Summary:

- Growing competition in the electric vehicle industry has led to bankruptcies and financial struggles for some start-ups, while legacy automakers like General Motors are thriving.

- Despite challenges such as labor settlements and slowing EV demand, General Motors had a successful and profitable year in 2023. FY 2024 should see a continuation of this momentum.

- General Motors offers a promising investment opportunity with its strong free cash flow, growing EV product portfolio, and low P/E ratio.

Nic Antaya

The electric vehicle industry has become significantly more competitive in 2023 as a number of both EV-focused start-up companies and legacy car brands increased their electric vehicle product line-ups and engaged in fiercer price competition in order to secure market share. Unfortunately, growing competition has pushed some EV start-ups either into bankruptcy, like Lordstown, or close to the brink of it, like Fisker (FSR). On the other hand, large legacy automakers like General Motors (NYSE:GM) are seeing strong financial results, boosted by their ICE divisions, and are growing their EV line-ups as well. With $9.0B of free cash flow expected in FY 2024, I believe General Motors could be a very promising EV investment for investors!

Previous rating

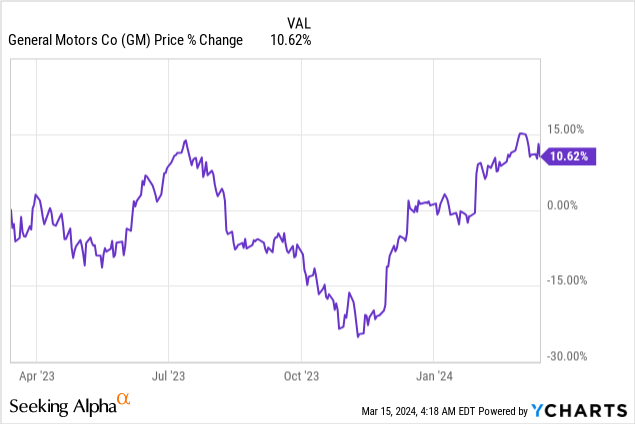

I rated General Motors a strong buy in October of last year as the company’s shares were languishing and trading near 1-year lows. At the time, I indicated that General Motors was suffering from negative sentiment overhang related to a potentially expensive deal with U.S. labor unions. While the deal is expensive, I believe General Motors’ FY 2024 guidance is very robust and shares remain cheap, despite an upside revaluation.

Strong results for FY 2023 despite labor settlement, slowing EV demand

2023 was a challenging year for the U.S. auto industry for a number of reasons. First, U.S. labor unions went on strike in Q4’23 to demand better pay and work-of-living adjustments, resulting in an expensive $9.3B pay package. Although the signed labor agreement will spread those costs out until FY 2028, the pay package is set to limit the company’s short-term earnings potential.

Second, slowing demand for electric vehicles has led the company to announce that it will slow its EV transition. General Motors originally laid out a medium term production goal of 400k by mid-2024, but this goal is being pushed back. Ford Motor (F) made the same announcement and said at the beginning of January that it is cutting back on its F-150 Lightning production, the car brand’s signature pick-up truck, due to weakening demand.

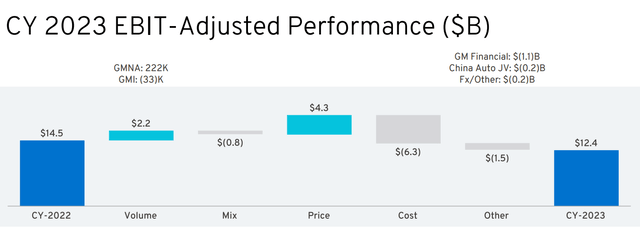

Despite those headwinds, 2023 was still a successful and profitable year for General Motors. The car brand delivered 2.6M vehicles to dealers across the country, in FY 2023, resulting in a 14% growth rate. General Motors also sold 2.1M electric vehicles in China as Chinese buyers seem to be much more open to EV adoption than U.S. buyers. In total, General Motors generated $12.4B in adjusted EBIT last year.

Importantly, the company continues to except resilience in auto sales in FY 2024, in part because General Motors is still overly reliant on ICE vehicles which allows the car brand to ride out a potential slowdown in EV sales. For the current fiscal year, General Motors expects $12-14B in adjusted EBITDA and free cash flow of $8-10B (see GM’s FY 2024 guidance).

General Motors said that it will delay the launch of a couple of its electric vehicles to FY 2025 in a bid to save costs. Nonetheless, General Motors’ new EV models are going to hit the market in the near future, including the Chevrolet Blazer EV, the GMC Sierra pickup EV and the Chevrolet Equinox EV. Since GM is still selling a lot of ICE vehicles and has optionality with regard to further delaying EV production, I believe that General Motors as well as Ford’s more diversified product and revenue mixes provide investors with a crucial hedge against a demand slowdown in the electric vehicle segment.

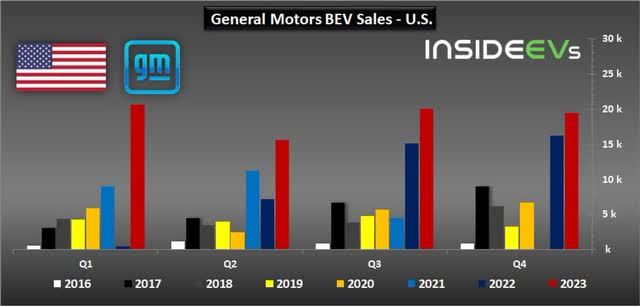

In FY 2023, General Motors delivered 75,883 battery-powered electric vehicles to its customers in the U.S. Although EV sales soared 93% year over year, the share of electric vehicles measured as a percentage of total delivery volume was only 2.9%. This implies that despite strong delivery and sales growth in the EV segment, ICE vehicles will continue to represent the overwhelming majority of auto sales for General Motors in the foreseeable future.

General Motors is trading at a 23% earnings yield

One of the most attractive feature of an investment in General Motors, besides its considerable free cash flow cash power and growing electric vehicle product portfolio, is the car brand’s low valuation based off of free cash flow and earnings. General Motors has a P/FCF ratio of 5.1X, based off of $9.0B in FY 2024 projected free cash flow. Ford has guided for a mid-point FCF of $6.5B for FY 2024 which implies a P/FCF ratio of 7.4X. Both companies obviously are cheap from a free cash flow perspective.

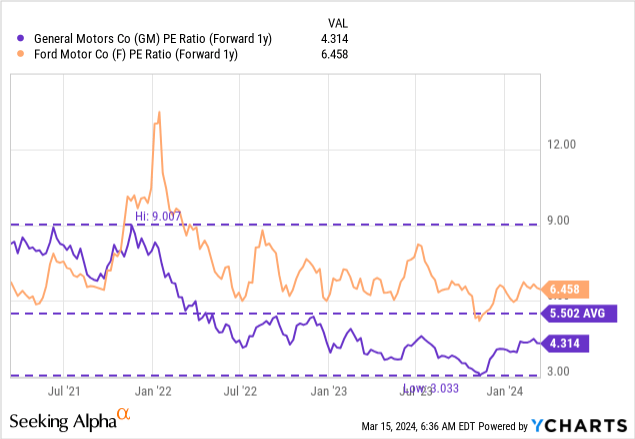

General Motors shares are also trading at a cheap P/E ratio of 4.3X, showing a 22% discount to the 3-year average P/E ratio. Ford is slightly more expensive with a 6.5X P/E ratio, but, again, both car brands provide investors with double-digit earnings yields: GM has an earnings yield of 23% while Ford has a 15% yield. I don’t see why General Motors couldn’t trade at the same P/E ratio that Ford has given that the car brands have similar product portfolios and both companies invest heavily into growing their EV line-ups. If GM were to trade at Ford’s P/E ratio, 6.5X, which itself is not a very rich multiplier, then shares of General Motors could be valued as highly as $60, implying approximately 50% upside potential. If shares were to revalue merely to the 3-year average P/E ratio of 5.5X, shares of General Motors could have upside potential to ~$52. Slower than expected growth in the EV segment, at this point, seems to be both properly reflected in General Motors and Ford’s valuation, in my opinion.

Risks with General Motors

There is one considerable risk that affects General Motors, which is that the market overall (including me) has overestimated the demand for electric vehicles. Reasons for this, as illustrated by a recent survey, are the limited driving range for electric vehicles as well the experienced inconvenience when charging an EV. General Motors has counteracted the slowdown in EV demand by delaying the introduction of some EVs. Buyer hesitancy with regard to electric vehicles may further push out General Motors’ EV transition.

Final thoughts

General Motors is a well-run car brand which made considerable investments in electric vehicle technology and is set to roll out new EV products in the near future including the Chevrolet Blazer EV, GMC Sierra pickup EV and the Chevrolet Equinox EV. Although these products are set to get launched into a weaker market, large automakers like General Motors with a diversified sales mix (including ICE vehicles) are best suited, in my opinion, to ride out any market volatility. Most importantly, General Motors’ strong FCF position as well as low P/E ratio make the car brand significantly more attractive than its smaller rivals in the start-up electric vehicle niche!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.