.

If tracking the industry lower was the only problem that GameStop was having, I would be more optimistic. But software sales also took a beating, plunging by 29.1% year over year from $338.3 million to $239.7 million. This is awfully painful when you consider that software sales, industry-wide for the US, were up 6.5% in the first three months of this year compared to where they were at the same time of 2023. Similarly, collectibles revenue is also down, having fallen by 20.9% from $173 million to $136.8 million. This was once thought of as a niche growth opportunity for the company. But now, things are looking rather scary.

This is not to say that everything has been awful. Management has been working on cutting costs. As a result, the firm’s bottom line went from negative $50.5 million last year to negative $32.3 million this year. Operating cash flow worsened from negative $102.3 million to negative $109.8 million. But if we adjust for changes in working capital, we get an improvement from negative $27.8 million to negative $15.2 million. Meanwhile, EBITDA for the company did worsen slightly, going from negative $29.4 million to negative $31.3 million.

A step in the right direction

Even though the bottom line improvement that GameStop demonstrated is great to see, this doesn’t change the fact that the retail space for video games is destined to eventually disappear. The switch to downloadable content, as well as a growing ecommerce market, is making this space irrelevant. Because of this, I am bearish on the company under almost any circumstance. But I have maintained that one potential escape for the company would be to heavily dilute shareholders and to use the proceeds from any capital raise to make some other big move that materially diversifies its revenue away from its core operations. I even gave an example of how the company could have, years ago, merged with Electronic Arts (EA).

Finally, management is making some progress on boosting the size of its balance sheet. On May 24th of this year, the company completed an At-The-Market (or ATM) offering, selling off 45 million shares in exchange for gross proceeds of $933.4 million. This was followed up by a monumental raise that was completed on June 11th. That raise was for 75 million shares, amounting to gross proceeds of $2.137 billion. Unlike most companies in distress, GameStop has virtually no debt on its books, with the debt as of the end of the most recent quarter totaling only $25.7 million. By comparison, it ended that quarter with $1.08 billion in cash and cash equivalents.

All combined, this means that the firm should have net cash of about $4.13 billion. Of course, this did not come without a downside. Shareholders who owned the stock prior to these two capital raises have now been diluted by 28.2%. But considering the circumstances, I see this as a small price to pay for the opportunity to benefit from the irrationally high share price that the company has experienced as of late.

Although I am a value investor at my core, I do have a contrarian streak in me. And one idea that I latched on to when I was just learning about investing around 16 years ago was the concept promoted by George Soros of reflexivity. The idea here is that a feedback loop can exist where the perceptions of investors can ultimately impact the fundamentals of a business or economic circumstance. As an example, I doubt that very many people would disagree with me when I say that, prior to these capital raises, GameStop’s intrinsic value was far lower than what shares have indicated. But since investors have decided to be irrationally speculative, essentially playing the greater fool, the company has been able to take advantage of that, raising real cash that improves its fundamental condition.

In the short term and medium term, this capital does give the company a great deal of fuel that it can survive off of. To think that the firm would go bankrupt in the next year or two, absent something big and unexpected coming out of the woodwork, would probably be foolhardy. But that wasn’t the case prior to the capital raise. In the event that management can continue to do these capital raises while shares are trading at crazy levels, or if management can take that capital and capture real value by investing it into some other opportunities, there could be a path by which the firm eventually moves away from its core operations and can create real value for investors.

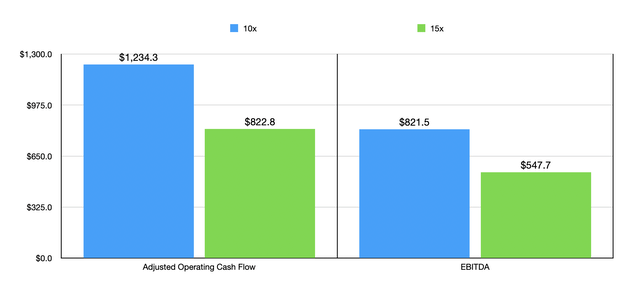

I honestly think that this path is what management has in mind, and I think we are closer to realizing that than at any other point in the past couple of years. Having said that, the road that the firm has to travel is risky and could take years in order to play out. As an example, in the chart above, you can see what kind of operating cash flow the company would need to generate in order to trade at a price to adjusted operating cash flow multiple of either 10 or 15. That same chart also has the same data when it comes to EBITDA for the EV to EBITDA multiple. It’s difficult to imagine a scenario where the company could be fairly valued at multiples above what I show in that chart. So even up to that point, we would be looking at a case where shares are perhaps materially overvalued.

Takeaway

As much as I would love to see GameStop stage a comeback, the company’s financial condition is still precarious. The good news is that management has finally been able to raise a tremendous amount of capital that gives the company the opportunity to move away from its core operations and into something else. But I think it’s still too early to bank on that scenario happening and, in the meantime, investors can almost certainly capture better returns elsewhere. Because I suspect that the stock will continue to underperform the broader market for some time, even in the best-case scenario, I still think that rating the business a ‘sell’ makes sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!