Summary:

- GoDaddy’s lack of competitive advantage in a fragmented market and high debt hold me back from investing in the business.

- The company has been increasing its operating margins by reducing its workforce and leveraging AI.

- Even with the decrease in valuation multiples, I don’t consider the company to be of sufficient quality to assume the risks.

svetikd

In my previous article, I covered VeriSign, Inc.’s (VRSN) unique business model as a registry for the most valuable top-level domains (TLDs). In this one, I will continue with the largest domain registrar and one of Verisign’s customers, GoDaddy Inc. (NYSE:GDDY).

Investment Thesis

GoDaddy has been able to grow in a highly competitive market through acquisitions and marketing spending, becoming the main registrar by the number of domains.

Even though there are some positive developments such as increasing operating margins, benefits from AI implementation, and higher revenue per user, there are significant aspects of the company that hold me back from investing in the business, even with the decrease in valuation multiples.

GoDaddy’s Overview

GoDaddy was founded in 1997 as Jomax Technologies and was the first company to launch a website-building software. After renaming to GoDaddy (because Big Daddy was already taken) and becoming an ICANN-accredited registrar, the company started its journey into becoming a one-stop shop to enable its customers to establish a digital identity and is currently the largest domain registrar with over 84MM domains (24% market share).

GoDaddy provides a wide range of services, including domain name registration and hosting, website creation tools, digital marketing services, online stores, payment systems, search optimization, and a domain name aftermarket platform.

The company is seeking to engage with its 21MM customers and increase retention by providing its services through the whole customer journey. Their business model is highly focused on cross-selling since costs associated with serving a client who purchases multiple products are not meaningfully higher than for a customer who only buys a domain.

I believe this has been a successful strategy to increase retention since GoDaddy enjoys an 85% retention rate, significantly higher when compared to Verisign’s retention rate (73.4% in 2Q 2023). Company’s CEO Aman Bhutani commented on this aspect on its latest earnings call:

If we have one product with a customer, they tend to retain sort of mid-80s. If we have two, it jumps. If we have three products with a customer, we pretty much have a customer for life.

Market and Competitors

When comparing the overall customer satisfaction with some of its competitors, GoDaddy is getting worse reviews (4 stars over 5), which is something that worries me. Other similar businesses such as Wix.com Ltd. (WIX) get 4.9, Hostinger 4.8, and Namecheap 4.6, which are significantly higher ratings.

GoDaddy reports two different market segments, its core platform, and applications and commerce.

Core Platform

The core platform segment represents 66.4% of total revenues (2Q 2023) and comprises domain registration and renewal, aftermarket domain sales, hosting, and security products.

As a registrar, GoDaddy is the market leader in a fragmented market and has been growing its market share from 20% market share in 2015 to the current 24% market share. The company also operates as a registry but has a small market share, since Verisign is the clear leader by owning the most used domains as .com and .net.

Even though it is remarkable that GoDaddy has been able to increase its market share over the years, it is a highly competitive market with over 2,400 ICANN-accredited registrars.

This segment is growing at a slower rate and has remained flat over the last twelve months (LTM). From 2020 until 2022 it has been growing at an average of 5.6% CAGR. Margins are also lower in this segment (27% EBITDA margins).

Studies available suggest that the global domain name registrar market is expected to grow at a 4.7% CAGR in the upcoming years and reach 557MM domain names by 2026. I believe these are realistic figures but could vary in the short term depending on the macroeconomic situation and the creation pace of new businesses.

Applications and Commerce

The application and commerce segment is what is driving GoDaddy’s growth in the most recent quarters, and over the last years, it went from representing 28% of revenues in 2020 to the current 33.6%.

This market segment has significantly higher growth rates (10% growth in annual recurring revenue YoY) and margins (41% EBITDA margins).

This is the market segment that differentiates GoDaddy from its competitors and adds value by providing an easy-to-use website and marketing tools that enable its customers without technical skills to successfully create an online identity, provide its services through the online store capabilities, and process payments.

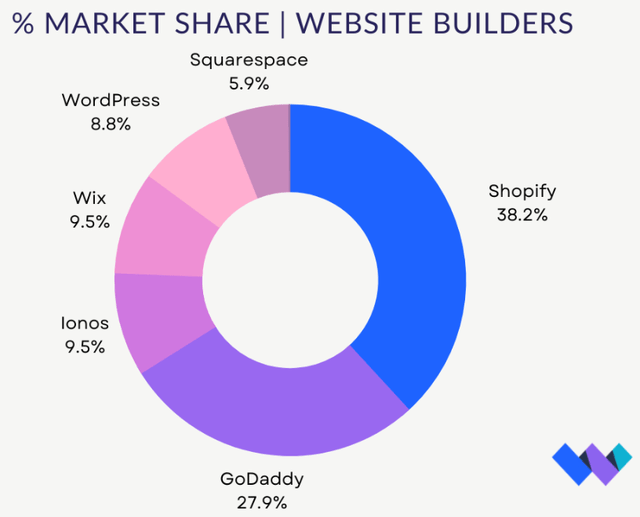

Even though there are other companies operating in this market segment, it is significantly more concentrated compared to the domain registration services, and GoDaddy holds a significant market share.

In this market segment, the strongest competitive advantages are accumulated technological development and company size, but all the companies operating need to continue investing in research and development to maintain their market share.

Leveraging AI

To benefit from the recent rise in artificial intelligence (AI) tools and provide a better service to its clients, GoDaddy has been implementing them in every possible stage of the website and online business creation process.

This year, the company has released its AI Prompt Library for Small Businesses to save time for entrepreneurs by designing optimized prompts in different categories such as content creation, SEO, customer support, and many others.

Since the second quarter, the company has also been offering a digital guide that will automatically build a free personalized basic website with every domain purchase.

From a marketing perspective, the digital guide also creates marketing messages and posts to social media to increase its customers’ traffic.

GoDaddy also incorporated its AI technology to make life easier by creating product descriptions from the picture that its customer has uploaded to the website and introducing Instant Video into its GoDaddy Studio to quickly create engaging videos for websites and social media.

For website creators, the company has integrated AI into its website builder and WordPress, which allows designers and developers to save time by proposing brand colors, creating the logo, and matching website colors automatically with the logo.

I believe GoDaddy can benefit from a revenue and margin perspective by leveraging AI and increasing loyalty and retention metrics, but also in cost reduction, where the company has been already implementing machine learning to make their marketing spending more efficient.

Financials

Apart from reviewing GoDaddy’s most recent developments, I would also like to provide a broad image of GoDaddy’s financial position and its evolution over the years.

Revenues

GoDaddy’s revenues are generated from three different groups.

The largest customer population is independent individuals and micro-businesses (fewer than five employees) with little technological skills.

Secondly, the company generates revenues through website designers and developers who build websites on behalf of businesses.

Finally, GoDaddy also generates revenue from other domain registrars and investors that use GoDaddy’s registration and domain management platform.

The company is operating in 54 global markets and 47% are located outside the U.S., mainly in the U.K., Canada, Germany, India, and Australia.

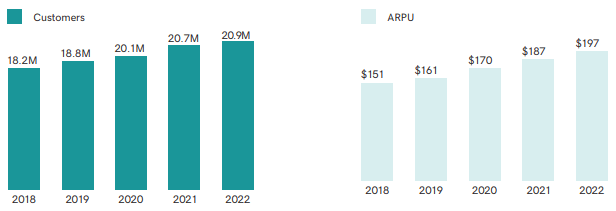

Revenues have been growing at an average CAGR of 15.3% since 2013, which has been mainly driven by increasing average revenue per user (ARPU) but also an increase in the number of users (6.4% CAGR).

GoDaddy Inc., 2022 Annual Report

During the most recent quarter (2Q 2023), total revenues have increased 3% YoY. This slowdown in growth rates has been caused by currency headwinds and flat revenues in the core segment that represents most of GoDaddy’s revenues. Aftermarket domain revenues have decreased by 5%.

On the other hand, the strongest segment has been applications and commerce, thanks to an increase in payment volume. The company expects this momentum to continue in the upcoming quarters and is launching GoDaddy payments in Canada during 3Q 2023.

Costs

The main costs for GoDaddy are related to domain registration fees paid to the registry that holds the agreement with ICANN, in the .com and .net cases, fees paid to Verisign.

The cost of revenue has been growing at similar rates when compared to revenues and I don’t expect the company to increase its gross margins since it is operating in a competitive industry and doesn’t have pricing power.

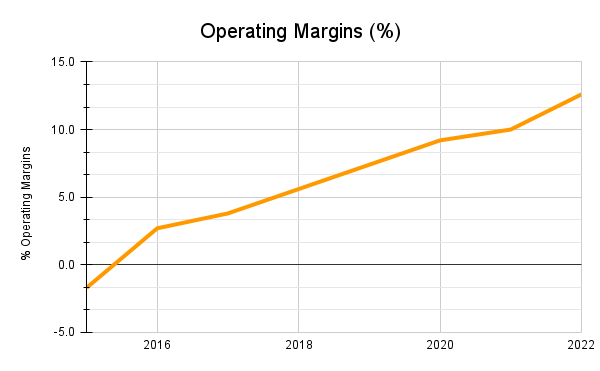

Where I expect the company could improve its margins is in the operating income, as it becomes bigger and benefits from higher ARPU.

Upselling doesn’t require a marginal increase in costs that equals the increase in revenue, and spending in marketing should go down as a percentage of revenue. The company has already reduced its marketing and advertising spending to 10% of revenue from 12.5% in 2015.

The bigger size has already shown an increase in operating margins since the company went public, and I expect this trend to continue since the company recently announced a restructuring plan to reduce approximately 8% of total employees.

Author (Data from GoDaddy’s Annual Reports)

Debt

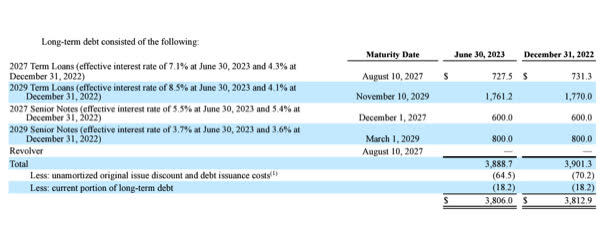

Debt levels are one of the aspects that worry me much in GoDaddy’s case since I believe the amount of debt is too high (4.22x Net Debt/EBITDA) given the cyclicity of the business.

Even though domain and website creation segments are not one of the most cyclical industries in the economy since the cost is relatively low for the business and it is a crucial tool for any business nowadays, the company is focused on micro-businesses that could be especially harmed in an economic slowdown.

The company doesn’t have a strong moat, and a big part of its debt has variable interest rates, which I believe is an important risk.

GoDaddy 2Q 2023

During 2019 and 2020, interest expenses were at $92.1MM and $91.3MM respectively, while during the first six months of 2023, interest expenses were already $91.4MM.

Free Cash Flow

The company is focused on delivering a 20% free cash flow (FCF) per share growth over the years, but up until now, the FCF per share has been growing at a 9% CAGR for the last decade.

Even though FCF has grown from $101.2MM in 2013 to the current $888MM for the LTM, the company has been significantly increasing outstanding shares and growing through acquisitions.

Capital allocation

During the last four years, the company has been allocating an average of 82% of its operating income into share repurchases ($3.4B) and has reduced the diluted outstanding shares by 15.2%.

Even though I prefer share buybacks over dividends, I believe this is not an optimal capital allocation for a company with high debt, since a 3.4% share reduction per year does not compensate for the risk and the increasing interest payments.

Expected Growth

For the next quarters, I consider management expectations to be realistic, with a 9 to 11% expected growth in the applications and commerce segment and flat in the core platform, delivering FCF of $1B for 2023.

During 2023, GoDaddy’s revenues should grow at 4% compared to the previous year, since the company is continuing to experience headwinds from the U.S. dollar appreciation.

Even though operating income margins are improving when adjusted for restructuring expenses ($69.8MM during 1H 2023), over the long term I believe interest expenses could harm net income margins and I don’t expect the company to achieve its goal of 20% FCF per share growth.

Given that GoDaddy’s revenue growth is reducing its pace when compared to previous years and I don’t see a competitive advantage, I expect growth rates on per per-share basis to be at high-single digits, with a 6% revenue growth, in line with expected growth in its markets, plus a 3% yearly reduction in shares outstanding.

Valuation

Even though GoDaddy’s valuation could look attractive when compared with its historical average, I still consider the stock to be overvalued, taking into account the high amount of debt, the lack of competitive advantage, and the increasing interest expenses.

The fact that the company has reduced its EV/EBIT multiple from over 75x to the current 27.4x, is not a reason to consider buying GoDaddy, and I believe there are better companies at lower valuation multiples.

Risks

Even though I see GoDaddy’s strategy has been working to improve engagement in a highly competitive market, I believe there are significant risks to take into account.

Macroeconomic environment

One of the main risks the company is facing is a recessionary environment, with fewer new business creations and closings. Since GoDaddy’s main customers are small businesses and individuals, it could be significantly affected by economic turmoil.

Low entry barriers

The company doesn’t have strong pricing power, and even though its retention rates are high, changing from one hosting provider to another is not complicated.

GoDaddy is operating in a highly fragmented market and it will have to continuously invest in R&D to maintain its customers, while at the same time offering a competitive price.

Debt

I believe low debt is a must when investing in a company.

High debt ratios are not a problem when the economy is strong and everything is doing well, and it can actually help boost earnings, but when the cycle changes, and sooner or later this happens, it can cause significant damage to the business.

In GoDaddy’s case, the current amount of debt, which is what partly allowed the company to increase its market share, I believe is too risky if the company is not able to increase its FCF over the next years.

If interest rates remain high for a long period, this will not only cause higher interest expenses in the next quarters, but they will also have to issue new debt at higher rates in the following years or stop share buybacks to repay debt, which will reduce FCF per share growth.

Conclusions

Even though I believe there are some positive aspects in GoDaddy’s business, such as the increasing operating margins due to its increasing scale and the implementation of AI to provide a better service, it doesn’t meet my demanding checklist to consider investing in the business.

I don’t see much competitive advantage and the company is operating in a highly fragmented business, which is something that I don’t expect to change in the near future.

When compared to its peers, the company doesn’t seem to be providing a better service from a review point of view perspective.

Finally, the high amount of debt and the capital allocation conducted by the management, which I consider suboptimal, makes me remain neutral on the company and I rate it as a hold, despite the decrease in valuation multiples.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.