Summary:

- GameStop stock has rallied but its fundamentals remain poor.

- The recent rally was driven by market speculation, not fundamental factors.

- GameStop’s sales have been declining and its profitability metrics are low.

jetcityimage

GameStop (NYSE:GME) stock has rallied incredibly the past month. The company’s fundamentals, however, are as poor as they used to be a month ago. This is an update of my earlier work on GameStop following GME stock’s miraculous rally. I will explain why buying the stock immediately after this rally would be pure speculation and why the company’s stock fundamentals are poor.

Recap of my previous GME analysis

In my previous analysis, I covered GameStop’s earnings. The analysis was published on 7 September 2023 and covered 2Q 2023 earnings. At the time, GameStop’s quarterly earnings showed a decrease in net loss and a slight fall in revenues. I also pointed to the company’s poor sales and profit histories. GME stock was not undervalued at the time and carried substantial downside risks. At the time, I also said there was potential for strategic changes or market speculation. No strategic changes have happened to the business so far. However, the recent market speculation had absolutely no fundamental factors behind it. Right now, the stock price is off its highs. And it is quite close to the levels seen when my September article about GameStop was published. One GME share was worth $18.89.

GME rally

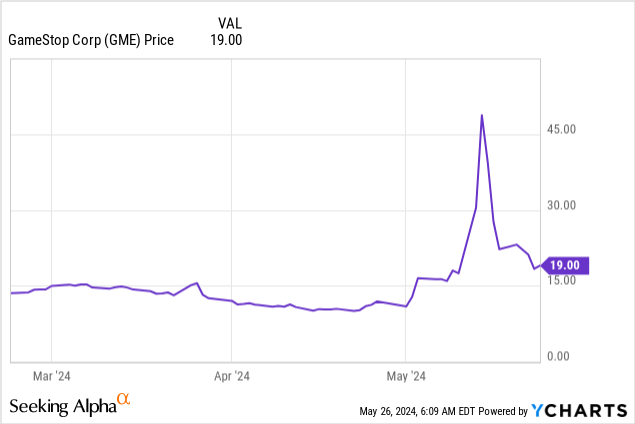

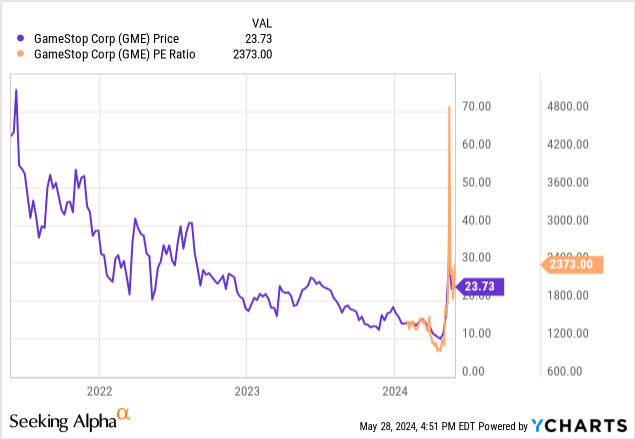

GameStop (GME) skyrocketed from less than $15 per share to $50 a share, reaching levels unseen since August 2022. The stock price surged after Keith Gill, the trader at the center of the meme-stock craze, made a post in social media.

GameStop’s (GME) share price had surged almost threefold from the end of April through mid-May.

Shares of the video-game seller soared after Keith Gill’s TheRoaringKitty account tweeted for the first time in almost three years. About three years ago, Gill posted an analysis of GameStop as an undervalued company. This post was said to provoke GameStop’s (GME) rally and also a massive short-squeeze, making hedge funds record losses in January 2021.

But what has happened to the company itself, not its stock, since my last coverage? Let me explain here.

GameStop’s fundamentals

First, let us talk about the company’s earnings results recorded since my last coverage.

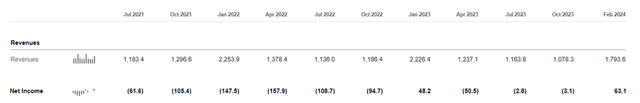

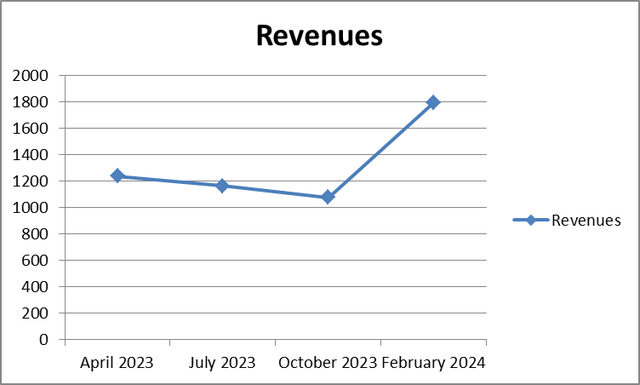

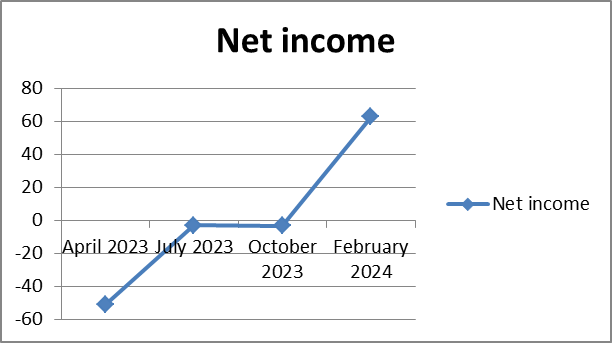

Overall, we can safely say that the company’s results have improved since then. This is both true of its quarterly sales and net income.

The data is given in USD millions.

GameStop’s quarterly revenues and net income

Seeking Alpha

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

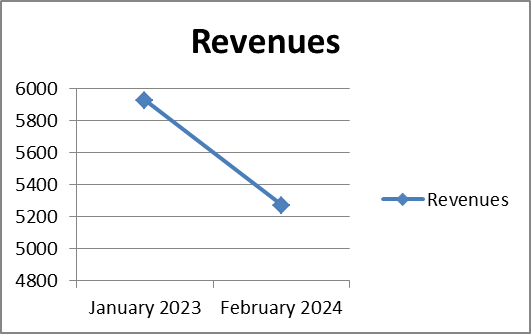

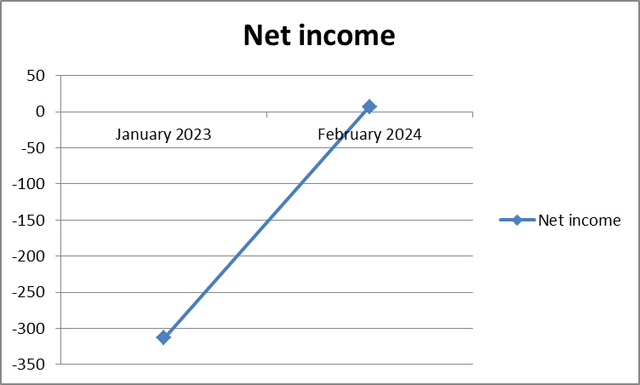

However, if we look at the company’s annual sales and net profit histories, we can see that the revenues reported in February 2024 have declined somewhat compared to the same period a year ago.

The data is given in USD millions.

| January 2023 | February 2024 | |

| Revenues | 5927,2 | 5272,8 |

| Net income | -313,1 | 6,7 |

Source: Prepared by the author based on Seeking Alpha’s data

At the same time, the net loss has declined over the same period. In fact, the company even managed to record a positive net result of $6.7 million.

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

This means that the company’s efficiency has increased. But how did GameStop’s management achieve this?

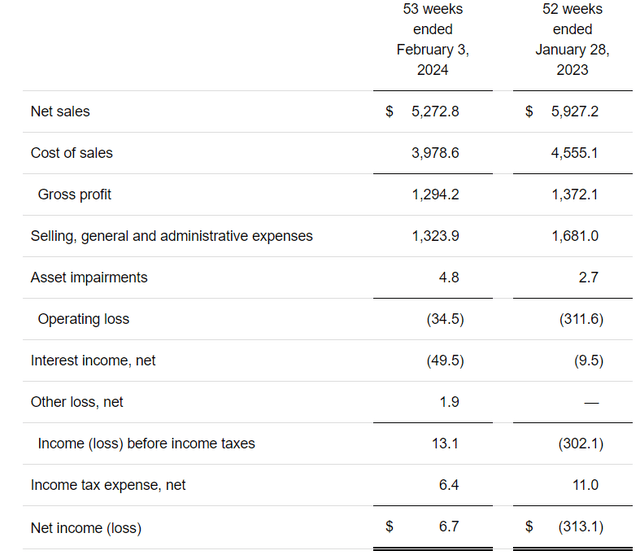

Well, as we can see from an excerpt from GME’s income statement below, the cost of sales has decreased. The cost of sales is normally the direct cost associated with the goods sold. But most of the cost decline was due to a plunge in the company’s general and administrative costs.

The declining cost of sales, as well as lower general and administrative costs, can be attributed to the company closing a substantial number of its stores.

Seeking Alpha

GameStop ended 2023 with 2,915 operational locations in the US, a decline of 34 stores compared to the 2,949 it had operated a year earlier. As concerns to its operations abroad, GME shut down 210 international stores, decreasing their count from 1,464 to 1,254. The closure of unprofitable stores, however, did not only lead to a drop in costs but also to a decrease in sales revenues.

For the 4Q 2023 fiscal year, GameStop reported sales of $1.79 billion. This was a drop of 19.4% versus $2.23 billion for the same period of the 2022 fiscal year. This weakness, however, affected all of GameStop’s departments. Hardware and accessories sales, for example, decreased from $1.24 billion to $1.09 billion. Software sales dropped even more, declining by 30.6% from $670.4 million to $465.3 million. Collectibles sales, meanwhile, decreased from $313.2 million to $233.7 million.

The most worrying fact is that the 4Q of 2023 included the holiday season, when many people rushed to buy Christmas presents. Video games sales should have also increased during this time period. So, this should have pushed GameStop’s revenues up rather than down.

Interestingly, total video game sales in the US reached $57.2 billion in 2023, a rise from $56.6 billion in 2022. Video game content spending increased to $48.0 billion in 2023 compared to $47.5 billion for the previous year, thanks to a 13% rise in digital download spending across console platforms and an 11% rise in digital premium download segments on PC, cloud and non-console VR platforms. Hardware sales remained almost unchanged at $6.6 billion, and accessory sales increased by 4% ($2.6 billion versus $2.5 billion). But GameStop’s sales have decreased for the same time period, despite the fact the industry did well, which should be worrying for GameStop’s investors.

GameStop’s financial fundamentals

|

Indicator’s name |

GameStop’s indicator |

Average indicator for the US (based on FullRatio’s data) |

|

Current ratio |

2,11 |

1,5 – 3,0 |

|

Debt/equity ratio |

1,02 |

0,8 |

|

ROE |

0,5% |

13,84% |

|

Cash flow from operations/Total debt |

(0,15) |

1 or above |

Source: Prepared by the author based on Seeking Alpha’s and FullRatio’s data

Overall, we can say that most of GameStop’s key financial indicators are in line with US averages. Moreover, GameStop’s net debt (total liabilities—cash and equivalents) is just $448.7 million, quite low for a company with annual sales of $5272.8 million. As many contributors here on Seeking Alpha pointed out, the company has ample amounts of cash. According to the last annual report, its cash and cash equivalents were $921.7 million, quite reasonable but a decline from $1271 million in 2021 and $1139 million in 2022.

The most problematic indicators of GME are its profitability metrics, including its return on equity (ROE), which is extremely low thanks to GME’s net profit of $6.7 million. Its cash flow from operations was also low. As I have mentioned above, that is because of the company’s falling sales. Even the cost cuts did not help.

GME valuations

GameStop is not undervalued right now, either.

Obviously, the profitability margins signal just that. For example, GME’s price-to-earnings (P/E) ratio is extremely high. However, this is explainable because GME has recorded its first profit, albeit very low, in several years’ time.

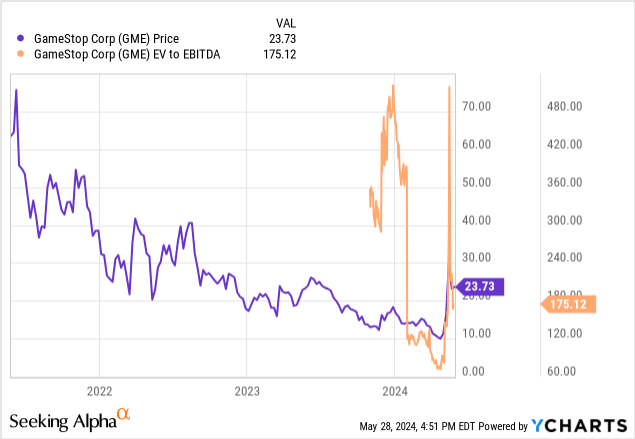

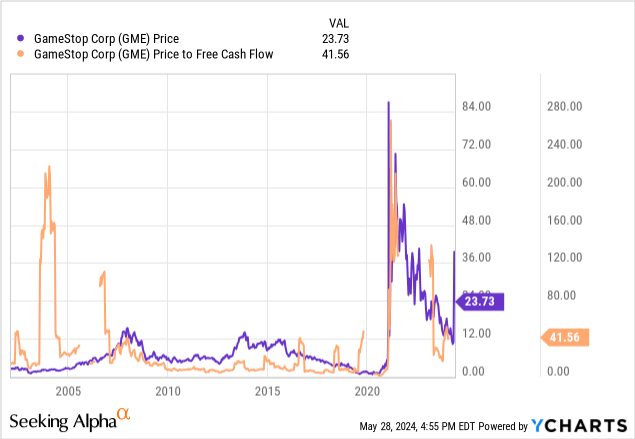

But other metrics, including the EV-to-EBITDA and price-to-free cash flow ratios, signal just that. Some businesses face high depreciation and amortization expenses. Some businesses are forced to service very high levels of debt. That is why such companies have low or even negative profit margins. But this is not the case with GME. It simply does not get enough money from sales. So, its EBITDA and free cash flows are also low.

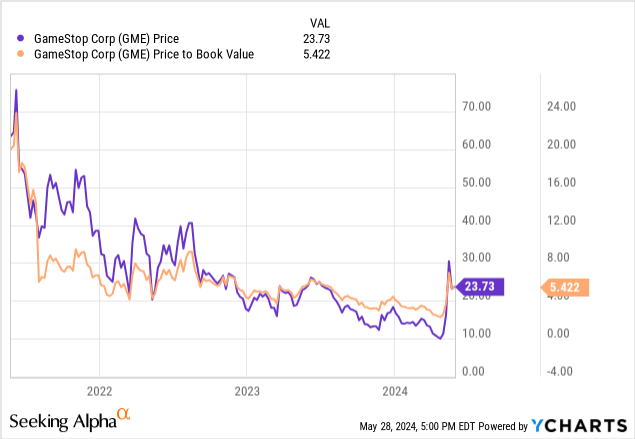

Finally, GameStop’s price-to-book (P/B) ratio is quite high as well. The average P/B of S&P 500 companies is equivalent to 4,312. Among the S&P 500 companies are overvalued high-tech corporations and very profitable businesses. So, it is a high indicator for a company like GameStop.

Although GME is trading below the levels seen a month or so ago, the stock is still not undervalued according to the key valuation ratios.

Risks to my thesis

I do not personally see many objective reasons for the stock’s justified rally. Of course, there is a possibility for the management to structurally reform the business. However, GameStop has been recording falling sales for many years already. And there was time for the management to change this brick-and-mortar game seller to a more innovative company. But not much has been done, indeed.

On the positive side, I can add that the company got “leaner and fitter” by cutting the cost of sales and general and administrative costs. GME also has a lot of cash and quite a low net debt. But the company’s sales have been falling for a while. So, the positive effect was quite limited. If the sales keep falling further, the cash reserves will eventually be over.

The biggest bullish factor for GME is market speculation, something that happened a month ago or in January 2021. However, such a speculative stock price surge is impossible to predict.

Conclusion

Although GameStop has managed to cut its costs, its sales are not doing well. In spite of the not-so-easy situation for the business, the company’s stock is quite expensive, according to the ratio analysis. The effect from the recent rally is not quite over. It is possible that the stock will eventually surge in value. But I do not personally see many fundamental reasons for the stock’s appreciation. My rating remains unchanged. It is “Hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.