Summary:

- I believe GoDaddy is reasonably priced at 13x next year’s free cash flow, reflecting its stable business model.

- The heavy debt burden will weigh on GoDaddy’s ability to rapidly return capital to shareholders.

- I see potential for GoDaddy’s AI-powered tools to enhance long-term growth and profitability.

- Despite intense competition, GoDaddy’s strong brand and diverse offerings provide a solid foundation for future growth.

alexaldo/iStock via Getty Images

Investment Thesis

GoDaddy (NYSE:GDDY) is not a business that one would call a fast-growing business. And yet, it’s still delivering some topline growth. And while the investment thesis isn’t blemish-free, there’s still a lot to like about this stock, even now.

More specifically, the bear aspect is rather obvious, with more than 15% of its market cap being made up of net debt.

However, I make the case that this consideration, together with its slow growth prospects, is more than factored in by the fact that GoDaddy is priced at 13x next year’s free cash flows.

In sum, I remain bullish on GoDaddy, despite noting that it’s not the most enticing stock in the market, but it’s not a bad pick either.

Rapid Recap

Back in June, I said:

GoDaddy has a lot going for it. And yet, to say that this is a blemish-free investment would be to misconstrue reality. Ultimately, GoDaddy carries more than $3 billion of net debt, which hinders its ability to in the near-term significantly return capital to shareholders.

And yet, the business is undeniably reasonably priced.

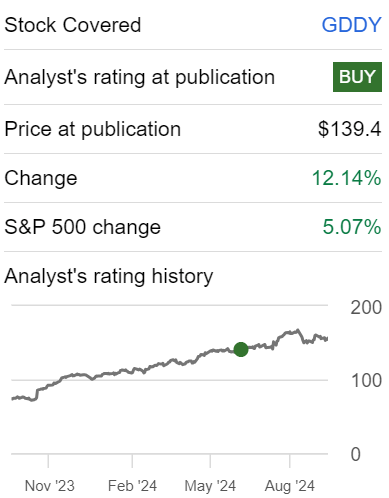

Author’s Work on GDDY

GDDY is a stock that has continued to perform strongly against the S&P 500 after my bullish recommendation, up 12% versus 5% for the index.

And as we go through this investment thesis, you’ll see that I’m still bullish.

GoDaddy’s Near-Term Prospects

GoDaddy is a provider of domain registration and website building to support small businesses and entrepreneurs.

GoDaddy provides tools and services that help small businesses establish an online presence. Its offerings span domains, hosting, and e-commerce solutions. GoDaddy’s value proposition lies in its ability to simplify complex technical processes, enabling entrepreneurs to launch and manage their digital presence without much technical knowledge.

In the near term, GoDaddy’s growth prospects are supported by its robust innovation strategy and strong momentum in key areas such as Applications and Commerce, which saw 24% growth in Q2. Its AI-powered tools, such as GoDaddy Airo, are driving new customer engagement. The focus on bundling, pricing, and optimizing user experience has bolstered customer retention and conversion rates, positioning GoDaddy for high-single-digit growth rates in the near term (this will be discussed more, soon).

However, GoDaddy also faces headwinds in an intensely competitive landscape. It operates in a sector with strong rivals like Shopify (SHOP), Wix (WIX), and Squarespace (SQSP), which offer similar services, often targeting the same small business customers.

This competition exerts pressure on pricing and the need to remain focused on delivering consistent improvements in the customer experience.

GoDaddy Is Still Delivering Some Growth Rates

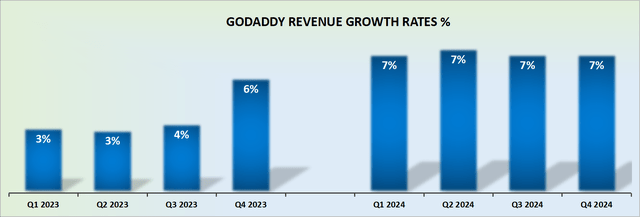

GDDY Revenue Growth Rates – Author’s Work

GoDaddy raised its full-year revenue outlook a hair. Consequently, this implies that this year, GoDaddy is expected to grow its revenue growth rates by 7% y/y in each one of its quarters.

This will be the first time in two years that investors could rely on GoDaddy to deliver high single-digit growth rates on a consistent basis.

And this takes us to my core argument. It doesn’t matter as much how high the overall growth rate ultimately reported is, as much as it matters what the expectations of the revenue growth rates are. How well can investors quantify its growth rates? Do investors buy into these growth rates?

And if they do, then, the multiple that investors are willing to pay up for a turnaround story can rapidly increase, beyond what at first looks like common sense.

GDDY Stock Valuation – 13x Forward Free Cash Flow

As an Inflection investor, you must have an understanding of a company’s balance sheet. This is a simple check that takes a few minutes. Literally, a few minutes, but saves a ton of capital in the long run. Don’t overcomplicate. Generally speaking, I like to back companies that have at least 10% of net cash.

And on this front, GoDaddy scores poorly, with about $3.4 billion of net debt. This means that not only is its balance sheet not in a net cash position, but in actuality, more than 15% of its market cap is made up of net debt! That’s heavy.

And this means that GoDaddy’s ability to return excess cash to shareholders is hampered in the near term. That’s the bad news.

And now, let’s discuss the bullish aspect. GoDaddy raised its free cash flow outlook for 2024 from $1.40 billion to at least $1.45 billion. Naturally, this means that there’s a high likelihood that when 2024 is done and dusted, the figure reported will be $1.5 billion of free cash flows.

Therefore, I believe it makes sense to grow out this free cash flow next year by around 10% relative to 2024. Why 10%? Because the business is most likely growing next year at approximately 5% on the top line, together with some further cost efficiencies, leading to improved operating leverage.

Therefore, I estimate that GoDaddy could see around $1.65 billion in free cash flow in 2025. This leaves this stock priced at 13x next year’s free cash flow.

A very reasonable entry point for new investors to the name.

The Bottom Line

Paying 13x next year’s free cash flow for GoDaddy is an attractive valuation given its stable topline growth and consistent ability to generate free cash flow.

However, the significant net debt load, which makes up more than 15% of its market cap, limits the company’s ability to return cash to shareholders in the near term.

While the valuation suggests strong potential for long-term gains, GoDaddy’s balance sheet will continue to restrict immediate capital returns.

In sum, GoDaddy is well-positioned to generate steady cash flow, but it needs to clear some financial hurdles before it can truly cash in on its clicks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.