Summary:

- GameStop is falling back into its pre-bubble price range as its turnaround efforts show lackluster results.

- The company’s “NFT” and cryptocurrency expansion efforts promoted its stock price but likely have been a net negative for its business fundamentals.

- Despite its small quarterly profit, GameStop’s gross margins continue to fall steadily, indicating its growing difficulty in competing with the now dominant digital sales market.

- The expansion of free-to-play, indie games and subscription game services may accelerate GameStop’s margin and sales pressures over the coming year.

- GameStop’s strong liquidity position will slow its demise, but I believe its life expectancy is falling faster today than in 2021-2022, creating a potential short opportunity.

Anski/iStock Editorial via Getty Images

In 2021, the stock market was frothy as immense QE and government stimulus money fueled a tremendous increase in asset prices. As many people spent more time at home, many gambled on “meme” stocks, causing some fundamentally (or nearly) obsolete companies to rise tremendously. Most of these newer investors were younger men in their 20-the 30s, thus, promoting the value of their personal favorite companies, such as GameStop (NYSE:GME).

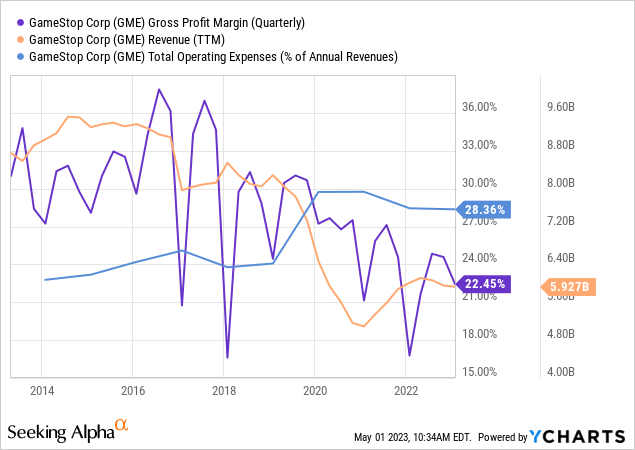

Despite the ongoing reversal in value, GME is still worth far more than before the buying spree. Much of the media commentary surrounding the stock focuses on the “ape vs. bear” arguments, which focus on mass sentiment far more than business fundamentals. Unsurprisingly, the company’s fundamental profitability has declined since 2021 as more game sales switch toward digital. Last year, 72% of console game sales were digital, while 90% in total were digital. Microsoft’s (MSFT) ongoing effort to purchase Activision Blizzard (ATVI) is expected to rapidly accelerate this trend as Microsoft gains more extraordinary monopoly-like powers over the Xbox’s content. The growing popularity of Microsoft’s “game pass” game subscription service is another major trend against legacy outlets like GameStop; however, it is also creating some potential anti-trust issues regarding the merger. At any rate, the long-term trend remains adverse to GameStop’s core business model.

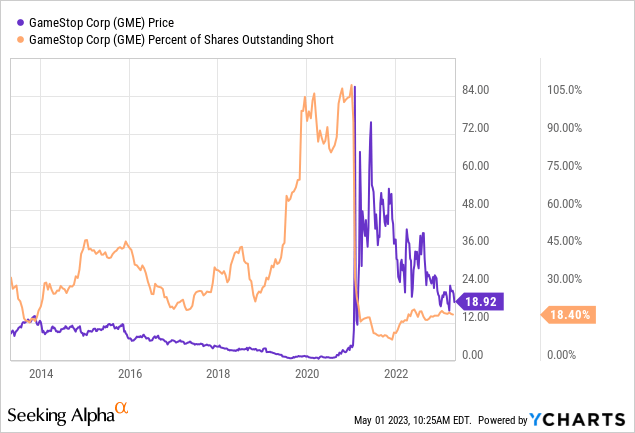

I believe GME is in a critical technical position today as it begins to retrace into its pre-2020 pricing range. Short interest in the stock remains far below normal before 2020, indicating its squeeze risk is much lower today than it was then. See below:

I believe GME is facing a crucial point where investors and analysts must look closely at the company’s true financial and operational condition. As the global economy slows and excess market liquidity evaporates (see banks), GME can no longer depend on steady streams of investor equity dilutions to offset its losses. Further, fewer investors are likely to continue giving money to a dying company. At some point, reality will kick in for GME, and I believe that time is soon approaching.

GameStop’s Chronic Failure To Adapt

Last month, GameStop’s Q4 earnings report exceeded expectations as its CEO stated it is on a path to profitability in 2023. The firm’s manager mentioned that the company’s improved cash and debt positions and “streamlined inventory” are key reasons pointing to the firm’s turnaround. The only issue, there is little concrete evidence that its core business model has turned around. The firm’s sales and gross margins have declined, while its operating costs-to-sales have remained elevated. See below:

GameStop did earn a very slight profit last quarter due to cost reductions and higher seasonal sales. However, its profit was still seasonally low compared to pre-COVID levels, and the necessary job reductions to earn this profit may have sacrificed its long-term potential. Of course, GameStop’s managerial focus is slightly uncertain as its investor calls were short, with less information than most companies, and its last call had no analyst Q&A (as is typical for virtually all companies). Despite significant rumors, the company has struggled to create a foothold in the online software sales space and has provided little information regarding its e-commerce goals. Instead, as detailed in its 10-K, the company made a strong effort in 2021-2022 to expand into the NFT and digital currency space; however, it has had to roll back such measures after losing millions. Put simply, following “hype” may boost retail investor interest, but it rarely helps failing companies turn around.

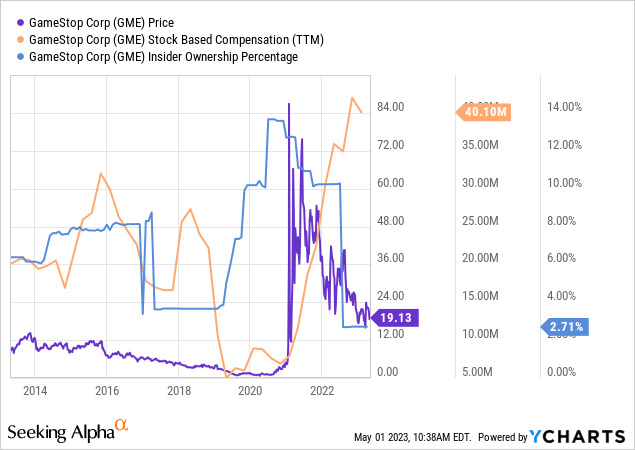

There have been notable changes to GME’s business since 2021. For one, its insider ownership percentage has plummeted while its stock-based compensation level has surged. See below:

The company’s stock-based compensation over the past year nearly equals its Q4 profit level of $48M. In reality, this is not a large figure compared to GameStop’s market capitalization today, but it is relatively large compared to its immediate cash-flow potential. To me, the most significant negative signal is the degree to which its stock-based compensation has risen since then while its insider ownership level has declined.

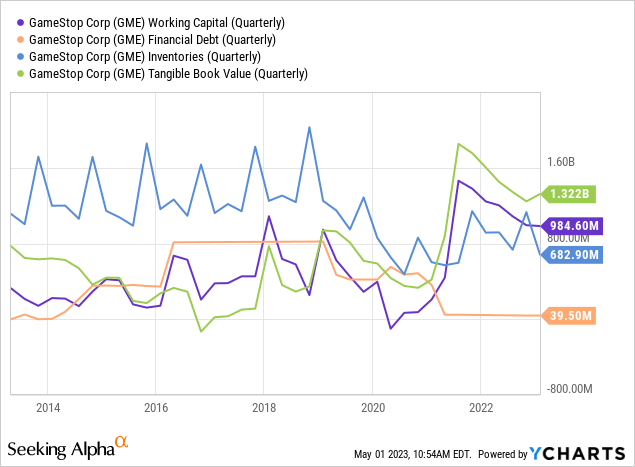

The one factor GME does have in its favor is its decent balance sheet position, fueled by equity dilutions during the 2021 rally. The company’s working capital is just below $1B today and is falling, but not rapidly, given its weak operational position. That said, most of its tangible book value is made of relatively liquid assets, and the company has no financial debt today. See below:

At the current pace of declines, GameStop could theoretically survive for around two to three years before it runs out of liquidity. Of course, given I expect its profitability to continue to decline due to its apparent failure to change, that timeline may accelerate. Still, I would not expect the stock to drop below its book value anytime soon because of its significant cash position.

Is GME A Short Opportunity?

In my opinion, based on the available evidence, it is highly likely that GameStop will eventually go out of business. While online rumors swirl surrounding increased investment from activist investors, merger or acquisition talks, or new “NFT” products, there appears to be little-to-no concrete evidence supporting these claims. Further, I believe there is minimal evidence that GameStop has turned a positive corner, as evidenced by its continually falling gross margins and stagnant operating costs, indicating its competitive pressure against direct digital sales is growing. To me, GameStop today was equivalent to a “floppy disk” company decades ago, a once-popular industry that could not adapt to technological changes.

I believe GME will eventually go bankrupt, and its stock will eventually become worthless. However, given its $980M working capital position, it can hemorrhage cash for some years before it runs out. GameStop’s TTM CFO level has consistently declined from around $300M-$750M in 2014 to -$750M (2021) to $100M today. There is a fair amount of volatility in its operating cash flow as the company’s specific position fluctuates; however, the overarching trend still appears quite negative and is ultimately driven by its falling gross margins and sales. Interpolating its TTM CFO levels over the past two years and assuming that the overall trend continues, I suspect its forward cash-flow loss will be around $400M-$600M and potentially more significant in 2024. This outlook has a fair amount of variance, but I believe it leaves GME with about two years before failure.

Obviously, equity dilutions would extend its life, but that may also cause such a significant devaluation that it would accelerate failure. Secondly, I do not believe GME could obtain debt financing at any reasonable rate today in the current banking environment. Thus, while GME may manage to last longer than 2-3 years, I doubt it and suspect it could fail sooner than many suspects today due to the accelerating growth in digital gaming subscription services and free-to-play content. If Microsoft acquires Activision, I believe GME’s life expectancy would become even shorter. Additionally, I believe the stock is significantly overvalued in the short run as its “surprise” Q4 profits pushed it up too quickly, and I do not believe its cash flows will remain positive in 2023.

Short activity in GME is high compared to many stocks at nearly 20% of the float, but that figure is very low compared to its pre-2021 short-selling volume. GME short-selling costs are much lower today but are still around 10% above that of most stocks. GME’s option implied volatility is “high” at 59%; however, that is on the 6th percentile of its average level, indicating its option premiums are very low today compared to their normal range over the past year.

GME is a riskier short or “put” opportunity than most stocks as it is extremely volatile, prone to rumors, and could build a new profitable business line. However, the cost of selling the stock is sufficiently lower today, indicating it may be a decent short opportunity. To me, the best bet for GME may be put options since the stock’s implied volatility level is subdued even though it is crossing back into its bearish technical range from ~2014. Put options also mitigate the risk of a “short squeeze” by having a defined downside. The short-selling risk could also be managed through the use of price stops, perhaps at a price of $24.5 – in-line with its peak price after its jump last quarter. Still, I believe GME’s short-squeeze risk is much lower today than many believe due to the sharp declines in its short-interest activity since 2020.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in GME over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.