Summary:

- GameStop Corp.’s recent price movements are disconnected from the company’s fundamentals and outdated business model.

- The company’s sales in the hardware/accessories, software, and collectibles segments have shown no meaningful growth, with continued declines year after year.

- GameStop’s failure to adapt to the digital gaming market and competition from platforms like Microsoft and Sony pose significant challenges.

- While traders may seek to take advantage of the high volatility fueled by Roaring Kitty, long term investors should stay away.

jetcityimage

Overview

As an investor who typically looks at companies through a long-term lens, GameStop Corp. (NYSE:GME) has never been appealing. I believe that the huge price movements fueled by the meme stock era has clouded investors’ judgement in pursuit of quick gains. While I fully see the appeal of chasing the large gains from heightened volatility, I stick to the principles of looking at the health and sustainability of the core business model. I previously covered GameStop back in February and rated it as a Strong Sell.

I plan to stick by that strong sell rating, despite the recent movements due to forces such as Roaring Kitty’s, known as Keith Gill, $116M bet. The recent price movements have been disconnected from the company’s fundamentals and even worse, the company still fails at trying to pivot away from their flawed and outdated business model. The gaming industry as a whole is changing, and GME remains dependent on an old sales model to generate income.

Just for some context, GameStop is a retailer of video games, gaming equipment and accessories, and other forms of gaming-adjacent entertainment. The company relies on sales through their physical stores as well as through their ecommerce platform. The company has been around since 1996, but I believe that their glory days are behind them with so many other companies stealing market share away from them.

GameStop Stock Price

Following the initial craziness in 2021, the price was on a steady decline. This was until Roaring Kitty’s return in mid-May, which fueled a spike of over 70%. Keith tweeted for the first time in about three years by posting a meme of a man leaning forward, indicating that he’s watching the stock. It’s crazy to think about the fact that we live in a time when a simple tweet from an account that isn’t verified can have such an influence on markets.

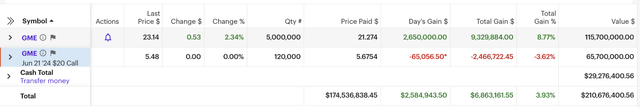

The price opened up higher this morning due to a huge bet of $116M by Roaring Kitty. This equates to 5M shares bought slightly above $21 per share, as well as 120k call options with a strike price of $20 per share. While I will not deny that money can be made here with great timing, the problem is that most people incorrectly time their moves. I recognize that plenty of traders are already aware of the poor quality of GME’s business, I would like to address the investors that may be wondering if GME might be making some kind of comeback.

The current price movements do not reflect the quality of the company. The rise does not reflect any sort of improved financial situation, improved product offering, any sort of shifts in business strategy, or any innovations within the video game space. GME’s business has been on a slow decline over the last decade, and I will cover a few of the fundamental reasons as to why. The poor performance of sales throughout all segments as well as losing market share to competitors is why this is a company to stay away from.

Financials & Fundamentals

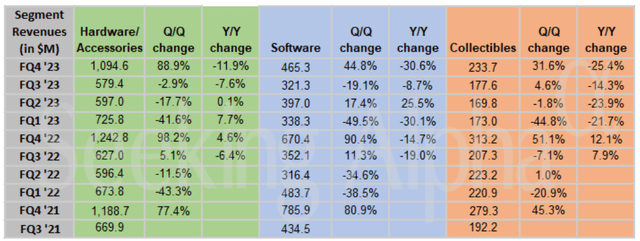

GameStop’s business depends on sales within three different segments: Hardware/accessories, Software, and Collectibles. Unfortunately, each of these segments has failed to show any meaningful growth over the last few years. Their largest segment is hardware and these sales are down 12% year over year, despite its latest Q4 numbers amounting to $1.09B in sales. Software sales are also down by 30.6% year over year while collectibles are down 25.4% year over year, despite an increase of 31.6% over last quarter.

Looking at these segment figures alone, you have to ask yourself: Do I really want to invest in a losing business? I understand that there’s a lot of sentimental value with a company like GameStop. If you’re under forty then odds are that video games were a large part of your childhood. The experience of heading over to a GameStop location to pick up a midnight release of a game is a memory that a ton of gamers will forever appreciate. Therefore, gamers like myself, genuinely want to see this company thrive and recover. However, the unfortunate truth is that GME has done almost nothing to adapt to the changing video game world, and these huge price spikes should not be mistaken as some sort of turnaround in quality.

GME tried to take advantage of the fact that the price was rallying with a $900M stock offering. Typically, stock offerings can be used to reduce debt, transform the business by investing in new ventures, increase operational efficiencies, or for expansion purposes. While there wasn’t much detail provided into the use of these additional funds, it was stated that this would be used towards ‘general corporate purposes’. According to the form 8k, this may include acquisitions and investments, but we currently have no additional insights on the matter.

GME is set to report first quarter earnings on June 5th and I believe the results will be poor. Based on recent reports that US-based video game sales decreased by 3%, accompanied by the fact that hardware sales fell by 43%, I imagine GME’s next set of earnings will come in below expectations once again. Taking a brief look at their most recent Q4 report, earnings per share came in at $0.22, missing expectations by $0.07. Additionally, revenue for Q4 was $1.79B, representing a year-over-year decrease of $260M.

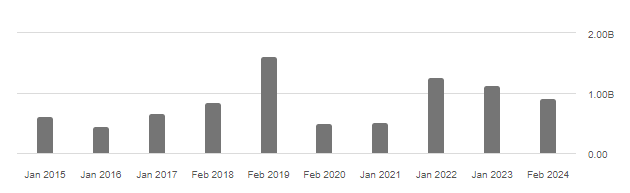

Despite all the poor performance, I do think that GME will stay around for a while. With all the hype-driven volume, GME has managed to accumulate $921M in cash and cash equivalents on hand. They’ve used a lot of their cash to reduce their debt levels down to a mere $17.1M currently, with accounts payable totaling $324M. So despite the lack of growth, they have enough capital to survive for some time.

GME Cash & Equivalents (Seeking Alpha)

Shifting Interests

Most of the vulnerability comes from GME’s failure to adapt to changing market trends within the video game space. They heavily rely on the sales coming from physical locations, even in a digital-driven world. Across all platforms, digital sales constituted a whopping 95% of all gaming revenues in 2023, totaling $174B in gaming purchases and in-game spending. Most GameStop locations depend on physical copy sales for consoles, such as the Xbox or PlayStation. However, the same data indicates that consoles get as much as 83% of their sales from digital purchases and only 17% of sales for physical copies.

Tweak Town

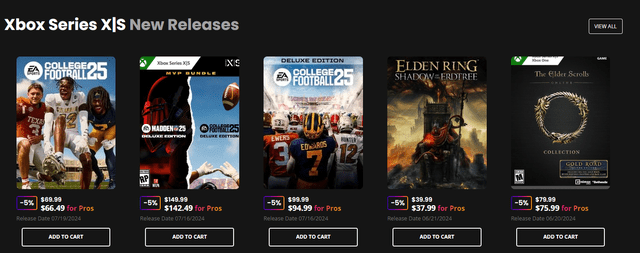

Most gamers buy their games from the digital stores offered on these platforms. This includes services such as the Microsoft store (MSFT) on Xbox, The PlayStation Store from Sony (SONY), or the Steam platform for PC users. These platforms by competitors have pumped millions of dollars into their platforms to make it the most user-friendly interface and as efficient as possible. These competitors make their stores easy to navigate and very detailed in learning about each product through descriptions, pictures and videos, and user reviews. Lastly, these platforms all have over a decade in the market and have built up their own respective audience.

I fail to see how GME can catch up and compete with these different channels. While they do have a digital store, it lacks a deep connection to any of the gaming hardware. While GME has their own pro membership that offers small 5% discounts on titles, this isn’t enticing enough to bring customers over to their platform. Most of all, it’s generally inconvenient to have to go to an external source like GME’s platform to get a digital code, to then input back into your gaming console.

Even when we compare the ease of use to PC alternatives like Steam, GME has almost no chance of competition in my opinion. Steam has built in its own library, store and launcher for games that make the whole process of PC gaming a lot more intuitive and easier to use. Even the inclusion of MSFT’s Game Pass offering to PC users makes the whole GME platform a bit obsolete. Game Pass offers a monthly subscription that provides you with access to a free library of games that are constantly changing, as well as exclusive discounts on titles that are generally more enticing than GME’s discounts.

As they continue to close stores, GME’s revenues may continue to drop as they have fewer sources of revenue. When you combine this with the fact that the business model has barely improved and continues to lose market share to competitors, GME is something to stay far away from.

Short Risk

The valuation fundamentals here are completely off the charts and trades at premiums to all typical metrics. For example, GME current trades at a forward price to earnings ratio of 2,314x. Therefore, it is currently rated with a valuation grade of an F on Seeking Alpha. More importantly, the short interest is rising, with a percentage of shares shorted around 22%. While the rise in shares shorted is completely understandable given the poor performance and lackluster business model, I would remain cautious here since the price is completely disconnected from fundamentals.

We’ve already seen how high the price can go here, and if you are not a risk-taker, it would probably be best to remain on the sidelines for now. GME has already shown us how high it can go in a short squeeze and as a result, loss potential is technically unlimited. Any sign of a positive movement in growth, financials, or business model can propel shares higher right now as GME remains high reactive to any news. Not to mention the volume of traders that will be coming from Reddit to report anything remotely positive on the wallstreetbets sub to drive momentum upward.

Takeaway

In conclusion, I rate GameStop as a Strong Sell for investors. While traders may take advantage of the extreme volatility presently, the core business model remains very flawed. Liquidity may be strong currently, but with no clear focus on how to improve things, GME is just floating and slowly draining its value. With such strong competitors as MSFT or SONY, GME fails to capture any meaningful market share with digital gaming. Additionally, the continued loss across all segments proves that GME is a bit outdated and has failed to adapt to the changing video game market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.