Summary:

- General Motors Company is halting its Cruise robotaxi project to focus on driver assistance and core ICE and electric vehicle production.

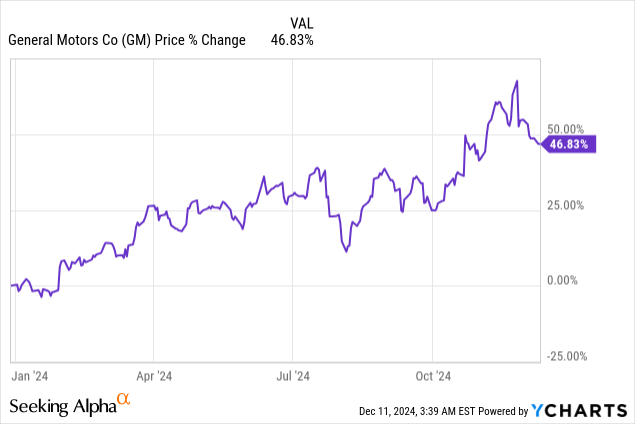

- I previously rated GM stock a strong buy due to double-digit revenue growth and significant EV delivery momentum, despite concerns about the EV market slowdown.

- GM’s restructuring allows the company to reinvest in its EV division or return cash to shareholders, enhancing long-term value.

- Cruise has been a loss-leader for GM, and the company expects to save $1.0B annually from the shutdown of its self-driving taxi project.

- GM’s low valuation, trading at 5.0X forward earnings, offers a high safety margin and favorable risk profile for investors.

JHVEPhoto

Automaker General Motors Company (NYSE:GM) just announced that it is stopping the funding of Cruise, its autonomous vehicle unit, in a surprise move that raised some eye-brows with investors. According to General Motors, the automaker is no longer interested in pursuing its in-house robotaxi development, but will instead focus on driver assistance programs. The company said that it is pulling back from its robotaxi project due to increasing competition, mainly from Tesla (TSLA) and Alphabet/Google’s (GOOG) (GOOGL) Waymo, and the move is expected to save the company a ton of money in the long term. It should help the company refocus its attention on its core business of producing ICE and electric vehicles, and may lead to higher capital returns in the future.

Previous rating

I rated shares of General Motors a strong buy in September due to the company achieving double-digit revenue growth and seeing a significant upsurge in electric vehicle deliveries: Inflection Point. I liked General Motors chiefly because of its EV potential as well as low valuation, although concerns about a slowdown in the electric vehicle market created some negative investor sentiment earlier this year. With General Motors now scaling back its commitment to its robotaxi venture, I believe GM has an opportunity to grow its electric-vehicle business while retaining more cash for investments in other areas.

General Motors ends Cruise robotaxi development

In a news release dated December 10, 2024, General Motors announced that it would stop the funding of its in-house Cruise robotaxi project. The announcement came as a bit of a surprise, since the company’s CEO had explicitly incorporated a robotaxi product into the company’s long-term growth plans. Robotaxis were part of Mary Barra’s vision for a future GM that included sophisticated driver assistance programs, battery development, robotaxis, and a major electric vehicle transformation. However, since Cruise has been a loss-leader for the company, General Motors expects its restructuring to help save at least $1.0B in expenses annually… with expense cuts expected in the first half of FY 2025.

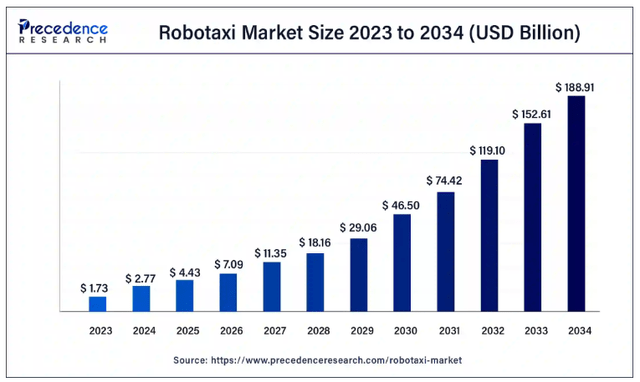

The main reason for the restructuring is increasing competition in the market for autonomous driving vehicles from companies like Waymo. Waymo just announced that it will bring its first self-driving taxis to Miami in 2025, which is part of a broader timeline to get robotaxis market-ready by 2026. Robotaxis could potentially be a big long-term business opportunity for automakers that manage to develop a viable self-driving technology. The market is expected to expand greatly (+60% annually until FY 2034) going forward, with both Tesla and Waymo expecting to have some kind of robotaxi solution available by FY 2026.

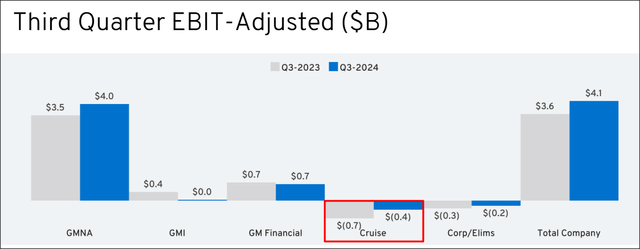

The second reason for General Motors to suspend its Cruise robotaxi project at this time is that self-driving cars are an expensive side project with very little hope of near term profitability. Cruise loses a lot of money for General Motors — about $400M in the most recent quarter — so the end of the Cruise project should immediately boost General Motors’ profitability.

Given that General Motors is already profitable and raised its outlook for FY 2024 revenues and EBIT, the shutdown of Cruise could lead to a healthy guidance for FY 2025 EBIT. Further, with General Motors standing to save $1.0B annually in expenses, the company may boost its capital return program and buy back more shares going forward.

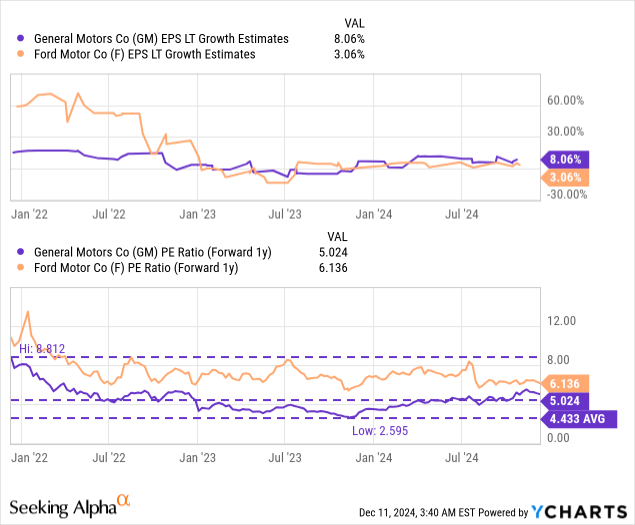

General Motors’ valuation

One of the most attractive features of General Motors is that the company is trading at a very low valuation that incorporates a high safety margin. General Motors’ shares trade at a rock-bottom 5.0X forward earnings multiplier, which implies an earnings yield of about 20%. For comparison, Ford Motor (F) is just slightly pricier: the car company is selling at a 6.1X P/E ratio — also based off a FY 2025 earnings basis — which calculates to an earnings yield of 16%. Both companies, General Motors and Ford Motor, are cheap-based off earnings and have a favorable risk profile, in my opinion.

In my last work on the automaker, I said that General Motors could have a fair value P/E ratio of 6-7X. This was based on the idea of growing net revenue (which grew at double-digits in Q3 ’24) and because General Motors hiked its free cash flow guidance for FY 2024. A 6-7X P/E ratio implied a fair value range of $60-70 per-share. Since consensus estimates for FY 2025 have risen since my last work on GM, I am increasing my fair value range to $63-74 per-share (based off a consensus estimate of $10.50 per-share for FY 2025).

Risks with General Motors

The general risk for General Motors is that the ramp of its electric vehicles disappoints investors. The company, like Ford, has invested billions of dollars into its EV transition, but recently walked back its EV transitions goals amid increasing competition, a down-trend in electric vehicle prices as well as slowing adoption. What would change my mind about General Motors is if the company were to see weaker free cash flow growth and were to suffer a decline in wholesale volumes.

Final thoughts

The end of the Cruise robotaxi project is not the end of the world for General Motors and its investors. Quite likely, it could help the company refocus its attention on the more profitable aspects of General Motors’ business. Cruise was a loss-leader for General Motors and the company is up against fierce competition in the field, with Tesla and Waymo leading the market in terms of robotaxi development.

In my opinion, the end of the Cruise development project is a positive for shareholders. The company is expected to save at least $1.0B annually in development costs, which in turn could lead to strong EBIT and free cash flow guidance for FY 2025. The money General Motors saves on its robotaxi development could either be invested in the electric vehicle division or be returned to investors through stock buybacks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.