Summary:

- GoDaddy’s transformation into an e-commerce enablement company has led to strong growth in sales and user revenue, with stock up 54%.

- Impressive growth seen in the Application & Commerce segment, driving strong sales and bookings growth, with a 15.3% y/y increase in Q2.

- Margin expansion outlook indicates near-term muted growth, with management expecting a slight contraction in NEBITDA margins for Q3.

AlexSecret/E+ via Getty Images

Investment Thesis

GoDaddy’s (NYSE:GDDY) transformation into a full-stack, one-stop-shop web development tool has seen the former domain registry & web hosting company see strong growth in all of its top-line metrics so far, turning around the company’s vision to a full-fledged e-commerce enablement company for the masses.

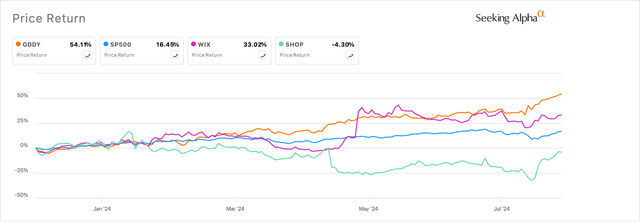

The company’s Q2 results, announced earlier this month, added another feather to its transformational hat, adding another quarter of strong growth in sales aided by higher revenue per GoDaddy user. The impressive performance has resulted in a powerful show of performance in the stock market, with the company’s stock up 54%.

Exhibit A: GoDaddy continues to outpace markets & peers in 2024. (Seeking Alpha)

While I have been bullish on this name, and was encouraged by the strong increase in revenue and ARPU, I would have held on to my bullish rating had the company been able to project a stronger outlook for its earnings this year.

With GoDaddy’s stock already up 54%, I believe the company’s growth prospects are now priced in for the year, unless management can upgrade their long-term guidance down the road.

For now, I have upgraded my price targets while downgrading GoDaddy to a Hold.

Impressive Growth Continues In The Commerce Enablement Business

In my previous coverage on GoDaddy, I explained how GoDaddy had been taking advantage of its strong install base acquired from its web hosting business and upselling its brand new suite of e-commerce applications, payment solutions, and web development solutions to create a powerful all-in-one web development platform for the user.

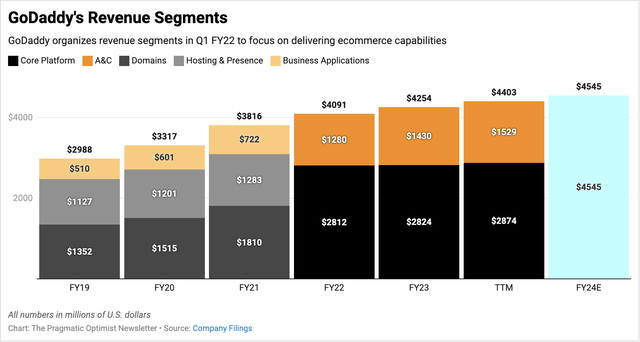

In addition, the company also opened up the general availability of its AI tool, Airo, earlier this year to all users, which was also adding some momentum to the strong growth seen in its operational metrics. For the sake of context, Airo helps users rapidly scale their presence online by assisting them in building websites, logos, and scaling social media operations in real-time. All these capabilities were reorganized under GoDaddy’s Applications & Commerce business segment in 2021, which demonstrated double-digit growth last year while GoDaddy’s Core Platform segment remained flat.

Exhibit B: GoDaddy’s Application & Commerce segment continues to pull the weight of growth for the company (Company reports)

The company’s recent Q2 results showed that users were continuing to spend incrementally on GoDaddy’s e-commerce applications and other solutions, with the Application & Commerce segment growing 15.3% y/y to $405.6 million, while its Core Platform business also saw single-digit growth, growing 3.2% to $718.9 million. The company’s total sales increased by 7.3% y/y to $1.12 billion, its strongest growth pace of sales in seven quarters.

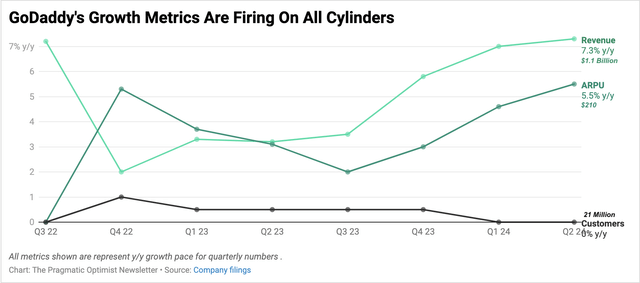

Exhibit C: GoDaddy’s revenue growth gets a boost by incrementally higher spending from users spending more on average. (Company filings)

At the same time, the company’s bookings, which are cash collected from customers for future services, increased by 11%, indicating expanded runways for revenue to continue growing down the road as demand for GoDaddy’s products remains elevated. Again, the Application & Commerce segment drove the bulk of the bookings volume, rising 24% y/y in Q2.

Management now expects 6.8% sales growth this year, as I noted in Exhibit B, up from the 6.5% growth they were initially expecting.

These results are very impressive for the decades-old Phoenix, AZ-based company that is continuing to reap the benefits of its big transformation.

Margin Expansion Outlook Indicates Near-Term Muted Growth

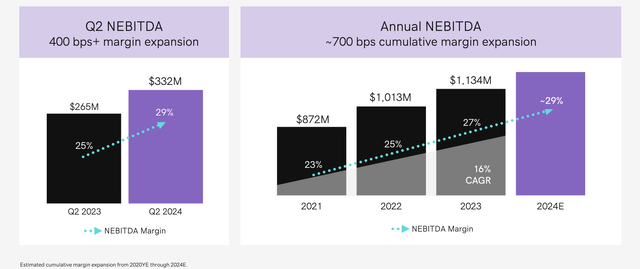

GoDaddy put up a strong show in their profitability department as well, which gets management closer to their FY24 expected adj. EBITDA margin targets of 29%.

In Q2, the company’s normalized EBITDA, or NEBITDA, grew 25.4% to $331.7 million, enabling management to deliver 430 bp of margin expansion to 29.5%. This was well above management’s own estimates for NEBITDA to be ~28% in Q2. On a GAAP basis, GoDaddy grew its operating income massively by ~52% to $214 million.

Exhibit D: GoDaddy’s Normalized EBITDA margin expansion over the quarters. (Q2 Earnings Presentation, GoDaddy)

Unfortunately, these impressive results were still not enough for the company to meet the lofty Q2 GAAP EPS expectations of $1.08 per share, as it reported Q2 GAAP EPS of $1.01 per share.

For the third quarter, the company expects to deliver NEBITDA margins of ~29%, indicating marginal deceleration on a sequential basis. With the overperformance in Q2 on NEBITDA, it appears management might have some room to raise their cost profile slightly in Q3 to ramp up marketing expenses. This sequential flatlining or contraction in margins would depress the valuation premium in the near term, which would encourage current investors to trim their allocations or new investors to initiate or raise their positions.

Valuations Point To Muted Upside In GoDaddy

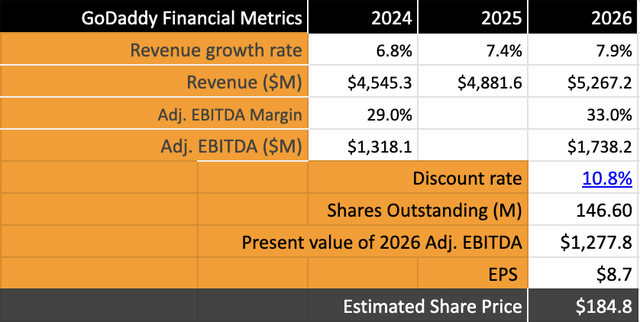

As I mentioned earlier, management expects FY24 revenues to grow 6.8% y/y. With the progress demonstrated in their A&C business as well as the return to growth in the company’s Core Platform business, I have raised my revenue growth rates through FY26 to be ~7.1% CGAR, up from the 6.7% CAGR I initially expected.

The increase in revenue would also raise the growth rates of its adj. EBITDA, now at 15.3%, up from the 14% CAGR I expected. This would have increased further had management raised the outlook of their adj. EBITDA along with their revenue growth rates. However, with the upgraded outlook missing in their EBITDA numbers, this will depress the valuation premium in the near term. My valuation model assumes a discount rate of 10.8%.

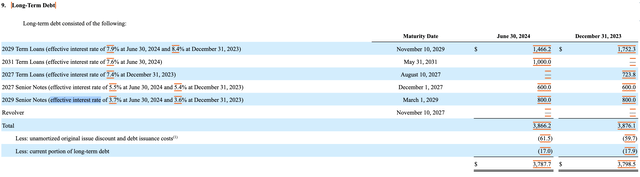

The 15.8% growth in adj. EBITDA would indicate the company warrants a forward premium of 28–29x forward earnings. However, the company holds ~$3.8 billion in long-term debt and $445 million in cash. Due to the strong growth in adjusted EBITDA, debt leverage ratios have dropped to 2.4x from 2.7x last year. Still, the net interest expenses of ~$169 million will weigh on the company’s valuation premium, which I estimate to be ~21x after factoring in their debt serviceability.

Exhibit E: GoDaddy’s long-term debt holdings (Quarterly filings, GoDaddy)

Therefore, assuming a forward PE of 21x, I believe the company can be valued at ~$184, up from the $162 I had valued it at in my last coverage. However, with just ~11% upside remaining, the majority of the gains for the year may have already been scored by its investors, and I expect a pullback in the stock soon.

GoDaddy’s valuation shows muted upside (Author)

Risks & Other Factors To Consider

My assumption for the near-term outlook depends on a stable economy that continues to spend, especially via digital platforms. This outlook would see GoDaddy’s customers continuing to spend on the platform’s tools to expand their suite of online e-commerce services. In addition, competition from peers such as Wix and Shopify can also impact GoDaddy’s growth, but for now, GoDaddy has been able to maneuver around its peers and deliver strong growth.

Additionally, my outlook is based on management’s tempered margin forecasts for Q3 coming in sequentially lower. Part of my reasoning here is also due to customer additions staying flat at 21 million, relatively unchanged this year. If the company is able to add more customers in Q3, it would indicate more scale in their revenue and margins since most new customers spend on GoDaddy’s A&C products. So far, their customer addition numbers are flat this year.

Takeaway

In the near term, I expect GoDaddy to take a break from its massive runup through the year after the company expects margins to slightly contract on a sequential basis. The tempered margin outlook indicates most of the gains for the year are mostly done unless the company is able to raise its guidance from current levels.

I expect a pullback in GoDaddy’s stock soon, which I view as healthy for the company’s stock given its 54% rise on the markets this year.

For now, I recommend staying on the sidelines, as I rate the company as a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GDDY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.