Summary:

- General Motors stock has underperformed in the past five years, but recent earnings show signs of improvement.

- Despite past challenges like sluggish growth and dividend cuts, we might see a potential turnaround.

- GM’s efforts in cost management and creating shareholder value have not gone unnoticed.

- In this article, we will look at the prospects of the stock to see if it’s an actionable investment and why.

buzbuzzer

General Motors Stock: Opportunity Or Value Trap?

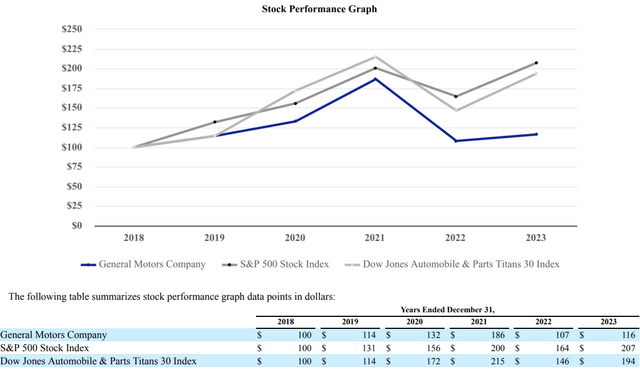

General Motors (NYSE:GM) has been a pain in the neck for many investors: Poor results, lack of growth, dividend cuts, you name it. The outcome was outrageous: the stock returned only 16% in five years, while the S&P 500 more than doubled and even the Dow Jones Automobile & Parts Titans 30 Index returned 94%.

GM 2023 Annual Report

However, the company’s Q1 earnings appear promising for GM. Since it seems to be overcoming several challenges.

GM stock belongs to an industry investors don’t particularly love – auto manufacturing – where most of the time, a company’s earnings are rated no more than a low-to-mid single-digit multiple. Investors do seem to think automakers are value destructive. This makes many consider this industry full of value traps. And, indeed, there are many. But, with some research-backed insights, even in this industry hidden gems and turnarounds do exist and General Motors may end up being one of these.

In this article, we will look together at GM as the company gets ready to release its Q1 earnings. We will see the good and the bad of the company. At the end of the article, I will share my stance and what I’m currently doing with automakers. Yes, even though automakers don’t exactly show the virtues and qualities of true compounders, with a little research, we can find hidden (or not-so-hidden) gems that can generate excellent returns. I currently own four automakers, only one is in the red by 7% (not counting dividends) and it’s the last position I started. The other three are up 107%, 77%, and 17%.

General Motors: Business Highlights

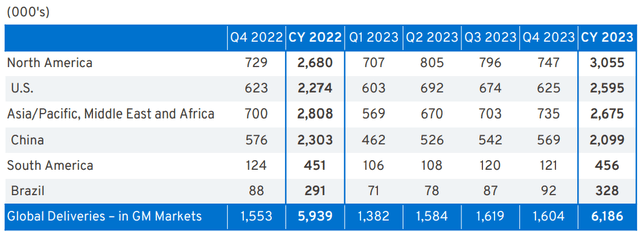

The company’s business is pretty straightforward: Manufacturing and selling vehicles (mostly ICE, but also BEV). In 2023, GM delivered more than 6 million units, making it one of the largest automakers in the world.

Its three main markets are North America (3.06 million vehicles), Asia (2.68 million vehicles), and South America (456k vehicles). Its three main countries are the U.S., China, and Brazil.

GM Q4 2023 Earnings Presentation

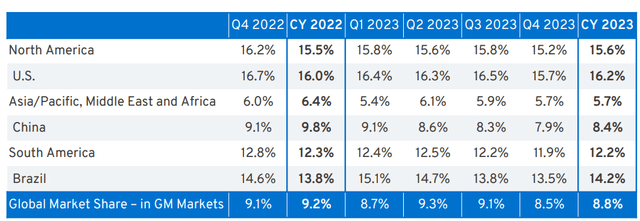

In 2023, GM reported a 16.2% market share in the U.S. and a 15.6% market share in the continent. In Asia, it holds 5.7% of the market, and in China it has 8.4% of the market. A concern for GM is its rapid decline in China: Just two years ago, its market share was 11.2%. In South America, the company increased its market share to 12.2%, led by the 14.2% market share in Brazil.

GM Q4 2023 Earnings Presentation

This means General Motors is highly exposed to three main countries and their economy. Now, the company’s management reported during GM’s last earnings call that “consensus is growing that the US economy, the job market, and auto sales will continue to be resilient […] And we have passed Honda and Toyota in the most affordable quadrant.”

GM 2023 Results Were Promising

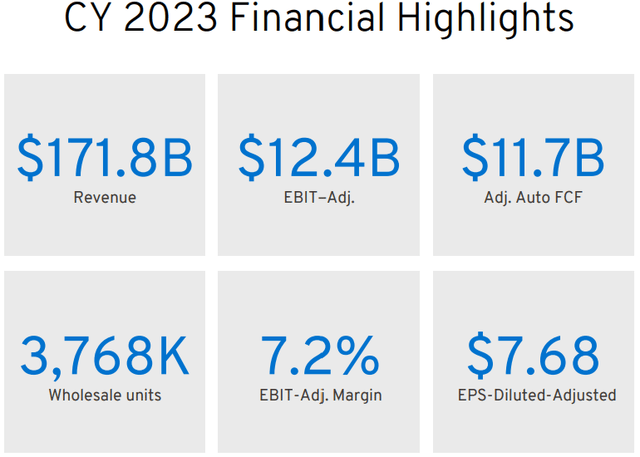

For FY 2023, General Motors reported good financial highlights: A record-high revenue of $171.8 billion, and good profitability, with $12.4 billion in adj. EBIT which is equal to a 7.2% margin. Industrial FCF generation was solid and generated $11.7 billion.

GM Q4 2023 Earnings Presentation

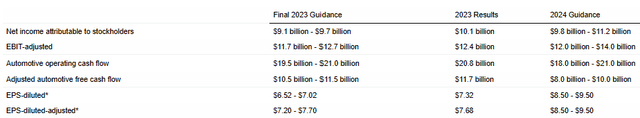

Let’s take a step back and see these results in perspective compared to the previous guidance the company had issued and the new 2024 guidance GM is giving, strong of these results:

GM 2023 Earnings Release

As we can see, the company was expecting net income below $10 billion but actually topped its guidance. As a result, the new 2024 guidance sees General Motors report a net income probably above $10 billion, with the high-end of the range coming above $11 billion.

At the same time, EBIT came close to the high-end of the final 2023 guidance. As a result, we can understand that the main tailwind that helped GM earn more money was linked to decreasing interest expense and, most importantly, decreasing taxes.

While these facts put into investors’ pockets more money, they’re not as relevant as if net income had exceeded expectations thanks to better-than-expected operations efficiency.

Speaking of which, we must acknowledge General Motors’ efforts.

During GM’s Q4 earnings call, we heard the whole management team highlight the progress GM has achieved from this point of view:

From a margin and cash flow perspective, we are making good progress on cost reduction and capital efficiency. Compared with 2022, our fixed cost net of depreciation and amortization will be down $2 billion as we exit 2024, which will offset the higher impact – the impact of higher labor costs. […]

We have eliminated over 100 selectable options across our current and near-term product programs, which is reducing hardware, software, ordering, and manufacturing complexity, and importantly, all the costs associated with them. In 2024, the savings are expected to be about $200 million. To be clear, we’re talking about $200 million of savings to execute the same product plan.

Moreover, the impact of the UAW strike has been around $900 million EBIT adjusted in Q4 and a $1.1 billion impact for the fiscal year, mainly because GM lost around 95,000 units of production.

At the same time, there were a few red flags that I saw in other numbers. For example, GM expects its capex to be in the $10.5 billion to $11.5 billion range. This means it’s at risk of being higher than the industrial FCF.

Moreover, General Motors said it already has reduced its marketing expense by $500 million and plans on cutting another $400 million in 2024. However, when competition becomes stiff, marketing becomes very important. Stellantis (STLA), for example, said in its last earnings call that as soon as it “communicates a little bit more on marketing communications, it has a very good response from the market.”

In any case, GM shareholders can be pleased to see that the company achieved $1 billion in cost reductions. Another $1 billion of savings is due in 2024.

As a result, the company felt confident to reduce its cash balance a bit and return some cash to its shareholders. At the beginning of 2023, General Motors started with $24 billion of cash and marketable securities.

During the year it generated an industrial free cash flow of $11.7 billion. The company then returned almost $12 billion to its shareholders through dividends and share repurchases. This includes the massive and accelerated share repurchase program General Motors initiated in Q4 which is worth $10 billion (more or less 20% of the current market cap). The overall target is to reduce the share count to less than one billion, which would be 600 million fewer than GM’s share count at its peak.

During the Wolfe Research Global Auto And Auto Tech Conference,

General Motors did explain why it’s pounding the table big on buybacks: It believes it is deeply undervalued:

If GM can sustain this level of profitability, we think that there could be another 15% to 20% (share count reduction) in another year. There’s some kind of disconnect here though because a 4 times PE, when you’re concentrating so much capital on reducing the share count, obviously suggests that there’s some concern about the underlying earning sustainability.

Behind the strong performance of GM stock, we can be sure to find the support of the buyback and the new interest for dividend investors because, after the dividend cut in 2020, the company restarted its dividend in 2022 and has now announced a 33% increase to a quarterly $0.12.

GM: BEV Spending Moderates

Moreover, GM has announced it’s moderating its EV spending. As of now, the company still declared during the earnings call that its running this business line at a loss. In the second half of the year, General Motors expects its U.S. BEV business to become profitable.

As the management admitted:

It’s true the pace of EV growth has slowed, which has created some uncertainty. But many third-party forecasts have U.S. EV deliveries rising from about 7% of the industry in 2023 to at least 10% in 2024, which would mean another year of record EV sales.

At the same time, last year GM had to cope with a few software glitches that stopped its newest EV sales.

GM Q1 Earnings

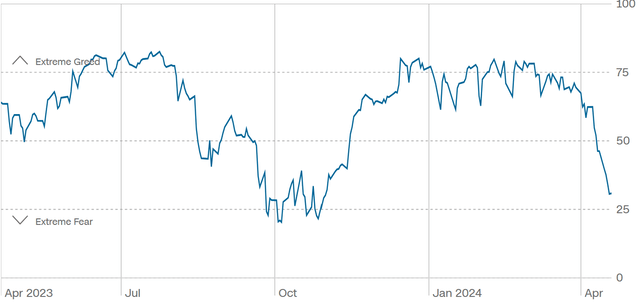

We’re close to the new Q1 earnings release which may impact GM stock in a rapidly changing environment. Just a month ago, the fear and greed index showed extreme greed and now we are close to extreme fear. Fed Chair Jay Powell and his caution on lowering interest rates coupled with the conflict between Israel and Iraq have exacerbated investor sentiment.

CNN Business

While this may scare some, it’s perhaps the beginning of a new market phase when it will become easier to scoop up some good deals, which I have had a hard time finding, as of late.

Back to GM and its earnings. First of all, we should know that Q1 is traditionally a weak cash flow quarter for automakers and industrials, in general. In fact, it usually reports heavy spending on parts and components that will be used for the manufacturing activity of the whole year. General Motors already released its Q1 sales report.

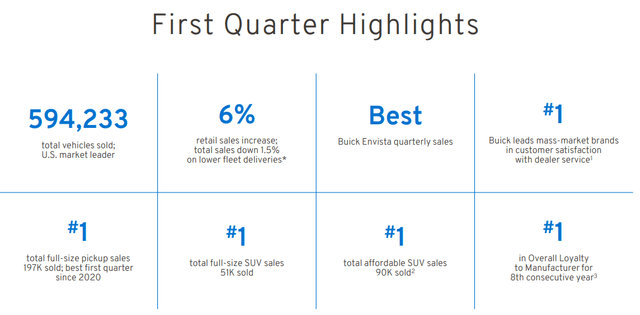

Here are the main sales highlights.

GM Q1 Sales Report

General Motors keeps on being the market leader in the U.S. with almost 600,000 vehicles sold, a 6% increase in retail sales. In particular, Buick is undergoing a transformation that has caused a strong comeback of old customers, with the addition of many new ones. Brand by brand, here’s the main information we already have.

- Chevrolet – retail sales up 6%, with Corvette sales up 9%.

- Cadillac – sales up 9%, with 5,800 LYRIQ sold (up 52% QoQ). outselling every EV from Mercedes, BMW, Audi and Volvo. It makes up 17% of Cadillac sales and is the second best-selling nameplate for the brand.

- Buick – sales up 10%.

- GMC – sales up 3%.

However, competition has increased and this is why General Motors assumes a 2% to 2.5% pricing headwind to support its sales.

So, we have to balance a few indicators to make an educated guess on General Motors’ earnings. On one side, we have strong sales and big buybacks. On the other, we know prices will probably be lower while capex should be a little bit up.

Current revenue estimates see GM report $41.62 billion in sales, with a 4.1% growth YoY and EPS of $2.11, which is a 4.4% decrease.

Now, looking at the sales report, I expect GM’s quarterly revenues to come above expectations. In fact, I forecast a 5% growth year-over-year as a result of stronger sales and better mix, partially offset by lower pricing. This leads us to $42 billion in revenues.

The net income margin I expect is 5% because of higher input costs (labor in particular). This makes me project $2.1 billion in quarterly net income.

The real big variable for these earnings is linked to buybacks. At the end of Q4 2023, GM had 1.2 billion shares outstanding. Assuming there has not been any share reduction, we would have EPS of $1.75. But if GM is keeping up the pace of its buybacks – as I think it is – we’re more likely to see it report 1 billion shares outstanding. This immediately brings GM’s expected EPS to $2.10.

So, to assess General Motors’ results, I will use these two main numbers: $42 billion for its top line; and $2.10 for its EPS. A report strongly above these numbers could probably make investors flock to the stock. An earnings release deeply below these numbers could generate a sell-off.

Valuation

How much is GM worth? If its growth path were to be clearer, there would be no doubt we are before a deeply undervalued stock. According to Seeking Alpha’s Quant Rating, GM stock is one of the best deals in the market right now, with a strong buy rating, supported by a 4.93 score (out of 5).

Seeking Alpha

In fact, GM Valuation Grade is a B+ and its fwd PE of 4.92 earns an A+ on Quant. The same grade is given to the P/FCF ratio, which is currently 2.8. GM’s recent growth has been strong, but its fwd metrics are weak. EBIT growth in 2024 is seen at -5.57%, which is graded with a D+. And FCF per share growth rate is also weak, with a D- grading its -9.79%.

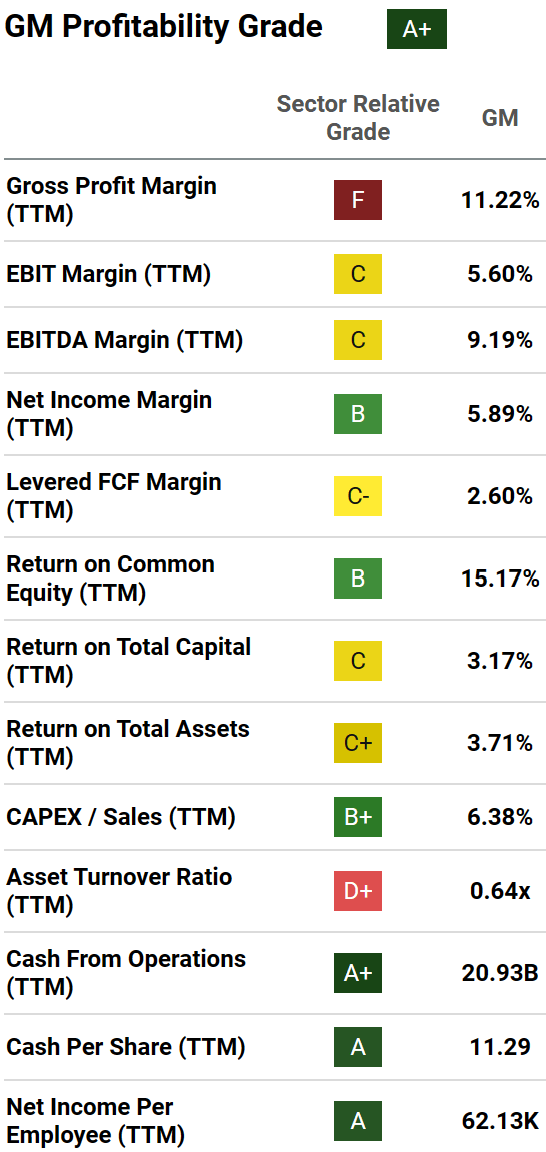

General Motors also earns an A in profitability, but I have a hard time agreeing with this rating. In fact, all its margins are graded with Bs and Cs and its gross profit margin is even given an F.

Seeking Alpha

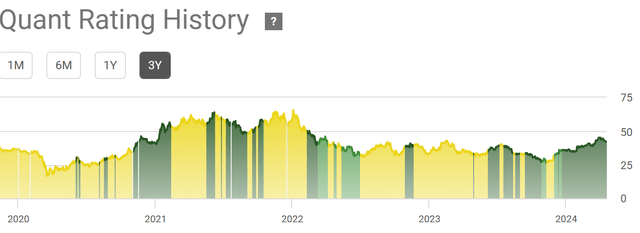

As we can see from the past Quant Rating History, not always have the calls of this system been correct. The true good calls were between 2020 and 2021 (even though Quant turned bullish a bit late) and from late 2023 until now.

Seeking Alpha

As a result, though I use Quant grades to have an overview of my stocks, I always double-check them with the outcomes of my research.

As far as I see it, GM can be a buy if investors believe we’re before a big buyback cycle. This is almost sure to have a big impact on the stock given its low market cap and the size of the buybacks. At the same time, considering its operations, GM trades more or less in line with its peers. To be honest, I see better deals: In the market, there are companies with higher margins and better efficiency compared to GM. Stellantis, for example, not only regularly reports double-digit margins, but is also already selling its BEV at a profit.

Conclusion: Is GM A Buy, a Hold, Or Sell?

In this case, I admit I see all three ratings as good. Let me explain why. The stock has significantly appreciated. Some investors may want to take their gains, seeing that the company’s growth prospects and future FCF are more or less flat.

However, the huge effort in buybacks does incline me to think there’s yet room for some upside, which may be meaningful. This would not only make me rate the stock as a hold but even as a buy, particularly as the market is undergoing a correction.

My rating will thus come from what I’m doing: Nothing. This translates into a hold. I’m neither shorting this stock because the company’s buybacks do create a favorable situation for appreciation, nor am I buying into it for the simple reason I believe I’m holding more profitable and more efficient competitors. But I do think that who owns GM stock could do fine this year. However, I suggest taking profits down the road due to uncertain prospects of how its operations will evolve.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.