Summary:

- GameStop’s Q2 2024 revenue fell 31.4%, missing expectations, but earnings exceeded forecasts, highlighting a significant sales drop despite bottom-line improvements.

- The company’s bleak future stems from missed opportunities to reinvent itself, with declining hardware, software, and collectibles sales harming it today.

- GameStop’s robust cash position prevents bankruptcy, but core operations lack a sustainable future, justifying a continued ‘sell’ rating.

- Despite some financial improvements, the company’s inability to find a new focus and declining sales signal deep trouble ahead.

jetcityimage

September 10th ended up being a really painful day for shareholders of video game retailer GameStop (NYSE:GME). After the market closed, the stock plunged roughly 10%. This was in response to disappointing financial results covering the second quarter of the company’s 2024 fiscal year. Revenue fell short of expectations, but earnings exceeded what analysts anticipated. Normally, this would not have resulted in such a painful drop in price. However, the magnitude of the drop in sales was significant. While the company is showing improvements on its bottom line and its cash position is robust, this does not do enough to negate all of the negatives associated with the business.

It has long been my opinion that the future for GameStop is very bleak. The company has missed out on major opportunities to reinvent itself. Its current cash position is honestly the only thing stopping me from having it rated a ‘strong sell.’ And that is because there is some opportunity for the business to change its operations around. For now, though, I am staying the course with a ‘sell’ rating. But this is not new. In my last article about the company, published in June of this year, I rated it a ‘sell’. Since then, and excluding this after-hours plunge, shares are down 19.8% while the S&P 500 is up 1.3%. And since I first turned bearish about the company with a ‘strong sell’ rating back in January of 2021, shares are down a whopping 73% while the S&P 500 is up 46.5%.

The picture is looking bleak again

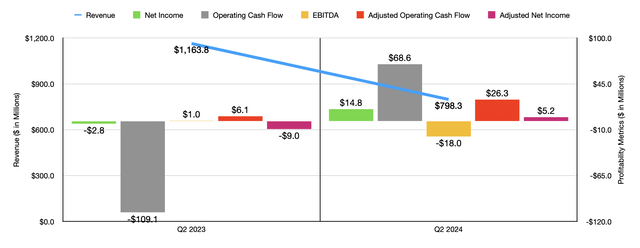

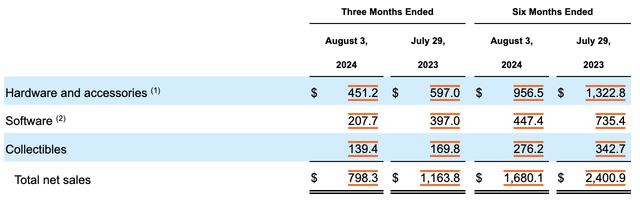

Fundamentally speaking, GameStop had a rather tough quarter during the second quarter of the 2024 fiscal year. For this window of time, management generated $798.3 million worth of revenue. This is down 31.4% compared to the $1.16 billion the company reported one year earlier. It also happens to be $105.7 million worse than what analysts anticipated. Digging deeper into the picture, we see sales declines across the board. As an example, hardware and accessories revenue declined by 24.4% from $597 million to $451.2 million.

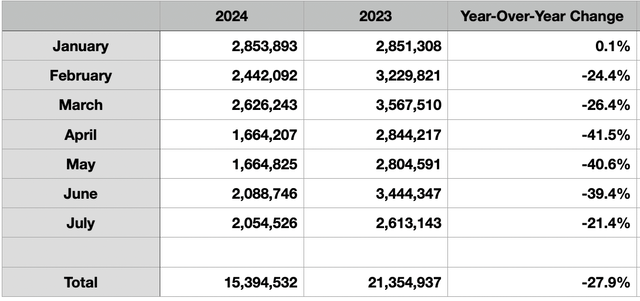

Unfortunately, management does not provide much in the way of detail. It is likely that a good portion of this drop can be attributed to a decline in store count. However, it is also true that industry console sales have dropped rather precipitously year over year. The details of this were covered in my prior article on the company. So I won’t rehash those here. But using the most recent figures available, it looks like for the three months that comprise the second quarter for GameStop, industry console sales were 5.81 million. That’s down 34.5% compared to the 8.86 million experienced one year earlier. And for the window of time from January through the end of July, console sales of 15.39 million are down 27.9% compared to the 21.35 million reported one year earlier.

But this wasn’t the worst of it for GameStop. The worst actually came on the software side of things. Software sales totaled $207.7 million for the most recent quarter. That’s 47.7% lower than the $397 million reported one year earlier. Software sales include new and pre-owned gaming software, digital software, and PC entertainment software. For a long while, I have thought that if there was any opportunity for the company to thrive again, it would be by investing in this space.

In general, it looks like there will be a shift away from hardware being involved in the gaming industry and toward software only. Software also offers the opportunity for more attractive margins. But on this front, it’s obvious that GameStop is faltering significantly. This is interesting when you consider that while hardware sales are expected to be lower this year industry-wide, the overall global gaming industry is expected to climb from $183.9 billion last year to $187.7 billion next year. Driven in part by rising console sales, as well as more attractive software sales, the industry is expected to rebound somewhat next year before climbing to $213.3 billion in 2027. So to see the company suffer so much in this category is downright scary.

There had been some hope, a couple of years ago, that another bright spot for the business would be its collectibles operations. This was viewed as an exciting and new growth opportunity. But even that is experiencing some pain. During the most recent quarter, the company generated only $139.4 million in revenue from these products. This is down 17.9% compared to the $169.8 million reported one year earlier.

With revenue falling, you would expect the bottom line for the business to suffer as well. But this has actually been a bright spot for shareholders. During the most recent quarter, the company generated a profit per share of $0.04. That was $0.05 greater than what analysts anticipated. It also marked an improvement over the $0.01 per share loss generated in the second quarter of 2023. Put another way, the company went from generating a net loss of $2.8 million last year to generating a profit of $14.8 million this year. On an adjusted basis, the company went from generating a loss of $0.03 per share, or $9.1 million, to generating a gain of $0.01 per share, or $5.2 million, this year. The adjusted earnings per share happened to be a whopping $0.10 greater than what analysts anticipated.

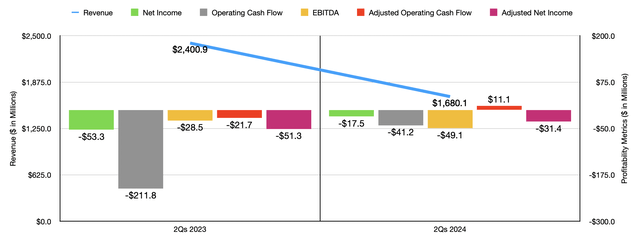

The primary driver of this improvement was a surge in the company’s net interest income from $11.6 million last year to $39.5 million this year. This can be attributed to the rising cash balance the business has and to higher interest rates. Year over year improvements are something the company has become accustomed to in recent quarters. In the chart above, you can see financial results for the first half of 2024 compared to the same time of 2023. With the only exception being EBITDA, the company’s bottom line improved on a year-over-year basis even as revenue took a dive. This is good in and of itself, but you can’t count on the bottom line improvements continuing for the long haul if sales are going to continue dropping. And with interest rate cuts on the horizon, it’s highly likely that interest income will start to decline as well.

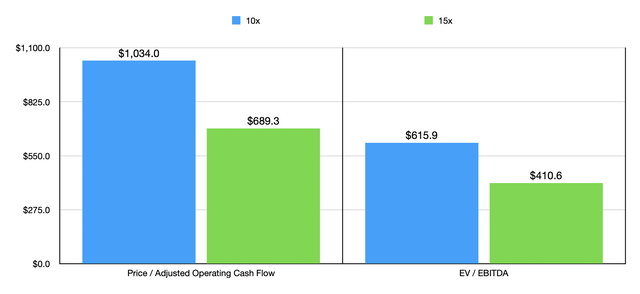

As I mentioned already, one of the good things about GameStop is its net cash position. During the quarter, the company had $4.18 billion worth of net cash. This did mark an improvement over the $4.13 billion reported one year earlier. But because of how high the firm’s market capitalization is, we still have an enterprise value for the business of about $6.16 billion. To put in perspective what it would take in order for the enterprise to be even fairly valued, I created the chart below. In it, you can see the amount of adjusted operating cash flow that management would need to achieve in order for the firm to be fairly valued at a price to adjusted operating cash flow multiple of either 10 or 15. You can see the same thing regarding EBITDA when it comes to the EV to EBITDA multiple.

These numbers, at least to me, seem to be virtually unreachable as things stand right now. As an example, if we annualize the revenue that the company has generated so far this year, even assuming a fair trading multiple of 15, the retailer we need to achieve an adjusted operating cash flow margin of 18.7% or an EBITDA margin of 11.1%. Even back in 2016, when the company’s revenue peaked at $9.36 billion, it achieved an EBITDA margin of only 8.7%.

Takeaway

As things stand, I can appreciate the improvements that management has made. But this does not negate all of the negative that we are seeing. The fact of the matter is that GameStop is in deep trouble. Its huge cash position will prevent it from going bankrupt. But its core operations have no future. Management has failed to find a new focus for the enterprise that the company can thrive in. Obviously, this picture could change as time goes on. But by this point, I have little hope that this will occur without significant additional pain. Given all of this, I’ve decided to keep the company rated a ‘sell’ for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!