Summary:

- The FLRAA helicopter contract is important for Textron Inc. to offset lower V-22 sales in the coming years.

- The Textron bid always seemed like the stronger one.

- Sikorsky-Boeing provided an FLRAA solution that was not prioritizing cost over capability.

- For Textron, there are tens of billions of dollars at stake, with the first batch worth $8.1 billion.

petesphotography/iStock via Getty Images

In a previous report, I covered the contract win from Textron Inc. (NYSE:TXT) in the bid to provide the Future Long-Range Assault Aircraft, or FLRAA, to the U.S. Army. As I discuss below, this was pretty much a must-win for Textron given revenue declines on other defense platforms. After Textron was awarded the initial contract, Sikorsky, which was the other contender to win the contract, protested the decision.

The Government Accountability Office denied the protest on the 6th of April. On the 13th of April the report was released, providing more details on the protest and how each design scored, which I will be reviewing in this report.

What is Future Long-Range Assault Aircraft or FLRAA?

The Future Long-Range Assault Aircraft is a 2019 program initiated by the U.S. Army that aims to develop the successor of the Sikorsky (LMT) UH-60. The program is part of the overarching Future Vertical Lift initiative to develop the successor of the UH-60 Black Hawk, AH-64 Apache, CH-47 Chinook and the OH-58 Kiowa helicopters. Initially, as the Joint Multi-Role [JMR] program the Future Vertical Lift program was divided into several classes:

- JMR-Light, which became the Future Attack Reconnaissance Aircraft Program.

- JMR-Medium-Light

- JMR-Medium, which became the Future Long Range Assault Aircraft Program.

- JMR-Heavy, which intends to replace the CH-47 Chinook.

- JMR-Ultra, which provides vertical lift comparable to fixed-wing aircraft.

The JMR-Medium that resulted in the FLRAA program initially had been envisioned as a replacement to the AH-64 Apache and the Black Hawks. However, there already had been signs that the program would end up being split. That makes a lot of sense, as the Black Hawk is a helicopter that is mainly used for dropping soldiers and it can be armed when needed, while the Apache is a pure attack helicopter. So, these two helicopters have little in common other than being medium-lift helicopters. The Army envisions the FARA program to develop the helicopter used to do spotting and attacking creating a clear path for troops injection from the product that would be developed under the FLRAA program.

That means that the Apache helicopter is a bit beyond the scope of the medium-lift replacement program, and it is too much firing power to be in the light category. The Boeing Company (BA) and the Army have diverging views, where Boeing sees a next generation Apache as the main attack helicopter rather than the Army’s FARA product. So, the FLRAA really is a Black Hawk replacement and not an Apache and Black Hawk replacement as envisioned earlier. I’ve been face-to-face with an Apache and that helicopters are built to let the enemy know they are coming with heavy weapons. So, it is a completely different class than light attack helicopters or the medium-lift Black Hawk. It lifts something else, weapons… lots of it coupled with an impressive sensor package.

That is not to say that with different capabilities, namely transport for one and gunship for the other, it is not possible to have it replaced by one platform, because that certainly is possible with different variants of the platform. However, we also see that while the Apache is set to be operating through 2045 and most likely beyond 2050, the Black Hawk replacement is set for 2030. So, there is a difference in capability and a difference in replacement timelines.

A Must-Win For Textron

Textron and Boeing-Sikorsky competed for the FLRAA project. Textron entered the competition with the V-280 Valor, a tilt-rotor aircraft, while Boeing-Sikorsky entered with the Defiant X, which is a compound helicopter with coaxial rotors.

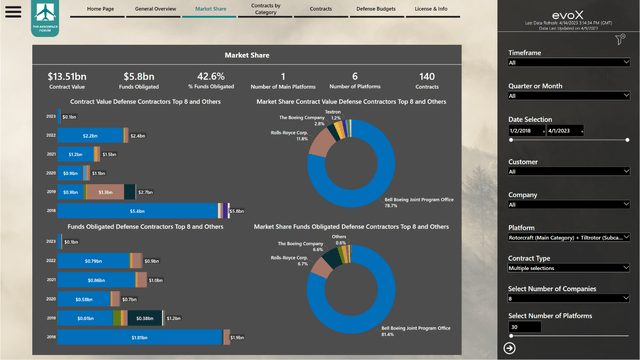

The figure above shows the contract awards for the V-22 for which Textron via its Bell subsidiary relies on heavily for defense revenues. What we see is that contracts awards are generally lower than 2018 levels and with lower contract awards this also means that in the coming years the V-22 revenues were set to decline. So, Textron really needed this win and they also positioned themselves for it, providing a capable product for the contest.

The Sikorsky Protest Is Denied

|

US Army Requirement |

Contenders |

Replacing |

|||

|

Minimum |

Desired |

V-280 Valor |

SB-1 Defiant |

UH-60 |

|

|

Combat Range [nmi] |

200 |

300 |

500-800 |

? |

320 |

|

Ferry Range [nmi] |

1725 |

2440 |

2100 |

? |

1380 |

|

Speed [kts] |

250 |

280 |

280-300 |

250 |

140 |

When I discussed the FLRAA contract award to Textron, I showed the table above. What was interesting was that the V-280 Valor seemed to exceed the U.S. Army desired requirements while there wasn’t much known about the SB-1 Defiant other than that due to an old T55 engine it would initially not meet the ferry range and combat requirements and this would happen later on with the introduction of the FATE powerplant. When Sikorsky protested the decision, I really wondered on what grounds that would be since it does not at all seem that it would ever be superior from requirement perspective.

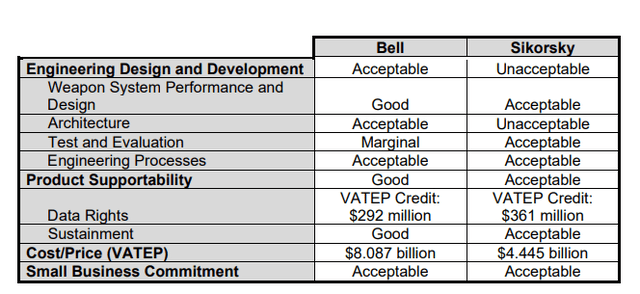

After reviewing the report from the Government Accountability Office, things became a bit more clear. Sikorsky did not agree with how the U.S. Army scored its design. The RFP outlined that non-cost/price factors, when combined, were significantly more important than cost/price and that, to be considered for award, a rating of no less than “acceptable” had to be received for each of the non-cost/price factors. The RFP defined an unacceptable rating as: “Proposal does not meet requirements of the solicitation, and thus, contains one or more deficiencies, and/or risk of unsuccessful performance is unacceptable.

Furthermore Sikorsky did not agree that the Textron design was deemed acceptable. The U.S. Army identified four significant weaknesses and 11 weaknesses leading to the architecture subfactor being scored with “Unacceptable.” It became clear that the Sikorsky functional architecture provided insufficient base to demonstrate that the design could meet the requirements. This kind of scoring matrix is extremely common in evaluating designs and if you look and it looks like Sikorsky simply did not provide sufficient subsystem level detail on the architecture for the design to be properly evaluated. That means two things, the first one is that its overall design could never receive an acceptable rating and as a result it could not be eligible for contract award. Secondly, because of the unacceptable rating of the design Sikorsky is also no interested party and cannot raise other challenges to the evaluation.

I already did not quite understand on what grounds Boeing-Sikorsky would protest the contract award and if I look at the findings from GAO, they could not either. In fact, Sikorsky did not provide sufficient detail for the agency to properly assess its acceptability and compare it to Textron’s bid. So, I am somewhat puzzled on why Boeing-Sikorsky went through all the hassle of developing only to end up providing insufficient detail in the paperwork to score the design but given on how little was known, this could have been somewhat expected. This was always a contract where Textron would have a bit of an edge because not winning the FLRAA contract would significantly weaken one defense player and reduce competition in the industry, so the what Boeing-Sikorsky would enter into the contest had to be extremely good. That simply was not the case, they delivered a less capable design or at least that is the way I see it at 55% of the cost.

Sikorsky heavily bet on cost being a decisive factor in the decision making while the RFP had clearly outlined that was not the case.

How Much Is The FLRAA Program Worth For Textron?

How much the program is worth to Textron will depend on the ultimate purchase quantity plus international sales, but the first batch is worth $8.1 billion, of which not all has been awarded yet in the form of firm contracts. The full lifecycle program value is up to $80 billion.

Conclusion: Textron Wins Rightfully As Sikorsky-Boeing Is Deaf To Requirements

I already had my doubts on how strong Boeing-Sikorsky protest would be and although I already had somewhat of an impression that the Bell bid was stronger, Sikorsky just seemed to have aimed in a completely different direction. While the RFP was clean on capabilities being scored higher than cost, Boeing-Sikorsky took the risk and focused on providing a less capable and less costly solution. However, that was not at all what the U.S. Army was looking for and that was clear. Boeing-Sikorsky just was tone deaf on the requirements and its paperwork was sufficiently lacking making their design score unacceptable and future challenges inadmissible.

For Textron Inc., this is good news, as they can now move on with the engineering and design work. That is a lower margin business as is always the case on these EMD contracts, but it is an important step in the process and even more important as Textron Inc. has to pace through the program well to offset lower V-22 sales.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.