Summary:

- General Motors’ reasonable valuation and ownership stake in Cruise present a potentially attractive way to capitalize on the rise of self-driving cars.

- Cruise is not without risks, though. The company has had operational and safety issues recently, and Waymo is the clear leader in the space.

- Even accounting for competition and recent problems, Cruise is still a valuable asset.

- GM’s market capitalization doesn’t appear to account for this, potentially creating an opportunity as Cruise restarts operations.

JasonDoiy

General Motors’ (NYSE:GM) ~80% ownership stake in Cruise presents a potentially interesting opportunity to capitalize on the rise of self-driving vehicles. While Cruise has faced serious issues in recent years, a successful self-driving company could be worth something like 100 billion USD, versus GM’s ~50 billion USD market capitalization.

Cruise’s recent struggles and uncertainty regarding GM’s willingness / ability to continue financing Cruise make this a risky proposition, though. Waymo also appears to be far better positioned for a number an of reasons beyond just its self-driving technology. Assuming the market remains supply constrained in the near-term, competition is a secondary consideration, though.

Cruise

Cruise was founded in 2013 and is now a largely autonomous subsidiary of General Motors. This makes Cruise a trailblazer in the development of self-driving technology, although it puts it several years behind Google (GOOG) (GOOGL), which began investing in autonomous vehicles in 2009. The company’s initial focus was on developing direct-to-consumer kits to retrofit vehicles with self-driving capabilities. Cruise pivoted to developing autonomous vehicles in 2014 and was acquired by GM in 2016.

Cruise began providing autonomous rides in November 2021 before opening to the public in February 2022. By September, Cruise was operating 100 robotaxis in San Francisco and had plans to increase its fleet to 5,000 vehicles.

While Cruise’s progression towards commercialization appeared to be broadly tracking Waymo’s, the company was forced to suspend operations after an incident in October 2023. Some of this may just have been the result of bad luck, but Cruise also appears to have been aggressively pushing expansion, despite its service having teething issues. For example, two Cruise vehicles delayed an ambulance in San Francisco in August 2023, with a patient later dying in hospital. In October, a Cruise robotaxi dragged a woman 20 feet along the road after she was hit by another driver and thrown into the path of Cruise’s vehicle. While Cruise wasn’t the cause of the incident, its vehicle dragging a pedestrian was a major error and the company’s poor response compounded the gravity of the situation.

As a result, Cruise recalled its 950 vehicles in November 2023, with its CEO and Chief Product Officer subsequently stepping down. Cruise later laid off 900 employees as a result of its scaled back near-term ambitions. This wasn’t just self-imposed either, as Cruise actually had its deployment and driverless testing permits suspended by the California DMV.

While Cruise began returning vehicles to the road in May 2024, resuming testing in Houston, Phoenix and Dallas, its timeline has been pushed back and its near-term ambitions appear to have been dialed down.

Technology

Cruise has chosen to develop its own hardware, with a concerted effort beginning in 2018. This encompasses areas like sensors, compute, network systems, connectivity, infotainment and UX. It also includes developing self-cleaning systems for sensors and bumpers that better integrate sensors, mounts and lidar. Cruise has suggested that around 75% of components required for autonomy in its vehicles are bespoke, including cameras, radars, compute modules, back-end telematics, networking and interface modules.

Cruise vehicles are equipped with over 40 sensors (lidar, cameras, radar and acoustic sensors), providing 360-degree sensing capabilities. Cruise has suggested that while cameras and radar work well on highways, lidar adds a lot of valuable information in urban driving situations.

Cruise acquired Strobe in 2017, followed by Astyx in 2020, to support its sensor development efforts. Strobe is a solid-state lidar company developing Frequency Modulated Continuous Wave lidar technology that offers an accurate measurement of both distance and velocity. FMCW lidars are also relatively immune to interference from sunlight and other sensors. Strobe claims a 300-meter range and a processing time of less than 45 milliseconds. Strobe was also targeting a sub-100 USD price target, which would have gone a long way toward increasing the commercial viability of Cruise’s vehicles. The product was supposed to be commercially available in 2018, but Cruise has reportedly experienced delays bringing the sensors to market, and as a result, still relies on third-party suppliers.

Mobileye (MBLY) recently abandoned its FMCW lidar development efforts, stating that advances in computer vision, imaging radar and solid-state lidar reduce the importance of its lidar development efforts.

Cruise has also developed a high-resolution radar, which enables its vehicles to detect objects and their velocity with high precision. This technology came through the acquisition of Astyx, a manufacturer of high-resolution radar sensors for automotive applications. Astyx and Analog Devices worked together for three years to develop the RF transceiver that enables this technology. Astyx’s radar reportedly provides 1-2 degree resolution in the horizontal direction.

Cruise is also developing its own chips, an initiative that appears to have been spurred by the high cost of Nvidia’s (NVDA) products. Cruise has developed four chips so far:

- Horta – ARM CPU (Cruise is also considering RISC-V)

- Dune – processes sensor data

- A chip for the radar

- A fourth chip for which details have not been made public yet

Cruise’s chips are expected to be deployed by 2025, with the company hoping that they will help reduce power consumption.

Cruise also acquired Voyage, a self-driving startup, in 2021. Voyage was founded in 2017 and is perhaps best known for operating a self-driving service in two senior living communities. It is not really clear if there were any specific technical capabilities that Cruise wanted through the acquisition, but it seems likely that Voyage’s experience operating a service was at least part of the reason.

As part of its self-driving efforts, Cruise was developing the Cruise Origin, a dedicated robotaxi that was unveiled in early 2020. Origin was an EV with seating for up to six passengers that didn’t feature any in vehicle controls. Cruise recently abandoned the Origin in favor of a next-gen Bolt, though. GM’s CEO suggested that there was regulatory uncertainty with the vehicle due to its unique design. Per-unit costs for the Bolt-based vehicle are also expected to be lower as it will share parts with another mass-produced vehicle.

Relatively little is known about Cruise’s software, training infrastructure, training data, simulation capabilities, etc. Cruise has tested its vehicles in areas like San Francisco, Phoenix, Austin, Houston, Dallas, and Nashville and has driven over 5 driverless miles, although the total number of miles driven is unknown. Cruise’s vehicles provide tens of GB of data per mile, giving the company access to petabytes of data in total.

Cruise also makes extensive use of simulation to test and train its vehicles. Real-world data is used to generate thousands of scenarios with small changes to details. Cruise has stated that this significantly speeds up development and reduces costs. Cruise is also experimenting with virtual models of US cities for testing ahead of deployment.

Performance

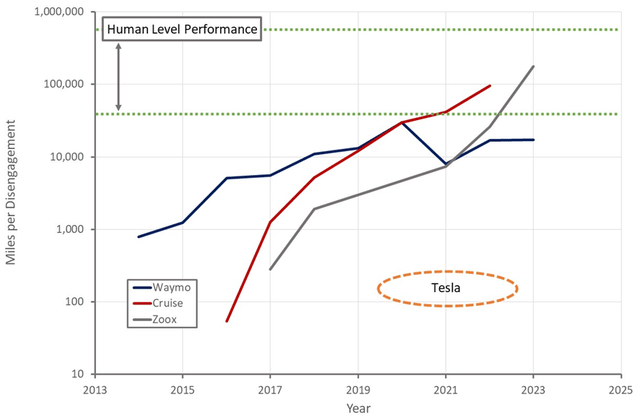

While Cruise has demonstrated comparable performance to Waymo in publicly available disengagement data, there are questions about the company’s capabilities due to some of the issues encountered when scaling up its ride-hailing service.

It is worthwhile noting that the disengagement data below only relates to disengagements for safety reasons, which is somewhat subjective. The miles driven by each company are also not necessarily comparable. For example, it has been suggested that Waymo’s service chooses more direct routes along busier roads. Cruise has also stated that its vehicles attempt to find the safest route based on a range of factors, which includes traffic and road conditions. This could mean that Cruise’s disengagement figures are inflated by avoiding difficult driving conditions.

It has also come to light that on driverless rides, Cruise’s vehicles make heavy use of remote assistants. For instance, remote operators reportedly need to intervene every 4–5 miles and are required 2–4% of the time on average, in complex urban environments. As a result, Cruise reportedly has around one remote assistant for every 15-20 vehicles.

This should not be particularly surprising though, given the state of the technology and what robotaxi companies are trying to achieve. Safety is paramount, meaning it is far better to provide remote assistance than have an autonomous vehicle try and navigate an uncertain situation.

The nature of this assistance also appears to be widely misunderstood. Remote operators provide the vehicles with guidance, but are unable to operate the vehicle. In addition, roughly 80% of remote assistance calls are resolved without action by the remote operator.

Figure 1: Autonomous Vehicle Miles per Disengagement (source: Created by author using data from the California DMV)

Cruise has also performed a safety study that point towards superior performance versus human drivers within the company’s operational domain. The study involved 1 million driverless miles for Cruise and 5.6 million miles of human ridehail driving in San Francisco. It measured crash rates, crash severity and tried to attribute fault in any incidents.

Human ridehail drivers were involved in a crash roughly every 19,800 miles, compared to 43,500 miles for self-driving cars. In addition, human drivers were estimated to be the primary contributor in 69% of their crashes, compared to only 10% for self-driving cars. Data also points towards self-driving vehicles being involved in less severe crashes.

Ride-Hailing Service

General Motors has been relatively forward-thinking over the past decade about positioning itself for the future of mobility. This includes, launching a car sharing service (Maven) in 2016 which was based on assets acquired from Sidecar. Maven provided services like car sharing, peer-to-peer car sharing for personal use and also rented to gig economy drivers. Maven never really took off though and was shut down in April 2020.

GM also demonstrated interest in acquiring Lyft (LYFT) before eventually investing 500 million USD in the company in 2016. This was likely due to a desire to control a distribution channel for robotaxis. Despite this relationship, Cruise developed its own app for its ride-hailing service, which riders were able to use prior to the 2023 incident.

Cruise now has a strategic partnership with Uber (UBER) which will bring its autonomous vehicles to Uber’s platform. The companies plan to launch the partnership next year with a number of dedicated Chevy Bolt-based autonomous vehicles available on Uber’s platform. The terms of the partnership are currently unknown, though. Waymo has a similar relationship where Uber provides fleet management services, including vehicle cleaning, repair, and other general depot operations.

In the second quarter of 2023 Cruise was providing around 10,000 rides per week with 390 AVs operating concurrently. This was an up from 240 driverless AVs in the prior quarter. The company also achieved 1 million miles in 49 days. While Cruise now appears set to begin ramping operations again, it seems like the company’s near-term ambitions are dialed back. As a result, it may be some time before the company achieves the same types of volumes as Waymo (100,000+ rides per week).

General Motors Synergies

While Cruise is largely independent of General Motors, and GM has its own team for developing ADAS technology, the Cruise relationship could have significant strategic value in the future.

General Motors offers its customers a L2 ADAS (Super Cruise) on a select number of its vehicles. While Super Cruise enables hands-free driving on compatible highways, the driver must still pay attention to the vehicle. Sensor inputs to the system include camera, radar and lidar. Super Cruise only works in pre-mapped areas, but is able to operate on around 750,000 miles of roads in North America. GM eventually wants Super Cruise to be able to handle 95% of driving situations, though.

Super Cruise appears to have leveraged hardware from Mobileye in the past, but GM more recently switched to Qualcomm (QCOM). General Motors could choose to use Cruise’s hardware in the future, and the company could also eventually deploy Cruise’s self-driving software in its vehicles.

Super Cruise’s price tag means that it could provide a substantial high margin revenue stream, but adoption currently appears to be low. I believe that this is because most customers place a fairly low value on systems that still need to be monitored. If Cruise can help provide GM with L3+ capabilities, it could therefore create significant value.

Financial Analysis

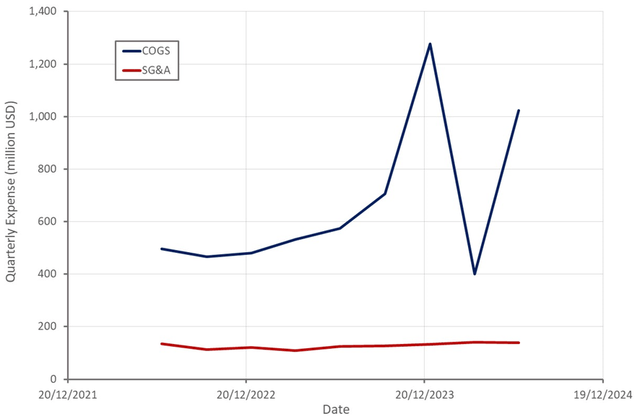

Financial information for Cruise is available through General Motors, although the disclosures provide limited detail. Cruise has so far generated little revenue, while incurring large losses.

Cruise’s costs were beginning to ramp in late 2023, as it scaled it ride-hailing service. The company has significantly cut back on costs since then as a result of layoffs and the operational pause. Cruise still recorded a relatively large loss in the second quarter of 2024 though, largely due to a write-off associated with the end of its Origin project.

Cruise was targeting 1 billion USD revenue in 2025 and 50 billion USD in 2030, although the company’s revenue targets are now unclear. While there could be some lingering demand headwinds created by recent bad press, I don’t expect demand to be a particular issue. Cruise’s revenue growth is likely to be dictated by its ability to safely increase its fleet size and expand across geographies.

While profitability will ultimately be determined by market structure and competition, I expect robotaxi margins to be relatively high once scale is achieved and efficiency improved. The company is targeting a cost below 1 USD per mile, which is broadly in line with estimates for the industry. At scale, I believe that costs could come in significantly under this, but it will take time.

Cruise could achieve breakeven at something like 5 billion USD annual revenue. Even if Cruise’s return to commercial operations goes smoothly, it may still be something like 2028 before this level of revenue is reached, though. As a result, the company will need further access to outside capital in coming years.

Figure 2: Cruise Expenses (source: Created by author using data from General Motors)

Valuation

Attributing a value to Cruise is difficult at the moment due to the uncertainty inherent in the commercialization of robotaxis, as well as issues specific to the company. Cruise has raised in excess of 10 billion USD and was valued at 19 billion USD in 2019 and 30 billion USD in 2021.

While the company has progressed since then, it has also fallen well short of prior expectations. A third-party estimate recently put Cruise’s value at 11.8 USD per share for internal purposes. This was down by around 50% from the previous estimate and puts Cruise’s total value at around 12 billion USD.

Despite recent issues, it seems somewhat odd that the company’s value has fallen so far, when it could be a few short years away from generating meaningful revenue and reducing cash burn.

I tend to think that a successful robotaxi company should be worth around 100 billion USD, but this assumes that the technology is broadly adopted over the next 10–20 years and that competition doesn’t create a race to the bottom on pricing.

Given Cruise’s relationship with General Motors, there are additional considerations around the value Cruise’s technology could create by being deployed in GM’s vehicles. Given Cruise’s recent struggles and the current cost of the technology, this is a secondary consideration, though.

Conclusion

Looking at GM’s valuation relative to peers, it doesn’t appear that the market has ever really attributed significant value to the company’s ownership stake in Cruise. This is somewhat surprising given the market’s reaction to Tesla’s recent robotaxi event, both in terms of Tesla’s and Uber’s share price.

Even if investors aren’t particularly optimistic regarding Cruise’s prospects, I still think the company should be worth at least 10-20 billion USD. As a result, GM’s market capitalization probably should be upwards of 20% higher.

Competition and access to capital are potentially the greater risks to Cruise’s value at this point in time. I think it is important to not overemphasize the importance of competition at this stage, though. Self-driving vehicles are likely to constitute a minority share of the market for many years to come, meaning that competition from other AV vendors is unlikely to be a determinant of success.

While GM could reasonably be expected to backstop Cruise’s financing needs, I question how committed the company is at this point. General Motors invested 850 million USD in June 2024, which pales in comparison to Google’s most recent 5 billion USD investment in Waymo. GM is also considering alternatives for how Cruise will be funded going forward, which suggests the company’s appetite for further investments has weakened. GM is also reviewing how Cruise’s technology will be monetized, which includes leveraging Cruise’s technology in its own vehicles.

Figure 3: General Motors EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MBLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.