Summary:

- GameStop capitalized on the 2021 short squeeze to raise over $1.6 billion in capital but has failed to evolve its business sufficiently.

- Recent years have shown stagnant revenues, negative operating cash flows, and a lack of capital projects despite raising significant funds.

- GameStop’s fundamental flaw lies in being a dying brick-and-mortar business in the era of e-commerce, with no clear strategy for sustainable positive cash flows.

Richard Drury

GameStop (NYSE:GME) isn’t the kind of stock I’d normally cover, but I think there is something unique about it, given the history of its infamous short squeeze and the legacy of that moment. Moreover, I think a review of its aftermath ultimately confirms that GME is not investable for the long term, deserving only a Hold rating.

Importance of the 2021 Squeeze

While the short squeeze in 2021 was self-evidently important to retail traders at that moment, its importance to GameStop itself was found in something else.

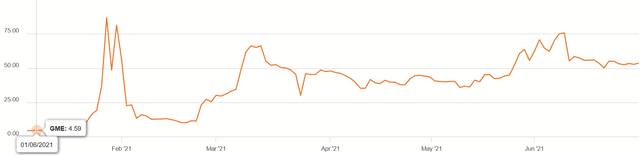

GME 2021 Price History (Seeking Alpha)

GME went from being a penny stock to several times higher in price in mere months. For the company, this offered a tremendous return on capital through share sales. Normally, when a business thinks about its capital allocation (and thus return on capital), it’s in the context of buybacks rather than selling shares, as well as how those buybacks compare to dividends or reinvestment in the business.

Yet, the logic cuts both ways: If buying back an undervalued stock creates good returns, then selling an overvalued one to get easy capital should as well.

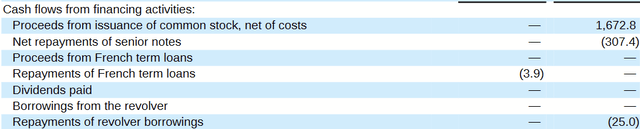

Cash Flow Statement (FY 2021 Form 10K)

Taking advantage of this overvaluation, GameStop raised over $1.6 billion in capital in the market. This was crucial for the company at such a tough time.

This was used to pay down hundreds of million in debt, and they were still ahead over $1 billion. Not many companies get a deus ex machina like this, and so there was actually some hope that GME could be investable here.

Recent Years

In my view, however, GameStop has failed to make use of this capital and to evolve its business sufficiently.

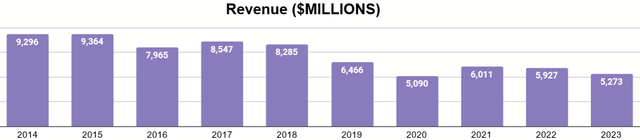

Seen above, revenues have not really moved much at all and are still well below GameStop’s more successful era a decade ago. (Note: 2023 in my charts would align with fiscal year ending Feb. 2024, and so on).

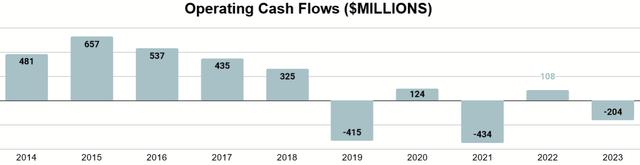

Operating cash flows, meanwhile, have turned negative, with FY 2023 only narrowly turning positive.

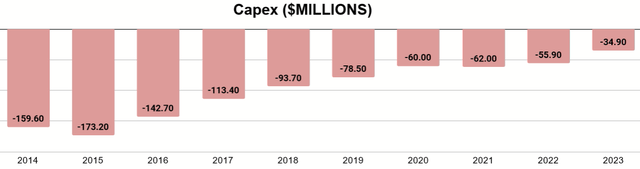

Capex, meanwhile, has declined each year. While this is a good thing in one sense, as the company needed to reduce its cash burn, this also shows that the company did not embark on any capital projects with the cash it raised.

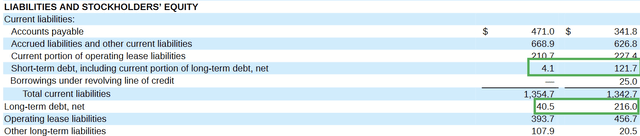

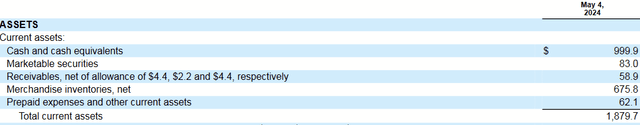

Balance Sheet (Q1 FY 2025 Form 10Q)

Consequently, they are still sitting on about $1 billion in cash. One would hope that they have something in mind, but it appears they raised capital for no purpose other than to buy themselves more time. The main change appears to be that operating expenses have been declining, so it seems the best any investor can hope to see is a turning point into positive cash flows at some point.

In June, they announced another ATM equity offering, and so we don’t have a reporting period for this activity yet. The stated purpose was about as non-descriptive and vision-less as everything else:

GameStop intends to use the net proceeds from the ATM Program for general corporate purposes, which may include acquisitions and investments.

This isn’t to say that the company can’t turn itself around and even become a grower, but with no conference calls or investor presentations since March of last year (and that call was disappointingly brief), there doesn’t appear to be a story for a turnaround here.

Investment Case

If there is an investment case for GameStop, the most likely one here seems to be a cigar butt. Of course, that depends on one getting a discount to its liquidation value. As of their latest quarter, GME’s book value per share was $4.27. At $22.40, that’s not a great entry price.

A similar (but technically different) out would be a tender offer by private equity, which often comes at a premium to liquidation. Still, it’s likely that investors would need a discount to the current price to make money off of such a transaction. Paying such a premium would require private equity to see potential in the brand and assets of GameStop that the current management does not.

Headwinds

Of course, this is thinking optimistically. I think GameStop’s fundamental flaw is that it’s a dying, brick-and-mortar business in an era of e-commerce. If we look at trends for total American retail sales, and compare that to the much faster growth of American e-commerce, it shouldn’t be surprising that older retailers have been in decline, particularly as the events of COVID catalyzed this process.

Just in 2022, 70% of game purchases were done through digital download. This is the erosion of the business opportunity that was GameStop. E-commerce threatens them with the instant delivery of physical copies to the home, but the industry itself is the coup de grâce. They are not creating product for GameStop to sell anymore. It’s what Netflix did to Blockbuster. First they delivered DVDs to customers. Then they made movie watching a primarily stream-based experience.

I think these brutal facts are why management isn’t bothering to sell us a turnaround story of wishful thinking. I’ve read reports and presentations by declining companies, where management defiantly talks about their plans for growth, and to see GameStop not bother with that is somewhat refreshing.

Yet, it’s a hint I think we should all take.

Conclusion

GameStop isn’t made of the right building blocks for success. It continues to be whittled down by forces beyond its control. It got something like a bailout from the 2021 short squeeze, and it seems to be taking advantage of a similar opportunity in the market currently. That merely buys time.

The fundamentals show a tale of decline, and there’s no obvious strategy to steer this company toward sustainable, positive cash flows. Unless a huge discount opens the door to some cigar-butt investing, I don’t see GME being investable.

Because of these weaknesses and since I never recommend shorting (especially a stock that is a big target for traders), I’ve decided to give GME a Hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.