Summary:

- GoDaddy’s transition to focus on e-commerce capabilities with AI, from just selling domains and web hosting, has reinvigorated growth.

- Company is on track to achieve financial targets for revenue growth, margin expansion, and free cash flow.

- Valuations suggest strong upside potential for investors, despite competition and potential risks in the market.

Leontura

Investment Thesis

It has been just over two years now since GoDaddy (NYSE:GDDY) underwent a significant transformation to add more value to users and business establishments that are entirely focused on conducting their businesses online. GoDaddy was once synonymous with domain registration and web hosting capabilities. This became extremely crucial because, with almost 21 billion customers using at least one GoDaddy product, market penetration had reached a saturation point and deceleration was picking up pace.

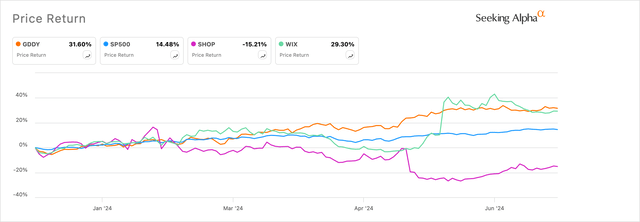

Exhibit A: GoDaddy outpaces markets in 2024. (SA)

Since the transition, their focus on packing e-commerce capabilities with AI as the backbone of their tech stack has reinvigorated a re-acceleration in growth in the company’s online business, all in a difficult two years when macro conditions were uncertain for smaller establishments and entrepreneurs.

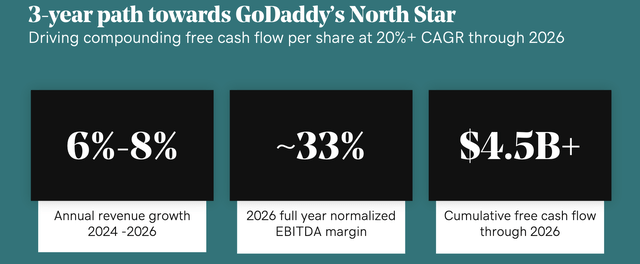

In my opinion, GoDaddy’s management is showing tremendous resolve in doubling down on their 3×3 Northstar targets—achieving 3 financial targets within the next 3 years, which I have expanded on below. I am encouraged by the transition story so far.

For now, I rate GoDaddy as a Buy.

Durable Revenue Growth Ramps

In an Investor Day presentation earlier this year, GoDaddy’s management laid out their vision for achieving three financial targets through 2026. The first target being discussed in this section revolves around building the ramp to benefit from durable revenue growth. Some of that revenue growth has already been demonstrated, as noted in Exhibit B below.

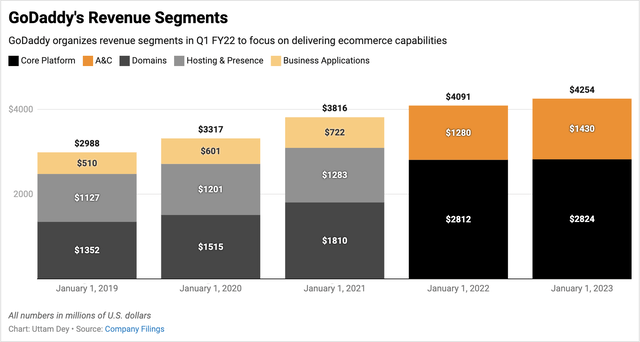

Exhibit B: GoDaddy’s Revenue Segments Are Reorganized in 2022 to focus on ecommerce applications (Company sources)

Heading into the 2022 transition year, GoDaddy was seeing its revenue grow at a ~13% CAGR rate between 2019 and 2021. Part of the tailwinds in those three years was also the surge in getting more businesses online as the world emerged through the pandemic. But growth immediately slowed, and management was faced with the reality of a rapidly maturing domain purchasing & web hosting market. At the same time, its Business Applications segment, as part of the pre-2022 business segment organizational structure, was growing at a sharp ~19% CAGR between 2019 and 2021. In the 2022 reorganization, the company doubled down on adding more capabilities to customers who had already used GoDaddy to purchase domains and host their websites.

As part of its growth, the company has expanded its e-commerce and AI capabilities to make it easier and more productive for entrepreneurs and businesses to manage operations online. GoDaddy launched Airo last year, which allows customers to build and customize marketing, logo creation, and website creation using AI. The company has been making Airo generally available to more customers across markets this year, in addition to a host of e-commerce capabilities as well.

As seen in Exhibit B above, post-reorganization, their Core Platform, which contains domains and hosting products, remained flat between 2022 and 2023. However, their Application & Commerce [A&C] revenue segment, which houses their AI and e-commerce solutions, grew 12% y/y during the same period. Management had revealed that they expect to see growth coming from AI initiatives such as Airo as well as Commerce applications supported by inventive pricing packages to tie customers down.

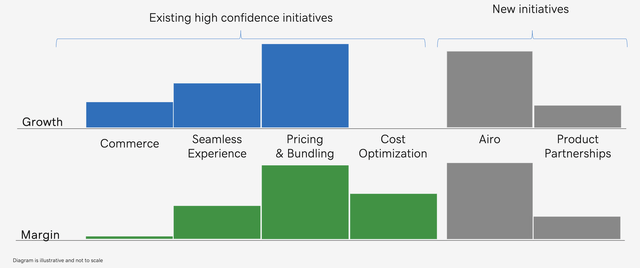

Exhibit C: GoDaddy’s expected growth and margin drivers (2024 Investor Day, GoDaddy)

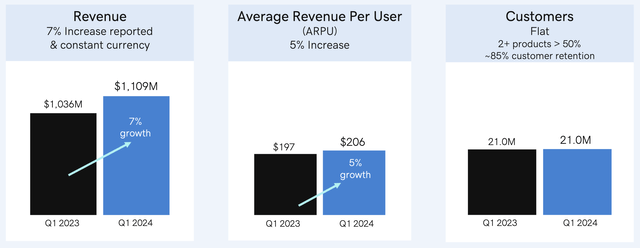

That strength continued in the first quarter results of FY24 this year, which can be seen in Exhibit D below, where revenue demonstrated a strong 7% growth, coupled with higher ARPU. While GoDaddy’s customer volume stayed flat at ~21 million, it’s clear to me that customers have been busy spending incrementally more on GoDaddy’s products. Bookings also increased by a massive 9% y/y in Q1 FY24, which is very impressive. More impressive was the fact that Applications and Commerce bookings surged 22% y/y in Q1, per management commentary.

Exhibit D: GoDaddy’s Revenue and Customer Spend Trends (Q1 FY24 Investor Presentation, GoDaddy)

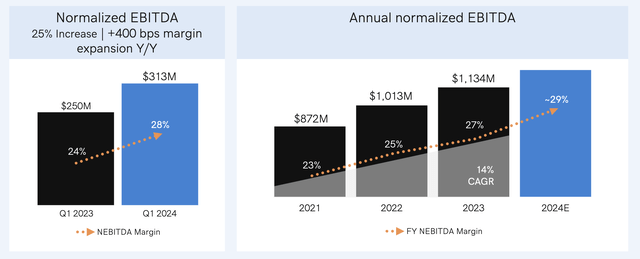

On Track to Deliver Strong Margin Expansion

The second target that the company has set its eyes on is expanding EBITDA margins. Part of its Investor Day narrative was also focused on detailing how beneficial the Application and Commerce segment was, not only to its top line but also in terms of margin expansion.

Exhibit E: GoDaddy’s adjusted EBITDA (Q1 FY24 Investor Presentation, GoDaddy)

While GoDaddy delivered a 4% boost in adjusted EBITDA margins, with adj. EBITDA growing 25% to $313 million, as seen in Exhibit E above, the silver lining lay in the main driver of their adjusted EBITDA margin expansion. On the call, management mentioned that:

Overall, if you look at Q1, we’ve always said accelerated A&C will be a tailwind to our ability to expand our margins over time. And with the pacing you saw in Q1, we saw some of the benefit of that.

For the year, we’re on track for the 31% to exit and we feel good about that and we’re on track for the 29% for the entire year. And obviously we’ve talked about our ability to expand that going out. And all those — all that framework remains in place and we continue to see the benefit of the A&C tailwind related to that.

This points to the top-line and bottom-line benefits that GoDaddy is experiencing from the mix-shift in Application and Commerce segments. The company also expects its EBITDA margins to benefit from commerce, inventive pricing packages and its AI applications as pointed out in Exhibit C earlier.

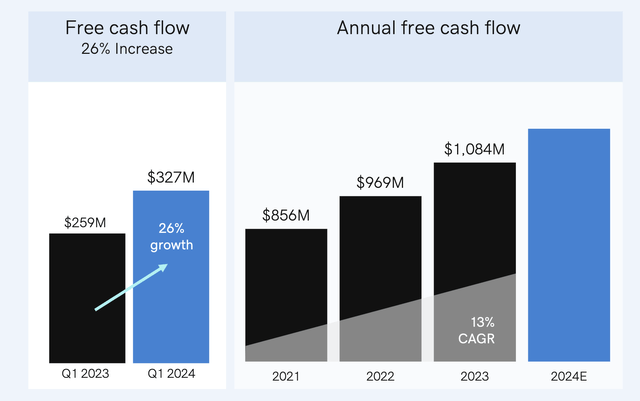

Additionally, I note that the company delivered robust growth in FCF margins as well as their third target. Unlevered free cash grew 26% y/y to $327 million in Q1 FY24. The company is targeting at least $1.4 billion in unlevered free cash by the end of the year, according to their investor day presentation, which translates to 12–13% y/y growth in FY24, per my calculations. That implies at least 1.5% of incremental FCF margins on an unlevered basis.

Exhibit F: GoDaddy’s Free Cash trends (Q1 FY24 Investor Presentation, GoDaddy)

Valuations point to Strong Upside

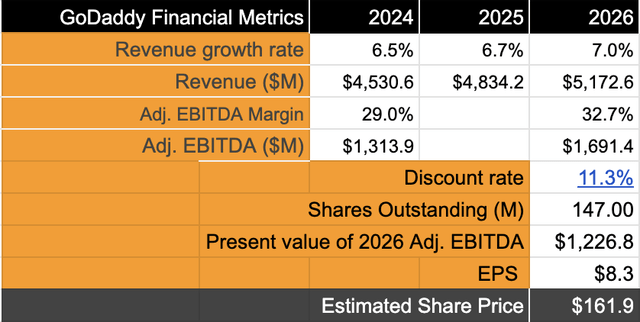

Here is a screenshot of what management is aiming for in their 3×3 targets – revenue, EBITDA and FCF by FY26:

Exhibit G: GoDaddy’s 3 year financial targets on 3 metrics (2024 Investor Day Presentation, GoDaddy)

Based on the sales & booking momentum the company has demonstrated in the last few quarters, GoDaddy should be able to easily achieve this target. In fact, I believe the company still has room to penetrate their own network of 21 million customers with their A&C products. This could easily scale the 7% CAGR mark, but, being conservative, I’ve estimated a CAGR of 6.7% through FY26.

Over the same investment horizon, its adj. EBITDA could double the pace of top-line growth with the large-scale efficiencies demonstrated by the company as well as the mix shift towards A&C products that should boost margins. Through FY26, earnings could clock ~14% CAGR.

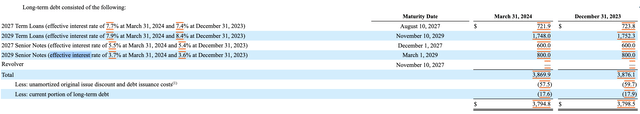

Currently, the company carries ~$3.8 billion in long-term debt split between term loans and senior notes, as illustrated in Exhibit H below. I estimate the company will be incurring ~$180 million in interest expense, which will dilute the net adjusted EBITDA investors get to value. So that will impact valuation multiples. I must point out that the company is still able to easily service its debt, given its strong EBITDA growth rates. While today, the company’s leverage ratios stand at a healthy ~3.4x, on an adjusted EBITDA basis, leverage could easily trend to a superior ratio under 1 at current EBITDA growth rates. This is also assuming the company does not take on more debt in the future.

Exhibit H: GoDaddy’s Long-term debt profile (Company filings)

Discount rates stay at 11.3%, while normal share dilution rates imply a future share outstanding volume of ~147 million shares.

Exhibit I: GoDaddy’s Valuation and price targets (Author)

My model assumes a ~19x forward valuation multiple given the ~14% CAGR growth I expect in its earnings, after accounting for all debt servicing as mentioned earlier. This implies a 15–16% upside from current levels.

Risks & Other factors to consider

As GoDaddy expands its capabilities, it will increasingly start encroaching on a multitude of players in the website building and e-commerce capabilities space. It faces direct competition from Wix (WIX) & Shopify (SHOP) in website creation and management solutions, as well as strong competition from legacy players such as Block’s Square (SQ), PayPal (PYPL), Stripe, etc. While current bookings and ARPU growth are not showing signs of slowing down yet, it is possible that GoDaddy’s direct and indirect peers may move to re-acquire customers or compete with GoDaddy, making the company’s task of reaching its 3×3 targets more difficult.

Takeaway

In my view, GoDaddy appears to have now passed its inflection point and is impressively tracking its path to the 3×3 targets that it has set out to achieve by 2026. All three targets—revenue, EBITDA, and free cash—have demonstrated encouraging growth trajectories so far, and I feel confident in management’s ability to drive the company towards its goals.

I recommend a Buy on GoDaddy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.