Summary:

- General Motors’ Q3 earnings beat expectations, with non-GAAP EPS of $2.96 and revenue of $48.8 billion, driving a 20% stock increase since my last analysis.

- I maintain a $77 price target for GM, citing strong free cash flow, profit growth, and a compelling valuation despite long-term uncertainties in EV and AV markets.

- Near-term technicals are bullish, with the stock above key moving averages and RSI momentum strong; the next resistance is at $67.

- Key risks include faster AV and EV adoption, macroeconomic factors like higher unemployment, and geopolitical tensions impacting the supply chain.

jetcityimage

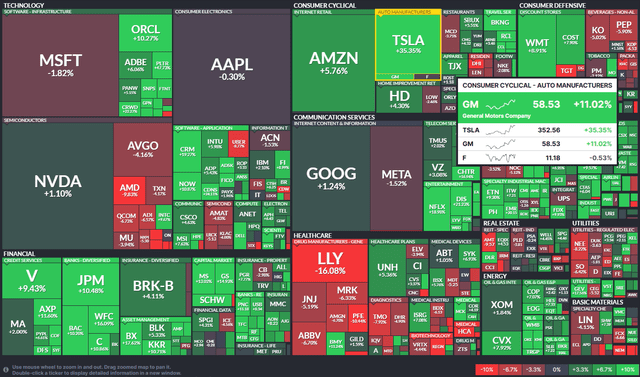

Tesla (TSLA) has captured much of the limelight following President-elect Trump’s victory earlier this month. Shares of General Motors (NYSE:GM) have posted solid gains, too, outperforming the S&P 500. The recent advance builds on a huge 2024 rally as the traditional automaker continues to fire on all cylinders, generating increasing profits and high free cash flow.

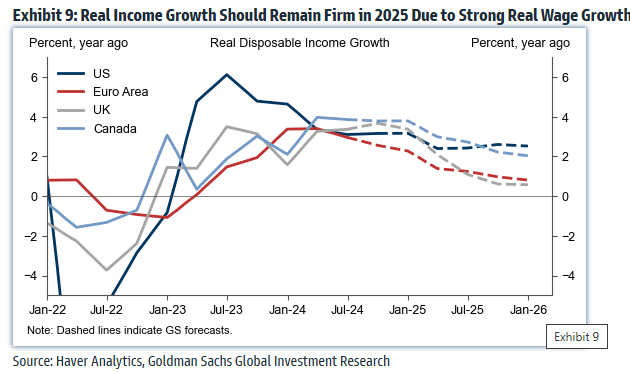

While earnings estimates looking out a few years are unimpressive, I reiterate a buy rating and maintain my $77 price target. Much will depend on American households’ propensity to consume and how real wage growth verifies next year, but so far, the outlook remains bright.

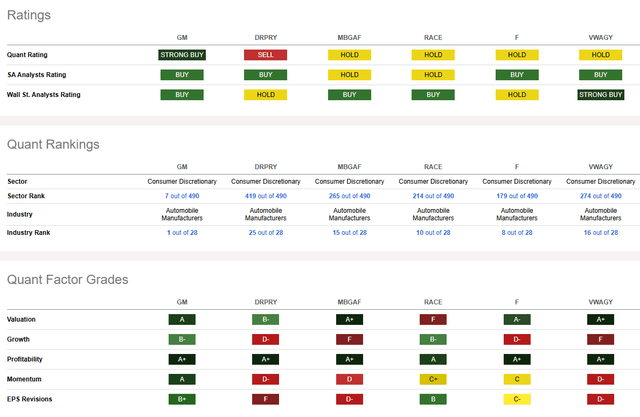

The stock is up a bit more than 20% since my previous analysis, helped in large part by an all-around robust Q3 earnings report. GM is now ranked No. 1 in its industry per Seeking Alpha’s quantitative scoring system.

S&P 500 1-Month Performance Heat Map: GM Strong

Positive Real Wage Growth in 2025 A Tailwind

Goldman Sachs

Back in October, GM reported a very strong set of quarterly results. Q3 non-GAAP EPS of $2.96 topped the Wall Street consensus target of $2.40 while revenue of $48.8 billion, up more than 10% from the same period a year earlier, was a material $4.4 billion beat. The management team updated its FY 2024 diluted EPS guidance to be in the range of $9.14 to $9.64 with diluted-adjusted EPS in the range of $10.00 to $10.50. The FY 2024 EPS consensus at the time was just $9.97.

GM’s ICE business performed very well during the quarter as demand for EVs lagged. What’s more, North American sales surged by 16% on a YoY basis, more than offsetting weakness out of China. It’s important to note that GM’s ICE division accounts for more than 80% of domestic sales, so the firm is a beneficiary of consumers broadly turning away from EVs right now.

The nixing of EV tax credits could also prove to be a tailwind for the company. As for its EVs, GM reduced costs related to that segment, helping to improve overall profitability last quarter. Big picture, GM is among the few automakers to beat the S&P 500 in 2024 as it continues to demonstrate impressive capital allocation discipline and keep a lid on expenses.

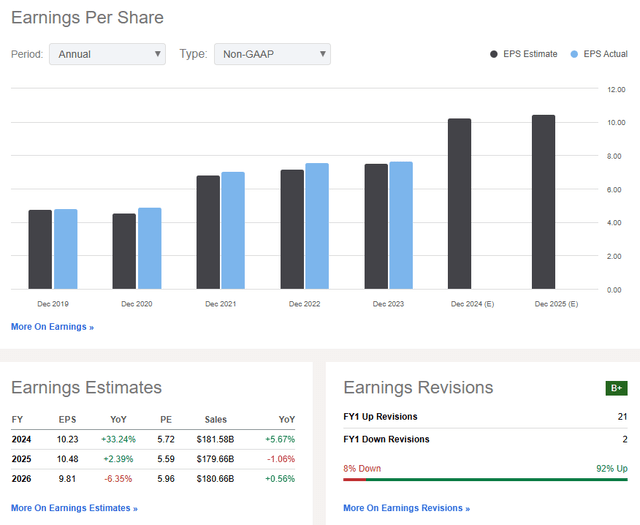

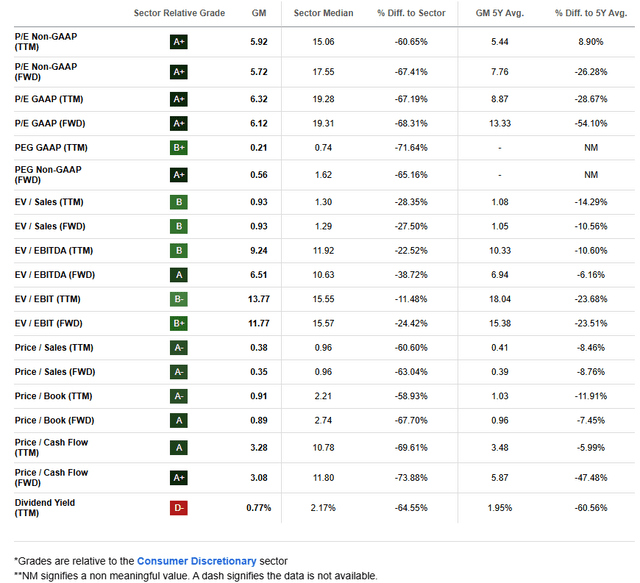

On the earning outlook, analysts expect more than $10 of operating EPS this year, but bottom-line growth is seen slowing in the out year. By 2026, per-share earnings could be on the decline, and there remains long-term uncertainty regarding how a traditional car company like GM will maintain viability if autonomous vehicles take off as some futurists predict. Still, the stock trades with a valuation that discounts that long-term uncertainty.

Moreover, there have been a high number of sell side EPS upgrades in the past 90 days compared with just a pair of downgrades, largely because of the gang buster Q3 report. Finally, profitability trends are very strong – free cash flow per share is $7.07, resulting in a more than 12% free cash flow yield.

GM: Revenue & Earnings Forecasts, EPS Revision Trends

On valuation, I am holding with my normalized $9.90 EPS assumption since while near-term profits are seen higher, the long-term EPS forecast actually dipped slightly since my summertime analysis. GM’s long-term price-to-earnings ratio remains near 7.8x, so the resulting valuation is $77.

What might change that? Another few quarters of strong execution, cost control, and any positive developments regarding EVs and AVs (from GM’s perspective) could make the story all the more bullish. A pickup in China demand would also be a boon.

GM: Continued Compelling Valuation Metrics

Key risks include faster AV adoption, which could result in lower long-term demand for GM’s fleet of ICE vehicles. The same mantra goes for EVs – if firms like Tesla, Rivian, and Nio pick up steam, then that could take market share from traditional OEMs.

From a macro perspective, higher unemployment and falling real wages, perhaps the result of inflation, could lead to softer GM sales. Also, heightened geopolitical tensions could disrupt the supply chain.

Competitor Analysis

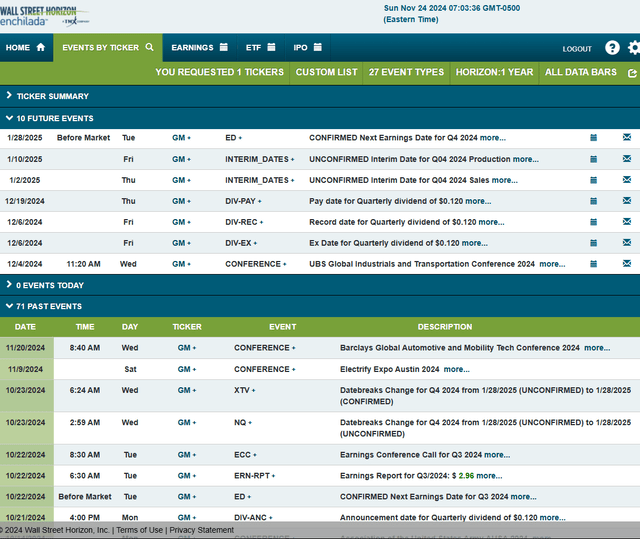

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q4, 2024 earnings date of Tuesday, January 28 BMO. Before that, the company’s management team is slated to present at the UBS Global Industrials and Transportation Conference 2024 beginning on Wednesday, December 4.

Shares then trade ex a $0.12 dividend on Friday, December 6. Finally, mark January 2 and January 10 on your calendar, as that’s when GM reports Q4 sales and production figures.

Corporate Event Risk Calendar

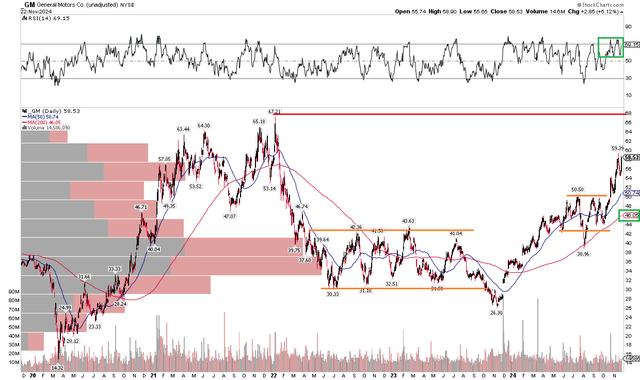

The Technical Take

With GM stock having more than doubled from a year ago, investors may be reluctant to continue buying shares today. But notice in the chart below that we don’t have significant resistance until the $67 mark – that was the high from early 2022. Shares encountered some resistance at the $50 area – a level I highlighted last time – but then gapped higher and took off to new multi-year highs last month. In August, I also outlined how the stock could achieve $60 in short order based on a measured move pattern, and that played out to a T. So, we could see some near-term consolidation.

Now, with rising short-term and long-term moving averages with the stock priced above both the 50dma and 200dma, the bulls clearly control the primary trend. There are also very few shares traded above the current spot, so that provides a clear path toward the $67 mark in the months ahead in my view. Finally, take a look at the RSI momentum oscillator at the top of the graph – it has been in a bullish range between 40 and 80 since Q3, providing further evidence that the price and momentum trends are bullish.

On the downside, support is seen near $54 and at previous resistance near $50.

GM: $60 Target Achieved, $67 Next Resistance

The Bottom Line

I have a buy rating on GM. I see the domestic automaker’s shares as undervalued by about 25%. With strong free cash flow and profit growth this year, the stage is set for continued strength in the new year. $77 is my fundamental target, while $67 is the next spot of technical resistance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.