Summary:

- GameStop, despite declining sales, has a strong cash position with virtually no debt, largely due to retail investor-driven equity sales during meme stock surges.

- The company focuses on omnichannel retail excellence, cost management, and leveraging brand equity, with potential investments beyond retail gaming under CEO Ryan Cohen.

- Short sellers are cautious due to GME’s unpredictable variables and strong cash position, reducing short interest and supporting bullish momentum.

- With Q3 earnings imminent, positive momentum may continue if cost reductions outpace revenue declines, potentially leading to breakeven or better bottom-line results.

JHVEPhoto

Investment Thesis

GameStop (NYSE:GME) is a cash-rich company with minimal debt, but it operates a declining business that is losing sales every quarter. What’s more, the stock trades at valuation multiples out of step with the reality of a business with these attributes.

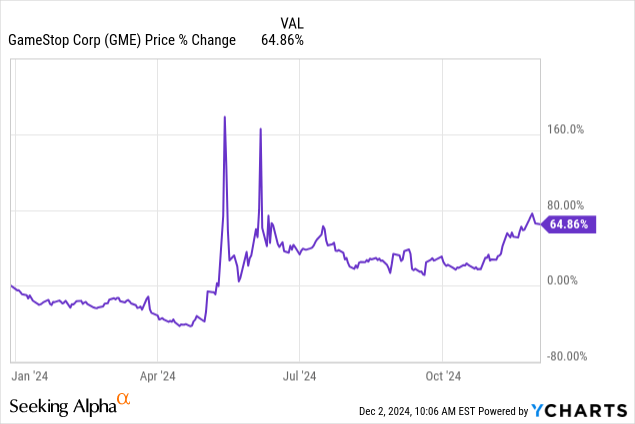

The video game retailer has had its “meme stock” nuances back this year, with the return of “Roaring Kitty,” in which it managed to secure a super infusion of cash to its balance sheet and has surprisingly managed to hold its share price at a very high level ever since, with momentum not going away.

As the company gets closer to reporting its Q3 earnings, I believe that looking from an unconventional point of view—where valuations and top-line growth have again seemingly been overlooked on the investment thesis on GME—the bullish momentum should be sustained if the drop in revenues continues to be smaller than the company’s cost management progress.

Of course, from a long-term business fundamentals perspective, GameStop stock still deserves a lot of skepticism, but I believe that with short sellers more fearful of betting against GME and with the real possibility of GameStop delivering another consecutive profitable year, the short-term outlook, at least, seems to be more favorable for GameStop’s shares than otherwise.

Retail Investors Made GameStop Cash-Rich

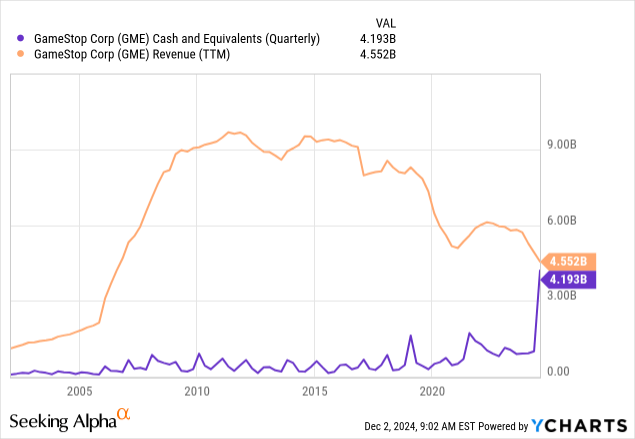

In the retail space, GameStop is probably the only case in the history of the stock market of a brick-and-mortar retailer that had its sales decline at a CAGR of -10.3% in the last five years and yet managed to increase its cash balance by 734% in the same period, and has no significant debt on its balance sheet.

This was only possible due to a totally abnormal phenomenon in the history of financial markets, where retail investors helped inflate the company’s stock price, largely under pressure from the massive short interest—natural to a business that had been poorly managed for years, outdated, and heading for bankruptcy, in my opinion.

As GameStop shares managed in 2021 to increase their share price by quadruple digits in just a few weeks, the company’s management team did what any decaying business should do in such a situation: sell equity to inject cash into its balance sheet.

That year, despite a dilution of shareholders, GameStop ended up raising $1.67 billion worth of shares in 2021 and used a large part of that amount to settle debts.

A lot happened after that. After years of extreme volatility, a tug-of-war between bulls and bears, GameStop, under Ryan Cohen’s profound influence (former Chewy (CHWY) CEO and co-founder, activist investor, and largest GameStop shareholder since 2020), tried to turn the business around, becoming the company’s CEO in 2023. Although Cohen was unable, under his command, to bring sales growth back to the company yet, GameStop achieved 2023, its first year of profitability since 2018.

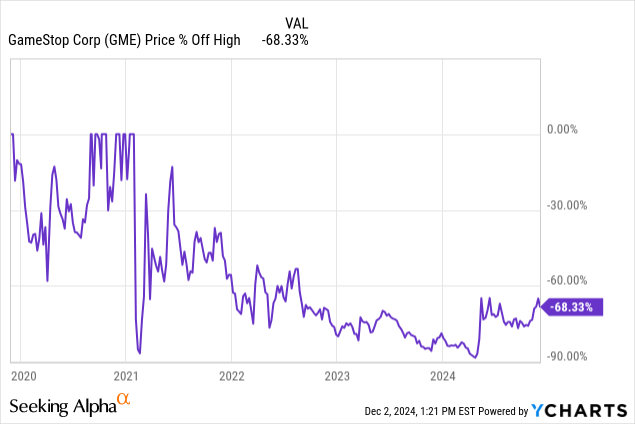

However, by the first half of 2024, GameStop’s shares were clearly losing their hype, and the company, despite posing a healthy balance sheet, was just a retailer declining sales every single quarter. So, from the peak in January 2021 until April 2024, GameStop shares had lost more than 87% of their value.

But there was one more stint to go. That year, the main character responsible for “introducing” GameStop’s investment thesis to retail investors on the internet, YouTuber-trader Keith Gill (also known as Roaring Kitty)—who has become something of a legendary figure among retail investor followers of GameStop stock—reappeared on the scene after more than three years of total disappearance.

Keith Gill made a comeback on social media, announcing a massive bet on GameStop once again, of around 5 million GameStop shares and 120,000 call options. The result was another epic short squeeze, albeit on a smaller scale than previous times. Shares jumped 400% in just a few weeks.

And again, what should a company do when a decaying business has its share price surging?

Sell more equity, correct?

So, Ryan Cohen and his team took advantage of this unexpected appreciation to sell 45 million shares, raising $933 million in cash. And they didn’t stop there. On June 7, after another massive surge, GameStop sold an additional 75 million shares, raising another $2.10 billion.

All this history has led up to this point: adding equity sales to the company’s cash balance, GameStop now has approximately $4.2 billion of total cash, equivalents, and short-term investments on its balance sheet with virtually no debt.

The Strategy for GameStop

Although many in the market argue that under Ryan Cohen’s management, there is no clarity about the paths GameStop should take, we can see from the company’s filings a few hints.

Starting with the fact that the company’s focus has been, in that order (according to the company itself), primarily:

- Establish omnichannel retail excellence: this objective can be interpreted as improving current channels without expanding stores, but rather focusing on fulfillment and shipment speed.

- Achieve profitability: involving a strategy of cost containment and anticipating future needs without necessarily expanding sales; in addition, the company also makes clear the strategy of focusing on improving margins with a focus on higher margin collectibles and pre-owned product categories, and also keeping the cost structure sustainable in relation to revenues, including steps such as “optimizing our workforce,” in other words, layoffs.

- Leverage brand equity to support growth: the company talks about growth but associates it with the company’s brand reputation among households rather than any different strategy to sell its products.

This last point is the most interesting, mainly because it touches on the question of “equity.” Earlier this year, in March, GameStop declared that the company’s board of directors had approved a new investment policy that guarantees that its CEO, who in this case is the company’s largest holder, Ryan Cohen, has the authority to invest in equity securities and other financial instruments.

Mr. Cohen directs the investment activity of the Company in public and private markets pursuant to authority granted by the Board of Directors. Depending on certain market conditions and various risk factors, Mr. Cohen, in his personal capacity or through affiliated investment vehicles, may at times invest in the same companies in which the Company invests,” the filing said.

In other words, with more than $4 billion in cash on the balance sheet, it seems quite clear that GameStop will continue to keep its operations as lean as possible, maintaining a breakeven profit, to gradually deploy cash in new businesses that don’t necessarily correlate with retail gaming.

GameStop’s filings also make it clear that Ryan Cohen’s commitment to the company’s cash balance being earmarked for possible investments beyond the core business makes sense, given the number of resources invested by the CEO himself in the company. It’s important to mention here that since Ryan Cohen built his entire 8.6% stake in GameStop over the past few years, he has never sold a single share, even with massive quadruple-digit appreciation at a certain point.

Such investments align the interests of the Company with the interests of related parties because it places the personal resources of Mr. Cohen at risk in substantially the same manner as the Company in connection with investment decisions made on behalf of the Company.”

What About GameStop’s Fiscal Q3 2025 Earnings?

The video game retailer is set to report its earnings on December 10 after the closing bell. As GameStop has been undercovered by analysts since it became a “meme stock” in 2021, it’s a bit difficult to follow the consensus formed by just two analysts forecasting EPS and revenues for the upcoming quarter.

But, in theory, the numbers to beat are an EPS loss of 0.03 cents and revenues coming in at $875.37 million, i.e., a 17.7% decrease in sales compared to last year. This is not surprising, considering that in the last four quarters, since FQ3 2024, the company has missed top-line expectations, showing a year-over-year downward trend ranging from -9%, -19%, -28%, and -31% in the most recent quarter. Ouch!

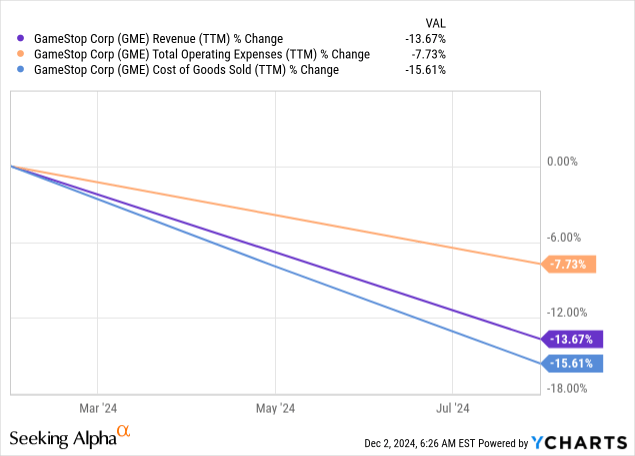

Looking at the bottom line, which is the company’s focus as stated in its briefly described objectives, last year FQ3 was one of the quarters in which there were no losses, after two consecutive quarters of losses. To do this, I’m going to focus on two metrics that I believe may be more useful to determining whether GameStop’s quarter could be successful or not—since another massive sales drop should be no surprise. These are the rates of decrease in cost of goods sold (COGS) and operating expenses (OpEx) > the rate of revenue decline.

First of all, it’s important to note that COGS directly affects gross profits, which is essential to cover other operating expenses. In other words, if COGS are lowered, which can occur for reasons such as better supplier deals and improving inventory management (which has been the great success of the Cohen management, in my view), they can improve margins without needing to increase sales.

OpEx, which involves marketing, salaries, rent, and R&D, comes only after profit and affects operating income, i.e., EBIT.

Over the last twelve months, we can see that revenues have fallen at a slower rate (although quite close) to COGS, although OpEx has fallen at half the rate of the fall in sales. This means that GameStop has managed to control its cost structure relatively well, despite the revenue drop, and is potentially improving its operational efficiency.

But, in general, for the purpose of achieving short-term profitability, arguably, the focus on reducing COGS is the most important, considering the more immediate impact on gross profit and, consequently, operating income. In the long term, aiming for sustainability and growth, arguably, the focus should be around OpEx.

In summary, I believe that no matter how badly sales fall in FQ3, if management continues to do a good job in reducing COGS and OpEx, likely GameStop’s share reaction could turn out to be positive.

Short Sellers Losing Their Appetite

Another point I’d like to highlight that could support the more bullish momentum for GME is that short sellers seem more cautious of shorting GameStop, even though it makes complete sense from a business fundamentals perspective.

Of course, being cash-rich doesn’t mean the business is healthy. In fact, a retailer that is consistently shrinking sales is not healthy at all. Especially if that same retailer trades at EV/EBITDA multiples of 197x, a forward price-to-sales of 3.2x (something like 220% above the retail industry average), as is the case with GameStop.

However, the traumatic history of short sellers who were burned by betting against GameStop cannot be ignored. At the very least, I don’t think anyone could have predicted that the return of Roaring Kitty this year would inject billions of dollars into the company’s balance sheet with the rapid appreciation of its shares.

Moreover, it’s hard to bet against a company with a CEO like Ryan Cohen, who hasn’t sold a single personal share bought at nearly penny-stock levels prior to 2021, is a hero for a legion of retail shareholders, and now has the green light to buy equity using GameStop’s cash.

Well, these are questions that most certainly complicate matters for short sellers willing to bet against a company with so many unpredictable variables.

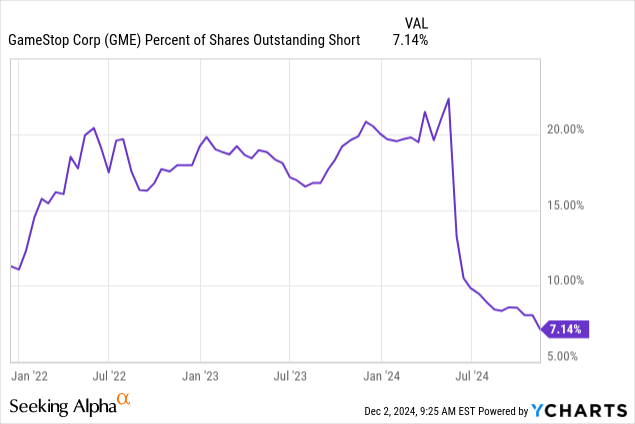

Notice in the graph below how GameStop’s short interest is at its lowest for two years. Of course, it has to be considered that the massive equity sales increasing outstanding shares have helped to reduce the interest percentage. However, I see this coupled with a diminished appetite for short positions, with bears somehow being forced to recognize that the company is in a stronger position to pursue growth in one way or another.

Another piece of data has caught my attention for some time. GameStop’s management has been disclosing for several quarters that many of the company’s shareholders have opted to hold their shares through a transfer agent rather than a brokerage house. The reasons behind this preference may vary, but it appears to be driven by retail investors who are concerned about potential illicit short-selling practices.

The excerpt below is from the company’s latest filings for Fiscal Q2 2025:

As of September 4, 2024, there were approximately 426,509,592 shares of our Class A common stock outstanding. Of those outstanding shares, approximately 353.7 million were held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 83% of our outstanding shares), and approximately 72.8 million shares of our Class A common stock were held by registered holders with our transfer agent (or approximately 17% of our outstanding shares) as of September 4, 2024.

An important point to mention is that when shares are registered away from brokers and banks, short sellers, in theory, can’t borrow them to initiate short positions. In this case, if we consider that 17% of the company’s float is far from the reach of short sellers, and another 8.7% belongs to Ryan Cohen, this, in theory, significantly reduces liquidity for shorting and could also contribute to lower short interest.

Final Remarks

Adopting a bullish stance on GameStop stock, from the point of view of business fundamentals, still seems to be much more of a gamble than an investment. In my humble opinion, I believe that this is how investors should still approach the GameStop stock, as I expect that volatility should follow the stock for many quarters to come.

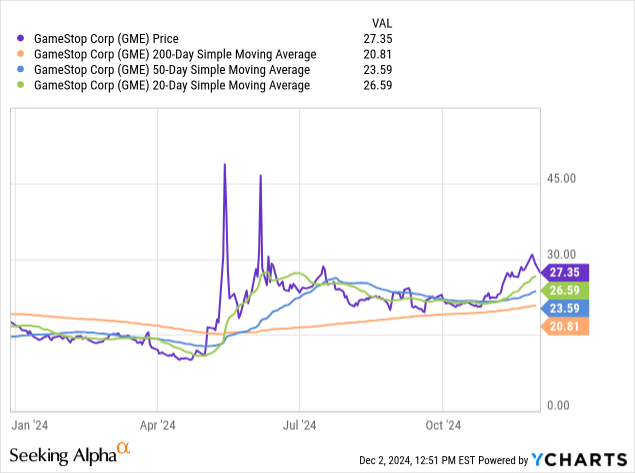

However, throughout this year, momentum has remained strong, even after the “Roaring Kitty”-driven rally, and the stock trading above short and long moving averages supports a bullish signal.

I anticipate that, with GameStop’s Q3 earnings report imminent and a real chance to see decent bottom-line results close to breakeven, along with COGS declining faster than sales, this could be enough to sustain the positive momentum at this stage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GME either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.