Summary:

- General Motors generates strong free cash flow and has repurchased a large percentage of shares outstanding.

- GM’s stock is underappreciated and undervalued due to sentiment.

- GM benefits from a softening in EV market share growth and can benefit from gradual growth in EVs and robotaxis.

- GM’s financial performance, balance sheet health, and investment in Cruise make it a good investment option.

Different_Brian/iStock Editorial via Getty Images

Investment Thesis

General Motors (NYSE:GM) generates enough free cash flow to make the stock significantly undervalued, in my opinion. The company has a strong reputation, loyal customers, and best-selling internal combustion (“ICE”) trucks and SUVs. I think the stock remains undervalued despite the company’s solid financial performance, because the market holds higher than reasonable expectations for EV market share gains and may underappreciate the FCF generation abilities of GM. Perhaps Tesla (TSLA) stock is still soaking up much of the air regarding investments in the automotive industry. Meanwhile, GM just prints cash.

GM benefits from both the softening of the EV market and growth in autonomous driving and EVs. This idea may seem contradictory for a legacy automaker. But the company expects to turn profitable on a variable cost basis in its EV portfolio by next year and GM’s joint venture with autonomous EV producer Cruise could pay off massively if Cruise successfully expands its robotaxi services.

How GM Can Be A Winning Investment

The company generates significant free cash flows from its bread and butter products, ICE vehicles, especially trucks and SUVs. Now that it’s apparent EVs aren’t going to eat the automotive market alive by 2035, it’s easier to see the bull case for GM. The company can continue to generate substantial FCF from what it does best and can slowly scale its EV business while benefiting from Cruise’s technology and hoping for a big payoff. After raising full year guidance and upping its share repurchase authorization after Q1, GM appears to believe that it can sustain its FCF generation if not grow it from here. The free cash flow alone makes the stock fairly or undervalued, and the investment in Cruise feeds back into GM’s EV growth potential and is a homerun bet on Cruise becoming a leader in autonomous vehicles and robotaxi services, which could be a huge market.

If I had to bet on how the robotaxi market would play out, my bet would be on several winners, not just one. Technology doesn’t come with moats, so I don’t expect Tesla to be the sole winner in this space, assuming it is even a long-term winner given its recent pivots towards AI and away from building its super-charger network.

As for EVs, like I said, technology has no moats. If GM can develop cheap enough EVs, it can compete with the likes of Tesla and eventually turn to absolute profitability on EVs. The fact that EV market share is stagnating also buys GM and other competitors of Tesla’s time to catch up with technology. I suspect they won’t be far behind in a few years.

Financials

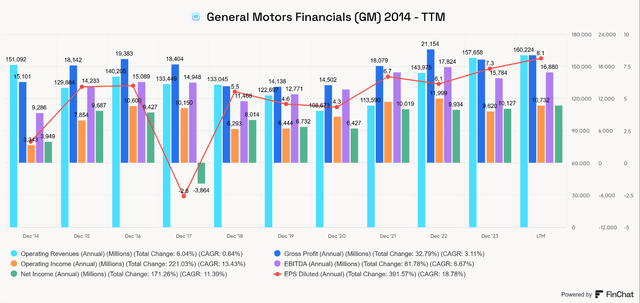

GM has exhibited tremendous operating leverage and provided significant capital returns to shareholders in recent years. In the chart below, you can see the CAGR of revenue, gross margin, operating income, EBITDA, net income, and diluted EPS. An operating revenue CAGR of only 0.6%, has turned into a 13.4% operating income CAGR and thanks to share repurchases diluted-EPS has grown at a 18.8% CAGR during the same period.

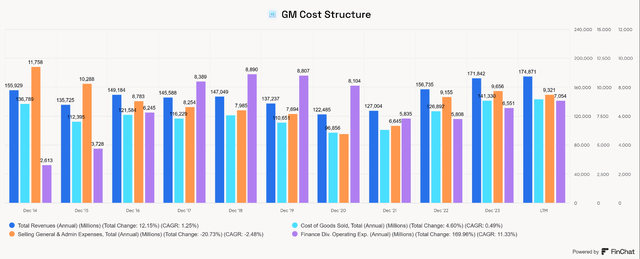

I want to highlight how well GM manages its cost structure by showing how total revenue growth has exceeded COGS and SG&A growth since 2014. SG&A expense has declined at an annualized rate of 2.5% since 2014, and COGS has only grown at a 0.5% CAGR. Meanwhile, total revenue is up 1.25% annually. Finance expenses have grown significantly but represent a very small portion of overall expenses.

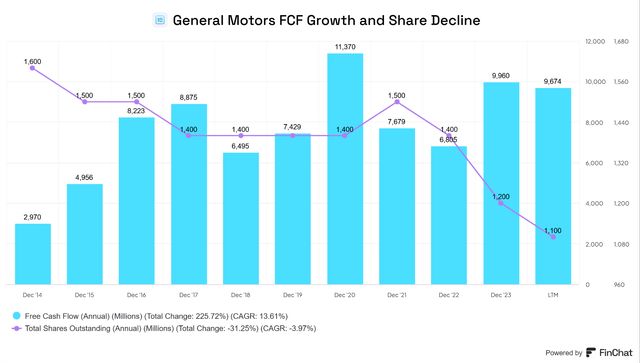

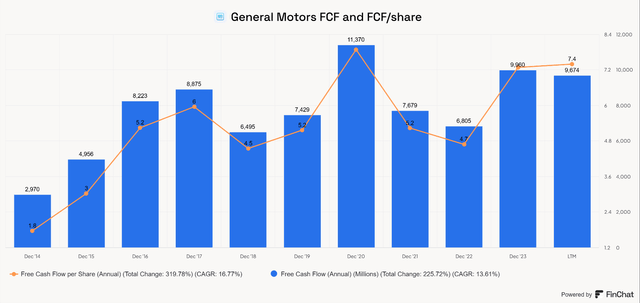

Since 2014, GM has reduced its outstanding shares by a CAGR of 4% while growing free cash flow at a CAGR of 13.6%. The company just authorized an additional repurchase authorization of up to $6 billion dollars, which is on top of the $1.1 billion remaining from its prior authorization.

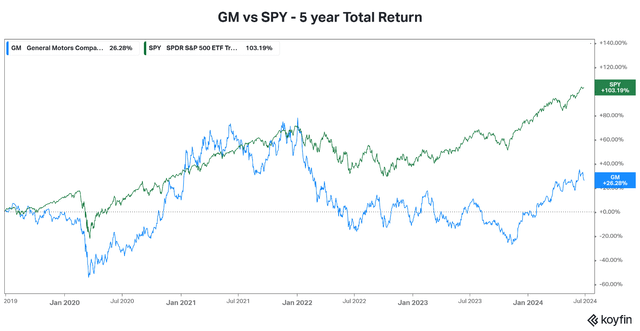

The company is enjoying a good deal of operating leverage and capital returns are flowing to shareholders. Which provides a high margin of safety for investors, in my opinion. However, the stock price has suffered in recent years, with total returns grossly underperforming the SPDR S&P 500 Index ETF (SPY), my proxy for the S&P 500.

I think a combination of supply chain issues, the impact of the pandemic and reduced driving, economic uncertainty, and overly bullish EV sentiment have all contributed to GM’s underperformance. A recent shift in new vehicle purchasing trends may indicate longer staying power for ICE vehicles. Any narrative shift back towards ICE vehicles could be a boost to GM stock.

The Bearish Take On EVs Helps GM

First, I must admit that the headlines depicting the EV market as weak or doomed are hyperbolic and misleading. EVs are still gaining in sales and probably will eventually overtake ICE vehicles. What is happening, though, is a normalization of growth rates, not a decline in overall EV sales growth. For some, the sentiment remains that EVs are going to kill ICE vehicles, I think that day is still a ways off. In the meantime, GM should be able to generate enough free cash flow through ICE vehicles and hybrids to reward shareholders, provide the company time to gradually catch up on EV technology, and potentially hit a homerun with its large investment in Cruise.

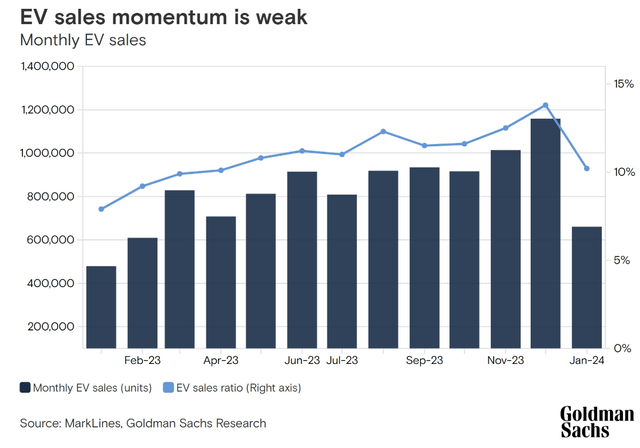

In May, Goldman Sachs published an article that described the softening in the electric vehicle market and reported on some of the reasons why this may be happening. Notice the significant drop in the EV sales ratio.

During the pandemic, EVs were capturing so much market share that an overly bullish narrative formed. EVs were going to dominate new car sales by 2035. In my opinion, the problem with this narrative is that many people were extrapolating extraordinary growth that was bound to normalize.

Early adopters and people with the means to afford and the access to charge EVs were buying all of the EVs. However, this segment of the market appears to have already been saturated, and non-EV drivers who are strongly considering purchasing an EV are fewer in number.

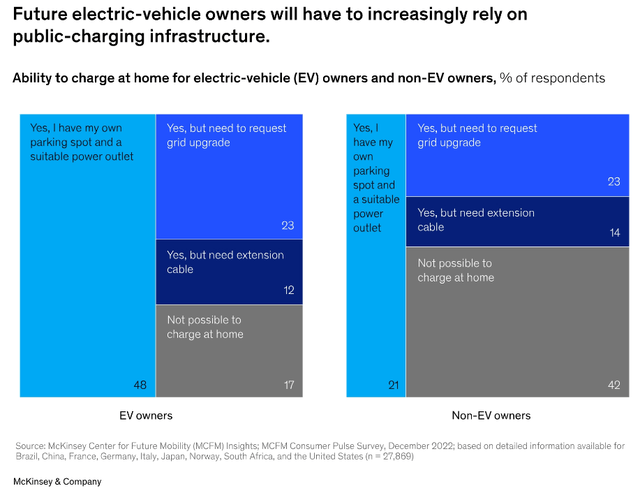

Charging availability and battery range appear to be concerns for non-EV owners and real impediments to adoption. According to a McKinsey survey, 42% of skeptical EV purchasers cited the availability of chargers, larger battery capacities, and longer driving ranges as tipping points or reasons holding them back from an EV purchase.

According to McKinsey, over half of EV charging occurs at home, making public charging an important factor for anyone with a long commute. Perhaps not coincidentally, the average American commute is getting longer these days, a potential factor in the declining EV market share gains cited by Goldman. Another factor preventing some from purchasing an EV might be that home charging can be very costly in some areas, and rooftop solar and storage systems are extremely expensive. Many people do not have the ability to add rooftop solar or even have access to readily available charging boxes. Worldwide, 48% of EV owners have their own parking spot and power hookup, and 35% state that they have the option to connect their parking spot to a charging box. Those who already own EVs may be the simple adopters, people I believe EV adoption is simple for. For people who do not share these ideal EV characteristics, such as apartment and condo dwellers, there could be a difficult-to-overcome reluctance to buy EVs.

I’m a believer in the long term EV growth story, but seeing EV sales growth soften in Europe and North America, and sector issues bubbling to the surface reinforces my belief that ICE vehicles are going to be a major part of the auto market for many more years. Rivian had to get a major investment from Volkswagen to stem the tide of excess cash burning that could have left the company insolvent within the next year. Tesla laid off its entire supercharger network team only to rehire them after pressure from outsiders.

These are not healthy signs for a market that requires very high growth to support unprofitable companies and one profitable but very richly valued stock like Tesla. As mentioned in this Seeking Alpha article, in the wake of the Rivian news and the Fisker bankruptcy we may see more partnerships between EV makers and legacy auto.

I also wouldn’t be surprised to see more partnerships being formed which will likely benefit the larger manufacturers. GM could be one of those beneficiaries.

Forward Outlook

GM’s Outlook and Performance

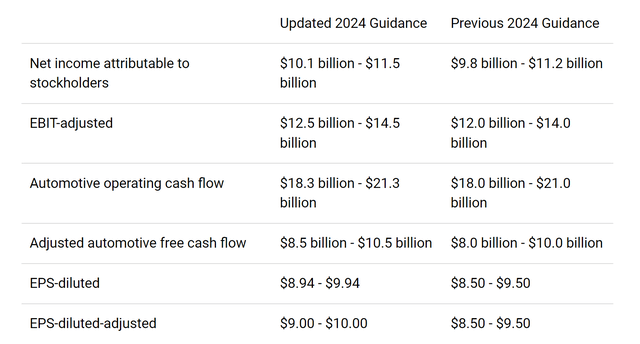

During the Q1 earnings call, GM reported beats on diluted EPS ($2.62 vs. $2.12) and revenue ($43.01 billion vs. $41.82 billion) and raised full-year guidance. The company’s goal is to increase market share without chasing unprofitable business lines, which appears to have been music to the ears of analysts and investors. Growth in growth in full and midsized pickups, SUVs, and EVs was noted during the call. The stock rose roughly 5% following the announcement but has given back some of its gains since.

GM Forward Guidance (Q1 2024 Earnings Press Release)

Regarding EV production, GM stated that it expects to achieve positive variable profits for its EV portfolio in H2 of 2024 and is targeting mid-single-digit EV margins by 2025. In other words, the EV portfolio foundation has been set and the profits are about to start flowing in when excluding fixed costs. Now GM can start to scale EVs and work on turning an absolute profit.

With softness in growth of the EV market, GM has an even longer time to ramp EVs and continue generating loads of free cash flow with its ICE portfolio. The fact that GM doesn’t need to rush into selling too many EVs is a great thing because it won’t cut into margins so much.

GM is also launching several new and redesigned models this year, including the Chevy Traverse, GMC Acadia, Chevy Equinox, Buick Enclave, and new versions of full-size SUVs (GMC Yukon, Chevy Tahoe, and Chevy Suburban). The next-generation Chevy Bolt EV is also expected to arrive in late 2025. New models should generate some excitement and help to offset lower sales in the event of a recession or normalization of sales after the company increased sales by 7.6% year-over-year in Q1.

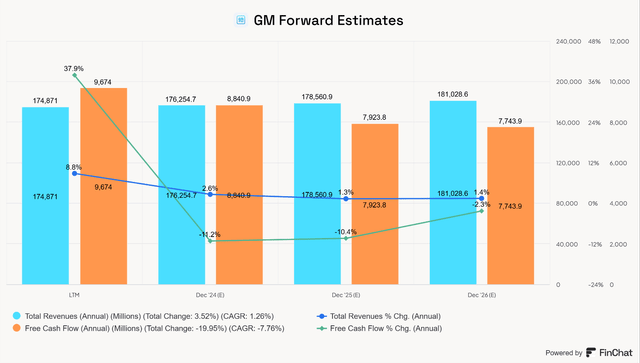

Analyst’s estimates are expecting lower adjusted automotive free cash flow than the $9.5 billion midpoint of GM’s revised guidance issued during the Q1 earnings report.

Analyst’s Expectations

Analysts are not very optimistic about the near-term outlook for GM’s revenue growth, and probably for good reason. The economy shows some weakness; inflation has not reached the Fed’s target of 2%, and consumer debt has risen. However, free cash flow estimates appear to be very low.

GM Analyst Consensus Estimates 2024 -2026 (FinChat)

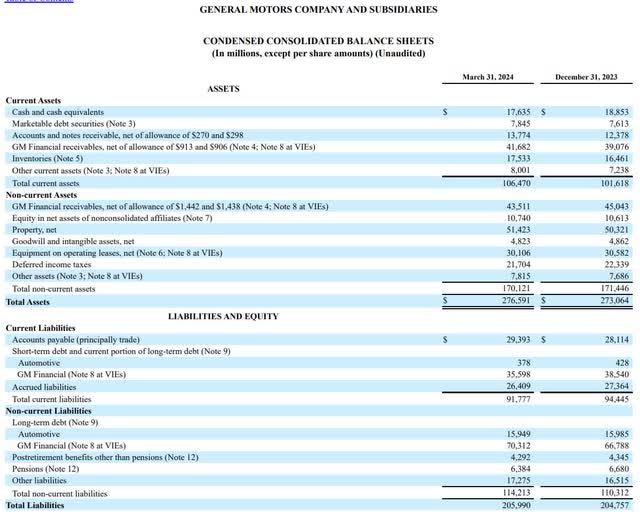

Balance Sheet Health

GM has a solid balance sheet, with only $15.949 billion in automotive long-term debt versus $17.635 billion in cash and $7.845 billion in marketable securities on the books. Inventory increased by 6.5% sequentially in Q1, which needs to be monitored. Holding an automotive net cash position of $9.153 billion supports GM’s shareholder return program, and investments in growth and Cruise. Being able to continue repurchasing shares at a time when the stock appears to be cheap is a great way to reward shareholders and the balance sheet will allow GM to do this.

Valuation

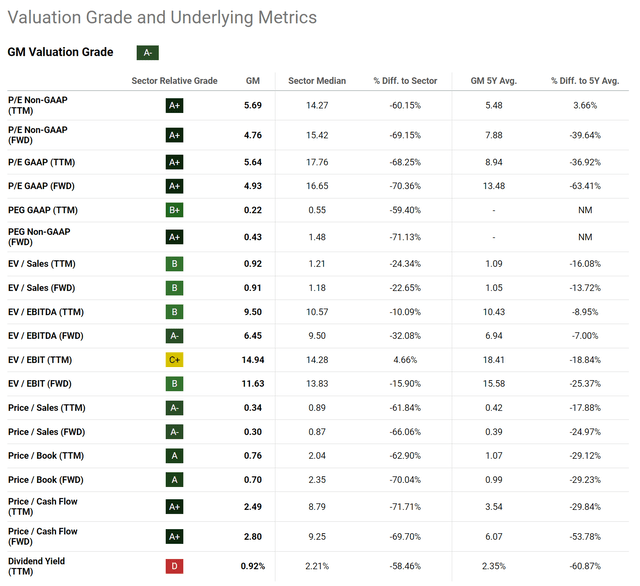

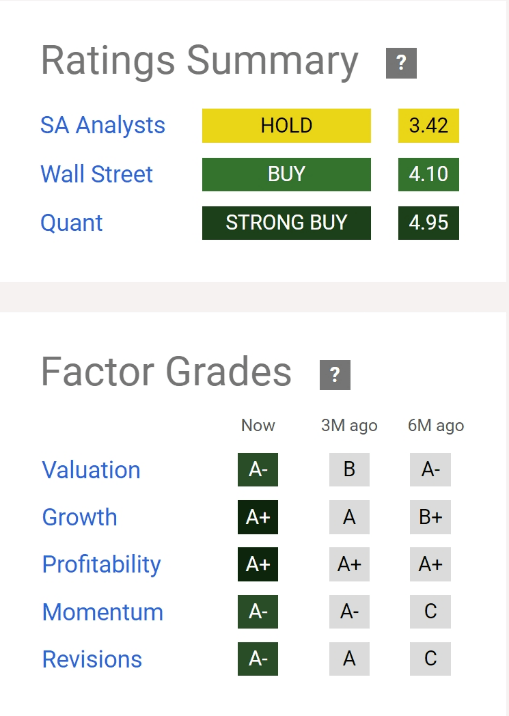

GM scores high in Seeking Alpha’s Quant rating system, with a current 4.95 strong buy rating. Its factor grades range from a low of A- to highs of an A+. Valuation is rated as an A-.

Seeking Alpha Ratings – GM

GM also appears to be grossly undervalued when utilizing analyst’s estimates for free cash flow growth for the next three years and very conservative assumptions for growth afterwards.

The stock currently trades at a TTM P/E of 5.6x and a FWD P/E of 4.9x, which are respectively 36% and 63% discounts to its five-year average.

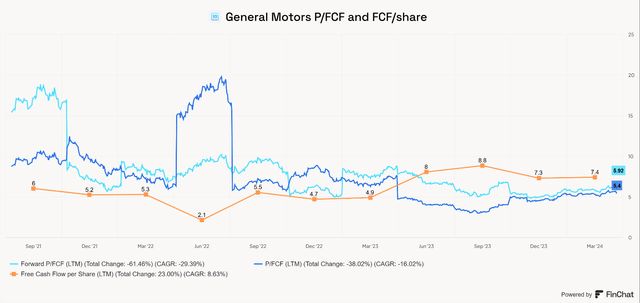

The stock trades at a TTM P/FCF of 5.4x and a FWD P/FCF of 5.9x.

GM has grown FCF/share at a 16.8% CAGR since 2014, which has outgrown absolute FCF 310 basis points thanks to the company’s aggressive share repurchases, which are expected to continue.

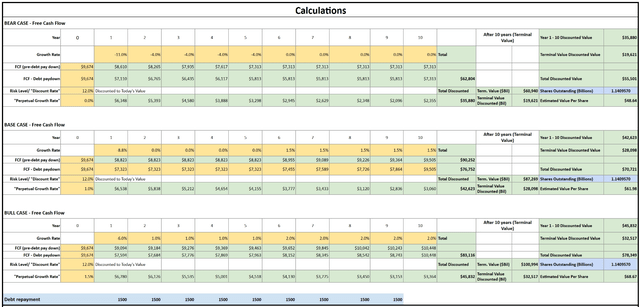

Discounted Cash Flow Analysis

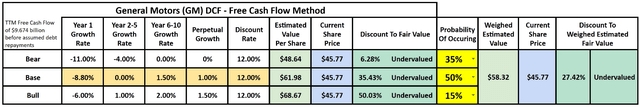

For my base case for free cash flow, I used analyst’s FCF estimates for year one and factored in a return to growth in years 4 and 5. I am conservatively estimating no free cash flow growth from years 2-5, and only 1.5% from years 6-10 and a terminal growth of only 1.0%. My bear and bull cases are adjusted as seen below. The terminal rates are all below historical GDP growth and appear ultra-conservative. The discount rate of 12.0% was chosen as it provides a hurdle rate that could reasonably beat SPY.

Because GM holds $15.9 billion in automotive debt on its balance sheet, I have made adjustments within my DCF to reduce annual free cash flow estimates by $1.5 billion each year for ten years, which would almost eliminate long-term debt.

With these assumptions, GM is grossly undervalued. Today’s estimated intrinsic value with a 12.0% hurdle is estimated at $58.32, a premium of 27.4% to the share price as of June 26, 2024. In other words, you could buy the stock at $58.32 and still expect a 12% annual return, given my assumptions.

Author-Generated DCF Model Calculations

Cruise Is the Homerun Play

Cruise is an autonomous EV startup attempting to implement and scale a robotaxi service. GM has made substantial investments in Cruise and has a partnership to develop battery technology together. The company recently resumed operations in Phoenix and represents a great risk-reward bet for the company. If Cruise can validate the effectiveness of its level four autonomous capabilities it should be able to compete with Tesla (TSLA) and Waymo by Alphabet (GOOG) (GOOGL). Despite the media attention focused on several high-profile incidents that had Cruise removed from the roads of California, Cruise has shown to be very safe and effective. I believe that autonomous vehicles and robotaxis are not something that should be relied on to generate a lot of cash in the near-future, but at some point the technology appears inevitable. The question will be how quickly regulators and the general public will be satisfied with safety and feel comfortable allowing wider access to public roads. If and when this happens, I expect that there will be several competitors in this space, with Tesla, Waymo, and Cruise being the main beneficiaries. It’s unlikely to be a winner-take-all market, much like automotive in general.

GM is heavily investing in future technologies like autonomous vehicles through its joint venture with Cruise. GM plans to spend between $10.5 billion and $11.5 billion on various projects, including battery cell manufacturing joint ventures with Cruise. This involves setting up facilities to produce the batteries needed for EVs.

It’s too early to tell how big the robotaxi market can become, assuming it comes to fruition, but Fortune Business Insights projects growth in the robotaxi market to reach$118 billion by 2031. Another way to value this market is to look at Uber’s revenue (UBER). Uber has generated $38.6 billion in revenue over the last twelve months and has grown revenue at a CAGR of 38.3% since 2016.

I have not even factored Cruise’s potential into my modeling. It’s almost like the cherry on top of my investment thesis sundae. If the robotaxi market takes off and Cruise is a leader in it, GM will benefit through its investments in Cruise.

Risks

The risks to my thesis are recession, inflation, and EVs accelerating market share gains. A recession will lower new vehicle purchase demand and cut into pricing and volume for GM. The financial business could suffer in the event of a deep recession and significant defaults. Inflation could pose a problem by driving up expenses for GM or causing consumers to cut back on large purchases. If EVs are not truly slowing their market share gains, and reaccelerate GM may be on the wrong side of the trend and margins may suffer as the company turns to relying on lower margin or unprofitable EV sales.

Conclusion

After evaluating GM, I believe it is significantly undervalued when looking at the free cash flow generation it has achieved, the opportunity it has to continue to grow free cash flow and the slowing of EV market share gains that should support ICE vehicle purchases for the foreseeable future. Cruise presents an almost binary outcome that could provide great revenue above and beyond what I have modeled. The potential reward in the stock far outweighs the risk that I see, and I recommend GM as a buy. If the story remains and shares pull back any further, I will consider it a strong buy. With deeper research into the company, I might consider it to be a strong buy given its current share price and valuation. I want to see signs that GM can meaningfully grow FCF over the next five years rather than simply maintaining it before calling it a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM, SPY, GOOG, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I plan to add to my GM position soon, but I will wait at least 72 hours before doing so.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.