Summary:

- General Motors’ optimistic FY2024 guidance likely supports its recent rally, but the euphoria embedded in the stock price is likely to be unsustainable.

- The whiplash between the unprofitable EV and legacy ICE business may continue for a little longer, with the latter temporarily taking center stage for now.

- Readers must note that things are likely to be volatile once affordable 2nd gen EVs are launched by 2025/ 2026, Cruise is relaunched, and the macroeconomic outlook normalizes.

- For now, with most of GM’s upside potential already baked in, we do not recommend anyone to chase it here, especially given the underwhelming dividend investment thesis.

Bulat Silvia

We previously covered General Motors Company (NYSE:GM) in December 2023, discussing its uncertain near-term prospects, attributed to the immense headwinds to its profitability, electric vehicle [EV] transition, and autonomous dreams.

While long-term shareholders might applaud the aggressive buybacks and dividend raises, we had believed that the stock might trade sideways at these levels over the next few years, with the recent recovery offering a minimal margin of safety.

In this article, we shall discuss why we are maintaining our Hold rating, with GM’s optimistic FY2024 guidance triggering another lofty rally as the market temporarily shifts their focus away from EVs while celebrating the inherent profitability of the ICE business.

While the improved bottom line is highly promising, readers must note that the euphoria embedded in the stock prices may be unwarranted, with 2025 and 2026 likely to bring forth expanded EV investments and capex, as the macroeconomic outlook lifts and price parity is achieved.

With minimal upside potential and an underwhelming dividend investment thesis, we do not recommend anyone to chase the rally here.

The GM Investment Thesis Is Rather Lofty Here, With Another EV/ICE Whiplash Likely To Occur

Most recently, GM delivered a double beat during its FQ4’23 earnings call, with automotive revenues of $39.26B (-3% QoQ/ -1.4% YoY) and adj overall EPS of $1.24 (-45.6% QoQ/ -41.5% YoY), with FY2023 numbers of $157.66B (+9.5% YoY) and $7.68 (+1.1% YoY), respectively.

The legacy automaker also recorded adj EBIT of $12.4B (-14.3% YoY) and automotive Free Cash Flow of $11.7B (+11.8% YoY) in FY2023, implying margins of 7.2% (-2 points YoY) and 7.4% (+0.2 points YoY), respectively.

When compared to FY2019 margins of 6.1% (-1.9 points YoY) and 5.4% (+1 points YoY), respectively, it is apparent that GM remains profitable enough in the latest fiscal year.

This was despite the sudden whiplash from the hyper-pandemic boom when global EV sales doubled YoY to 6.6M units in 2021, with GM also accelerating multiple EV programs to capitalize on the growing consumers demand and expanding Average Transaction Prices [ATP] of $50K (+3% YoY).

As the inflation soared and the Fed commenced rate hikes, demand quickly dwindled as Tesla (TSLA) chose to embark on a drastic price war since early 2022 to boost sales. The global EV sales also decelerated to 14.2M units in 2023 (+35% YoY) as ATPs fell to $55K by January 2024 (-16% from June 2022 peak of $66K).

The sudden change in market trend is also worsened by the fact that the EV and Cruise segments remain unprofitable for GM, with the cash burn funded by the profitable ICE segment as the macroeconomic outlook turns uncertain.

However, GM did continue to deliver volume growth to 2.6M (+18.1% YoY) in the US in FY2023, without having to participate in the price war, attributed to the former’s ATP’s “that are 112% of the industry average and incentives that are 9% of the industry average.”

The same has been observed in the somewhat stable automotive gross margins of 10.3% (-1.5 points YoY) in FY2023, compared to the 9.8% reported in FY2019 (+0.5 points YoY).

At the same time, GM’s balance sheet remains healthy, with $15.98B of long-term debts (inline YoY/ +28% from FY2019 levels of $12.48B) and cash of $18.85B (-1.5% YoY/ -1.1% from FY2019 levels of $19.06B) by the latest quarter.

We may also see things improve ahead, with the management already guiding for profitable EV growth and moderated Cruise cash burn, by $1B YoY, while building upon its successful portfolio with new ICE models.

As a result of the slower EV ramp up and stable capex plans, it is unsurprising that GM has offered highly promising FY2024 EBIT guidance of $13B and adj EPS guidance of $9.00 at the midpoint, way exceeding the consensus estimates of $11B and $7.70, respectively.

Part of the EPS tailwind is also attributed to the management’s aggressive $10B accelerated share repurchase program, with 118M shares retired over the LTM and 124M since FY2019, with a long-term target to further reduce to “less than 1B common shares outstanding.”

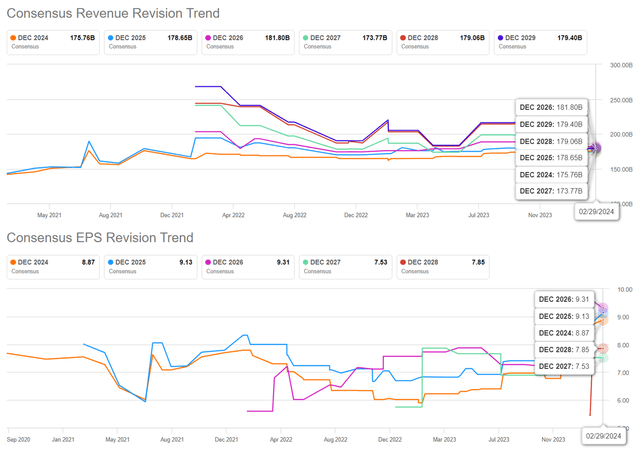

The Consensus Forward Estimates

The same has been observed in the consensus forward estimates, with GM expected to generate an accelerated top/ bottom line expansion at a CAGR of +1.9%/ +6.6% through FY2026.

This is compared to the previous estimates of +2.6%/ -2.08% and the historical growth of +1.3%/ +3.3% between FY2016 and FY2023, respectively.

It is apparent that the slower EV adoption/ transition has directly contributed to GM’s expanded bottom line, with its Free Cash Flow generation likely to be similarly improved.

GM Valuations

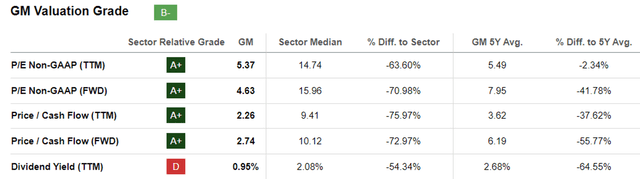

As a result of the bottom-line tailwinds, we can understand why the market has temporarily upgraded GM’s valuations to FWD P/E of 4.63x and FWD Price/ Cash Flow of 2.74x, compared to its October 2023 bottom of 4.19x and 1.59x, respectively.

The same re-rating has been observed in Ford (F) from FWD P/E of 5.98x to 6.90x and Stellantis (STLA) from 2.97x to 4.71x, implying the market’s increased conviction surrounding the legacy automakers’ improved profitability through ICE vehicles.

While there remains a great distance to the sector median of 15.96x and 10.12x, the upgraded numbers also bring GM’s prospects nearer to its 3Y pre-pandemic mean of 6.21x and 3.60x, respectively, implying that the stock is moderately undervalued at the moment.

However, readers must also note that the market is dangerously fickle, with GM’s legacy position (previously looked down upon during the hyper-pandemic EV boom) now being overly celebrated, attributed to the profitable ICE segment.

With the second generation affordable EVs projected to be launched in 2025/ 2026 as price parity is similarly achieved by H2’26, we may see things turn volatile for legacy automakers such as GM, depending on the success and profitability of their EV segments.

So, Is GM Stock A Buy, Sell, or Hold?

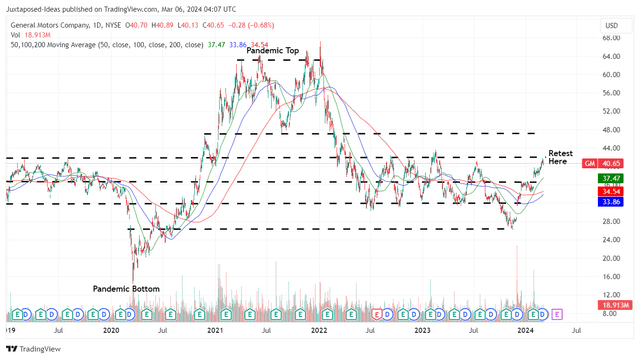

GM 5Y Stock Price

For now, GM has already rapidly broken out of its 50/ 100/ 200 day moving averages, with the stock also retesting its previous resistance levels of $41s.

Based on the FY2023 adj EPS of $7.68 and applying its FWD P/E valuation of 4.63x to this, we believe that the stock is trading above our fair value estimates of $35.50.

It is apparent that the market has gotten ahead of itself here, with GM pulling forward most of its upside potential to our near-term price target of $41.60, when applying the FWD P/E to the management’s FY2024 adj EPS guidance of $9.00 at the midpoint (+17.1% YoY).

Thanks to the recent rally, GM also does not offer a compelling dividend investment thesis with a forward yield of 1.1%, based on the current stock prices and the annualized FQ4’23 dividends of $0.48 (+33%).

In the near term, there may be more pain for automakers as well, attributed to the inventory glut across EV, Gasoline, and Hybrid vehicles at US automobile dealerships, as the ATP of new vehicles continues to fall to $47.4K (-2.6% MoM/-3.5% YoY) by January 2024.

With the January 2024 CPI still rising by +0.3%, up from the +0.2% reported in December 2023, it seems that the Fed pivot may not occur as soon as previously expected in H1’24, as the market increasingly prices in rate a cut only by the June 2024 FOMC meeting.

Combined with the higher borrowing costs of 7.1% for new vehicles (inline MoM) and 11.6% for used vehicles (+0.2 points MoM) as of January 2024, compared to the normalized 5.4% in December 2019, we believe that GM’s recent rally may not be sustainable.

While we remain optimistic about the long-term electrification trend as the macroeconomic outlook normalizes and EV demand returns over the next few years, it remains to be seen if the stock may break out of the $41s, with a near-term sideways trade more likely than not.

As a result of the potential volatility, we prefer to maintain our Hold (Neutral) rating on the GM stock.

Patience may be more prudent here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.