Summary:

- General Motors reported Q4 revenue of $43 billion, exceeding analyst expectations by 11% and showing a 9.64% increase in annual revenue.

- The new wage agreement is expected to add $9.3 billion to GM’s costs, potentially impacting profitability and increasing the cost of producing each vehicle.

- GM’s focus on EVs for future growth has been met with skepticism as analysts doubt the company will achieve EV profitability in the short term due to intense competition and potential margin pressures from cheaper Chinese competitors.

JHVEPhoto

Much has changed since I last covered General Motors Company (NYSE:GM). At the time the autoworkers’ strike was still ongoing, and it seemed inevitable that the company would need to cut capital expenditures. The expected reduction in capital expenditures materialized while the share price performed substantially better than I had expected at the time in the aftermath of the strike ending. The company also reported earnings at the end of January which beat analysts’ expectations. In this article, I consider the key takeaways from the earnings report and what it likely means for GM investors going forward.

GM Earnings

GM reported around $43 billion in revenue for the fourth quarter, which exceeded analyst expectations by around 11%. This was slightly lower than its revenue in the same period last year when revenues were around $43.1 billion. However, on an annual basis, its revenue increased by 9.64% from $156.7 billion in 2022 to $171.8 billion in 2023. Earnings per share also improved by an impressive 19.4% from the previous year’s earnings, indicating a fairly solid set of top line and bottom line earnings numbers.

Some uncertainty remains over the eventual impact of the new wage agreement on earnings, particularly when considering that automakers like GM often have quite tight margins. GM’s net income margin for 2023 came in around 0.4% lower than its net income margin in 2022, indicating that its net income margin was under some pressure even before the full impact of a new wage agreement was felt. GM recently indicated that it expects the wage agreement to add around $9.3 billion to its cost over the lifetime of the agreement which would increase its cost of producing every vehicle by around $575 per vehicle.

The bulk of the increased cost associated with the new labour agreement is not reflected in the 2023 results as the impact for 2023 was only around $200 million. Nevertheless, the impact of the strike itself is reflected in the 2023 results and is estimated to have cost GM around $1.1 billion in adjusted earnings over the duration of the strike. This is similar to the expected annual costs of the new labour agreement which GM expects to cost around $1.5 billion in 2024. What remains uncertain is just how much of this cost GM would be able to pass on to the consumer. Given the fairly intense competition in the automotive industry, it seems likely that GM will attempt to recoup only part of this cost through the consumer and implement other cost reductions for the balance.

Interestingly, GM’s guidance for 2024 indicates that the company is on track to achieve a net $2 billion fixed cost reduction by the end of 2024 despite the increased cost associated with the labour agreement. It also has targeted a 0.6% improvement in its EBIT margin. In my view, the increase in labour costs is likely to present a challenge in reaching this target but doesn’t seem impossible given the relatively strong performance in 2023 despite the cost of the strike.

What about EVs?

GM seems to be placing much of its hope for future growth on electric vehicles (EVs) and has predicted EV profitability by the second half of this year. However, some analysts have expressed skepticism over these claims indicating that it seems highly unlikely that this target could be achieved in the short time given. Garret Nelson, equity analyst at CFRA, noted that they don’t expect GM to reach EV profitability for at least the next two to three years. The EV market is highly competitive and offers limited opportunities for price increases.

The new labour agreement also includes EV battery plants which would previously have been excluded from the UAW master agreement. The inclusion of these plants in the labour agreement also will likely result in a fairly substantial increase in labour costs at these plants going forward. This is particularly problematic at a time when US automakers are increasingly concerned over Chinese competition. BYD Company Limited (OTCPK:BYDDY) has presented a growing competitive threat to US EVs with its much lower cost of manufacturing.

It also has recently been reported that BYD is looking at establishing a plant in Mexico, which could potentially see it benefiting from the United States – Mexico – Canada (USMCA) free trade agreement. This could see US automakers face further margin pressures in their EV businesses which could further push back EV profitability for GM. Nevertheless, it’s likely to take some time to establish a plant, but the competition from cheaper Chinese competitors should be monitored closely. In my view, EVs do present good opportunities for GM, but many teething issues remain, and this business is unlikely to be a clear profit driver in the near future.

Is GM stock a buy, sell, or hold?

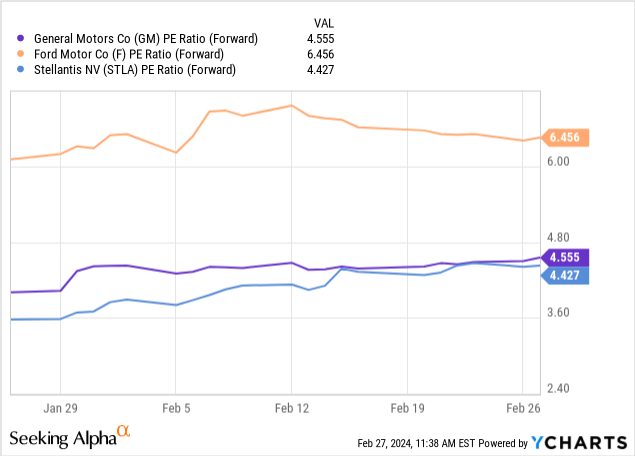

GM has consistently been trading at an extremely low price-to-earnings ratio in recent years. Its current forward P/E ratio is around 4.555 which is extremely low when the average P/E ratio in the S&P 500 is around 23.27. It’s also quite a bit lower than that of peers like Ford Motor Company (F) albeit broadly in line with that of peers like Stellantis N.V. (STLA).

Despite its low valuation there appears to be a lack of clear catalysts that could lead to a rerating of the stock in the near term. It’s cheap, but has been cheap for some time now. However, should GM reach EV profitability as early as indicated this might well lead to a gradual rerating of the stock. Given that this seems unlikely, I presently rate the stock as a hold.

Conclusion

It’s clear that GM has navigated through significant challenges, including the auto-workers strike and increased labour costs, while still managing to deliver a solid set of earnings numbers for 2023. Despite facing uncertainties surrounding the impact of the new wage agreement and the path to EV profitability, GM remains committed to its cost reduction targets and aims for improvements in its EBIT margin.

While the company’s focus on EVs holds promise for future growth, skepticism remains regarding its ability to achieve profitability in the short term, especially amidst intense competition and potential margin pressures from cheaper Chinese competitors. The inclusion of EV battery plants in the labour agreement further adds to the complexity of the situation.

From an investment standpoint, GM’s low valuation presents an opportunity, but without clear catalysts for a rerating in the near term, the stock is presently rated as a hold. In my view, this could change should GM reach EV profitability as early as this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.