Summary:

- Both Gilead and AbbVie are strong picks for dividend investors.

- Ailing cash cows are hampering revenues at both.

- Each has had a mixed bag of positives and negatives for Q1, 2023.

- In a tight match Gilead’s experience with HCV helps reach a decision.

Evening Standard/Hulton Archive via Getty Images

Gilead (NASDAQ:GILD) and AbbVie (NYSE:ABBV) are two big pharma names I have followed extensively over the years. My most recent take on AbbVie was 04/2023’s “AbbVie Stock Q1 Earnings Preview: What To Watch For” (“Watch“); for Gilead it was 10/2022’s “Peak Gilead” (“Peak“).

Both AbbVie and Gilead are top performers in terms of dividends.

Dividend overview

Gilead and AbbVie are a pair of light heavy weights in the biotech arena. They are not the biggest of the big like the real big boys in Seeking Alpha’s Big Pharma Stock group (the “Group”). With market caps of >$266 billion (AbbVie) and >$102 billion (Gilead) each has plenty of heft. Both pay strong well covered dividends which have grown over the years.

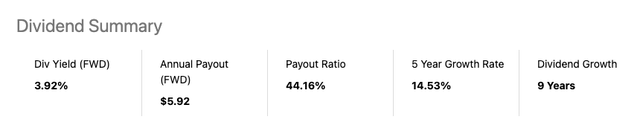

AbbVie dividend metrics

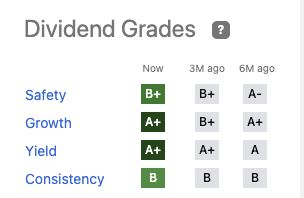

AbbVie’s dividend scorecard provides a concise look at its most important metrics:

All are comfortable; its yield is among the very top (7th) among the 1170 in the healthcare space. Its 4 year average yield of 4.54% is the second highest. Its Quant dividend grade panel is pristine:

seekingalpha.com

Cautious investors who check out the multiple components contributing to AbbVie’s overall B+ dividend safety grade will find elements worth considering. For instance it merits F’s in four metrics and various flavors of D in seven more. These include such important issues as its debt to equity ratios and various approaches to calculating its payout ratio.

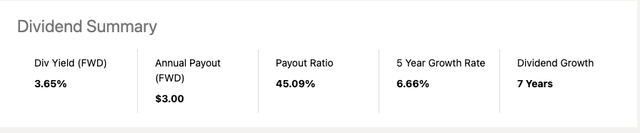

Gilead dividend metrics

Gilead’s dividend scorecard is a near mirror of AbbVie’s:

Again its scores are quite similar to AbbVie’s. In terms of yield compared to the Quant system’s healthcare universe of 1170 stocks it ranks 8th, next in line behind AbbVie’s 7th. As for its 4 year average yield of 4.00% it is the sixth highest compared to AbbVie’s second highest.

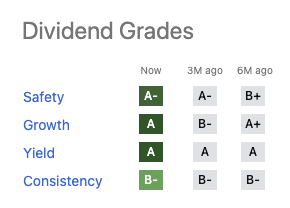

In terms of its dividend grade panel it is also pristine:

seekingalpha.com

Its individual dividend grades are a skosh under AbbVie’s except in terms of safety, where Gilead has a slight edge. However Gilead’s underlying safety metrics show little to prefer over AbbVie’s.

Both Gilead and AbbVie are suffering revenue disruptions from shifting market dynamics.

AbbVie’s revenue disruptor

AbbVie’s storied HUMIRA, the highest grossing pharmaceutical ever, is facing its first US biosimilar competition in Q1, 2023. Later in the year another eight are expected to flood into the market as described in Watch. AbbVie is paying a steep price as its champion loses revenues.

Its global HUMIRA net revenues of $3.541 billion decreased 25.2 percent on a reported basis. As announced in its Q1, 2023 earnings call (the “AbbVie Call“), it expects HUMIRA revenues to face steeper competition as H2 develops.

The Call was generally upbeat as to HUMIRA erosion; however it offered no specifics that would undercut the ~37% rate for erosion forecast in Watch.

Gilead’s revenue disruptors

Gilead has faced two revenue disruptions. Its long past but still reverberating Sovaldi, Harvoni, Epclusa, and Vosevi (S.H.E.Y.) HCV therapies pulled in billions in the 2015-2020 era, as I have chronicled in detail.

Its next short-lived blockbuster is of more current vintage. Gilead’s COVID-19 therapy, VEKLURY (remdesivir) generated revenues of ~$2.811 billion for 2020, $5.565 for 2021 and ~$3.905 billion for 2022. Pretty special for a drug that received its EUA in 05/2020 and full approval in 10/2022.

How sweet it was. As reported in Gilead’s Q1, 2023, earnings call (the “Gilead Call“, Gilead expects VEKLURY sales to sputter down to a measly $2.000 billion for 2023. Not a terrible sputter by any comparison other than Veklury’s own previous three years revenues.

Both contenders scored some points and took some punches for Q1, 2023.

AbbVie’s highlights

It is important for AbbVie that any quarterly highlight reel prominently feature its SKYRIZI/RINVOQ duo. These are AbbVie’s two new immunology champions that it is positioning to fill the gap left by dwindling HUMIRA revenues.

These two are tough to compare on a period to period basis because each is growing its suite of approved indications at a rapid clip. RINVOQ has had multiple approvals spread across several years. AbbVie’s 2022 10-K (the “AbbVie 10-K”) sets out the cadence of 2022 RINVOQ (upadacitinib) approvals at pp. 34-35 as follows:

- 01/2022, FDA approval in treatment of second line moderate to severe atopic dermatitis in adults and children 12 years of age and older;

- 03/2022, FDA approval in second line treatment of adults with moderately to severely active ulcerative colitis (UC);

- 04/2022, FDA approval in second line treatment of adults with active ankylosing spondylitis;

- 07/2022, EC approval for the second line treatment of adults with moderately to severely active UC and for the treatment of adult patients with active non-radiographic axial spondyloarthritis (nr-axSpA);

- 10/2022, FDA approval for the treatment of adults with active nr-axSpA with objective signs of inflammation who have had an inadequate response or intolerance to TNF blocker therapy.

Earlier in 2019 the FDA had approved RINVOQ for second-line treatment in rheumatoid arthritis [RA] and in 10/2021 for psoriatic arthritis [PsA].

As for SKYRIZI (risankizumab) it can boast fewer (three) approved indications. It was approved:

- 04/2019 to treat moderate to severe plaque psoriasis in patients who may benefit from taking injections or pills (systemic therapy) or treatment using ultraviolet or UV light (phototherapy);

- 01/2022 to treat adults with active PsA;

- 06/2022 for the treatment of adults with moderately to severely active Crohn’s disease [CD].

During the AbbVie Call, AbbVie tends to discuss these two as a pair. In fact they are very different. CCO Stewart provides a granular view of each therapy’s performance by indication during the AbbVie Call.

Rather than burden readers here with minutiae, I will report that RINVOQ scored global quarterly revenues across its seven approved indications of $686 million. SKYRIZI on the other hand brought in ~$1.360 billion across its three indications.

Why the discrepancy with SKYRIZI outperforming? They are approved in different indications. Be that as it may, RINVOQ has limitations that SKYRIZI does not; RINVOQ is a JAK inhibitor and as such its label in diverse indications carries the JAK inhibitor class warnings. Also RINVOQ’s approvals are all secondary for use only after patients have failed one or more prior therapies.

While SKYRIZI may reliably outperform RINVOQ over time, this is not to downplay RINVOQ’s importance. Its revenues grew at a healthy 50% growth during Q1, 2023. It will be a factor in AbbVie’s overall growth profile for years to come.

Moving on from RINVOQ and SKYRIZI, VENCLEXTA (venetoclax) in treatment of hematological malignancies continued it winning ways. It generated >$2 billion in 2022 global revenues; its global revenues were $538 million for Q1, 2023, up 17.5% on an operational basis.

VRAYLAR (cariprazine) in treatment of schizophrenia and bipolar disease was another positive. It generated revenues of $2.038 billion in 2022. With addition of adjunctive treatment of major depressive disorder as an indication in 12/2022, it generated Q1, 2023 revenues of $561 million up 31.3%.

Additional therapies with double digit growth included global botox therapeutic and UBRELVY. Botox therapeutic Q1, 2023 revenues were $719 million, an increase of 18.7% on an operational basis. UBRELVY revenues were $152 million, up 10%.

AbbVie’s lowlights

AbbVie’s overall Q1, 2023 picture hampered by HUMIRA’s first biosimilar challenge was downbeat. It reported worldwide net revenues of $12.225 billion, a decrease of 9.7% on a reported basis, or 8.3% on an operational basis.

Beyond HUMIRA, other therapies returning negative growth include IMBRUVICA (ibrutinib) and JUVÉDERM. Global IMBRUVICA net revenues were $878 million, a decrease of 25.2%. Global JUVÉDERM net revenues were $355 million, a decrease of 7.4% on an operational basis.

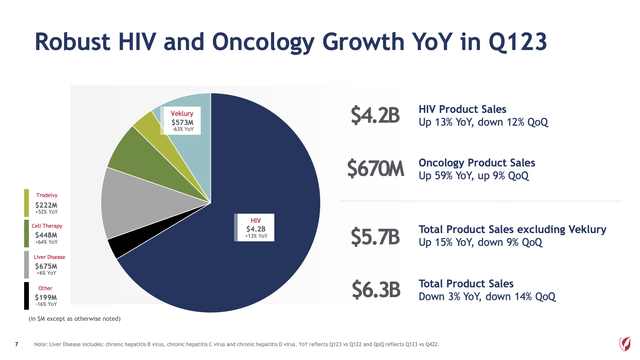

Gilead’s highlights

Gilead’s portfolio of income producing therapies performed well, generally notching gains outside of its troubled VEKLURY as described above. Gilead’s HIV portfolio is its major revenue producer. It is performing well from a revenue perspective.

As a whole it generated quarterly revenues of $4.2 billion. Its lead therapies within its portfolio saw particularly strong growth. During its Q1, 2023 earnings release (the “Gilead Release“) Gilead reported:

Biktarvy® (bictegravir 50mg/emtricitabine 200mg (“FTC”)/tenofovir alafenamide 25mg (“TAF”)) sales increased 24% year-over-year in the first quarter of 2023, reflecting higher demand, as well as favorable pricing and inventory dynamics.

Descovy® (FTC 200mg/TAF 25mg) sales increased 20% year-over-year in the first quarter of 2023, primarily driven by higher demand and favorable pricing dynamics.

Gilead’s lowlights

Gilead’s VEKLURY revenue drop off from ~$3.095 billion in 2022 to ~$2 billion anticipated in 2023 is disconcerting. It does not however undermine Gilead’s basic value proposition.

VEKLURY has helped Gilead fund the untold billions it has spent working to accumulate a cancer portfolio of scale to balance its HIV franchise. As I describe in 10/2020’s “Gilead’s Cancer Follies“, this has proven terribly difficult.

If one were to judge from isolated data points in the Gilead Release, one might think Gilead was well on its way to solving the problem. Certainly the following excerpt from CEO O’Day is cheering:

…Oncology revenue increased 59% year-over-year, driven by Trodelvy and Cell Therapy. We look forward to helping even more people with Trodelvy following the approval for pre-treated HR+/HER2- metastatic breast cancer, making this the third U.S. approval for Trodelvy in three years.

How can 59% year over year be consistent with a “lowlight” feature? Am I being too harsh? Take a look at slide 7 graphic below from Gilead’s Q1, 2023 earnings presentation (the “Gilead Presentation“):

Gilead’s cell therapy revenues of $448 derive from its 2017 ~$12 billion Kite acquisition. Its $222 million in TRODELVY revenues derive from its 09/2020 ~$21 billion Immunomedics acquisition. These high growing revenues have been purchased at high cost. They still haven’t reached a scale to balance out Gilead’s HIV franchise.

Gilead’s HCV travails provide a helpful analogue to AbbVie’s HUMIRA.

The investment merits of AbbVie and Gilead are sufficiently close that one has to search to discover a tie-breaker. AbbVie’s ratings summary panel compared to Gilead’s panel is inconclusive. Seeking Alpha and Wall Street Analysts both aggregate a small preference for Gilead. Quant is almost identical between the two.

Over the years as an investor in and observer of AbbVie’s now developing but long expected HUMIRA woes, I have often thought it comparable to Gilead’s experience with S.H.E.Y. They are comparable insofar as both HUMIRA and S.H.E.Y. at one point made up >50% of revenues.

They are comparable in that both HUMIRA and S.H.E.Y. involved huge revenue falloffs. The lesson that S.H.E.Y. imparts is concerning. HUMIRA revenue erosion is entirely different from VEKLURY erosion. It is likely to grow ever bigger in the US as it has done ex-US.

So far CEO Gonzalez has managed this situation with great finesse. Unfortunately the length of his tenure is uncertain. During the AbbVie Call he responded as follows to an analyst question as to the timing for his expected retirement announcement:

…We obviously have a process in place, we have very experienced board. I’ve had many, many discussions with the board about succession. The board knows I’m committed to be here to ensure a successful and smooth transition. The criteria that we’re operating against are we need to completely get through the transition for Humira biosimilars here in the U.S. I’d say so far, I’m pretty pleased with how the transition is going and I’m even more pleased with the way the growth platform is operating right now.

He went on to confirm his expectations for AbbVie to return to robust growth in 2025 once it has addressed the following headwinds:

- IMBRUVICA revenue falloff,

- aesthetics business return to its normal growth rates and

- HUMIRA biosimilar erosion.

He indicated that no transition should be expected in 2023.

Conclusion

I consider both AbbVie and Gilead to merit strong contention for inclusion in any dividend investor’s portfolio. As between the two I would give the edge to Gilead. Its HIV portfolio has proven its resilience and growth capacity over the years.

Its cancer portfolio has been absurdly expensive over the years. However on a going forward basis, the fact that it has profligately spent profits is a shame. It does not gainsay the potential for future growth of the gems (TRODELVY and cell therapy) that it has landed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.