Summary:

- GM’s electrification strategy faces challenges, with slower BEV demand, battery issues, and a shift in battery technology, impacting profitability and production timelines.

- Despite setbacks, GM’s strong balance sheet, low forward P/E, and continued dividends and share buybacks provide some stability for investors.

- CEO Mary Barra emphasizes internal combustion engines’ profitability while awaiting more established electrification trends and technological advancements.

- Hold GM shares pending significant improvements in BEV adoption and battery technology advancements, as current growth prospects remain uncertain.

Chevrolet Bolt EV electric vehicle display. Chevy discontinued Bolt EV and EUV after the 2023 model year. A new version is expected for 2026. jetcityimage/iStock Editorial via Getty Images

General Motors Company (NYSE:GM) first unveiled its vision of “zero crashes, zero emissions, and zero congestion” in 2017 and though the automaker has never retracted it, the vision’s realization – a world without internal combustion engines – remains at least as far off today as seven years ago.

At the automaker’s Investor Day on Tuesday, held for equity analysts at its Spring Hill, Tennessee assembly plant, chief executive Mary Barra assured investors that improved profitability lay ahead for GM though she said specific guidance for 2025 would be provided several months hence, likely in January.

Paul Jacobson, chief financial officer, said operating losses from BEVs would narrow by “$2 billion to $4 billion” next year. GM said the automaker is on track to sell roughly 200,000 BEVs this year, short of earlier projections and due in part by slower growth of BEV demand and battery production problems.”

Less lithium

Widely reported, though not confirmed by GM, is the intention to phase out the use of the Ultium name as a marketing brand to describe the battery power in all future BEVs. So far, GM has employed the more common nickel cobalt manganese (NCM) battery chemistry in its Ultium platform.

The Ultium name was originally conceived by GM marketers in a similar fashion to the way the “Intel Inside” brand had been used to describe the semiconductor chip powering many laptop models. Versions of Ultium’s batteries and other components were to have powered all GM BEVs.

Model of Ultium battery vehicle platform (GM)

No more. According to GM’s latest thinking, the automaker will institute different configurations and chemistries for a variety of models; one such variant is LFP (lithium iron phosphate), which already is in wide use in China due to its lower cost and better safety record. While GM so far has manufactured lithium-ion “pouches” as the primary component of its batteries, the automaker will henceforth also use cylinders and prismatic chambers for some applications.

Due to slower than forecast consumer demand in its principal market in the U.S., GM has delayed the forecast start of production at a $3.5 billion joint-venture LFP battery plant in Carlisle, Indiana by a year.

Strategy in flux

Clearly, GM’s electrification strategy is a work in progress, its original ideas having collided with consumer resistance to BEVs as well as some of the automaker’s own inexperience with advanced battery technology. In May of this year, GM and LG Chem established a $150 million fund to compensate Chevrolet Bolt owners after a faulty battery caused some of the electric vehicles to burst into flames.

In February, GM hired former Tesla battery executive Kurt Kelty as vice president of batteries and spearhead of GM’s strategic shift.

As pointed out in the Automotive News (with a bit of understatement):

GM at its investor day this year “offered a more measured outlook than at its last investor day in 2022, when executives said they planned to book more than $50 billion in revenue from EVs in 2025 and have the capacity to build 1 million a year in North America.”

The No. 1 producer of vehicles in the U.S. continues to struggle with mastery of basic advanced technologies – not just batteries – that are likely to dominate personal transportation for the foreseeable future.

Kurt Kelty, GM battery vp (GM)

In August, GM laid off more than 1,000 software engineers after a leadership shakeup in the organization – and presumably unsatisfactory performance. Electronic systems and the accompanying software have become a major focus of automakers as new capabilities such as voice, navigation, third-party apps and over-the-air updates for a variety of vehicle features become more common on new models.

Autonomy repair

Another trouble spot for GM has been self-driving technology, recently derailed due to an accident in San Francisco that brought regulatory scrutiny upon the automaker’s Cruise subsidiary. GM gave few details of progress since the accident, while Google’s Waymo subsidiary has been expanding its commercial self-driving operations.

Per Reuters: “Cruise has resumed supervised driving in select cities, she said. Pressed for more details about Cruise, GM chief financial officer Paul Jacobson said the business is expected to lose no more than $2 billion in 2025.”

Another subject on the minds of investors is China. After years of more or less robust profit there, the automaker posted a $104 million loss in the second quarter of this year as consumers switch to Chinese brands, which are gaining favorable notices from reviewers and sell at lower prices than comparable foreign models. GM said it is working with joint venture partners there to restructure operations with the intent of improving profitability.

But China also poses a longer-term threat to GM as Chinese automakers increase exports, a trend that raises global consumer awareness and one day may bring Chinese models to the U.S. – despite protective tariffs meant to keep them out.

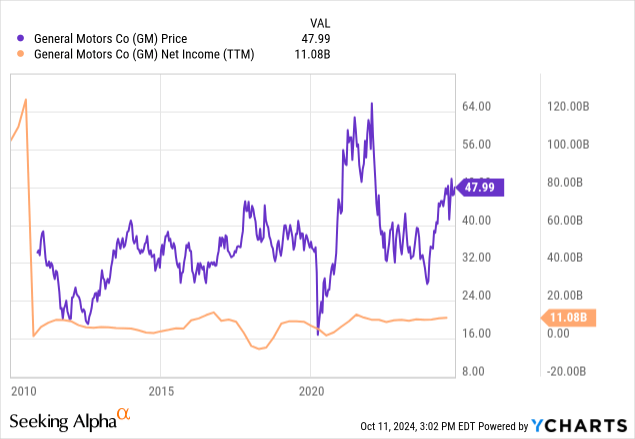

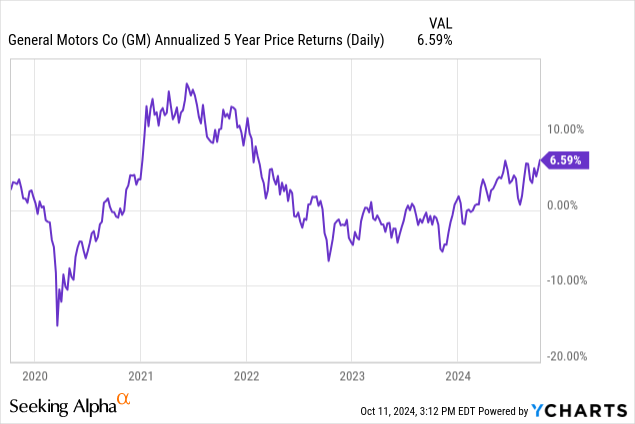

Wall Street and Seeking Alpha analysts are quite bullish on GM, as is Seeking Alpha’s Quant Analysis and for straightforward reasons: the stock is trading at a quite low forward P/E of below 5, with decent profitability and a strong balance sheet. Additionally, one Seeking Alpha analyst makes a reasonable case for owning the shares and deriving an attractive return from call option premiums and dividends even if the price of the stock doesn’t appreciably increase.

My concern with GM’s financial performance is the slower-than-anticipated consumer adoption of BEVs, combined with the rapid in battery technology. Solid-state batteries, with substantial advantages over the current lithium-ion and lithium iron phosphate chemistries, are set to debut within a few years and may require substantial new investment.

Barra has wisely talked less about the “zero-zero-zero” commitment and now points to GM’s internal combustion portfolio as a reliable source of profit until electrification trends are more established, from consumer and technological standpoints. Unlike some of its rivals, GM hasn’t pivoted strongly to gas-electric hybrids, mentioning only the addition of plug-in hybrid powertrains – with few specifics about when or how many.

Continued share buybacks and sustained dividend payments should keep GM share prices at least their current level. However, for those investors expecting a minimum 9% compound annual growth rate for their equity investments, it’s too soon to rely on GM. HOLD GM shares, pending significant improvement on the electrification front.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.