Summary:

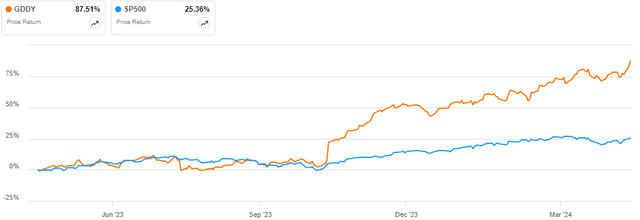

- GDDY stock has outperformed the S&P 500 by 62.51% in the past year and is currently on a strong bullish trajectory.

- The company’s market leadership and brand recognition, along with its diverse product offerings and global footprint, serve as growth catalysts.

- GoDaddy’s financial resilience is evident in its consistent revenue growth, increasing profit margins, and strong balance sheet, making it an attractive investment option.

Fasai Budkaew/iStock via Getty Images

Investment Thesis

GoDaddy Inc. (NYSE:GDDY) stock has gained about 87.51% over the last year, outperforming the S&P 500 by a margin of about 62.51%.

Looking at this stock from a technical point of view, it is currently in a strong bullish trajectory which, I believe, will be sustained in the long run given the company’s market leadership and brand recognition which, I believe, is a major growth catalyst. Further, the company has resilient financials that translate to good financial health, which is a recipe for bullish market sentiments. From a valuation point of view, GDDY is undervalued and as a result, I recommend this promising stock to potential investors at a discount.

Company Overview

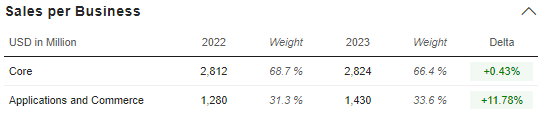

This company provides a wide range of internet services, and it is primarily known globally for its domain registrar and web hosting. Its operations involve designing and developing cloud-based products. It operates through two major segments, whose details can be found here. Below is the revenue contribution for each business segment for the 2022 and 2023 FYs.

MarketScrener

GDDY has a vast global footprint with customers in more than 125 countries, and more than 40% of its customers come from outside the US.

From this company profile, one attribute about this company is very evident and that is diversity, both in offering and geographically. In my view, this diversity is critical for the company’s growth because of several reasons. For example, it can help in risk mitigation. This is possible in that in case one product or market faces a downturn, GDDY can rely on the other booming products or markets, and by so doing the company’s vulnerability to economic fluctuations and competitive pressure is reduced. The second example of how this diversity can bring about growth is market penetration. Through its regional diversity, GDDY can penetrate various markets around the globe. Since each region has its unique tastes and preferences, the company’s ability to tailor their services to meet local demand can help them attract and retain a broader customer base. A good example of a product that GoDaddy has tailored to meet local demand is the Local Pickup Plus. The service allows businesses to provide pickup locations across the country or other countries, catering for the convenience of local customers.

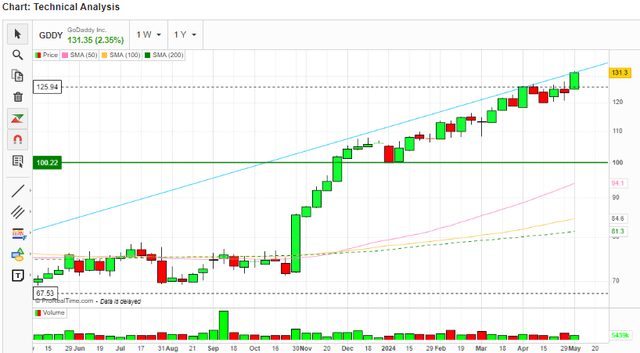

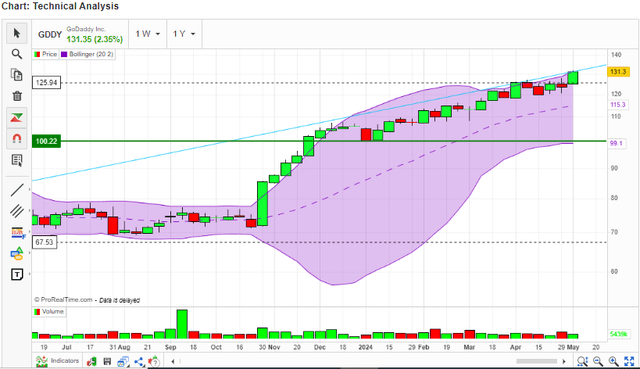

Price Chart

From a technical perspective, GoDaddy stock is on a solid upward trajectory. Let’s look at different technical indicators to get a clear picture of this trend. To begin with, the price is above the 50-day, 100-day, and 200-day moving averages, an indication that the stock is bullish on the short, medium, and long-term horizon. Most interestingly, the three MAs exhibited a bullish crossover in November 2023 exhibiting that the bullish trend is very strong.

Further, the stock is trading around the upper Bollinger band an indication that the upward momentum is strong, further, the lower and the upper bands appear to be diverging currently an indication that the trend is getting stronger and that a trend reversal is unlikely.

In summary, based on these technical indicators, this stock is on a solid upward trajectory with no signs of a trend reversal. Owing to this bullish outlook, I think a buy decision is justified.

GoDaddy Market Leadership And Brand Recognition

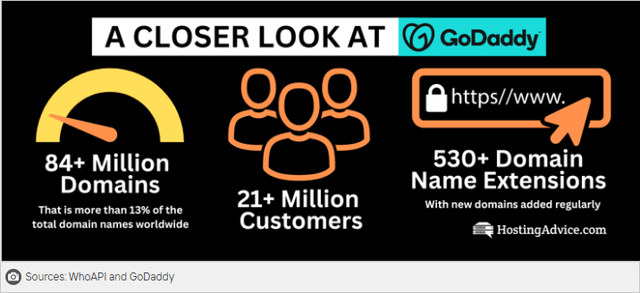

Among GoDaddy’s growth levers is its market leadership, which I believe serves as a competitive advantage. The company is the world’s largest domain registrar, boasting more than 21 million customers, and 84 million registered domains.

Its brand is identified with domain services, which have translated to a loyal customer base, as shown by the over 21 million customers. With the company’s comprehensive set of services tailored to micro and small businesses, this company has secured a competitive advantage that is hard for other entrants to emulate.

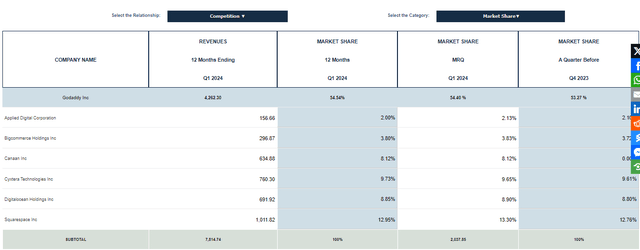

To make this even more interesting, let us compare the company’s market share with its close competitors as of Q1 2024. Based on revenue, GDDY has a market share of more than 54%, which makes it a dominant figure in the industry compared to its peers. It should be noted that this is an improvement from a market share of about 53% in the previous quarter, something which speaks volumes about the company’s growing market dominance.

Further, the company’s acquisition of Poynt has diversified its product range, enabling it to leverage the omni-commerce space which is projected to grow by a CAGR of 13.6% between 2022 and 2030. In my view, this is a demonstration of the company’s forward-thinking, which is essential for its sustainable growth.

Given this background, I see this company’s market leadership as a competitive advantage and hence a growth catalyst for several reasons. For instance, its solid brand recognition and customer loyalty demonstrated by the above numbers, in my view, makes it easier for this company to retain existing customers and attract new ones. This can be demonstrated by its increasing market share based on revenue, as shown above. Another example is its ability to innovate and adapt. Owing to its position as a market leader, GDDY has the resources to invest in innovation and adapt to changes faster. This ability is essential in a fast-paced tech industry where staying ahead of the curve can impact growth tremendously.

A notable example of an innovation that has helped this company stay ahead of the competition is its Commerce Bulk product feature. The innovation allows small businesses to upload numerous products across their online and in-person catalog at once using a premade CSV template. It helps streamline catalog management, saving time and effort. This reflects the company’s commitment to providing time-saving solutions to cater to evolving needs of time-saving by business, therefore remaining competitive in the digital marketplace.

Above all, the company’s product offering tailored for micro and small businesses makes its model very unique and hard to replicate by other entrants, making it a major competitive advantage. In summary, GDDY’s market dominance serves as a major competitive edge, which makes it a major growth catalyst in the long run.

Financial Resilience

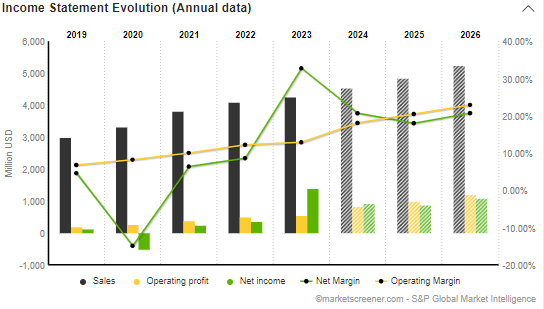

The company’s financial health is robust, as demonstrated by its growing revenues and profit margins. The company’s revenue streams are diversified geographically as well as segmenting the business, something which mitigates market risk as discussed earlier. This diversity has helped ensure the company’s financial resilience despite several challenges, including the inflationary economy. To demonstrate this, the company’s revenue has been increasing consistently over the last couple of years, growing from $3.32 billion in 2020 to $4.25 billion in 2023. Similarly, its operating income and net margins have increased consistently from $272 million and negative 14.93 respectively in 2020 to $537 million and positive 32.74% in 2023.

Market Screener

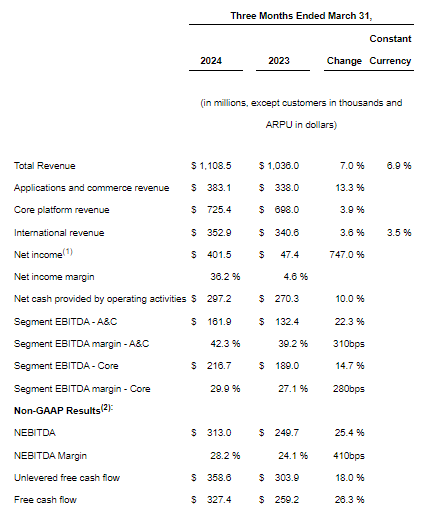

Interestingly, in Q1 2024, the company appears to have maintained its resilience having reported revenue of $1.1 billion marking a growth of 7% YoY and beating estimates by $11.72 million. Net income of $401.5 million inclusive of non-routine items marked a growth of 747% YoY and normalized EBITDA of $313 million marked a growth of 25% YoY. Its free cash flow came in at $327.4% a 26% YoY growth.

10-Q Form

The company’s ability to manage costs was also evident, with the company reducing its total costs and operating expenses from $965.2 million to $932.6 million YoY. Further, the company’s balance sheet is stable with a total debt of $3.94 billion which is covered more than 2x by its total assets of $7.98 billion. Further, with total interest expenses of $174.4 million, its coverage is very healthy at 5.1x given an EBITDA of $895.4 million. Above all, the company has a very healthy cash flow generation as demonstrated by its trailing operating cash flow of about $1.07 billion (covers total debt by 27.16%) which speaks volumes about the company’s ability to generate enough cash flow to meet its obligations. Given the company’s market leadership and diversity, I am confident that this company will sustain its strong financial performance in the long run due to its competitive position in the market.

In my view, these resilient financials position this company in an ideal position to invest in growth opportunities as well as weather economic adversities. Further, its strong financial health translates to solid fundamentals which inspire confidence in investors and thus bullish sentiments which may culminate in higher valuation.

Valuation

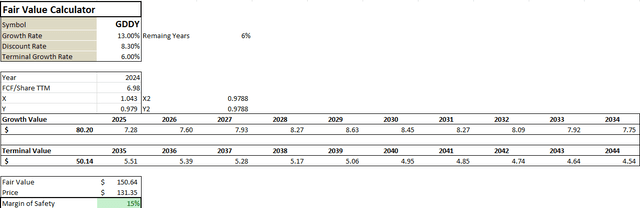

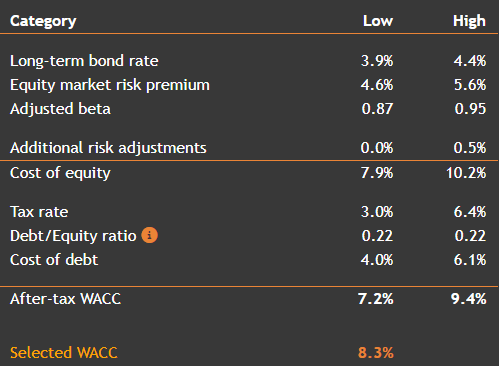

Based on relative valuation metrics, GDDY appears to be trading at a significant discount. The stock has a trailing GAAP PE of 11.03 which is 62.26% lower than the sector median PE of 29.22. This shows that this stock is undervalued, and therefore it offers a decent entry point for potential investors. To support this undervaluation observation, I ran a DCF model based on several assumptions. First off, I used a growth rate of 13% which is conservative considering the company’s 5-year FCF CAGR of 15.95%. I used a conservative rate to manage the major drawback of a DCF model, which is overreliance on assumptions. Secondly, I assumed a discount rate of 8.3% which is the company WACC as shown below.

Value Investing

Using these assumptions and taking the trailing FCF/ share of $6.98 as a base case, I arrived at a fair value of $150.64 translating to an upside potential of about 15%. This shows that this stock is undervalued and offers a good entry point for potential investors.

Risks

Investing in this stock has its share of risk, which investors should be wary of. One of the main risks of investing here is the dependence on the domain registration market. While the company is a leader in the domain of service, this strength poses a risk. A shift in the market dynamics or any advancements in the evolving IT sector that affect the domain of services could adversely impact this company’s operations and financial health. Although the company is diversifying in other segments such as omni-commerce, its success in the new venture is yet to come, and therefore investors should keep a close eye on the market dynamics to manage any potential risk arising from changes in the domain of service.

Conclusion

In conclusion, GDDY is currently in a bullish trajectory, backed by a competitive advantage arising from its market dominance. Its solid financial resilience buffers against adverse economic climate and offers it flexibility to invest in growth opportunities, which bodes well for its future growth. Given this background and considering it is undervalued, I rate this stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.