Summary:

- GameStop has seen significant volatility in its shares as well as changes in its business, including a new executive chairman and a strategic pivot back to a focus on brick-and-mortar retailing.

- Nonetheless, despite struggling with revenue growth and profitability, I believe GameStop has maintained a robust balance sheet and has the capital structure to potentially turn its business around.

- The company’s strategy now includes using its retail stores as fulfillment centers for digital orders, and leveraging its brand recognition from the meme stock frenzy could help improve its prospects.

- The picture here is that a turnaround is credible but that we don’t have any indicators as of yet that it is happening.

- Until we start to see movement on financial metrics, I will rate it a hold.

Scott Olson/Getty Images News

Overview

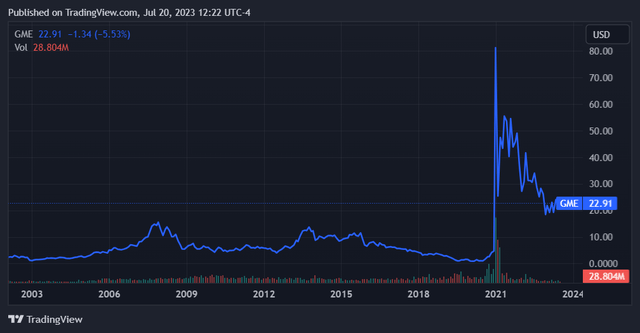

GameStop (NYSE:GME) is a company that most of us have heard about by now, one way or another. Widely considered to have been the first, as well as the most significant, of what are now referred to as ‘meme stocks’, GameStop stock has been on a wild ride for the last years. Forming the centerpiece of a high-profile saga in which retail investors piled into the stock and pressured high-profile short sellers in the process, GameStop shares have experienced significant volatility all throughout. We can see just how popular shares of this video game retailer became by looking at its price history.

While GameStop shares generally traded in a relatively constrained manner since its Q1 2002 initial public offering, its shares exploded in 2021 and subsequently went through major swings to end up where it is now, which is roughly a quarter of its peak price. Nonetheless, the stock price is evidently still elevated as compared to its trading history. Its current price of roughly $23 is higher than it ever was before it became a meme stock.

Along with this volatility, GameStop has seen significant changes in its business. The latest and most noteworthy of these was the appointment of a new Executive Chairman, Ryan Cohen, last month. Cohen was formerly the Executive Chairman of GameStop’s board. This leadership change has occurred during ongoing turbulence in the company’s strategy, with GameStop’s nascent foray into e-commerce now being backpedaled as it returns to its core focus on brick-and-mortar retailing.

This puts the company, as well as its stock, at an interesting inflection point. GameStop shares are no longer trading on the basis of it being a meme in my opinion, and I believe management is focused on executing a genuine turnaround in its business. This should mean that GameStop is back to being a stock that trades on the basis of its fundamental performance. As such, we can review its financials and evaluate how its business has been doing recently while also determining how its shares could fare as turnaround efforts continue.

Fundamentals

As a first bit of context, we can note that GameStop has struggled with revenue growth for quite some time. The last decade has seen slow growth rates and plenty of years of decline, including a significant (albeit expected) drop-off during the pandemic era. The last two fiscal years show a volatile trendline that is nonetheless better than average, yet with revenue still declining marginally in the most recent year.

This top-line pressure has occurred along with a deterioration in the firm’s profitability. GameStop started posting a steep loss in fiscal year 2018 and has not been able to reverse this since.

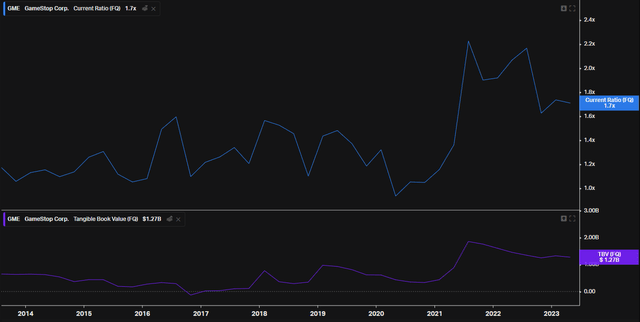

Evidently, this is a distressed business. Yet, the company’s situation is not as bad as it may seem. This is because it has been able to maintain a robust balance sheet. GameStop has maintained a reasonable current ratio that stood at 1.7x as of last quarter. Additionally, it has maintained a positive – even somewhat increasing – level of tangible book value.

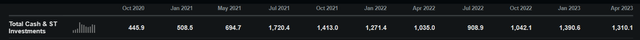

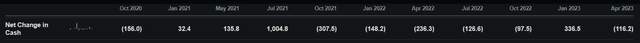

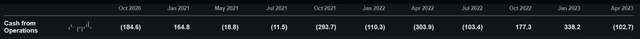

Of course, these metrics matter but are not quite as important as the company’s cash position. Here things look to be holding steady for the time being. GameStop acquired $1B cash from financing in Q3 2021 and has been drawing this down since.

Interestingly, the firm’s latest cash infusion (Q4 2022, ending Jan 2023) came from operations and not additional financing. While the overall cash from operations picture has not been a good one for the last 10 quarters, recent quarters show that it is not impossible for the firm to have cash flow generative quarters.

Overall these numbers don’t indicate that GameStop will face a cash crunch any time soon. Its balance sheet provides it with plenty of time to operate, and at minimum appears robust enough to make a turnaround effort credible.

My take from reviewing the books here is that GameStop has not begun a turnaround in earnest but that it has the capital structure in order to go about it properly. In the next section, I’ll detail more intangible factors such as the company’s strategy and positioning within the marketplace.

Strategy and Idiosyncratic Considerations

Prior to its current strategic posture, GameStop was focused on establishing itself as an e-commerce player. This has not gone particularly well. In response to these developments, management pivoted their approach and decided to make e-commerce an auxiliary part of the business. The core focus would now again be on retail stores, and digital orders would be fulfilled from the company’s brick-and-mortar establishments. This, along with general cost cuts, has been the company’s approach since the start of Q2 this year.

At first glance, it is sensible to use the company’s stores as fulfillment centers and to save on the significant costs of building out a full e-commerce supply chain. The company’s robust retail footprint provides it with a built-in fulfillment network that could undergird a higher-margin e-commerce capability with less marginal investment. This is also an area in which Mr. Cohen has expertise, having wrestled with similar problems as a co-founder of Chewy.

On the whole, however, getting what is primarily a physical retail business into profitability is a tall order. There are not too many examples of this succeeding. I am, however, reminded of the transformation that Barnes and Noble has gone through after it was made private again. The story there was similar, and the turnaround story has involved the company doubling down on its physical presence and leveraging it as a differentiator as opposed to a liability. While a bookstore and a video game store are distinct, they are not entirely dissimilar – both kinds of businesses focus on selling a specific kind of content product. While the way that it will play out will likely be different, the B&N case study shows us that it is still indeed possible to get ahead as a brick-and-mortar business in today’s high-tech retail landscape.

The final element worth mentioning here is the GameStop brand. While having been well-known amongst its consumer base for some time, it is now a much more prominent name due to the previous meme frenzy. It’s not out of the question that participants, or observers, in the meme situation will gravitate towards the brand. It is recognizable, well-known, and has a good reputation amongst a large number of consumers. This is another potential stepping stone to turning around its prospects.

Conclusion

I’m not certain if GameStop will be able to turn itself around, but I believe that it’s possible. The company’s balance sheet, brand, and strategy all work to make me cautiously optimistic. Of course, we don’t yet have proof that GameStop’s financial metrics are heading in the right direction. If they start to do so, I will take it as proof that the company’s new strategy is working and would likely be inclined to buy the stock. Given the levels of activity that we’ve seen in GameStop shares over the last few years, a return to bullish momentum could end up driving the shares up quite significantly. For now, I will call it a hold until the next earnings report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.