Summary:

- GoDaddy’s recent stock surge is driven by historical income growth and new AI tools, as it re-prices following chronic undervaluation from 2018 to 2023.

- The company’s strong fundamentals, including rising sales, income, and operating margins, justify its current valuation, though debt levels are a slight concern, attenuated by a lower rate outlook.

- Future growth depends on continued R&D and macroeconomic trends in e-commerce, with potential risks from a “website glut” and slowing retail sales.

- GoDaddy’s competitive position remains strong, but the stock’s upside is limited due to a high-growth outlook and potential excessive expectations from AI hype.

Martin Barraud/OJO Images via Getty Images

GoDaddy (NYSE:GDDY) has broken out into a high-momentum rally as investors have caught wind of its strong historical income growth and have renewed competitive hopes in the firm following its AI-generative tool development. The tool Airo allows customers to quickly generate domain names, logos, and websites. This is important because it gives GDDY positive exposure to the AI trade, or “AI bubble,” and highlights how the company wants to compete more directly for website building, hosting, and the online shopping platform space.

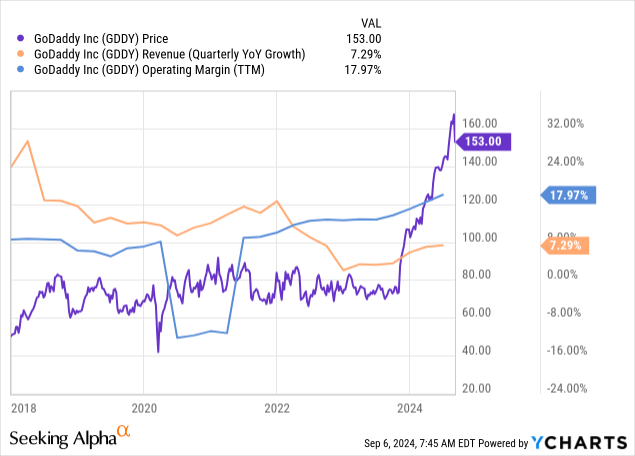

The stock has moved hyperbolically higher this year in response. Despite this, its sales growth is lower than during the “stagnant” years of 2018-2023, although its operating margins are rising. See below:

At first thought, I am cautious, and often bearish, on stocks with extreme rallies following the development of an “AI tool.” In my view, there have been many such companies over the past year, and not all will necessarily garner the long-term competitive advantage implied by their share-price growth. That may be the case for GoDaddy, as its competitors, like Squarespace (SQSP), have similar generative AI web development tools while Shopify (SHOP) is developing them.

That said, GoDaddy had strong growth across its segments over the past five years, which was not reflected in its stagnant stock. Looking at analyst commentary since 2018, significant bearish sentiment on GDDY revolved around its competitive risks. Although that risk remains relevant, the fact is that GoDaddy’s fundamentals were not under apparent competitive pressure from 2018-2023, with its cash flow, income, and sales all rising significantly. Thus, GDDY’s ongoing breakout may not depend on the “AI Bubble” (in my view) but a sharp price-discovery trade built on its historical fundamental growth.

If so, we must consider what GDDY might be worth, as its share price has moved so quickly that it may be far from its fair value. In my view, that depends less on its AI tools’ immediate impact but on its ability to continue R&D to maintain a competitive edge. We may also need to consider the broader macroeconomic trends facing e-commerce.

GoDaddy’s Fundamental Trend is Strong

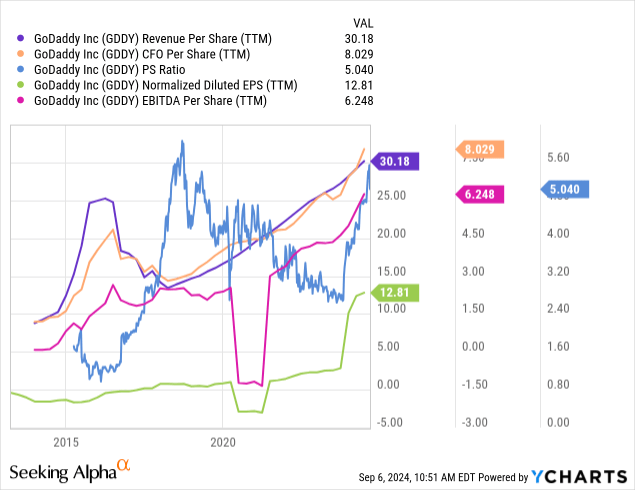

Although reasonable to question how fast GDDY has risen, I also question why it failed to rise for five years despite sustained fundamental growth. This is reflected in both its per-share sales and income. See below:

The company’s sales, income, cash flow, and EBITDA all rose considerably per share from 2018 to today. At the end of Q4 2023, it released a deferred tax asset, giving over a billion dollars in one-time income. Still, we’ve seen both a rise in sales and an improvement in profit margins. Today, its price-to-sales is back near its previous long-term high, though its operating margins are nearly twice as high as they were, mitigating some overvaluation risk.

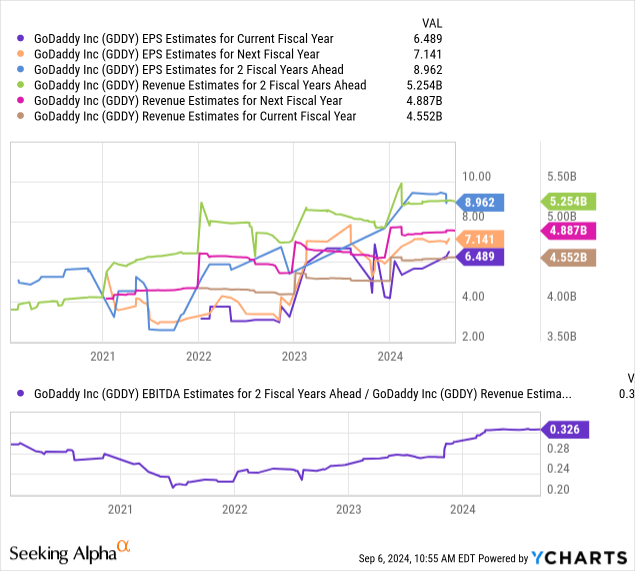

Over the past year, the company’s income and sales projections have continued to improve. Notably, previous estimates from 2022 have mainly proven accurate, giving some credence to the analyst consensus outlook. The company is expected to see a ~15% increase in sales over the next two fiscal years and a 38% EPS increase, mirrored by an improved EBITDA margin outlook two years ahead. See below:

These are all strong growth metrics, reasonably demonstrating GoDaddy’s past performance. Still, there is some volatility in these analyst estimates, likely because the competitive and economic factors impacting GoDaddy are complex.

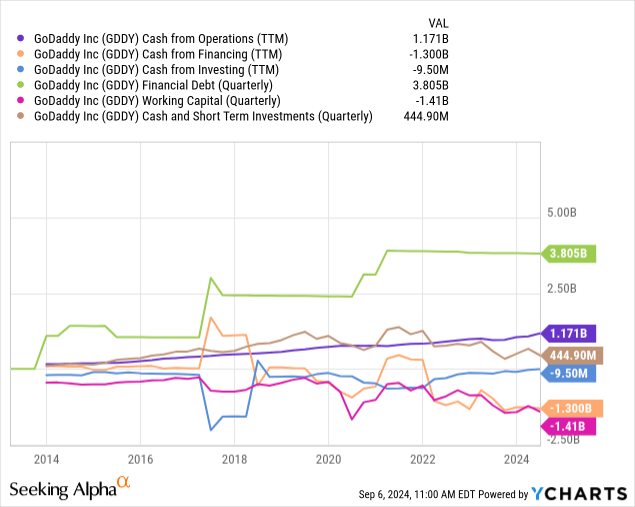

Looking forward, I expect slower sales growth from GoDaddy but, ideally, more organic growth with stable profit margins. Much of the 2018-2023 period saw GoDaddy pursue inorganic growth through acquisitions, many of which used debt, giving the company a reasonable debt burden of $3.8B. However, its operating cash flow rose consistently over this period. More recently, its cash from financing has turned far more negative as the company repurchases shares. That may slow now that its valuation is higher, but it indicates the firm may have some dividend potential, which has not been discussed.

Its cash from investing is now back toward zero as its acquisition splurge ends. That said, its cash and ST investment position is smaller than it was, while its working capital is quite negative at -$1.4B. See below:

Overall, the company’s cash flow and balance sheet indicate it is transitioning from inorganic growth to newfound maturity. I believe the company would be best off raising its dividend from its high cash flow while using some portion to continue R&D spending to maintain a competitive moat.

The company’s negative working capital stems from significant unearned revenue. Most of GoDaddy’s income comes from domain renewals, giving it recurring subscription revenue, usually accrued over the year. This business model is relatively stable within a given year, so I do not think its negative working capital is a concern, as there are no indications it should lose customers anytime soon.

Still, its debt burden is somewhat of a concern. Its debt-to-EBITDA is around 4.2X TTM, while its Times Interest Earned is 4.5X. Those ratios are not concerningly high but are elevated compared to typical leverage for software-type companies. Since it does not have significantly securable assets, most of its debt is term loans with variable rates, effective rates in the upper 7% range today. However, given that the SOFR will likely decline over the next year, GoDaddy’s income may rise as interest on that debt decreases.

Reasonable Long-Term Competitive Outlook

The company’s immediate forward “P/E” is high at 23.6X. Analyst projections point to an $8.96 EPS by 2026, giving it a more reasonable long-term forward “P/E” of ~17X. The “consensus” of two analysts looks to a $16.3 EPS by 2029, giving it an even longer-term forward “P/E” of around 9.25X. Those projections reflect a 67% sales growth outlook over the next six years, indicating a continued rise in its sales and profit margins.

Although these are high-growth targets, they are on pace with the company’s trend in recent years. That said, GoDaddy has managed decent EPS and sales growth through acquisitions. Although those purchases have been generally accretive, they’ve left GoDaddy with enough debt that it can likely only continue to grow by reinvesting cash flow. Indeed, its CFO is strong enough that it is a reasonable assumption, depending on our outlook for market conditions.

If these projections pan out, I believe GDDY is fairly valued today. Despite its meteoric rise this year, I think it is predominantly a price-discovery trade based on its previously rising fundamentals. That said, I do not believe it is likely that GDDY will outperform these growth projections. We’d need to see increasing estimates for the stock to continue to rise, which, I think, is unlikely as its current growth expectations are reasonably high.

Although its generative AI platform is notable, I see that as a development that will help GoDaddy maintain its competitive moat. However, its competitors should be following in similar footsteps. Market share estimates for GoDaddy vary widely and seem to depend significantly on calculation methods; however, the company is generally seen as having the largest share, with Amazon’s (AMZN) AWS and Google Cloud (GOOGL) being in the top three.

Those two are undoubtedly large contenders but cater more to enterprises, while GoDaddy focuses on small businesses. It may have an advantage with AI in that market over its smaller competitors like BlueHost, Siteground, and others. Being much more significant than most of its peers, GoDaddy has a definite advantage in its ability to use R&D and strategic acquisitions to give its customers a broader set of options, allowing it to charge more. Although the soon-to-be private Squarespace and, to a lesser extent, Shopify and Wix (WIX) have similar economic scale advantages, it seems GoDaddy remains the go-to option in the niche.

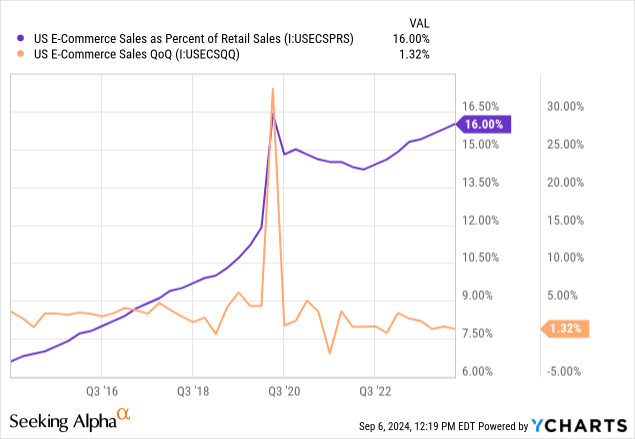

As long as its management remains focused, I do not see significant competitive risk from GoDaddy. To me, its performance over the past five years shows that neither the large players like Amazon or Google nor the fast-growing alternatives like Shopify will hamper its position. Still, I think there is some risk that the immense growth of e-commerce will slow. Much of its historical growth and outlook depends on the assumption that there will be much greater e-commerce activity in the future. Although e-commerce continues to expand its retail sales position, its overall growth rate has slowed slightly. See below:

E-commerce sales rose only 1.3% last quarter, about twice as high as inflation over the same period. This market is expanding and has maintained its gains following the end of COVID lockdowns. Some data points to a 47% increase in the number of US e-commerce websites between 2022 and 2023, with similarly high growth over the years prior.

Although these statistics may be hard to calculate, depending on how an “e-commerce” site is determined, I believe it’s likely that e-commerce sales are not rising as fast as the number of e-commerce websites. In other words, there may be a potential glut as more people look to start e-commerce website businesses, but total economic demand for retail sales is not rising as fast. Keep in mind that total US retail sales, adjusted for inflation, have declined since 2021.

If there is a “website glut” as some data indicates, that would likely harm Shopify more than GoDaddy because GoDaddy caters to a wider market. Still, online stores are a key market segment for the company, and its AI platform primarily caters to small e-commerce businesses. To that end, I think GoDaddy’s rosy growth outlook may be too focused on the high historical growth of e-commerce during the pandemic, with that trend unlikely to remain so strong in the long run simply due to stagnant retail sales. The company’s CEO recently indicated that bookings are slowing, potentially indicating the slight business e-commerce tailwind may be reaching its peak.

The Bottom Line

Overall, I believe GDDY is fairly valued today but is at some risk of decline due to excessive sentiment surrounding AI and potentially unrealistic expectations regarding the long-term growth of e-commerce website demand. Certainly, its historical growth levels are great and support widespread assumptions of continued growth that justify its current valuation. Further, AI and the general trend of higher e-commerce sales may support its development. Still, I believe few analysts and investors are accounting for the possibility that web hosting demand is rising too quickly compared to e-commerce sales, possibly meaning some GoDaddy customers are not running profitable businesses and may shut down websites, particularly if the economy slows.

There is insufficient data on the e-commerce and web hosting markets to give a clear secular trend for the industry. Thus, my “website glut” view is mainly speculative, so I would not bet against GDDY or have an outright bearish opinion. Given its track record, I think its current price is reasonable, while its price in recent years seemed unreasonably low. Still, I see little upside in the stock today, with some risk associated with the retail e-commerce macroeconomic trend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.