Summary:

- GameStop faces challenges in the age of e-commerce with declining sales, margins, and store closures.

- The US$2.3bn cash infusion provides management with time to attempt a turnaround or cash to burn before the inevitable.

- Under three scenarios – turnaround, zombie, and extinction – none provide upside potential in 2025.

- I would avoid GME: Given the meme stock status, which ignores business fundamentals, I would not short, buy, or hold the stock.

simpson33

Introduction

I have stayed away from meme stocks. While the wild rides could produce high returns if timed correctly, I found it too speculative and did not see them as a good business. However, curiosity got the best of me, and I decided to analyze GameStop (NYSE:GME), is there deep value I am missing or a lot of hype? I applied my experience in retail analysis to GME and built a simplified model that points out the stark challenges this business faces in the age of e-commerce.

Business Analysis

GME has a straightforward retail business model. It focuses on selling video games, consoles, peripherals, and more recently, collectibles. It is a brick-and-mortar retail business with around 4,300 stores in the US, Canada, Australia, and Europe based in malls and stripes centers. It is a very similar model to other specialized retailers such as shoe stores, and pet shops for example. The logic is to gain scale in specific products, where the retailer can obtain better prices and payment terms. The retailer markets and builds a brand as a specialist to draw traffic and revenue. On the cost side are store leases, sales, and distribution to name a few. The key in retail is to have negative working capital, selling products faster than one needs to pay suppliers, this generally allows for small margins to generate solid cash flow that is then recycled into adding new stores, adding more scale, etc.

The model worked well for 1000s of retailers until the distribution of products began to move from a physical store to online, i.e., e-commerce and Amazon.com (AMZN). This new distribution system empowered producers to sell directly to consumers and also brought down barriers so that many folks with modest capital could build virtual stores, drop-ship, etc. GameStop, like many such as Block Buster, Department stores, did not, have not evolved and may be headed to extinction or a zombie status at best.

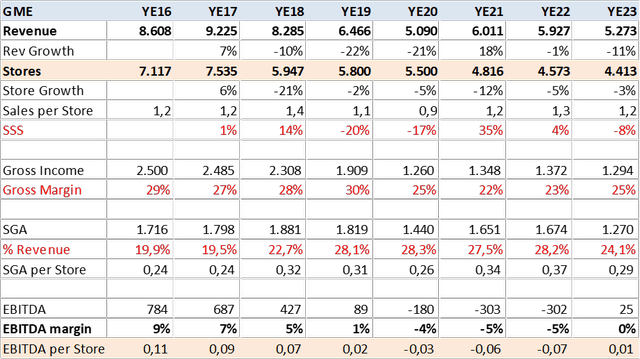

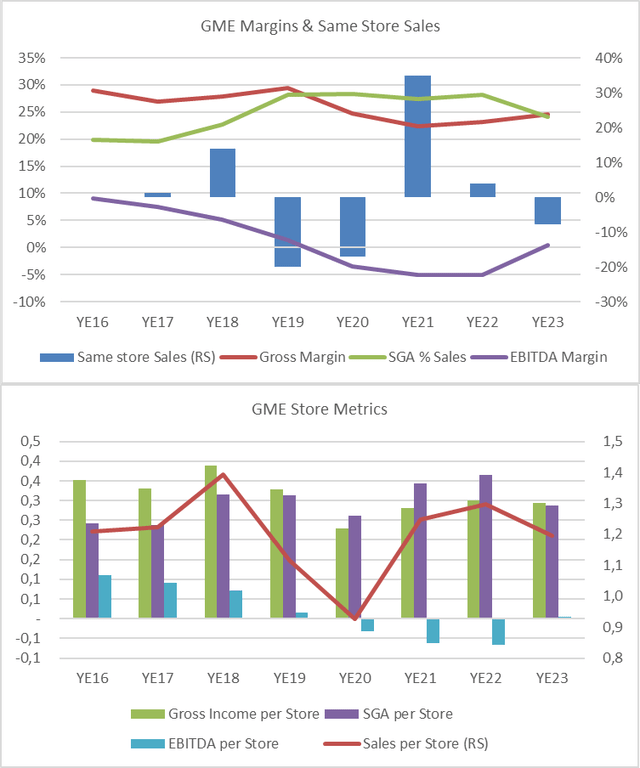

GME has cut 40% of its stores since 2016 and has seen same-store sales fall 1% while gross margin contracted to 25% from 29% and SGA per-store grew 19% that drove EBITDA to negative. It’s been a losing battle that seems difficult to revert.

Created by author with data from Bloomberg Created by author with data from Bloomberg

Sensitivity Analysis

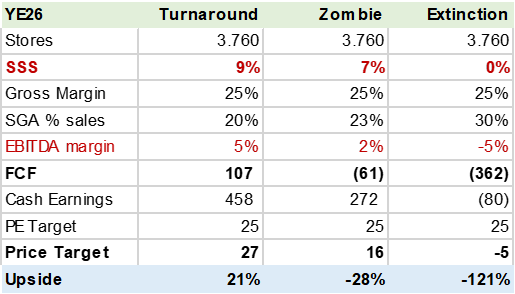

There are only a few analysts that cover the stock, while the company’s disclosure and market communication have diminished. Thus, I decided to present three possible scenarios for GME and potential valuation. The key drivers are same-store sales, store count, gross margin, SGA per-store, capex, and working capital needs. The recent follow-on, that injected US$2.3bn, provides the company with the ability to execute a turnaround or delay the inevitable.

All scenarios assume the company will continue to close stores to focus on those that are most profitable, while also limiting capex needs. I have also assumed working capital needs stay relatively high on tight supplier terms and high inventory levels.

Under the turnaround scenario, I assume the company can grow sales by 3% which translates into 9% same-store sales growth that helps reduce SGA per-store cost and boost EBITDA margin to 5% by YE26. This turnaround does fly in the face of the current consumer trends, but perhaps the cash infusion allows the company to increase marketing/promotions to draw back traffic.

The Zombie scenario assumes sales do not grow, but store closures boost EBITDA margins to 2%. However, under this low growth scenario, the company may not be free cash flow positive and would need to eventually raise debt just to stand still, hence a zombie or stagnation situation.

In the Extinction scenario, the company continues to see total revenue fall or remain flat on same-store sales metric on store closures. This drives SGA as a percent of revenue higher and EBITDA stays in the -5% territory with a cash burn of US$360m a year that would eventually require closure of the business. The equity value is zero under these assumptions, which is the path GME was on before raising capital in the recent price spike.

Sensitivity Analysis (Created by author with data from Capital IQ)

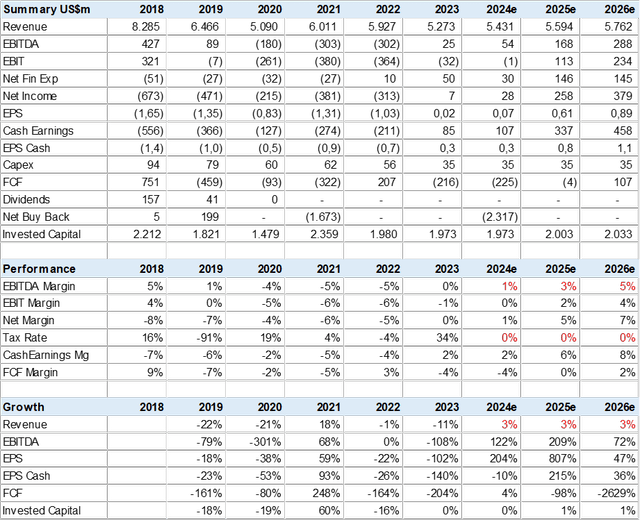

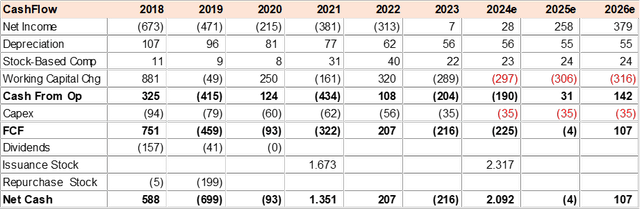

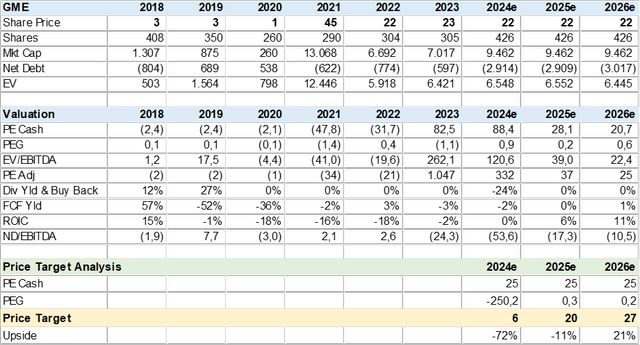

Financial Summary & Estimates

In this section, I present the financial summary and valuation for the turnaround scenario. As can be seen, the company’s historic fundamentals are terrible and indicative of a company heading for extinction. The turnaround scenario is quite frankly an optimistic guess, backed by a strong balance sheet that may provide management with time to revert Game Shop’s demise. However, it does not seem that the shares are worth owning until this turnaround is well in execution.

Created by author with data from Capital IQ Created by author with data from Capital IQ Created by author with data from Capital IQ

Conclusion

I rate GME an avoid. The US$2.3bn cash infusion provides the company time to attempt to turn around years of underperformance driven by changing consumer trends and technology, but may ultimately fail. Given the meme stock status which ignores business fundamentals, I would not short, buy, or hold the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.