Summary:

- General Motors is a strong buy with a target price of $89, driven by its EV expansion and cost control.

- Interest rate cuts should boost demand as financing becomes cheaper and consumer confidence increases.

- GM’s dominance in the US market, bolstered by strong sales in trucks, SUVs, and fleet vehicles, positions it well for future growth.

- I expect Q3 EPS to be another positive surprise.

Joni Hanebutt

Introduction

General Motors (NYSE:GM), a titan in the automotive industry, has exhibited a remarkable transformation from its bankruptcy in 2009 to becoming a leading global automaker. With strategic expansions in EVs and a solid footing in traditional ICE vehicles, I expect GM to achieve its ambition of doubling 2021’s revenues by 2030. This will be driven by the traction of its EV models, the price premium of its vehicles, and the new high-margin revenue streams.

In 2022, I wrote an article about GM, I believe the thesis is unchanged, in fact, recent performance and outlook are better than I expected. As a result, I am adjusting my target price from $72 to $89 per share.

GM is beating market expectations and I foresee this continuing in the medium term

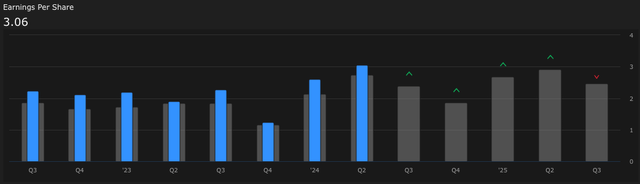

Historical EPS consensus and actuals (Interactive Brokers)

GM has consistently beaten expectations in recent history. In Q2 2024, GM announced an impressive net profit of $3.51 billion, translating to $3.06 per diluted share. This strong performance is attributed to cost control measures and improved operational efficiencies across the board.

In the last couple of years, GM has made some strategic changes that have helped control costs, and I believe those cost savings will continue. Some examples are:

- GM has forged strategic partnerships with suppliers, especially in semiconductor manufacturing and battery production. These partnerships help GM stabilize the supply chain and reduce costs due to logistics or unavailability of parts.

- GM is focusing on ten strategic decision areas, which include process and capacity design. This is helping in enhancing productivity while controlling costs.

- GM employs a cost leadership strategy.

- GM is improving the visibility with suppliers By using advanced analytics and supply chain mapping. This helps in better coordination and cost savings.

The current market expectation for Q3 is an EPS of $2.41 per share. My estimates indicate that Q3 EPS would be another positive surprise with an EPS ranging from $2.55 to $2.75 driven by stronger revenues than expected. I expect strong performance of the new EV models, supported by an increase in demand from the interest rate cuts.

Interest rate cuts to boost demand

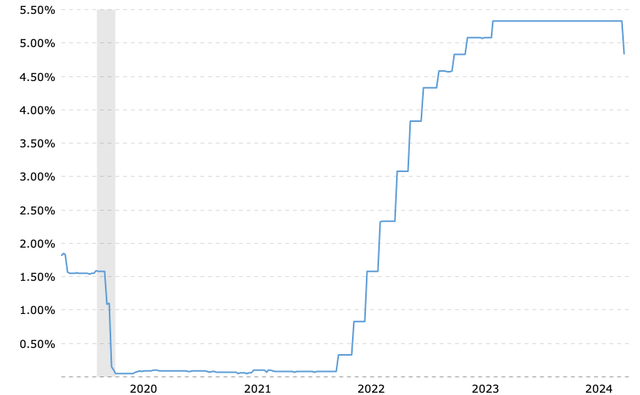

On September 18, the Feb cut interest rates by 50bps. While interest rates are still significantly higher than in 2021, this cut could boost demand for cars as it stimulates the economy, increases consumer confidence and makes consumer financing relatively cheaper.

I expect the Fed to cut rates again before the end of 2024 and the rate cuts should continue in 2025 and 2026 to bring the Fund Rate in the low 2% territory. That means the boost in demand will continue as financing becomes cheaper and consumer confidence increases.

Strong market share in the US

In 2023, GM reinforced its dominance in the US automotive sector, grabbing a substantial market share driven by strong sales across its vehicle lineup. GM announced a market share of 16.3%, a slight increase from the previous year, supported by a 14% rise in vehicle deliveries which totaled 2.6 million for the year.

The company’s impressive performance spanned several categories, notably in trucks, full-size pickups, SUVs, and fleet vehicles. GM’s approach of sustaining strong pricing while keeping incentives low played a key role in this success, positioning it ahead in multiple vehicle categories.

I expect market share to stay constant, as any decrease in volume market share would be offset by the premium GM is obtaining over its competitors.

Continuing the EV momentum

In 2020 GM announced its intention to accelerate its EV investments by increasing the number of EV models and EVs with better performance. In 2021, GM doubled down its commitment to EVs by aiming to double revenues by 2030 by increasing investment in EV and launching new businesses.

In the last couple of earning releases, we have seen the release of new EV models and the momentum seems to continue. On September 20, GM announced it is ending the production of the Chevy Malibu in the GM Fairfax plant and retooling the plant for the Chevy Bolt EV and Cadillac XT4. The Chevy Malibu 2025 model is expected to be the last model. This is relevant as the Chevy Malibu is one of the few ICE sedans remaining. This is a further indication of GM’s focus on EV, and I expect this trend to continue.

Valuation

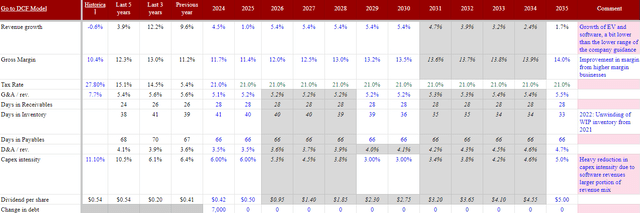

I value GM’s shares at $89 per share, which is an increase from my previous target of $72. I assume that GM would be close to 2030’s ambition of doubling 2021’s revenues. This is driven by the increased sales of EVs, continuing to demand for a premium ticket price over competition, and revenues from new channels such as software and selling data. As per 2024, consensus revenues are $179.1 billion, I expect revenues to be slightly higher at $179.6 billion, supported by the above-mentioned demand boost from interest rate cuts and the better performance of EVs.

As per the growth margin, the consensus is a 200 bps drop in gross margin in 2024 versus 2023. However, I expect the margin to expand 50 bps as the new revenue streams are more profitable.

Due to all the cost savings, I expect SG&A costs to decline in 2024. In 2023, SG&A represented 5.6% of revenues; I expect it to decline to 5.1% in 2024 as all the cost control efforts mentioned above should start translating into savings.

Below are my key assumptions:

GM Financial Key Assumptions (Analyst estimates, Bloomberg, Interactive Brokers, Seeking Alpha)

Conclusion

I believe that GM’s focus on EVs, cost control and new revenue streams positions it well to reach its 2030 targets. Also, the Federal Reserve’s recent interest rate cut could further stimulate demand for cars, aiding GM’s growth. I value the shares at $89 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.