Summary:

- I do not want to base an analysis on assumptions or potential short squeezes, so I analyze the share like all other companies.

- It seems that net income is only stabilized to some extent by interest income.

- GameStop is still wildly volatile, and I think it is a risky investment both as a long and short position.

Massimo Giachetti

For its market cap and overall relevance, GameStop (NYSE:GME) is probably the most famous stock worldwide, and we all know ‘why.’ Based on the research presented in this article, I think it is still a dangerous stock for both long-term holding and shorting. I don’t want to base an analysis on guessing, memes, and potential short squeezes, so I’ll analyze the stock just like all other companies. Seeking Alpha is a serious platform for serious analysis; anyone interested in gambling will find enough information elsewhere.

In this light, the business’ development is very negative; it seems that net income has only stabilized to some extent by interest income. The valuation makes little sense, for example, when compared with competitors. Although the company has a high cash position, it still presents no plan for a potential turnaround. The lack of a plan is disappointing, as the company would be in an excellent position to attempt, given its financial resources and fame.

The past: Financial Progress & Trends

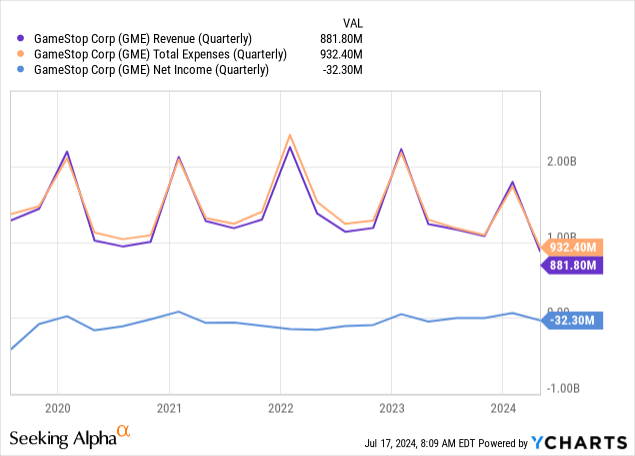

First, a short overview over a longer period for revenues, expenses, and net income. Overall, we can see the downward trend here. The last quarter was the worst for a long time. Net income was more often negative than positive, but at least it is not increasing.

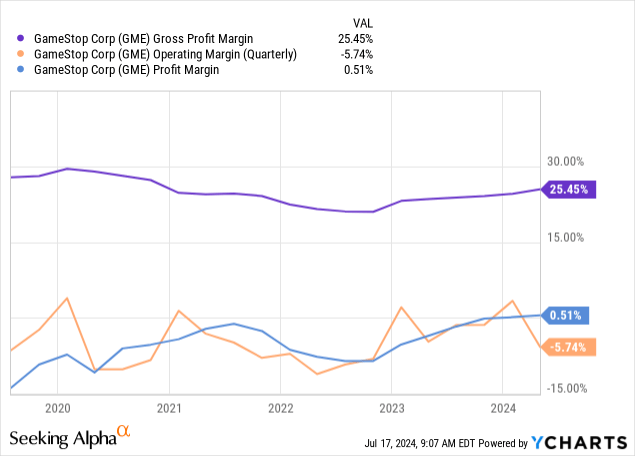

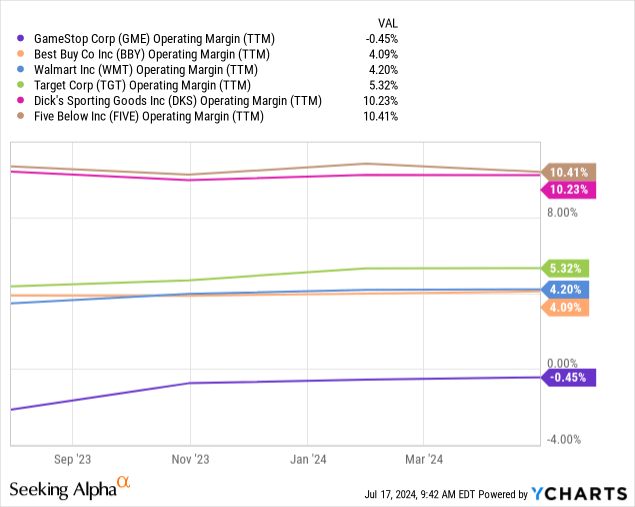

However, margins look better, with an upward trend noticeable since mid-2022. However, the operating margin has mostly been negative, and the profit margin has recently only been marginally positive. This is likely due to the company earning significant interest income from its cash position, which has somewhat improved the profit margin. According to the income statement, net interest income was about $55M in the trailing twelve months (compare that to the net income above, and you can see how tremendously the interest income has helped stabilise the losses).

The present: Cash, Valuation & Current Developments

The company’s enterprise value is $11.7B; the market cap is $12.2B, so its net cash position is about $500M. Valuing unprofitable companies is always difficult, so we should look at several metrics.

First of all, according to the last balance sheet, the company has about $3.27 cash per share. But, if we use the net cash position, cash minus debt, the number cuts in half. However, the balance sheet seems outdated because it doesn’t yet include a recent share issuance program that brought the company about $933M in cash. Overall, we will have to wait for the following report to see the exact cash per share; but clearly, financing is in a good position for the following years. The company has reacted quickly and used the price spikes to collect cash.

But how do we evaluate the future value and cash flow the company could generate in the future? Here is a comparison with other companies operating physical stores; GameStop is at the bottom of the list.

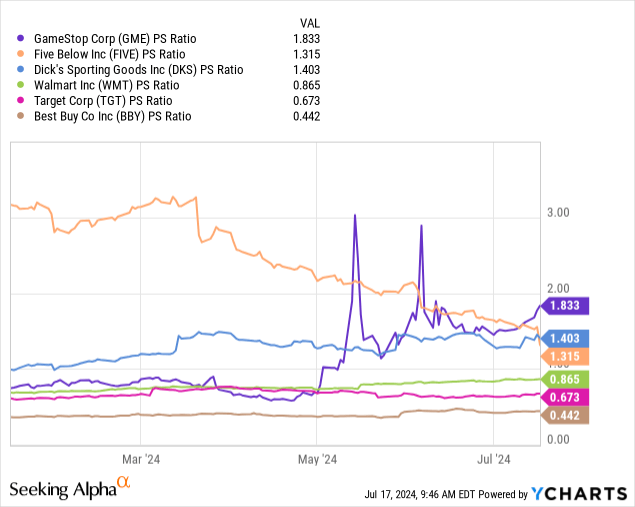

A comparison of the price-to-sales ratio with the same companies is also not favorable for the share.

We can’t value the stock on a P/E basis, as the stock operates at a loss in most quarters. The charts above show that GameStop is valued nearly 40% higher than Five Below and three times higher than Target on a P/S ratio basis, even though Five Below and Target have operating margins of 10% and 5%, respectively.

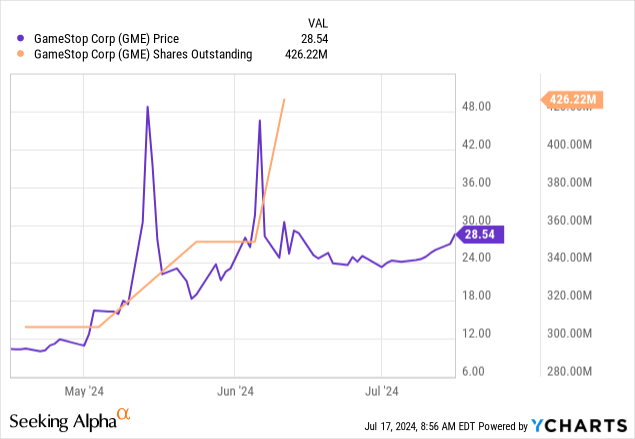

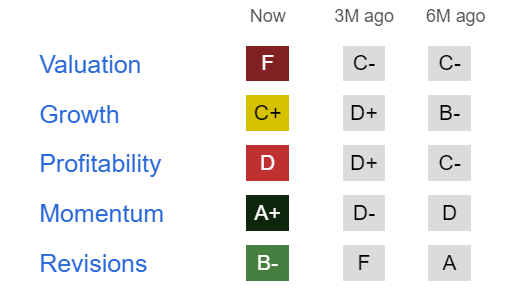

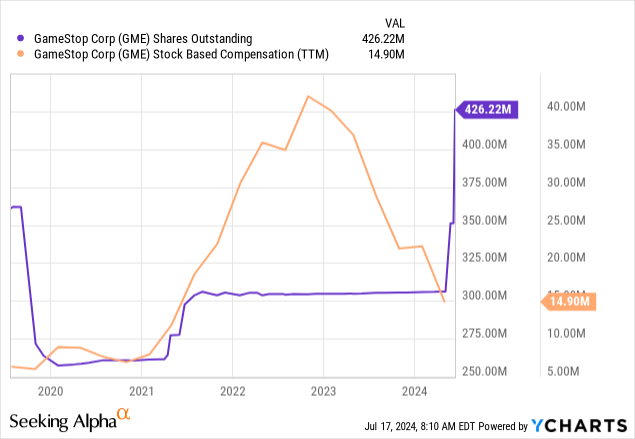

Given the company’s long-term trends of declining sales and frequent losses, it is questionable whether assigning significant value to future cash flows is appropriate, especially since the company presented no real plan for a turnaround (see next chapter). While the future interest income from the cash position has some value, the per-share impact is marginal. The company has approximately $933M more cash after the recent issuance of new shares, but also significantly more shares outstanding. Also, we can see that Seeking Alpha’s factor scores are negative in terms of valuation, growth, and profitability.

Seeking Alpha

The future: No plans for a turnaround

With a lot of cash on the balance sheet, we can ask the obvious question: What are the company’s plans? After all, the core business is not going well and requires change and innovation. So what does the management say?

Unfortunately, the communication is disappointing. There is no information on this in either the full-year report for 2023 or the Q1 2024 report. In addition, the annual meeting was an online event held just a few weeks ago in June. Investopedia headlines that the lack of details of plans has contributed to the fall in the share price. Reuters states:

Cohen said he anticipates the business will be operated with “a smaller network and more value-added” items as part of the company’s attempt to boost sales and profitability. He did not reveal how the company will use its roughly $4 billion in cash, which it built up following share sales in June and May, saying only that having a stronger balance sheet is “always an advantage.”

Reuters: GameStop shares tumble after CEO says store network will shrink.

In another article, the analyst speculates whether GameStop could launch a digital game store that competes with Steam or Epic Games. I don’t think so! Firstly, because the company does not mention something like this. Second, it would be a mammoth task, as established as Steam is among gamers. This means that even if GameStop were to attempt this, it is questionable whether such a large and years-long undertaking would be crowned with success.

Long or short? Both risky

Given the share’s past, both long and short positions are risky. The stock continues to be highly volatile in both directions. Based on traditional valuations, it is relatively clear that the share is considerably too expensive. The share is still not traded like other ‘normal’ shares. It is dangerous to be involved in this, and anyone who wants to take part, should be careful.

We all know that sales and profits should determine the share price in the long term. However, the whole market or individual stocks can be incredibly irrational in the short and medium term, and we never know exactly when rationality will return.

Otherwise, the business risks already mentioned remain. Sales are still falling, and there are no signs of a turnaround yet. The plan to close more stores is likely to accelerate the decline in sales. The interest income is one reason why net income still looks relatively stable and has not followed this revenue decline.

Share dilution, insider trades & SBCs

I include these three basic checks in every article, as excessive share dilution and share-based compensation can be detrimental to shareholders. Insider trades also sometimes contain valuable information about management confidence.

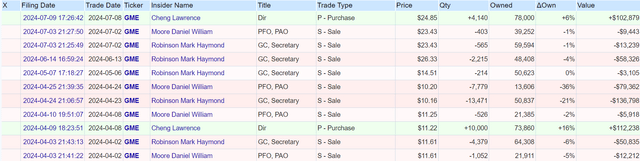

These are all insider trades over the last six months. Not too much going on here (which is a positive for shareholders).

Conclusion

After analyzing GameStop, like any other company, I can only conclude that it is not advisable to invest here. The company still seems to be treated as a speculative stock (to put it mildly). However, I know little about speculative stocks and have no interest in them, so I can only issue a sell rating.

On the plus side:

– huge cash position

– strong interest income

Negatives include:

– The company is still trading wildly fluctuating, which often makes the company appear overvalued (as at the moment)

– but the same volatility and the old meme-stock past also make short positions dangerous

– declining business

– massively increasing outstanding shares (almost doubling since 2021)

– checking the share price daily could increase blood pressure

Here is a quick checklist to summarize some of the most essential aspects.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

No |

Increasing over longer periods |

|

Improving margins? |

No |

Possible competitive edge |

|

PEG ratio below one? |

No |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

No |

Returning capital to shareholders |

|

Stock in an uptrend? |

Not long-term |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.