Summary:

- General Motors’ stock has surged by 70% in the last four months, and yet, its valuation multiples indicate the stock may still be undervalued.

- GM’s Q4 2023 earnings exceeded expectations, with positive growth in net income and EPS guidance for 2024.

- GM must overcome two key challenges to continue its success.

MicroStockHub

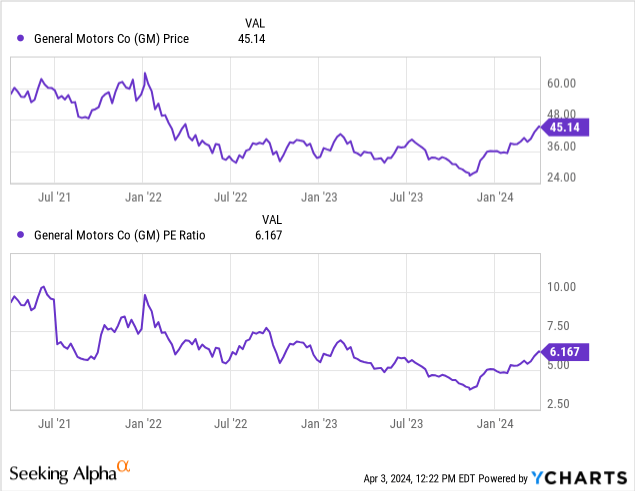

General Motors Company (NYSE:GM) stock has surged by 70 percent in the last four months, and yet, its valuation multiples indicate the stock is still undervalued. In this article, I review GM’s recent financial and market share results and explain why the stock is still trading at a 6x price-to-earnings multiple.

General Motors Put Up Great Results in 2023

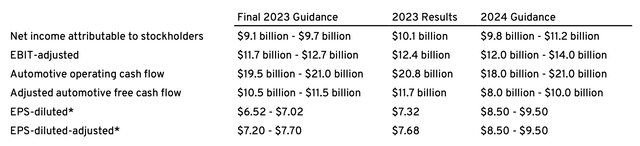

My review of the company’s Q4 2023 Earnings Press Release and the Earnings Deck shows that General Motors has put up solid bottom line results in 2023, and the following are my key takeaways from the two documents I linked:

- GM exceeded the higher end of its Final 2023 Guidance for net income, and the mid-point of its guidance for 2024 indicates 4% year-over-year growth in earnings;

- Management guidance for 2024 indicates 11% to 24% year-over-year EPS growth; and

- Even though Adjusted Automotive Free Cash Flow exceeded net income attributable to stockholders in 2023, management forecasts free cash flow to come in approximately $1 billion to $2 billion below net income in 2024.

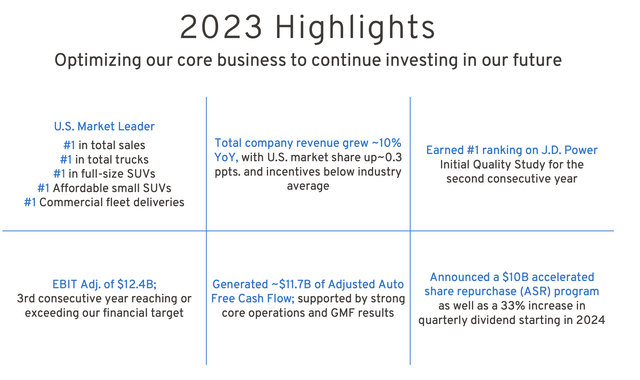

Below are other highlights from GM’s 2023 results. Even though I can’t cover each highlight in this article, I note that GM is the undisputed market share leader in the US and that from revenue growth to profitability, GM has had a successful 2023.

These impressive fundamentals beg the question: Why is GM still trading at a paltry 6x price-to-earnings multiple? Let’s dig further into GM’s results.

Global Picture Tells A Different Story

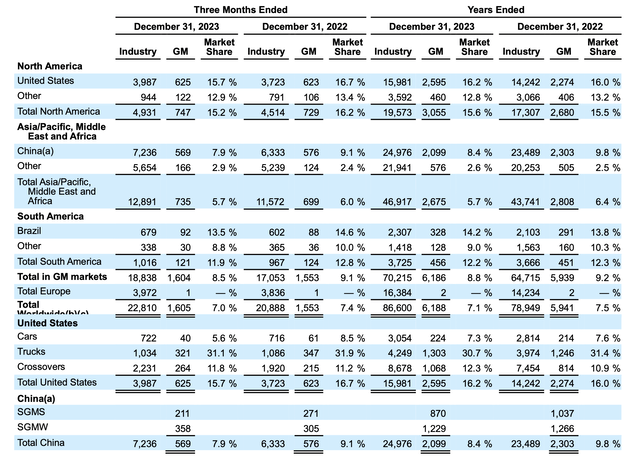

Even though GM gained market share in the United States, the company has seen its worldwide market share in 2023 drop, as this table illustrates:

In the three months ended December 31, 2023, GM’s worldwide market share dropped to 7.0 percent from 7.4 percent in the year-ago quarter; and in the full year 2023, GM’s worldwide market share dropped to 7.1 percent from 7.5 percent in 2022, pointing to an ongoing declining throughout 2023.

Further, GM’s market share in the world’s largest automotive market, China, dropped to 7.9 percent in the most recent quarter from 9.1 percent one year ago. GM also experienced market share declines in Asia/Pacific, the Middle East and Africa, Brazil, and the other South American regions.

I also note that, even though GM’s North American market share rose in 2023, it dropped to 15.2 percent in Q4 2023 from 16.2 percent in Q4 2022, so GM’s North American market share is something for us to watch in the coming periods to gauge the long-term trend.

Yesterday, GM announced that its vehicle deliveries dropped 1.5 percent in Q1 2024 in the US, and we will get its worldwide deliveries when the company announces its Q1 2024 financial results on April 23.

I believe GM’s mixed results in market share are in part due to the intensifying global competition, which I discussed in my articles titled, Ford: Consider Selling For 3 Reasons and Tesla: Here’s Why It’s Down 24%, both of which I recommend reading as industry trends may impact automakers in tandem.

In conjunction with reversing its worldwide market share decline, the key challenge that GM must overcome to earn a valuation multiple materially higher than the 6x P/E ratio is two-fold, as I discuss in the next section.

Two-Fold Challenge Facing General Motors

In my opinion, there are two challenges that General Motors must overcome before market participants assign higher valuation multiples to the automaker:

- Cruise, the self-driving subsidiary of GM, must satisfy regulatory scrutiny, resume its geographical rollout, and reach profitability; and

- GM must ramp its in-house Ultium battery production to high volume.

Let’s dig deeper into each challenge one by one.

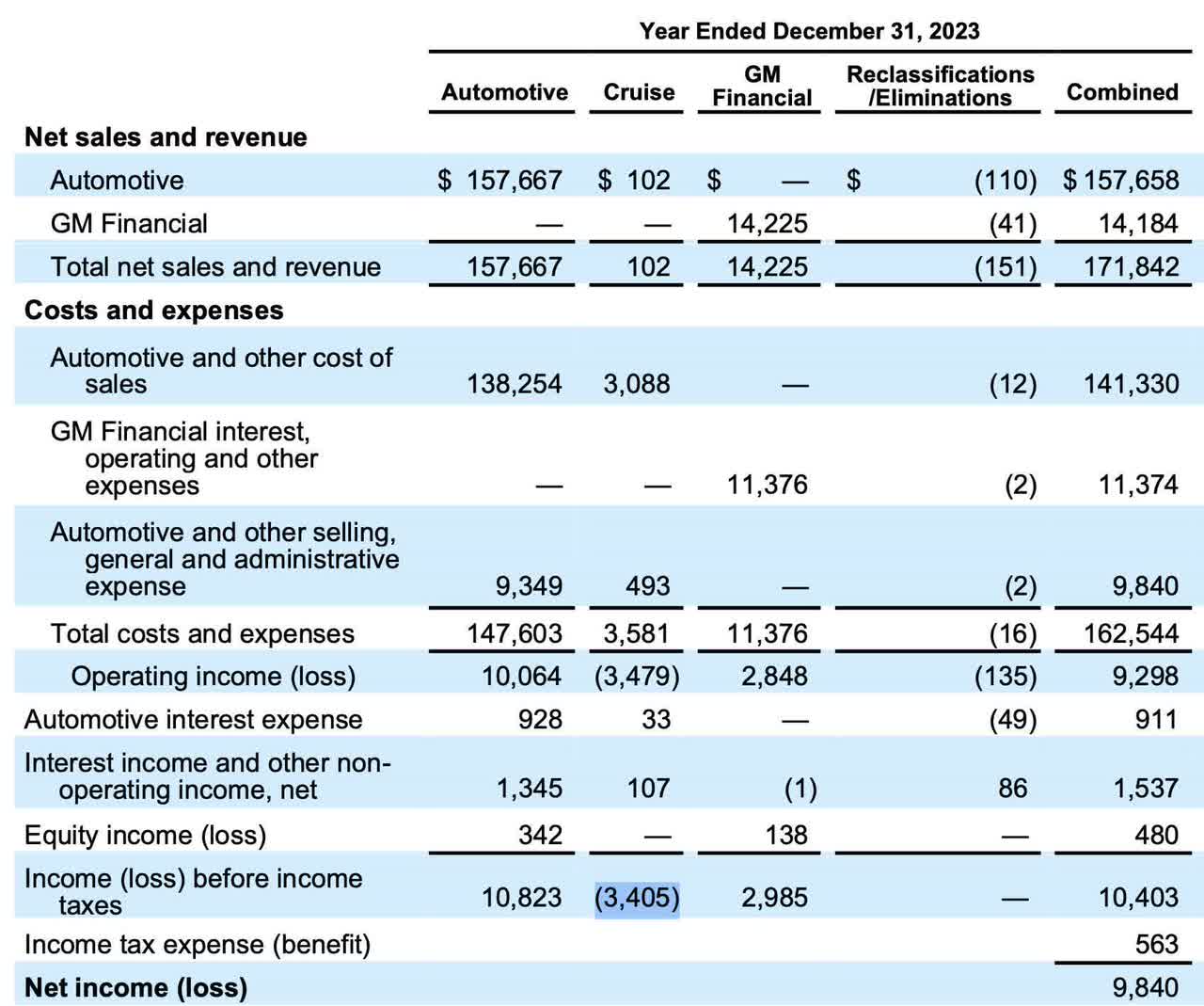

General Motors lost $3.4 billion in Cruise in 2023, according to this table on Page 6 of the company’s most recent earnings press release:

GM management indicates in its most recent earnings deck that the company remains “committed to Cruise’s vision” and that it “expects to reduce expense by ~$1B and slow down the cash burn to align with a narrower focus in 2024.”

Given the ongoing, steady progress shown by Alphabet Inc.’s (GOOG) (GOOGL) subsidiary Waymo, its expanding partnership with Uber Technologies, Inc. (UBER), and its planned expansion into Washington DC and Austin, I’d like to see concrete steps from General Motors before incorporating management forecast to any valuation methodology and assigning material value to Cruise.

On the other hand, General Motors appears to be faring better on its in-house battery production efforts relative to its Cruise division, and management indicated in the most recent earnings deck that “Ultium Platform Production On Track” and that the company would “begin shipments of Chevrolet Equinox EV to dealers in the first half of 2024,” “resume sales of Chevrolet Blazer EV in March” and “begin deliveries of Chevrolet Silverado EV in the coming months.”

I will be closely watching management comments on these two important fronts in the upcoming earnings call on April 23 and will look for concrete steps taken rather than forward-looking forecasts in order to gauge the company’s competitive positioning in the future of a rapidly evolving automotive industry.

Recent Performance And Valuation

The following chart illustrates GM’s recent stock performance along with its price-to-earnings and other popular valuation multiples:

The above two graphs illustrate that the change in the company’s stock price in the last three years has been mostly explained by a corresponding change in the price-to-earnings ratio and that the company’s price-to-earnings ratio has experienced a generally declining trend in recent years, except for the last six months.

At its current 6.2x P/E multiple, some investors might argue that the stock is still undervalued, but in my opinion, until General Motors solves the two key issues I discussed above, i.e. in-house battery production and autonomy, I expect the stock to be valued at the recent range of 4x to 6x P/E multiple; therefore, my target price for the stock is $35 to $45 per share.

The following chart compares GM’s price-to-earnings multiple to those of Volkswagen AG (OTCPK:VWAGY), Bayerische Motoren Werke Aktiengesellschaft (OTCPK:BMWYY), Nissan Motor Co., Ltd. (OTCPK:NSANY), Mazda Motor Corporation (OTCPK:MZDAF), and Stellantis N.V. (STLA), all of whom face similar challenges in the coming years:

If General Motors solves the two key challenges it faces and proves that it can build affordable electric vehicles with autonomous driving capabilities in high volume, then I’d expect the market to award higher valuation multiples to the company, potentially closer to Tesla’s 39x price-to-earnings multiple, but the market currently believes the chances of that outcome are slim, and I agree.

Conclusion

General Motors achieved impressive profitability in 2023 when others such as Tesla have struggled with sustaining profit margins in the near term. Having said that, however, the two looming challenges are keeping a lid on the stock’s valuation. I recommend that investors remain on the sidelines until the company proves that it can overcome the battery and autonomy challenges. I rate the stock HOLD, for now, and will closely watch for new data to update my analysis following the next earnings release.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.