Summary:

- General Motors is effectively managing the impact of strikes, resulting in improved operating margins in Q1 2024.

- This quarter, the company will begin production of previously promised higher-margin models.

- General Motors is making progress in the electric vehicle segment, with plans to release new models and increase EV sales forecast for 2024 and 2025.

RiverNorthPhotography/iStock Unreleased via Getty Images

Investment thesis

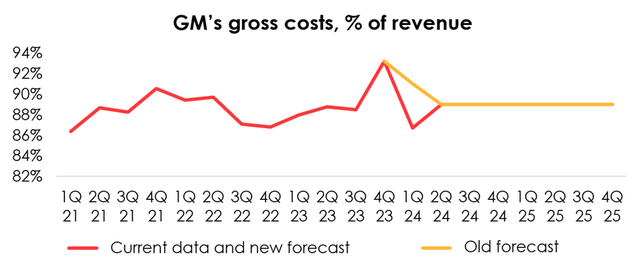

General Motors is managing the impact of the strikes very well: automotive and other cost of sales fell to 87% of revenue in Q1 2024, down from a record 93% in Q4 2023 and against our expectations of 91% of revenue. General and administrative costs are also recovering faster than we expected. Together, this resulted in an operating margin of 8.7% in Q1 2024 (+6.4 percentage points QoQ).

We have covered the stock before and published our previous forecast after GM’s 4Q 2023 earnings report. Since our last article, stock prices have risen more than 15% and our BUY recommendation was correct (as well as our earlier purchase recommendation). This article is dedicated to updating the forecast for the company’s key indicators, as well as providing an overview of the state of various business segments.

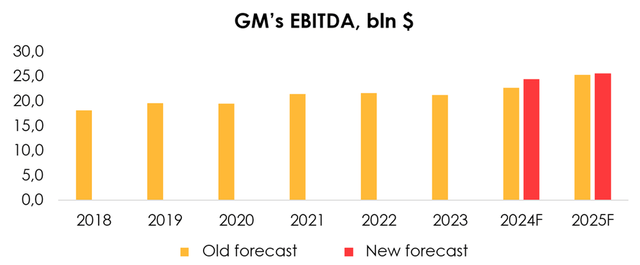

Despite the reduction in our GM vehicle sales forecast, we are increasing our EBITDA forecast from $22.7 billion (+7% yoy) to $24.4 billion (+15% yoy) in 2024 and from $25.3 billion (+11% yoy) to $25.6 billion (+5% yoy) in 2025 due to the reduction of GM’s total projected expenses. The rating continues to be a BUY.

The situation on the car market

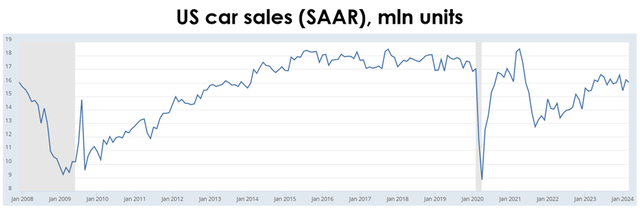

US car sales averaged 15.9 mln units in 1Q 2024, up from 15.5 mln units a year earlier (+3% y/y) and have gone sideways from the previously observed uptrend.

Automakers are seeing a shift in demand from large pickup trucks – one of the industry’s most expensive segments – to budget cars and compact SUVs due to the Fed’s persisting high-interest rates. Following the regulator’s May meeting, the market has pushed back expectations for a rate cut to the end of 2024. And if there is no progress in the fight against inflation, the Fed is ready to consider a rate hike. This is a negative factor for the automotive market, as car ownership will remain an expensive item for consumers, which may significantly slow the growth in US car sales.

FRED

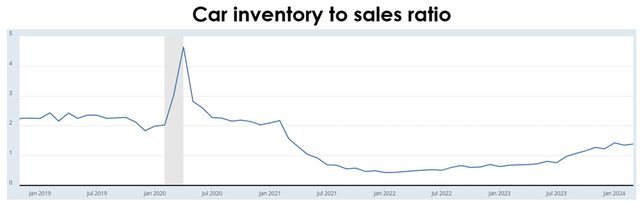

The car inventory-to-sales ratio was 1.39x at the end of March 2024 versus 1.35x at the end of February and a historical average of 2.5x, indicating that car supply exceeds demand and prompts inventories at dealerships to expand.

FRED

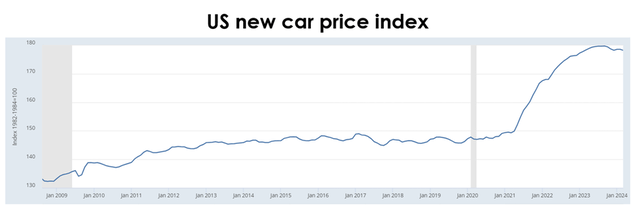

Amid ongoing imbalance of supply and demand, the US new car price index continues to hold high. However, it is reluctantly declining in 1Q 2024 as it maintains the momentum started in 4Q 2023.

We believe that new car prices will decline steadily as the fight against inflation goes on in the US, and we do not expect a sharp drop anytime soon.

FRED

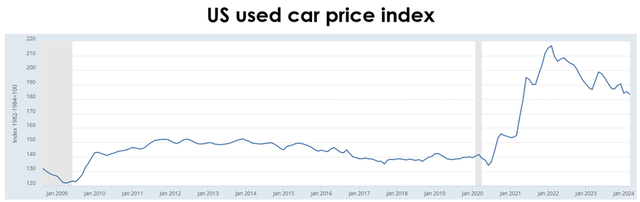

US used car prices went down by an average of 7% y/y in 2023. Due to numerous reasons for consumer worries, used car prices were quite volatile throughout 2023, a behavior that is not expected to continue in the coming months amid an improving environment in the auto-market.

As there is still a significant shortage of new cars in the market, automakers continue to pass costs on to the consumer, albeit at a more moderate pace.

FRED

Outlook for GM’s car sales

GM sold 896 thousand cars in 1Q 2024, down from our forecast of 987 thousand, and is attributable to lower car sales both in and out of North America.

Car sales in North America

In 1Q 2024, 792 thousand cars out of a total of 896 thousand were sold in North America (+10% y/y). General Motors experienced some production constraints that affected the lead time of supplying motor-vehicle fleets with mid-sized commercial vans and pickup trucks and resulted in a temporary decline in deliveries. The company expects to make up for most of the delayed volumes in the second half of 2024.

Regarding new products in the segment of gas-powered cars, it is worth to note the Chevrolet Traverse, GMC Acadia and Chevrolet Equinox: The higher-margin models that the company previously announced and is now rolling out starting this quarter.

We have maintained our sales outlook for gas-powered vehicles in North America for 2024 and 2025 and expect them to average 3.2 mln cars.

Car sales outside of North America

Outside of North America, the company’s largest operating market is China. The company is struggling to maintain its previous sales levels there for a number of reasons: price competition, rising consumer confidence in domestic brands and demand for electric vehicles, along with a tightening regulatory environment related to emissions.

In 1Q 2024 the company suffered a loss of ~$100 mln from the joint venture producing cars in China as it cut production to balance inventory levels at dealerships.

Despite the headwinds, General Motors is not going to leave the Chinese car market and is developing new models for Chinese consumers. For example, in 2024, the company will roll out the Cadillac OPTIQ, update the Buick Velite, and also release Buick GL8 and Equinox hybrids.

As for GMI’s other regions, the company had some downtime in South America. That’s one of the reasons GM decided to close production facilities in Colombia and Ecuador. According to the latest data, they operated at just 9% and 13% of their maximum capacity.

Progress in making and selling electric vehicles

We are seeing clear improvements in General Motors’ electric vehicle segment, both in terms of rising capacity and profitability. Management said that installation of EV assembly lines is on track and the company will be able to double its current capacity by the end of the summer. The Tennessee battery cell plant is ramping up even faster, building on the experience of the first plant, and is expected to reach installed capacity fully by the end of the year. The new software development team, which joined the company six months ago, is also showing progress.

As was mentioned earlier, GM is planning to release some new electric vehicles. For example, sales of the Chevrolet Equinox EV (the most affordable long-range electric vehicle on the market) will open in 2Q 2024. The second half of the year will see the introduction of more affordable trim levels for the Chevrolet Equinox EV, Blazer EV and Silverado EV, which will boost sales and market share. The premium segment won’t be left out, either, as Cadillac will expand its EV lineup to include the OPTIQ and Escalade IQ. The company noted that EV adoption in luxury segments is happening faster and in a more sustainable manner than it is in the broader market.

Also, by the summer of 2024, the GMC Sierra EV Denali and Chevrolet Silverado EV RST models will be available, which have a record range (up to 440 miles) not only in their electric-vehicle segment, but also exceed the range of any gas-powered vehicle.

Given the expected rollout of GM’s new electric vehicle models, we are raising the forecast for General Motors’ EV sales from 99.4 thousand units (+33% y/y) to 102.4 thousand units (+37% y/y) for 2024, and from 145.5 thousand units (+46% y/y) to 175.9 thousand units (+72% y/y) for 2025.

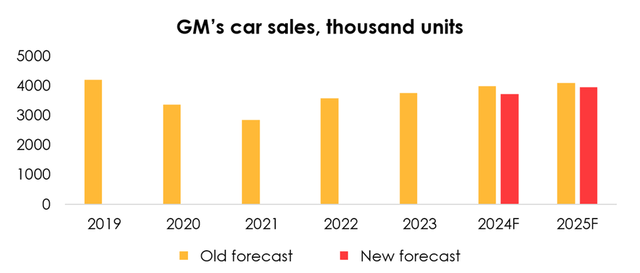

Therefore, given the lower sales forecast for the GMI segment, albeit it was partially mitigated by the higher forecast for GM’s EV sales, we are cutting the forecast for GM’s total car sales from 4 mln units (+5.9% y/y) to 3.7 mln units (-0.9% y/y) for 2024, and from 4.1 mln units (+2.8% y/y) to 4 mln units (+6.1% y/y) for 2025.

Invest Heroes

Robotaxi Cruise

Over 1Q 2024, GM has also made some progress with Cruise. In early April 2024, Cruise resumed driving tests in Phoenix, Arizona, albeit with humans behind the wheel for now, with the aim to collect more road data and update maps. In addition to Phoenix, the company is conducting tests in simulations and closed-course driving.

The fateful accident in October 2023 (when a pedestrian was hit by a robotaxi, causing Cruise to misclassify the accident as a side collision, turn around and drag the person about 6 meters further, resulting in serious injuries to the victim) and the subsequent investigation have shown that, while Cruise demonstrated in multiple tests its higher driving safety when compared with human drivers, it is not enough, and more progress is required to gain approval for its autonomous driving technology. Among other things, the company is now looking more closely at accident scenarios that have a lower probability but a higher injury risk.

Undoubtedly, safety remains a top priority for Cruise and will define further progress in the development of robotaxis. The company is communicating with regulators and rebuilding trust as it works to regain momentum in its operations.

The company’s stated goal for 2024 is to demonstrate efficient performance of the autonomous driving technology in one city, which would enable Cruise to expand its footprint in the future. At this time, the company has not announced when and where it will resume driverless operations.

GM financial results

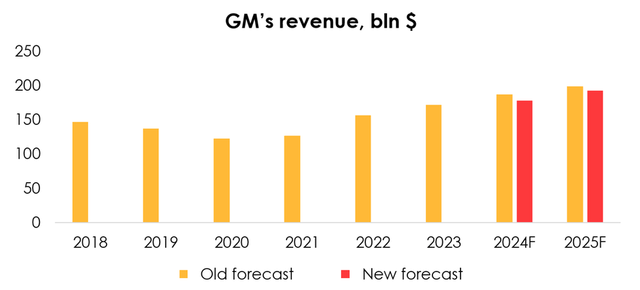

We are lowering the forecast for GM’s revenue from $187.1 bln (+9% y/y) to $177.7 bln (+3% y/y) for 2024, and from $198.9 bln (+6% y/y) to $192.5 bln (+8% y/y) for 2025 on the back of reducing the forecast for GM’s car sales from 4 mln units (+5.9% y/y) to 3.7 mln units (-0.9% y/y) for 2024, and from 4.1 mln units (+2.8% y/y) to 4 mln units (+6.1% y/y) for 2025, although it was partially mitigated by increasing the projected average selling price of cars for 2024 from $43 thousand to $43.4 thousand.

Invest Heroes

In November 2023, General Motors started a $10 bln accelerated share repurchase program in a bid to restore investor confidence.

In December 2023, under this program, GM issued an advance of $10 bln to a group of banks and received about 215 mln common shares valued at $6.8 bln. But the annual financial statement did not reflect the decrease in the number of outstanding shares, with the books showing 1369 mln shares as of the end of 2023 (down by only 9 mln shares from 3Q).

The total number of shares repurchased will be based upon the daily volume-weighted average prices of GM common stock during the term of the ASR program. It is expected that the final settlement of deals under the ASR agreements will happen no later than the fourth-quarter of 2024.

In 1Q 2024 the number of outstanding weighted-average diluted shares was 1.15 bln (-15% q/q), so the forecast for the number has been cut. We expect that there will be about 1.1 bln of them at the end of the FTM period.

The company made most of the one-off strike-related payments in 4Q 2023. At that time, costs reached ~93% of the selling price of cars. In 1Q 2024, the impact on costs was below our expectations: They reached ~87%, down from our forecast of ~91%. Against this backdrop, GM’s dollar margin per car totaled $5820 in 1Q 2024, compared with $2810 in 4Q 2023 and $5090 in 1Q 2023.

We are maintaining our forecast for gross costs through the end of 2025 at ~89%. Given the lower number in 1Q 2024, the average for 2024 will reach 88.4%, instead of the old forecast of 89.5%.

Invest Heroes

Given the faster-than-expected decline of general and administrative expenses (SG&A), we are cutting the forecast for them from ~5.3% of revenue to ~4.9% for 2024, and from ~4.9% of revenue to ~4.5% for 2025. The forecast for the remainder of operating costs as a percentage to revenue has been left unchanged.

We are raising the EBITDA forecast from $22.7 bln (+7% y/y) to $24.4 bln (+15% y/y) for 2024, and from $25.3 bln (+11% y/y) to $25.6 bln (+5% y/y) for 2025 due to:

- the reduction of GM’s total projected expenses from $176 bln (+8% y/y) to $164.8 bln (+1% y/y) for 2024 and from $185.2 bln (+5% y/y) to $178.4 bln (+8% y/y) for 2025, although that was partially offset by the lowering of GM’s revenue forecast from $187.1 bln (+9% y/y) to $177.7 bln (+3% y/y) for 2024, and from $198.9 bln (+6% y/y) to $192.5 bln (+8% y/y) for 2025.

Invest Heroes

Valuation

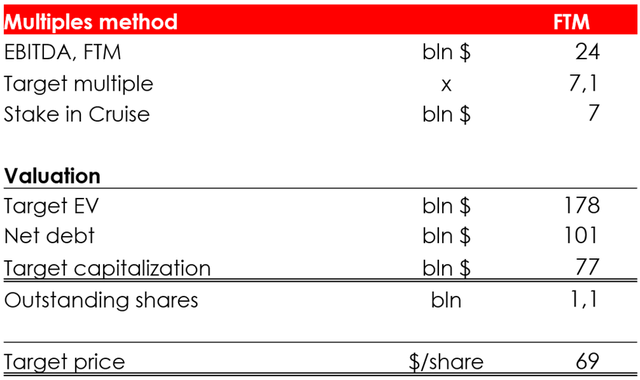

We are raising the target price of the shares from $53 to $69 due to:

- the increase in the company’s target EV as we improved the EBITDA outlook for 2024 and 2025, although that was partially offset by the lowering of the target EV/EBITDA target multiple from 7.3х to 7.1х;

- the decrease in the projected number of outstanding shares at the end of the forecast period from 1.4 bln to 1.1 bln on account of the program of accelerated share repurchase;

- the shift of the FTM valuation period.

We are maintaining the rating for the shares at BUY.

Invest Heroes

Conclusion

GM continues to develop the electric car segment and is committed to its plans to capture this market by launching new models in various auto categories. Despite the crisis, GM will continue to invest heavily in EVs, both through the opening of new plants and through the development of new product lines: the largest portion of capex is spent on the development of electric vehicles and batteries for them.

Most of the shares under the ASR program have already been repurchased by the Company, which, among other things, has served as a kind of stimulus for the stock performance.

We believe the company has strong underlying fundamental strength and is still trading well below fair value. The rating is BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.