Summary:

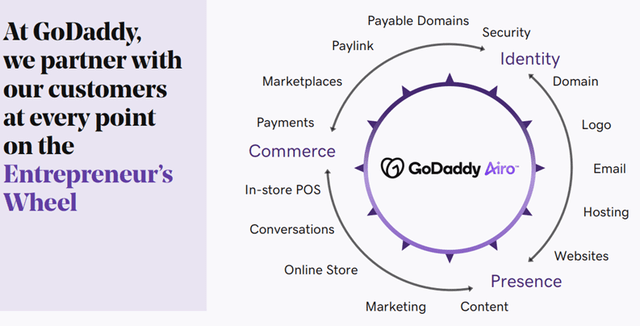

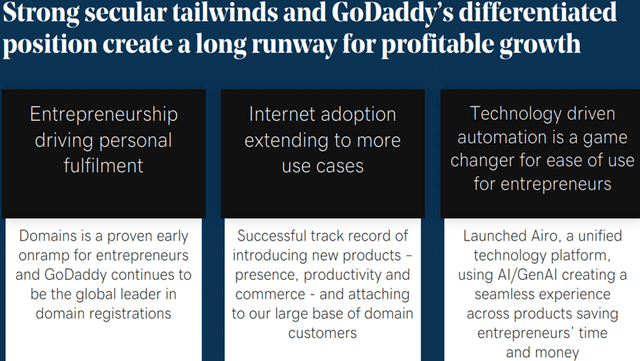

- GoDaddy is expanding its e-commerce and digitization platform with the help of AI, which is driving growth and increasing margins.

- Aero the AI tools rollout in the March Investor Day drove a valuation re-rating that needs to be followed with financial results.

- Market expects an uptick in growth with 20% free cash flow gains.

- I rate the stock a Hold, the market may require execution of higher growth to warrant further multiple expansion.

Traitov/iStock via Getty Images

Introduction

A few days ago I analyzed the Invesco S&P MidCap Momentum ETF (XMMO) and one of several of its holdings caught my attention given the higher EPS growth and a relatively low valuation (PEG). Thus, I decided to take a deeper look at GoDaddy (NYSE:GDDY) the website builder and domain company that is transforming into an e-commerce or digital platform boosted by AI.

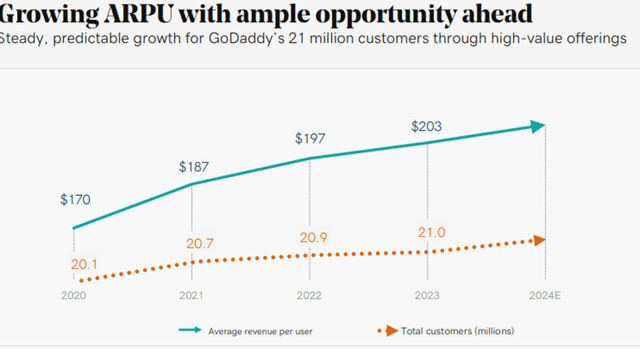

What is GoDaddy

Sure, it’s a funny name and the company roots are based on registering domains and hosting websites, then expanding into building websites, and now providing digital commerce services along the lines of Shopify (SHOP) but perhaps with a broader focus on professional services. At present, the company has 21m users that generate US$206 per year i.e. recurring revenue. Growth comes from adding more customers and increasing the services charged per website. The Core Platform revenue is more mature with under 5% growth, while added Applications & Commerce (A&C) is growing at 13% and accelerating with the rollout of its AI function called Aero. The AI function is reportedly adding value via far more rapid and automized web design and functionality that also costs GDDY less to support and helps increase margins on an already solid operating leverage. Below are a few slides from the recent Investor Day that explain the company’s mission and strategy and basic drivers.

Performance

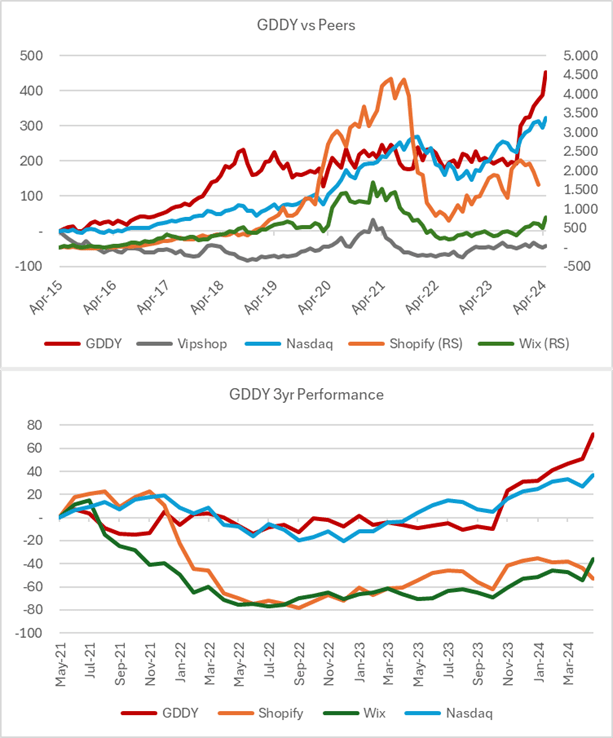

GDDY went public in 2Q 2015 and has gained over 400% with a long period of stagnation between 2018 and 1Q24 as seen in the first chart. Shopify and Wix.com (WIX) vastly outperformed to the point their price gains need to be on the right axes for comparison sake. In the last 3 years, GDDY has been a clear outperformer vs Shopify and Wix, and with recent gains post the March 2024 investor day where it provided the details on the Aero AI development.

Created by author with data from Capital IQ

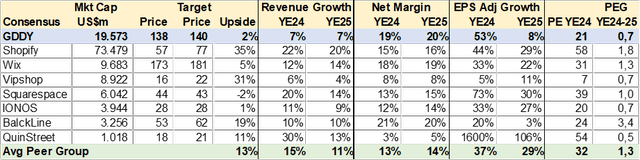

Peer Comps

I gathered consensus data to build a comparison table to gauge growth and valuation in this sector. The companies have similar services and compete with digital entrepreneurs of various sizes. GDDY has lower revenue growth estimates with better margins and a discounted valuation vs many peers. However, the consensus upside is only 2% to year-end 2024 and may require analyst upgrades.

Created by author with data from Capital IQ

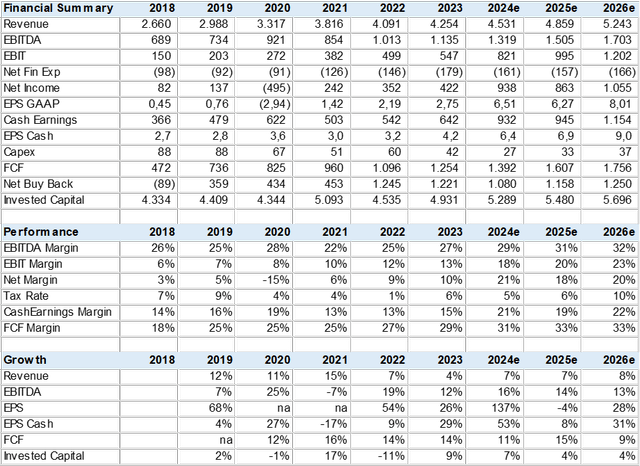

Consensus Estimates

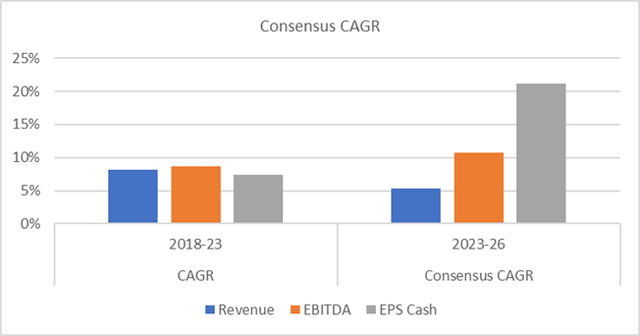

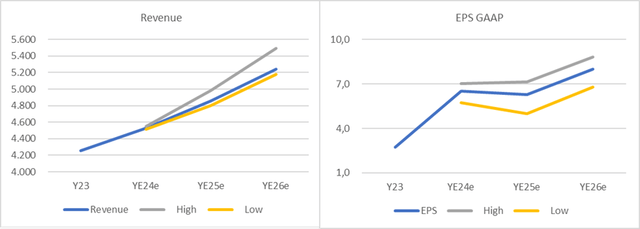

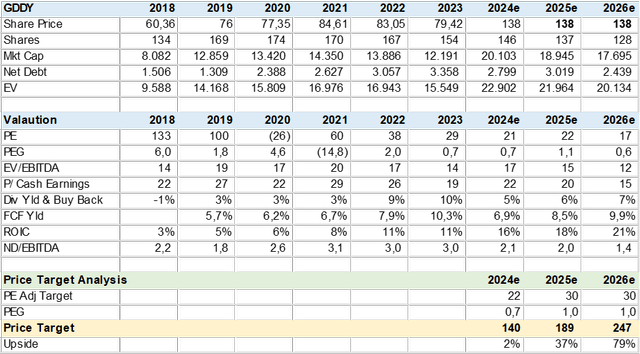

The following table is a financial summary of key metrics as well as consensus forecasts for GDDY. The market has turned increasingly more positive on growth, margins, and cash flow post Investor Day when it presented its AI tools that may accelerate user interaction and ARPU as well as the overall addressable market as a more full-service e-commerce or digital platform such as Shopify. Consensus EBITDA growth has taken a step-up to 10% while cash flow over 20% in the next three years with a dip in 2025. It’s probable that if GDDY´s AI tools are as successful as the initial reaction suggests, the market will need to upgrade growth and price targets.

GDDY Consensus (Created by author with data from Capital IQ) GDDY Consensus (Created by author with data from Capital IQ) GDDY Consensus (Created by author with data from Capital IQ)

Cashflow

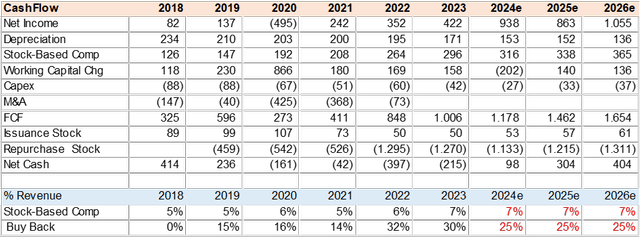

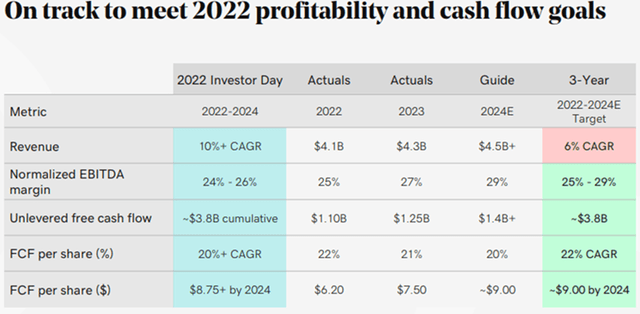

Management has delivered on this free cash flow target, with 20% growth as seen in the table provided on the recent investor day.

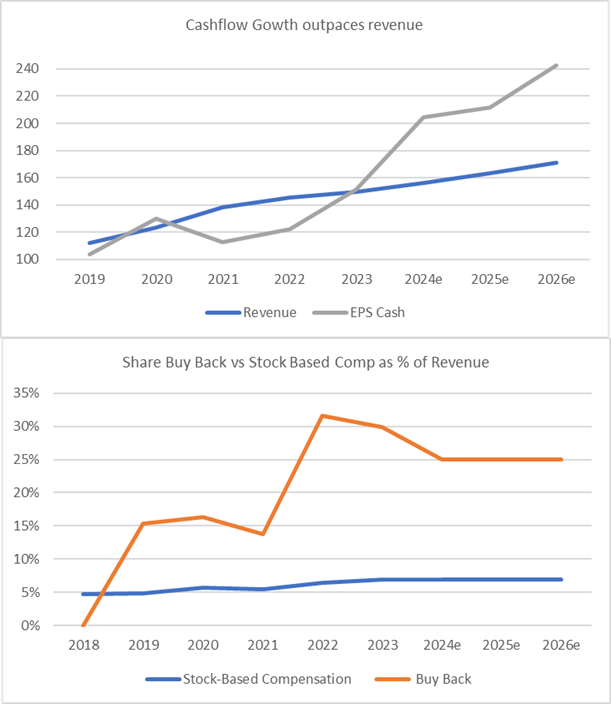

GDDY is not a high revenue growth company with a revenue CAGR of under 8% in the 2018-2023 period, instead, it has focused on free cash flow generation as seen in the FCF margin that grew to 29% in YE23 from 18% in YE18. This has allowed it to initiate and increase share buybacks reaching 30% of revenue in 2023, and I estimate GDDY can continue share buybacks at 25% of revenue or 5% of the current market cap.

The company, like many in the tech sector, uses stock-based compensation to reward and keep talent that passes through the income state and is largely a non-cash item that impacts EPS GAAP, thus a better gauge of growth and profitability is cash earnings. New shares issued as part of stock-based comp are significantly less than shares bought back.

GDDY Free Cash Flow Estimates (Created by author with data from Capital IQ) Guidance (GoDaddy) GDDY Estimates (Created by author with data from Capital IQ)

Valuation

The market has a US$140 price target for YE24, which does not leave much upside. However, this is due to a very recent share price run post-Investor Day in March 2024 which may have caught many analysts off guard. On consensus results, the current price target has an implied cash PE of 22x and 0.7x PEG (PE to EPS growth) which indicates a relatively inexpensive valuation in my view.

For the YE25 price target, I increased the PEG ratio to 1x on YE25-26 growth, this drives a fair PE to 30x and a price target of US$189. I believe there is room for GDDY to continue to re-rate given its accelerating growth and cash generation plus share buybacks.

The main risk to further re-rating is in the execution of the AL tools, which should have a noticeable impact on margins this year.

GDDY Valuation (Created by author with data from Capital IQ)

Conclusion

I rate GDDY a Hold. The stock has largely incorporated an increase in expected growth and cash flow driven by the recent rollout of its AI tools. While there is room for further multiple expansion, the company may need to first deliver on this growth before further valuation gains, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.