Summary:

- GoDaddy’s stock experienced a significant rise due to the promise of AI-driven growth, particularly through the launch of Airo AI tool.

- Despite increased sales, high variable costs from reliance on third-party providers limit GoDaddy’s profitability.

- GoDaddy’s growth pales compared to competitors like Wix, Squarespace, and HubSpot, highlighting its challenges in maintaining a competitive edge in an increasingly crowded market.

- The company’s Q1 earnings are boosted by a one-time tax benefit. Adjusted PE ratio puts GoDaddy in the over-valued territory.

novia manda sari/iStock via Getty Images

Investment Thesis

GoDaddy’s (NYSE:GDDY) recent stock surge marks a significant departure from its flat performance over the past five years, capturing investor attention. This surge has been driven by a compelling narrative: the promise of AI unlocking new growth avenues for the company, which is the largest domain name registrar and web-building platform for small businesses. The 14% growth in productivity tools sales, coinciding with the launch of their Airo AI tool, further reinforces this narrative.

However, we believe this rally is likely short-lived. GoDaddy relies heavily on third-party service providers, often acting as a reseller, which leads to high variable costs. Any revenue increases are therefore offset by these costs, limiting profitability. Additionally, the stock is not cheap when adjusted for non-recurring items.

These factors underpin our Hold rating, suggesting that GoDaddy is unlikely to outperform its peers over the next twelve months. The primary risk of our thesis is management’s ongoing cost reduction plans, which have already boosted earnings in Q1. If margins expand enough to reach our valuation threshold of 13x – 16x PE ratio, we would consider an upgrade.

On the other hand, a downgrade would be considered if margins decline, particularly as VeriSign (VRSN) — GoDaddy’s primary supplier of .com and .net domains — prepares to increase prices in November 2024. In the medium run, we expect GoDaddy to exhaust its loss carryforward tax assets, introducing further tax costs and further narrowing margins. Finally, management’s cost reduction plan relies on reducing ad spend, an element that brought it to the forefront of the industry. With competition rising, we see it harder for GoDaddy to maintain its cost-reduction trajectory without sacrificing growth, constituting another potential catalyst for a downgrade.

Pros and Cons of GoDaddy’s Business Model

GoDaddy’s revenue model is predominantly subscription-based. The company sells domain names, website hosting, emails, web security, productivity apps, and marketing services, all on a subscription basis. In December 2020, it expanded into the payments processing market through the acquisition of Poynt, which makes the valuation process a bit more complicated but aligns well with its existing services, including e-commerce, which it offers through its partnership with Woo-Commerce. It is worth noting that Wix offers a payment solution powered by Stripe, while Block (SQ), a prominent payment processing provider, expanded in the web hosting and building space, mirroring a broader trend where traditional boundaries between sectors blur.

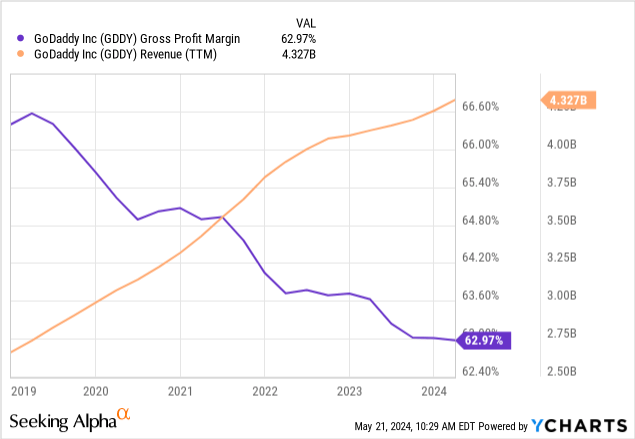

On the other hand, GoDaddy’s reliance on third-party providers, such as Amazon (AMZN)(AMZN:CA) AWS for hosting, VeriSign (VRSN) for domain registration, and Microsoft (MSFT)(MSFT:CA) for email/productivity tools, introduces significant variable costs that limit its ability to achieve economies of scale. Unlike software companies who own their infrastructure, GoDaddy’s costs rise with usage, hindering the cost efficiencies typically seen with scaling. Gross margins have been decreasing for the past 5 years despite sales increase, as shown in the chart below.

Customer count has been crawling up slowly, increasing by 5% since 2020 to reach 21 million customers commanding 84 million (85 million according to GoDaddy’s website) domains. The company prides itself on its customer service, and retention rates are adequate, standing at 85%. This figure increases to 92% for customers who have been on the GoDaddy platform for +3 years, according to management. Last year, the company announced headcount reductions, laying off 550 employees, 416 of which were customer care employees, according to the company’s latest 10-K SEC filings (p.26). This year, the company plans to reduce its employee count by a further 250, of which 180 were made redundant in Q1 2024, according to its most recent 10-Q filings (p.19). With productivity improvements from AI integration initiatives, the impact of this employee reduction could be positive on margins, but it is too early to know for certain. In 2023, cross-selling by GoDaddy’s customer care team, known as GoDaddy Guides, accounted for 9% of the company’s total booking. The good news (or bad depending on how you look at it) is that GoDaddy paid those employees made redundant severance packages of $35 million in 2023 and $11.1 million in Q1 2024, which were reported along with other restructuring charges on the income statement.

Testing the Service: Comparison to Wix

When testing GoDaddy’s platform, we were pleased with its intuitive flow, and freedom to customize our test website. We were first prompted to choose a domain, which, in our case was taken, so were presented with other domain alternatives, but also with an option to hire a GoDaddy broker for £97 who’d contact the current owner of the domain to negotiate a sale, of which we’d also pay an additional 20% commission of the negotiated price. We got a discount offer on the alternative options for the first year if we signed up for a 3-year contract. The value-added services such as email and web security were presented with clear explanations during the setup process. However, the costs of these optional services rapidly increased. Interestingly, this boarding process happened before signing up or committing to the service or building our site. In contrast, Wix (WIX) streamlines the onboarding process by collecting user information via a sign-up prompt, and website details upfront, only then introducing any potential purchases.

Both companies are gradually integrating AI into their web development tools, but the current offerings remain limited. Wix AI web developer, designed to build websites using user prompts, is slow and frequently fails to execute commands accurately. For example, during our testing, it was unable to position Customer Testimonials before the About Us section, as requested. Wix’s AI tool is also limited to changing the Layout, Theme, and Structure. GoDaddy’s opted to focus its AI implementation on content creation, rather than rushing to deploy an underdeveloped full-fledged AI web development solution like Wix.

Modest Revenue Growth

Sales increased by 7% in Q1 to $1.108 billion, up $72 million from the $1.036 billion it reported in Q1 2023. What excited the market is that two-thirds of the growth (~$45 million) came from outside the domain and hosting segment, particularly email, bringing AI enhancements to light. Last year, the company launched GoDaddy Airo, an AI assistant that helps in writing emails, marketing content, and images, so connecting the two created a compelling narrative that fueled GoDaddy share’s recent rally. During the Q1 2024 earnings call, management also mentioned pricing and bundling changes as a factor helping drive the Application and Productivity segment’s 13% growth.

The Domain and Hosting segment increased to $725 million up $27 million (3.9%) compared to the same period of last year. This growth was predominantly attributed to cost increases and sales of high-value domains in secondary markets, as noted by the management team during Q1 2024 earnings call:

Our growth was driven by strong demand for domains in the primary and secondary market, increased pricing in the primary market and a higher average transaction value in the secondary market – Mark McCaffrey, GDDY CEO, Q1 2024 Earnings Call.

GoDaddy’s Q1 2024 growth appears lackluster when compared to its smaller peers. Wix (WIX), reported a 12% growth. Squarespace (SQSP), another competitor in website building and hosting, significantly outperformed GoDaddy with a 19% growth. HubSpot (HUBS), a leading CRM platform with website-building capabilities, achieved a remarkable 23% growth in Q1 ’24. Tucows Inc (TCX), a domain registrar, Alkami (ALKT), a content deliver network and website hosting service provider, and Fastly (FSLY), an edge cloud platform, reported 9%, 8%, and 13% growth rates respectively, underscoring GoDaddy’s lagging position in terms of total sales growth (6.9% in Q1 2024)

Perhaps GoDaddy is a victim of the ‘Law of Large Numbers,’ given its size, making it harder to maintain growth rates as high as its smaller peers. On the other hand, one can argue that GoDaddy’s extensive resources and market presence should enable it to find new avenues for growth and compete more effectively in a fragmented market. After all, many small businesses – GoDaddy’s target market – still don’t have a website, representing a significant growth opportunity. With $664 million in its bank account, GoDaddy has the financial resources to continue executing its ad and market strategy.

Still, for investors looking for robust brand names in the Hosting and Domain market to invest in, Block (SQ) seems a good contender. Block, through its Weebly platform, directly competes with GoDaddy. Square’s payment solutions dwarf GoDaddy’s Point-of-Sale and Digital Payments segments. Finally, with a market cap more than twice that of GoDaddy, Block’s 19.3% sales growth in Q1 also highlights GoDaddy’s mediocre revenue growth.

Thus, it is safe to say that for growth-focused investors, companies like Block, Wix, Squarespace, and HubSpot present far more compelling investment opportunities than GoDaddy.

Non-recurring Items on GDDY’s Income Statement

GoDaddy’s earnings call highlighted significant increases in earnings, up 747% on a GAAP basis, but this figure is distorted by a one-time tax allowance benefit related to previous losses’ Deferred Tax Assets ‘DTA’ and Loss Carryforwards. The tax allowance added $258 million, more than doubling net income before tax, which stood at $143 million. On the other hand, the company incurred extraordinary expenses related to its restructuring, including recent layoffs, divestments, and early retirement of debt, which together added $24 million in expenses in Q1.

Adjusting GoDaddy’s bottom line for these non-recurring items, we arrive at a revenue run rate of $167 million or roughly $670 million annually.

The company recorded 141 million shares outstanding as of May 2024 and roughly 4 million shares as stock options, and restricted units for its management team, totaling 145 million common shares on a diluted basis.

Using our net income estimate and diluted shares, we arrive at an EPS of $4.6. With GoDaddy now trading at $138, the adjusted PE ratio stands at 30x, which isn’t particularly attractive.

Next year, Wall Street expects an EPS decline, factoring in the impact of this year’s Tax Allowance benefit. Using 2025 analyst’s consensus estimates, GoDaddy trades at a 2025 PE ratio of 22x, which again, isn’t a bargain.

Skeletons in the Closet

GoDaddy’s $258 million tax benefit in Q1 stirs up unpleasant memories for investors, as it relates to the company’s controversial dealings with its prior private equity owners, KKR and Silver Lake. It also relates to an ongoing class action lawsuit against GoDaddy.

Before GoDaddy went public, its private equity owners pressured the company into borrowing to pay them dividends. This increased GoDaddy’s debt and resulted in years of reported losses. They also stipulated that any future tax benefits from Tax Loss Carry Forwards would be directed back to them, not GoDaddy. In 2020, GoDaddy borrowed $850 million to buy back these deferred tax benefits (which amount to $1.4 billion), part of which was recorded in Q1.

While GoDaddy is now prioritizing profitability to cash it its Tax Benefits before they expire, some investors are still upset about what they see as unfavorable dealings between GoDaddy and its prior owners, and a lawsuit is now progressing in US courts related to the TRA agreement. Despite selling most of their holdings, KKR and Silver Lake still have influence over GoDaddy via two board seats.

Summary

GoDaddy’s current valuation, driven by the one-time tax benefit, seems inflated. Investors should exercise caution due to the company’s slowing growth and reliance on third-party providers, increasing variable costs, thus limiting economies of scale often seen in cloud-based businesses. While GoDaddy’s AI initiatives show promise, their long-term impact remains to be seen. A significant portion of the 7% YoY growth seen in Q1 relates to price increases and bundling changes rather than higher activity on the GoDaddy platform. With a high adjusted PE ratio and mature core business, GoDaddy appears to be an unattractive investment at its current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.