Summary:

- GM reported a 10% sales growth in Q3, with North American sales up 16%, driven by trucks and SUVs.

- CEO Mary Barra emphasized optimizing ICE margins and accelerating EV profitability.

- GM’s EV division is nearing profitability due to declining battery costs, improved technology, and increased volumes.

- Electric vehicles now make up 7.6% of GM’s US sales, with hybrids at 11.1%, setting a new record for EV sales in Q3.

Michael Vi

Investment Thesis

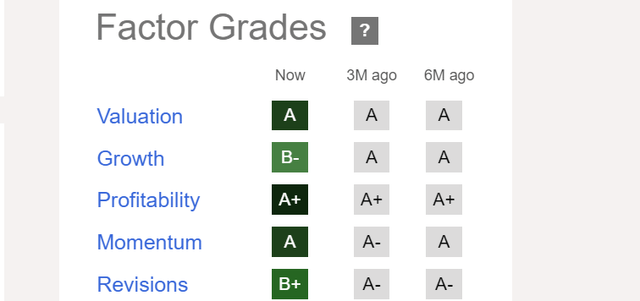

General Motors (NYSE:GM) currently offers several positive aspects, such as strong momentum in the share price, while valuations are still relatively cheap, and good Q3 results. The share buyback program in the second half of 2024 has contributed massively to the increase in the share price. Although long-term risks exist, such as sticking to the plan to stop selling ICE cars from 2035 and generally worsening sales in China, the current momentum and positive aspects make the stock a buy.

Long term developments

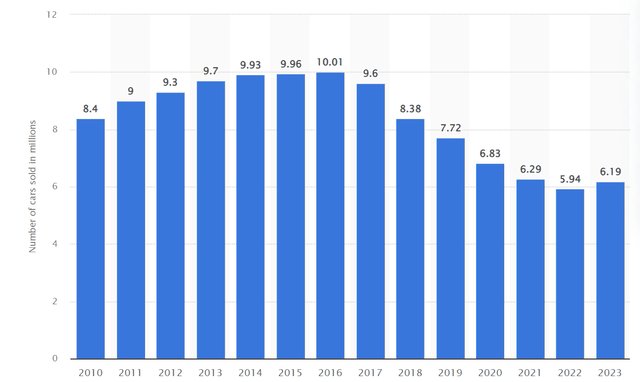

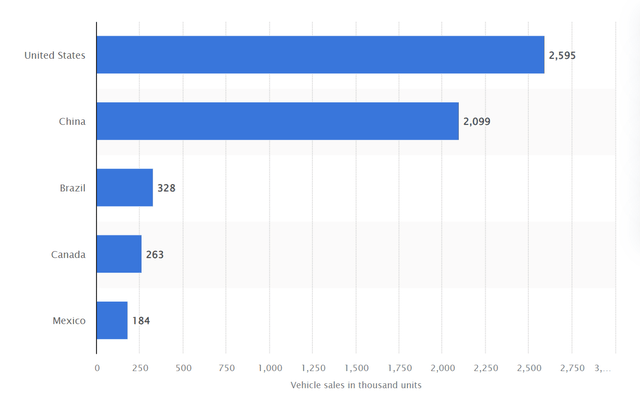

Unfortunately, 2024 is not yet included in these statistics. However, taking a step back and looking at the long-term development is interesting. It is positive that 2023 was the first year in a long time with rising sales, and 2024 looks even better (as we will see below).

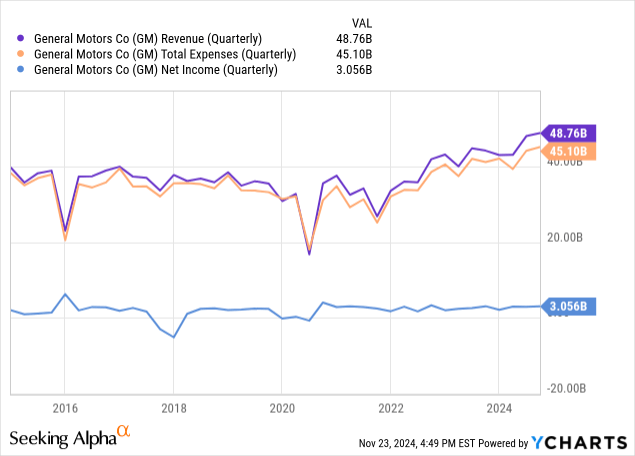

We can also clearly see this turnaround in 2023 in this graph of long-term revenues, expenses, and net income.

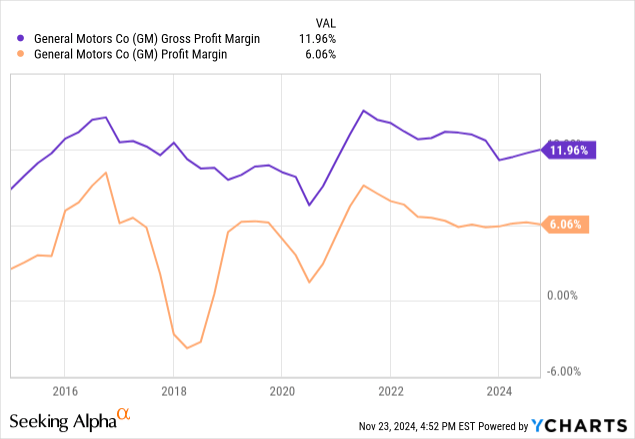

As is typical in the automotive industry, the margins are relatively thin. However, at least GM has stabilized profit margins slightly above average compared to the 10-year history.

Q3 Results

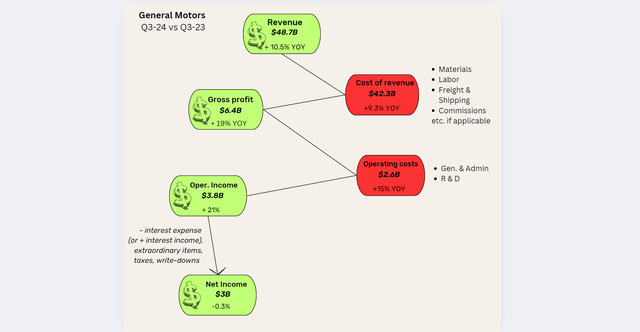

I have created this overview of the income statement of the last quarter compared to the previous year, showing where money is spent and how the revenue and cost development is in general.

Author from income statement numbers

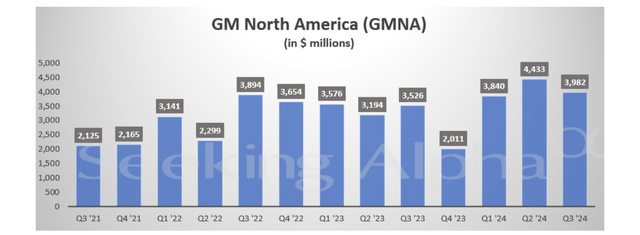

Overall, these are good figures. Revenue increased by 10% while costs grew more slowly. In addition, strong growth of 16% in North America.

North American sales increased by 16% in the latest quarter with trucks and SUVs continuing to make up the bulk of the increased sales

Seeking Alpha News

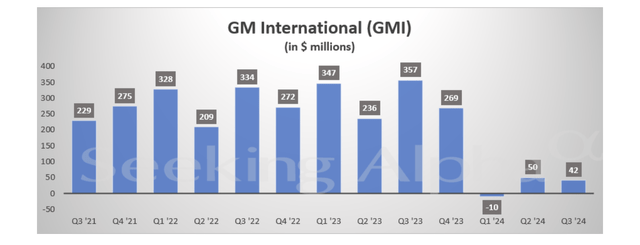

Internationally, the company is becoming less and less relevant. More on this below in the risk segment.

CEO Mary Barra commented on that as follows:

“I’m proud that GM is delivering our best vehicles ever with strong financial results. But I want to be clear that we are not mistaking progress for winning. Competition is fierce, and the regulatory environment will keep getting tougher. That’s why we are focused on optimizing our ICE margins and working to make our EVs profitable on an EBIT basis as quickly as possible,”

CEO Mary Barra said in a letter to investors

In addition, the overall outlook for the year has been raised. A complete overview of the results can be found on GM´s website.

Are EVs on the path to profitability?

GM’s EV division is not yet profitable, even though the company says it is making rapid progress in this direction. GM explains this with lower costs, a simultaneous volume increase, and technology improvement. The battery is the decisive component; on the one hand, battery cells have become cheaper, and on the other hand, reliability and range are improving so that an EV purchase or change is becoming more attractive for more people.

As range anxiety ebbs and choice expands, demand should continue to grow. Our EV economics will improve as volumes increase and we’re nearing the crossover point to profitability for EV sales. What has been a headwind to earnings will soon become a tailwind.

EV profitability is benefitting from declining battery cell costs, thanks to the quality, efficiency, and scale of our joint venture cell plants, as well as the other efficiencies driven by our purpose-built EV platform. We’ve also been aggressive on reducing fixed costs, which have come down by $2 billion over the last two years net of depreciation and amortization.

GM News Release

An interesting phrase in the above quote states that from 2025, “headwind will turn into a tailwind”; that´s a nice way to put it. Overall, the company set a record for EV sales in Q3 and is now the second-largest EV manufacturer in the US. These currently account for around 7.6% of GM’s sales in the USA, and hybrids for 11.1%.

Debt & Valuation

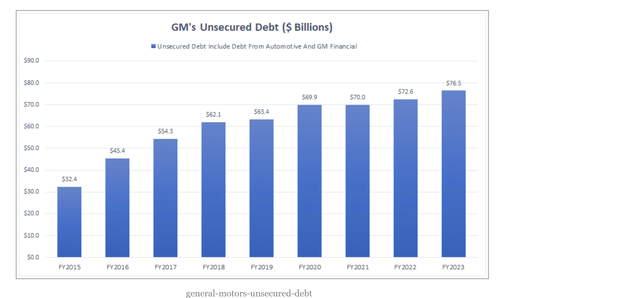

The company is currently valued at an enterprise value of $169.8B, and its market cap is $64.4B. I have found a very detailed and interesting article about GM´s debt situation, which distinguishes between secured and unsecured debt. It contains numerous graphs, e.g., the one below. The conclusion is that given the cash flow, the cash position, and the debt due dates, GM should be in a fine situation overall.

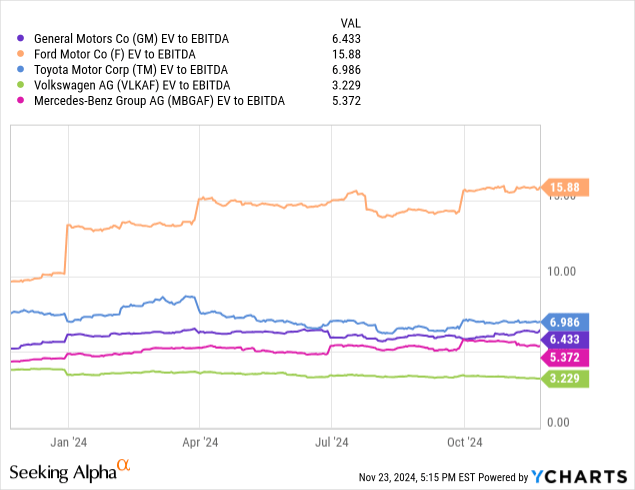

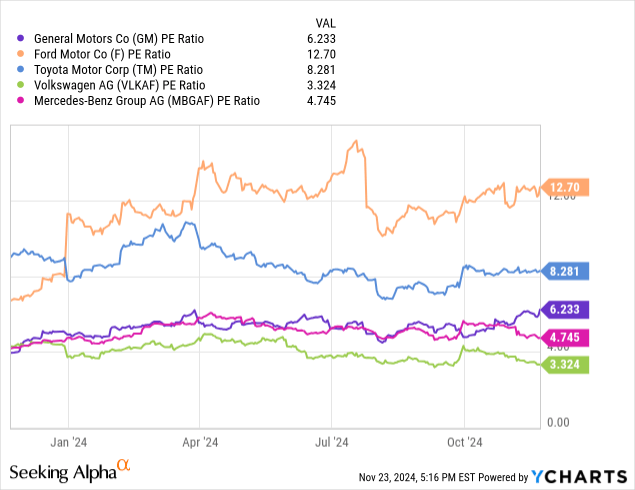

As far as valuation is concerned, we can look at different approaches and compare some of them with competing companies with similar market cap:

EV/EBITDA:

P/E compared to the competition:

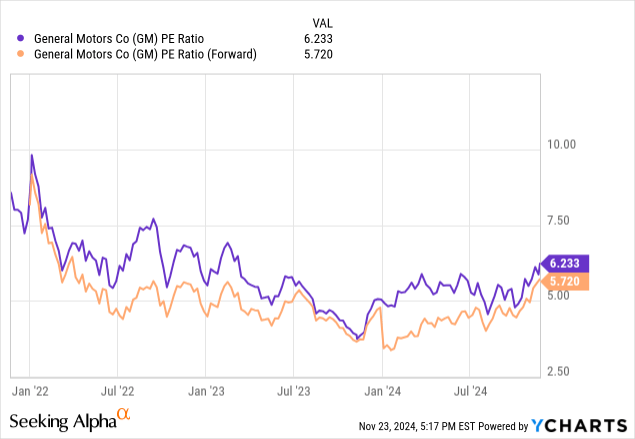

P/E & forward P/E of only GM. Here, we can see how the valuation is slowly rising somewhat but is still relatively low, even by its historical standards.

Given these metrics and also given the comparisons with competitors, it can be said that the company is still cheaply valued, even if there are, of course, challenges, which are discussed in the next chapter.

Risks

It’s crucial to be aware of the risks and negative aspects. I differentiate between potential risks and already existing weaknesses.

Risks: potential future threats

Current strong sales are still mainly due to combustion cars. However, it is crucial to realize that under the current management, the company wants to stop selling these cars by 2035 and solely focus on EVs. Deciding to do this while ICEs are doing great and the EV segment is not even profitable yet sounds very risky. In positive terms, you could say it’s an ambitious endeavor; in negative terms, you could say it’s a pretty crazy plan. There are only 11 years left until 2035. This is not an extremely long time for the automotive industry.

Barra also told the publication that GM will still phase out the sales of internal combustion engine vehicles by 2035, a goal it set in 2021 alongside a promise to be carbon neutral by 2040.

This plan automatically means considerable costs for converting factories and the entire product range. The aim is to no longer produce combustion engines in 2035 – factories cannot be converted from one year to the next but have to be prepared years in advance. The number of combustion vehicles produced will probably already have fallen by the decade’s end. To comply with their 2035 plan, the production facilities must be fully converted between 2030 and 2035 (correct me if I’m wrong; I don’t know precisely how long this process takes). Anyway, this is a huge change and a risky one.

Weaknesses: already existing disadvantages

I have already written two detailed articles about the electric car market in China, the last one in June 2024 with the title ‘Power Shift Part 2: Western Brands In China’s EV Market’.

To summarise briefly, in my opinion, Western brands will have an increasingly difficult time in China in the future, which is a problem because it is the largest car sales market in the world. However, China has decided to switch entirely to EVs for various reasons and has many strong brands of its own. Accordingly, General Motors and virtually all other foreign companies find competing increasingly difficult.

This development has also been apparent in GM´s figures for several years. For a long time, China has contributed substantially to sales and revenues. But last quarter, the “China equity income” turned from a profit of $192M in Q3 2023 into a loss of $137M.

If you look at this press release from GM, you get the impression that things are going great: “…up 14.3% in Q3 vs. Q2 on EV and hybrid growth”. However, the reality is that this number is quarter against quarter, but year-on-year sales have fallen by 21%. Chevrolet brand sales, for example, have plummeted by 83% to just 8,300 vehicles. Almost all of the total sales come from joint venture activities with Chinese partners. General Motors is now considering job cuts.

This development is particularly worrying since General Motors only has two main markets; the company does not play a significant role in Europe and South America. And now, in China, there is massive competition and thus price pressure, not only for Western brands; there are simply an enormous number of Chinese manufacturers on the market; even the hardware manufacturer Xiaomi has done what Apple once planned and then did not realize: bring out its own electric vehicle and in this case very successfully.

In my article on China, I already surmised that the West will probably seal itself off with tariffs. One negative consequence of this strategy is likely to be a long-term loss of importance in the rest of the world. Although Chinese manufacturers are kept out of the USA, they can continue to produce in large quantities and expand worldwide.

Chinese brands are pushing into the European and global markets; politicians are likely to respond with trade tariffs, which will probably lead to a Chinese response. This could save the Western market for Western brands but would still likely lead to a significant loss of market share in China and the rest of the world.

Share dilution, insider trades & SBCs

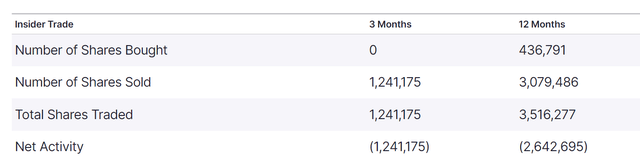

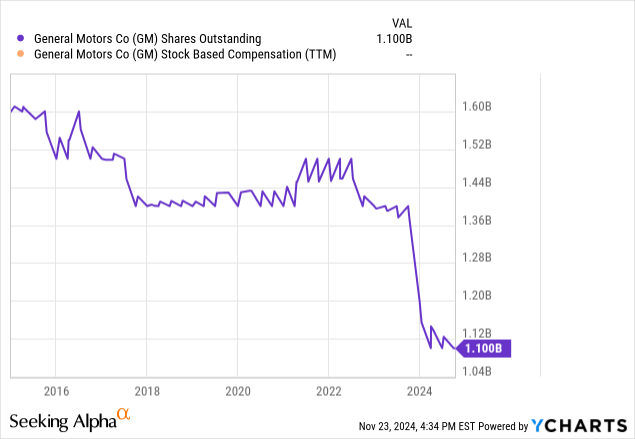

I check these aspects in each article: Excessive share dilution and stock-based compensation (‘SBC’) can be detrimental to shareholders, and insider trading (see all trades of the last 6 months) sometimes contains valuable information about management confidence. The chart below shows the massive impact of the share buyback program of up to $6B, decided mid-2024.

Regarding insider trading, there are net sales, but 1.2M shares at the current price are not even $100M. Not a lot, given the market cap of $64B.

Conclusion

Even if GM does lose the Chinese business in the long term, a large American market remains and is now closing itself off through tariffs and thus excluding Chinese manufacturers. The combination of rising sales in the American market, good momentum in the share price, still cheap valuation, and share buyback programs make GM an attractive buy. This is also visible in the Seeking Alpha Quant ratings, which currently look excellent.

Here is a checklist that summarises some of the most important aspects.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

Yes |

Increasing over longer periods |

|

Improving margins? |

No |

Possible competitive edge |

|

PEG ratio below one? |

No |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes – especially buybacks |

Returning capital to shareholders |

|

Shareholder negatives? |

No |

Actions that disadvantage shareholders (like excessive SBCs) |

|

Stock in an uptrend? |

Yes |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.