Summary:

- Initiating GoDaddy at a sell rating, and recommending investors take profits after a sharp YTD rally on this stock.

- GoDaddy’s growth rates are slowing to single digits, and its services are highly commoditized with intense competition from Wix, Squarespace, and WordPress.

- Activist investor Starboard Value has also trimmed its position in GoDaddy after pushing for changes late last year.

- The stock’s revenue multiple sits above most of its peers, and is overvalued for such minimal growth prospects.

metamorworks

With the stock market stretching continually toward new all-time highs, it has become more important than ever, in my view, to exercise careful stock-picking. In particular, we should take a close look at some of this year’s biggest tech winners and determine if there is really any fundamental driver for them to continue their win streaks.

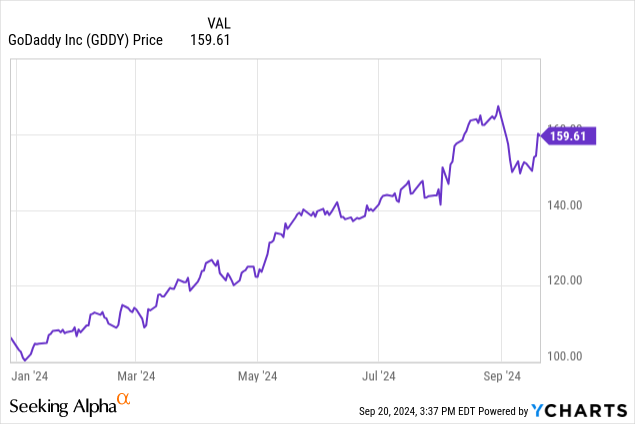

GoDaddy (NYSE:GDDY), the website hosting service, has reached the end of its rope. The company began its win streak late last year, after activist investor Starboard Value pushed for changes at the company, including a possible sale. Though no acquisition offer has been floated, GoDaddy has risen more than 50% year to date, and Starboard, apparently satisfied, has trimmed its position in the company in Q2. That, in my view, is a strong signal that investors should do the same.

I’m initiating GoDaddy with a sell rating and recommending investors lock in gains on this position and invest elsewhere. Buying medium-term (6 to 9 month duration) puts on this name may be another way to capitalize on potential downside.

My pessimism on GoDaddy is predicated on a number of factors:

- GoDaddy’s growth rates are slowing to the single digits, and its service is almost entirely commoditized. The company faces a number of competitors including Wix.com, Squarespace, WordPress, and a number of others. These offerings are highly commoditized and have almost no differentiation. In addition, with potential macro threats looming, many smaller businesses and SMBs may fail, leading to a risk of higher churn as well as slower new account additions.

- Steep valuation. GoDaddy trades at excessive multiples of both revenue and EBITDA, despite the fact that its growth rates have tapered off to the single digits. This is added on top of the fact that the company is shouldering a substantial debt load (most of which is fixed-rate, and thus the company won’t benefit substantially from recent interest rate cuts).

Steer clear here and sell this stock.

Unimpressive growth rates demonstrate a staid, commoditized industry

Among the software and technology industries, GoDaddy arguably has one of the easiest business models to understand. The company offers website-building and hosting software, perfect for smaller entrepreneurs who are looking to set up websites for the first time. The company’s services include:

- Buying and selling website domains, for a small $5/annual fee

- Website builder with drag-and-drop templates, starting at $10/month

- Website hosting, starting at $6/month

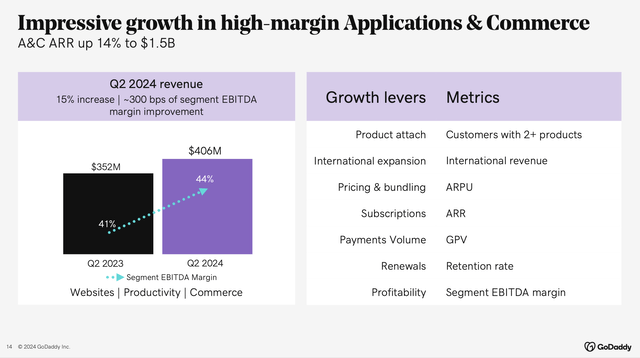

Recently, the company has been focusing on its “Applications and Commerce” segment which features more purpose-built, plug-and-play templates like online stores. Management views this faster-growing segment as an upsell play, as a GoDaddy storefront starts at $21/month.

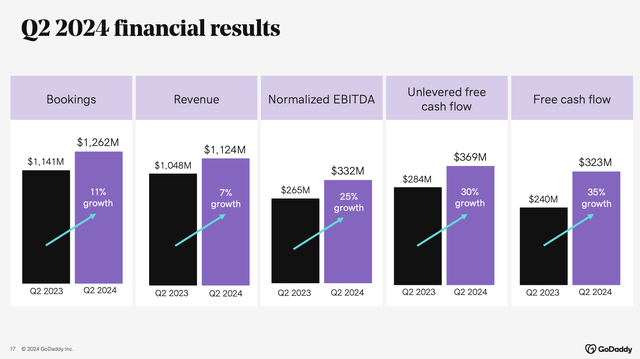

Despite the plethora of offerings, we can’t escape a number of cold facts. First, growth is entirely unimpressive. The chart below shows that GoDaddy’s revenue growth has slowed to just 7% y/y in its most recent quarter:

GoDaddy recent trends (GoDaddy Q2 investor presentation)

Slow growth is a symptom of the fact that website building and hosting is a decades-old market and has now been saturated by a number of highly competitive players. GoDaddy’s considerable list of competitors includes a number of equally recognizable brands, such as Squarespace, WordPress, Wix.com, and several others.

Squarespace, in particular, is a highly reviewed and formidable competitor. A recent Forbes review of competing options notes that while GoDaddy has a slight price advantage to Squarespace, the latter features easier and sleeker drag-and-drop interfaces that make it much easier for a first-time website builder to use.

The company is touting its Applications & Commerce segment as an important vehicle to future growth. A&C ARR grew 14% y/y to $1.5 billion in the most recent quarter, just over a third of the company’s $3.8 billion in annual recurring revenue.

GoDaddy A&C segment (GoDaddy Q2 investor presentation)

And yet we can’t ignore the fact that when it comes to building storefronts, GoDaddy faces more specialized competition as well. Shopify (SHOP) is perhaps the best known of the dedicated e-commerce website builders, with pricing starting at $30/month, but including very critical PoS (point of sale) capabilities to process sales.

Looking ahead to FY25, Wall Street analysts are expecting GoDaddy to continue plodding on at a 7% y/y growth pace. And given the number of competitors in the market offering these commoditized services, it’s unlikely that GoDaddy has any pricing power to grow revenue by lifting its rates.

Premium valuation for lackluster growth

At this juncture, we have to step back and ask ourselves: why exactly has this stock skyrocketed >50% year to date when it has delivered, at best, ho-hum boring performance?

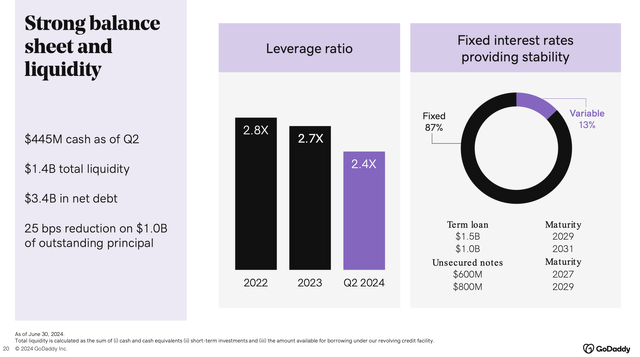

We should additionally note as well that unlike many tech peers, GoDaddy finds itself in quite a large net debt position, stacking up to $3.4 billion in net debt as of the most recent quarter. It’s worth noting too that 87% of this debt is at a fixed rate, so GoDaddy doesn’t stand to benefit much from recent rate cuts.

GoDaddy debt load (GoDaddy Q2 investor presentation)

Now let’s dig deeper on valuation. At current share prices near $160, GoDaddy is trading at a market cap of $22.5 billion. After adding in the $3.4 billion in net debt showcased above, the company’s resulting enterprise value is $25.9 billion.

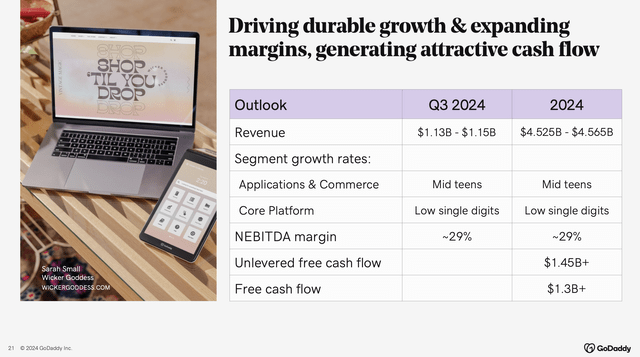

And as shown in the chart below, the company is guiding to $4.525-$4.565 billion in revenue this year (representing 7% y/y growth), and an adjusted EBITDA margin (unlike most of its peers, the company refers to this metric as “normalized EBITDA,” or NEBITDA) of 29%, or $1.32 billion, and a similar “$1.3+ billion” FCF multiple.

GoDaddy outlook (GoDaddy Q2 investor presentation)

This puts GoDaddy’s valuation multiples at:

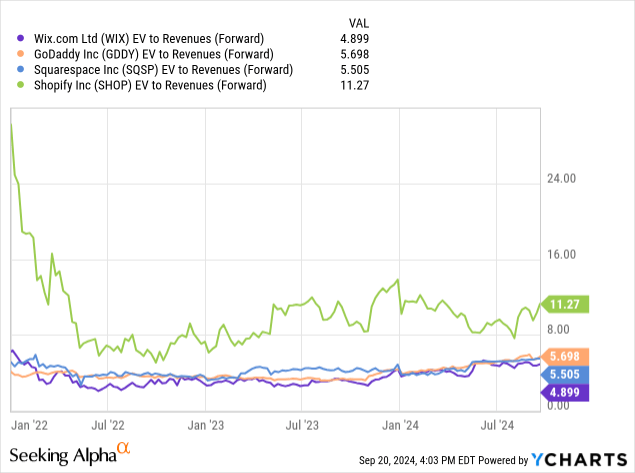

- 5.7x EV/FY24 revenue

- 20x EV/FY24 adjusted EBITDA

- 20x EV/FY24 FCF

We note that the company’s revenue multiple sits above all of its publicly traded peers, save for Shopify (SHOP) which deserves a premium for its much faster 20%+ revenue growth rates.

Key takeaways

With slow single-digit growth rates, a highly competitive industry that doesn’t give GoDaddy much room for greenfield expansion opportunities, and a rich valuation that sits above most of its peers, it’s a small wonder why Starboard chose to shrink its stake in GoDaddy this year after an impressive year-to-date run up. I’d suggest you do the same and trim this holding to invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.