Summary:

- General Motors stock is trading at an incredibly low 4.8x FWD P/E, presenting a significant value opportunity despite current market conditions.

- GM has consistently beaten EPS and sales estimates over the past two years, and growth on both the top and bottom line is expected to continue.

- Management has retired over 300 million shares since early 2022, which is incredibly accretive for shareholders at this price.

- Capital returns are set to increase dramatically as long as operational strength and the current ‘underpricing’ continue.

- We rate GM stock a ‘Strong Buy’.

Artistic Operations/iStock Editorial via Getty Images

When it comes to investing, getting a solid value for your deployed capital is a key component of producing substantial returns over time.

This doesn’t necessarily mean that you should only be investing in stocks that look ‘cheap’ by virtue of their P/E, P/S, and P/B ratios – far from it.

Sometimes, finding value can be complicated.

For evidence of this, check out our recent article on HIMS. Despite the stock’s high ‘sticker’ price, we think that the company is actually a deep value if you look at where the financials could be within a few short years.

Other times, though, a stock’s value proposition reaches out and smacks you in the face.

That’s what recently happened when we took a deeper look at General Motors (NYSE:GM).

On the face of it, shares of the leading American carmaker are incredibly cheap, trading at roughly 4.8x FWD P/E.

Here’s the thing, though – we can’t figure out why the stock is trading down here.

Sure, consumer sentiment is relatively soft right now. It makes sense that GM would be discounted somewhat. But to the tune of an 85% vs. the market?

We’re not so sure this multiple is warranted, especially as GM’s NTM EPS and Revenue growth rates are expected to outpace the consumer discretionary sector (XLY) median.

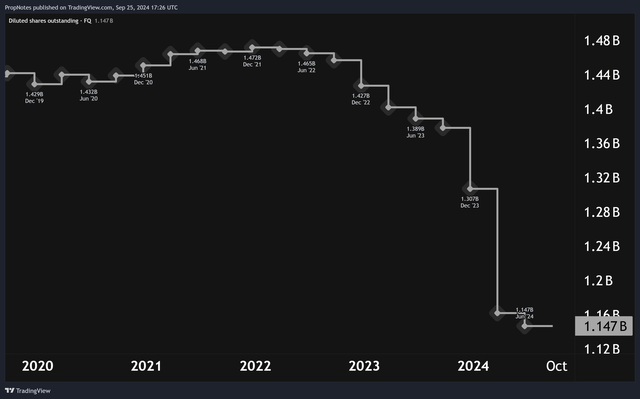

It appears as though management is taking advantage of this advantageous multiple, given that more than 300 million shares have been retired since early 2022 (nearly a quarter of all outstanding stock).

Here’s the bottom line – we think you should follow management in buying shares off the open market before other investors catch onto this apparent mispricing.

Today, we’ll touch on GM’s recent financial performance, explore the unbelievably cheap multiple, and explain why we think GM investors should prepare for significant capital returns to shareholders over the short, medium, and long term.

Sound good? Let’s dive in.

GM’s Financials

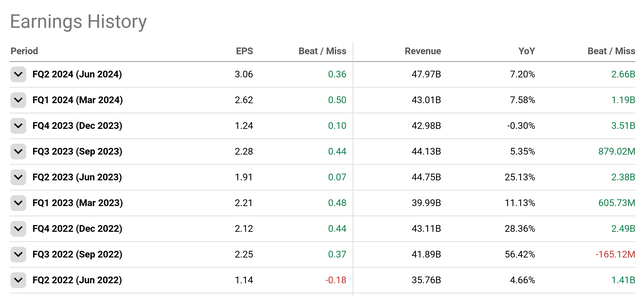

Let’s start with GM’s recent earnings reports, which have been quite strong as of late:

As you can see, aside from a miss in Q3 of 2022, GM has outperformed analyst estimates, beating EPS and sales projections for the last two years.

Not only that, but YoY sales growth stands at 7% from the most recent quarter. While it’s true that this YoY rate has been somewhat choppy over this period, it’s been a somewhat strange market for GM to be operating within since Covid.

First, lockdowns shuttered factories and secondhand car prices went through the rough.

Next, the world went through a period of severe global inflation following low interest rates, higher energy prices, and supply chain issues, which made manufacturing automotives a significant execution challenge.

Only now, finally, are we seeing things normalize in the auto market, just in time for consumer sentiment to be crashing on the back of a broader economic slowdown.

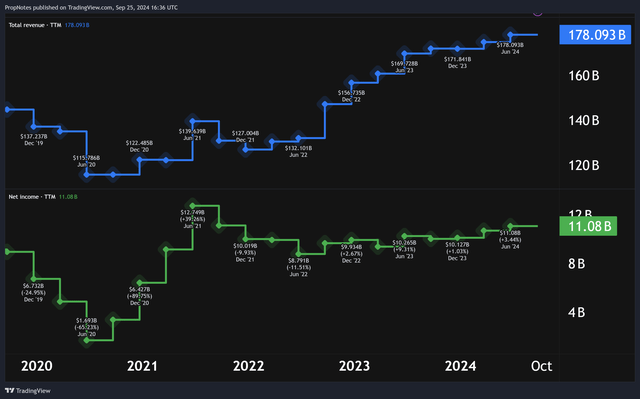

Yet, through it all, GM has kept revenue and net income numbers stable on a TTM basis:

Margins have come in somewhat over the last year, but we expect that as GM improves manufacturing efficiencies in the EV space, they should recover.

Management has also been working on this issue with a keen eye towards delivering profitable volume on the EV front:

Next, our EV portfolio is scaling well and gaining market share. In fact, our U.S. EV deliveries grew 40% year-over-year in the second quarter, while the industry grew at 11%. We’re encouraged by these early results because disciplined volume growth is key to earning positive variable profits from our EV portfolio in the fourth quarter…

This is encouraging, as we expect consumer demand to continue shifting to EVs over the foreseeable future.

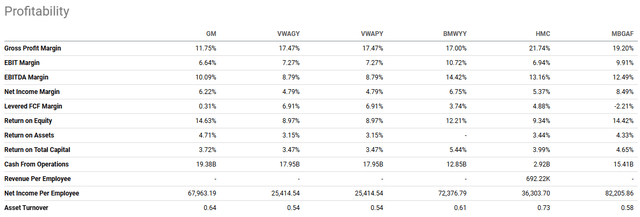

From a profitability lens, GM has also been doing well, especially against peers, when it comes to net margins and return on assets:

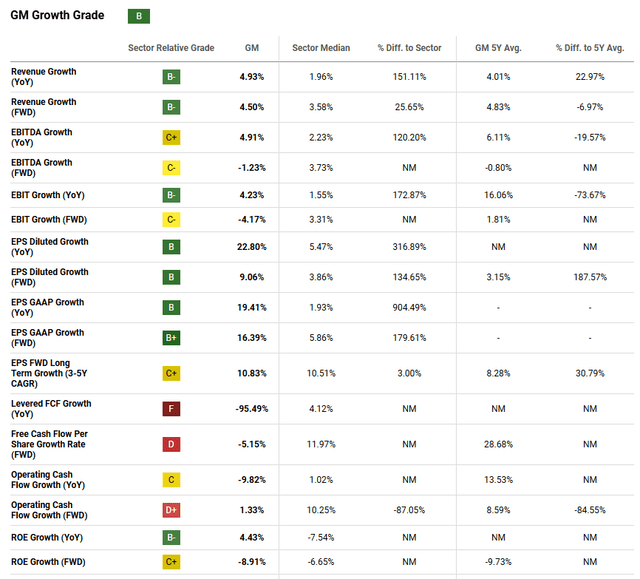

With analysts expecting solid sales and EPS growth looking forward (particularly as a result of the decreasing share count), we see a solid path towards increases in GM’s organic business through the end of the decade:

Finally, GM’s automated division, Cruise, has recovered from setbacks and is once again ready to begin testing its vehicles in the Bay Area.

As one of – really – only three major U.S. companies going after the AV market, GM’s Cruise segment appears to be an attractive call option on GM’s overall value looking forward.

GM’s Valuation

This all brings us to the valuation.

If margins are stable and could recover into next year, and top and bottom-line results are set to grow for the foreseeable, then why is the stock priced where it is?

Every year, GM produces roughly $17 – $20 billion in cash from operations, which is a strong indicator of how profitable the business is on an operational basis.

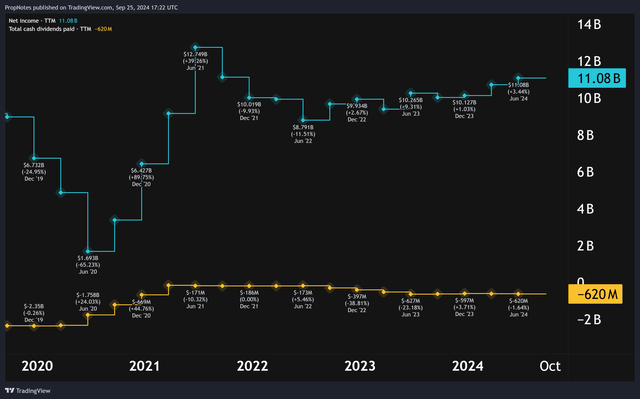

Even when you factor in D&A, interest and taxes, GM’s total net income position still comes in at around $9 – $12 billion per annum. We don’t see any functional reason this should stop or slow anytime soon. In fact, we expect that results will continue to grow, as we’ve laid out above.

Thus, why is the company priced at roughly $51 billion in market cap?

For reference, this represents a PE of around 5x, depending on if you’re looking forward or backward, and whether or not you’re using GAAP numbers.

The balance sheet is clean, with only 15 billion in long-term debt. Thus, it’s not a liquidity / solvency issue.

Why this chronic underpricing?

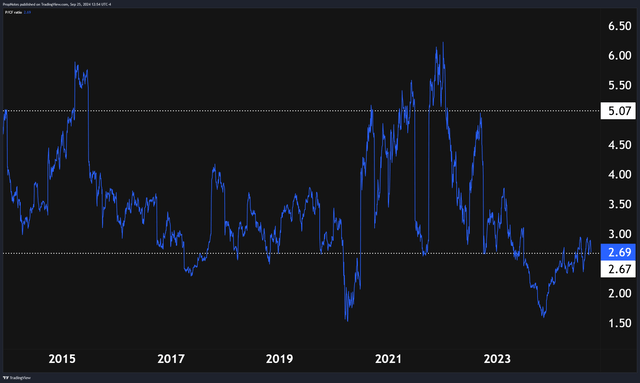

If you look at GM’s multiple over the last decade, you can see that shares have traded at roughly 2.6x FCF to 5x FCF:

Right now, shares are perceptibly cheap, which makes us think that investors at this point could enjoy significant capital returns to shareholders at this depressed price.

On the dividend front, there is a LOT of room to raise payouts, given that $620 million per year is the current annual expenditure, and GM’s net income is around $11 billion:

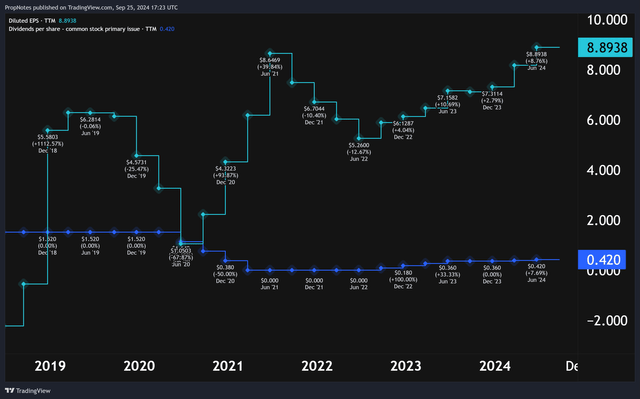

On a per-share basis, this payout still looks incredibly well covered, and we believe that dividends should begin growing more quickly as long as shares remain at this depressed valuation:

On the buyback front, GM has been hammering the offer, retiring a LOT of shares since the start of 2022:

This is nice for a number of reasons.

First, we think that this is incredibly accretive to investors at this price, as discussed.

Secondly, this move boosts both EPS and investors’ ownership stakes in the business passively, which is always nice to have.

Finally, this buyback also improves the dividend yield on a per-share basis, leading to a one-two punch of capital returns to investors.

If GM continues to buy back shares, and the company remains at this multiple, we see very high annualized return potential from GM, even without the need for multiple expansion in the stock.

Again, this is due to the combined action of buybacks and dividends creating a robust earnings yield given the company’s underlying operations and attractive-looking share price.

Risks

There are some ways that our thesis here is wrong.

First off, GM’s board could remain conservative, choosing to avoid returning capital to shareholders.

We’re not sure why they would do this, given the immense room the company has to boost payouts, but sometimes inertia is a powerful force.

We expect that an activist firm could/would come in, in the event that capital payouts to shareholders did not rise materially, and the multiple did not re-expand.

Otherwise, GM’s financial division, which is the lending arm of the company, could face rising defaults on vehicle financing as a result of weakening consumer health and the broader economic downturn.

This would be a serious EPS headwind, as the segment makes up a small portion of revenues but an outsized portion of profits in any given year.

Summary

That said, with a multiple this low, we don’t think there’s a lot of room for the valuation to head lower, even if any of these risks do materialize further and act to stunt EPS growth.

Thus, with tremendous room to expand capital returns to investors, which would power above-average rates of return even without multiple expansion, we see GM as a ‘Strong Buy’.

Stay safe out there!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.