Summary:

- GM CEO Mary Barra’s tenure is burnished after the company reported a $2.98 billion net profit in Q1, beating expectations.

- Barra has successfully balanced government and environmentalist pressure for more electric vehicles while maintaining the competitiveness of internal combustion engine models.

- GM’s new 2024 Chevrolet Traverse poses competition for other midsize SUVs, but the lack of a gas-electric hybrid powertrain may hinder its appeal to consumers and meeting emission standards.

- The shares have had a good run. Price sustainability will be important.

Second-generation Chevrolet Traverse — a gasoline stalwart that GM is about to replace with a third generation at US Chevy dealers. jetcityimage/iStock Editorial via Getty Images

Mary Barra has bought herself more time as chairman and CEO of General Motors Co. (NYSE:GM). Moving decisively in late November to institute a $10 billion accelerated share buyback program and dividend increase, GM shares have been on a tear for five months.

This week’s first quarter earnings report further spotlighted her tenure, at least for the moment. Despite GM’s massive expenditures to develop battery-electric vehicles (BEVs) – whose timetable for return is uncertain, on top of losses in China and from Cruise autonomous vehicle operations, the automaker turned a $2.98 billion net profit, up 24.4% year-over-year, and beat analyst expectations.

Blue sky

GM also raised its financial guidance for the year.

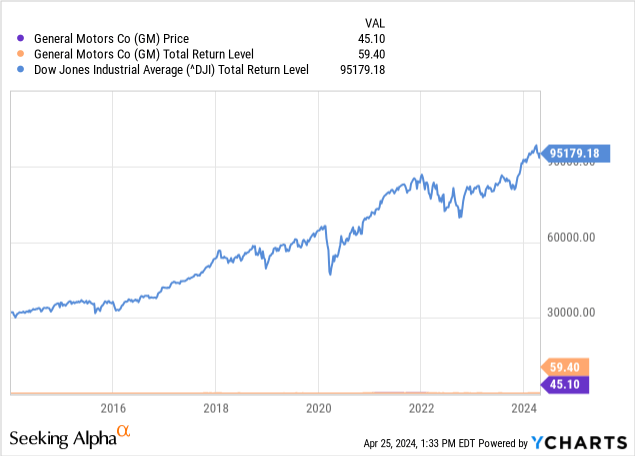

Since Barra’s installation as CEO in 2014, GM stock has averaged a tepid 4.4% a year average total return, assuming the reinvestment of dividends, compared with a 12.8% return over the same period for the S&P 500 Index.

Yet, Barra has managed adroitly to balance government and environmentalist pressure for more BEVs, while maintaining the competitiveness of GM’s internal combustion engine models. The concept has been to earn enough selling ICE models until the BEVs can attract mainstream buyers and, in her vision, create a profitable zero-emission future.

Latest in the string of modernized ICE models is the 2024 Chevrolet Traverse, a midsize three-row family carrier in its third generation. GM’s new Traverse has been restyled to look more like a rugged SUV and less like a large station wagon. It’s powered by an all-new four-cylinder 2.5-liter turbocharged engine that develops more horsepower and torque than the 3.6-liter six-cylinder engine it replaces.

Spirited competition

The redesigned Traverse poses worthy competition for models like Hyundai Palisade, Kia Telluride and Ford Explorer. Unlike the new Toyota Grand Highlander, however, the Traverse does not offer a gas-electric hybrid powertrain, forfeiting the advantage of a significantly higher fuel-efficiency rating. Traverse clocks in at 21 miles per gallon combined, while the Grand Highlander gets 34-36 miles per gallon combined, depending on configuration.

2024 Chevy Traverse RS and Z71 (GM)

GM’s disadvantage without a gas-electric hybrid powertrain means that the automaker will be less appealing to some consumers and have a tougher time meeting federal emission and fuel economy standards. In the event, it must purchase credits from a maker of BEVs or pay a fine. GM last year paid $128.2 million in fines to the U.S. for failing to meet fuel efficiency standards and in previous years elected to buy credits.

GM, which has said it will institute fuel-saving plug-in hybrids, has so far failed to spell out any definite plans for shifting to efficient gas-electric hybrids, as its cross-town rival Ford Motor Co. has done. Earlier this month, Ford announced it will expand gas-electric hybrid options across its entire line of ICE models by the end of the decade. My guess is that GM will be forced to respond soon with a similar plan to roll out gas-electric hybrids, which would further strengthen investor confidence in the company as well as its competitiveness.

GM’s Super Cruise feature will be available on the new Traverse for the first time. The system is able to operate on 750,000 miles of limited access highways and roads in the U.S., allowing the driver to take hands and feet off the controls while keeping eyes on the road. GM says more than 80% of its customers who have the feature on other models say it makes driving more relaxing. (I’ve experienced Super Cruise on other GM models – it’s impressive.)

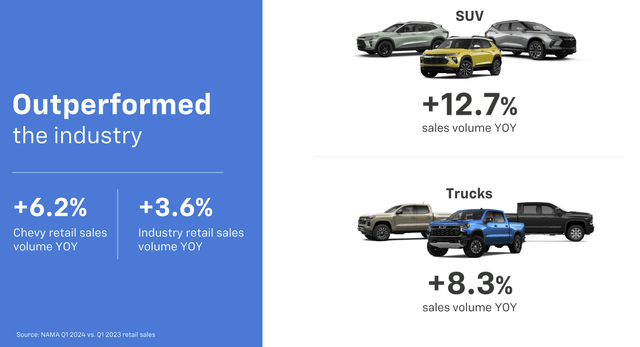

Chevy enjoyed a strong Q1 in the US (GM)

The midsize SUV segment in which Traverse competes has grown into a category that’s larger than full-size pickup trucks and a bit smaller than compact SUVs – making it all-important to GM and its biggest brand, Chevrolet. Later this year, GM will roll out a new Buick Enclave and a new GMC Acadia that are built on the same architecture as Traverse.

Sales plan

GM officials are counting on selling roughly 120,000 of the new Traverse. To expand its customer base, Chevrolet created a Z71 version of the Traverse with skid plates and other features that make it more appropriate for rugged, off-pavement adventures. The RS version will skew younger and toward female drivers who are hauling families. The entry-level LS will start at $39,000. The top-level RS will cost just over $58,000 retail.

Trouble spots remain for GM’s long-term financial outlook, notably its struggles with software development, the pause at Cruise’s autonomous vehicle activities and rising competition in China, which resulted in a $106 million loss for GM’s joint venture there in the first quarter.

Another worry is net pricing of GM vehicles, which was down 2 to 2 ½% for the quarter and could continue to decline for the year, said Paul Jacobson, CFO.

In the earnings call on Tuesday, Barra told analysts “all of our product programs are benefiting from the end-to-end improvements we’ve made in software, including the increased rigor we have instilled in our quality and validation processes.” In December, GM halted Blazer EV sales after software bugs plagued the infotainment and charging systems in some vehicles. In March, sales of the model resumed, following software fixes and a reduction in Blazer’s price.

Barra told analysts GM, who lately have been positive on GM, “was making progress at Cruise. The team is back on the road in Phoenix updating mapping, gathering more road information. This is a critical step for validating our improved self-driving system and building upon the more than 5 million driverless miles we’ve logged before the pause,” which was ordered by regulators in San Francisco following an injury accident last October involving a driverless Cruise vehicle. Cruise accounted for a $400 million deficit in the quarter, compared with an $800 million deficit a year earlier.

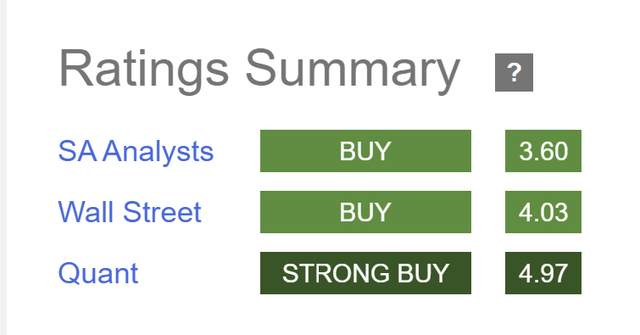

Analyst ratings for GM (Seeking Alpha)

The biggest question looming for GM will be the pace of introductions, sales and eventual profitability of several BEV models that are coming to market, most notably the Silverado EV full-size pickup truck in coming months. The automaker once had forecast sales of 400,000 EVs this year, a figure that GM has reduced to a range of 200,000 to 300,000, given lower demand and other production and supply problems.

If the signals turn positive at Cruise, in China and for EVs for the remainder of the year – topped by brisk sales of ICE models at strong prices – GM’s income statement will benefit, and its shareholders should reap the reward. Those are a lot of “ifs.” GM stock remains a hold in my opinion – an opinion I’m ready to abandon to the positive side should events bear fruit.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.