Summary:

- I’m bullish on GoDaddy because of its strong free cash flow generation, projected to reach $1.6 billion in 2025, making its 18x valuation enticing.

- I believe GoDaddy’s focus on pricing, bundling, and AI-driven innovations positions it for sustained revenue growth and profitability.

- I recognize that GoDaddy’s $3.1 billion net debt is a risk, but its operational efficiencies and consistent cash flow mitigate my concerns.

- I am closely monitoring GoDaddy’s ability to maintain 6-8% annual revenue growth, as this is critical to my investment thesis.

MTStock Studio/E+ via Getty Images

Investment Thesis

GoDaddy (NYSE:GDDY) has a lot going for it. It’s a business that investors haven’t been too bullish on; hence, the stock is still reasonably priced.

More specifically, I make the case that paying 18x next year’s free cash flow for GDDY makes sense.

That being said, I note that this investment thesis is not blemish-free as its balance sheet carries a fair amount of debt.

And yet, I believe that there’s a lot to be bullish about GDDY and that over the next several months investors will look back to $198 per share as a cheap price to be involved with this stock.

Rapid Recap

Back in October, prior to its earnings results, I said:

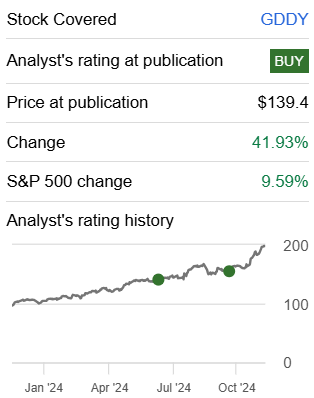

I remain bullish on GoDaddy, despite noting that it’s not the most enticing stock in the market, but it’s not a bad pick either.

Author’s work on GDDY

GDDY is a stock that I’ve been bullish on for a while. The thesis here is straightforward. This is a business that many investors have low expectations, even though it makes a lot of free cash flow.

GoDaddy’s Near-Term Prospects

GoDaddy empowers entrepreneurs by providing them with tools and services to establish and grow their online presence. They offer a range of products, including domain registration, website building, and hosting. They strive to allow small business to build their online presence.

GoDaddy is simple to use and bundles valuable services to maximize customer success.

Moving on, GoDaddy is experiencing solid near-term growth, particularly in its Applications & Commerce segment, where bookings have grown by 20% y/y. The company forecasts annual revenue growth of 6-8%, with expanding EBITDA margins expected to reach 33% by 2026.

Innovative initiatives such as pricing and bundling are driving free cash flow growth and increasing the adoption of new services like the GoDaddy Digital Marketing Suite and Airo.

Given this background, let’s now discuss its fundamentals.

The Main Question: What Does 2025 CAGR Look Like?

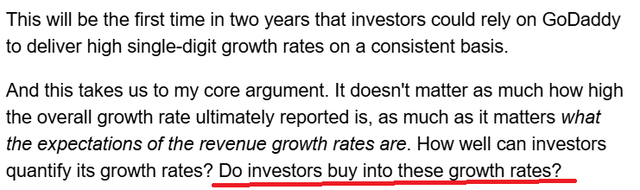

This is what I said in my previous analysis:

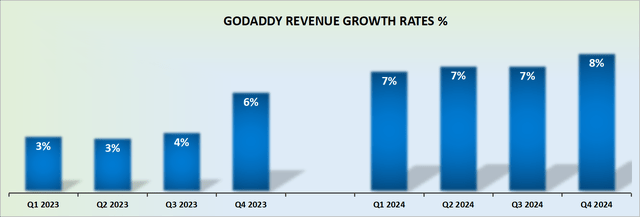

My questions from the previous analysis stand. Allow me to be blunt. Specifically, I have one question in my mind. What sort of growth rates can we expect from GoDaddy in 2025?

Needless to say, the comparables next year will be rather tough. Or better said, tougher than this year, at least! This will lead to a natural deceleration in its growth rates.

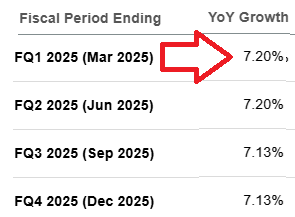

But at the same time, the pace of deceleration matters. For my part, I don’t believe we are going to see 7% y/y topline growth in 2025. But at the same time, consider what analysts following this stock are estimating.

SA Premium

For now, analysts are still expecting to see 7% topline growth in 2025. And, if indeed, the analysis is right, this would meaningfully strengthen the bull case for GDDY.

With that in mind, let’s now discuss its valuation.

GDDY Stock Valuation – 18x Forward Free Cash Flow

As an Inflection investor, I’m always thinking about the company’s financial footing. On this front, GDDY with a net debt position of $3.1 billion doesn’t fare too well. This means that about 11% of its market cap is made up of cash.

I’m happy to compromise in the right instance, but for me, this blemish keeps me away.

Beyond that, I like the fact that GoDaddy oozes free cash flow. For 2024, GoDaddy’s free cash flow points to close to $1.4 billion. Now, this is where things can get a bit tricky.

For now, I’ve assumed that since GoDaddy’s free cash flow is likely to end up 27% y/y relative to 2023, it’s difficult to assume this sort of improvement continue into 2025. After all, most of the efficiencies will have already been picked over in 2024.

That being said, for now, I am for the most part satisfied to assume that GoDaddy could raise its free cash flow line by 10% y/y. This means that GoDaddy could probably deliver around $1.6 billion of free cash flow in 2025.

In sum, investors today are paying around 18x forward free cash flow. A figure that is clearly enticing for a stably growing business.

Investment Risks

The main aspect that could significantly impair the bull case will be if, in 2025, GoDaddy’s revenue growth rates end up being too insignificant. Basically, anything less than 3% topline growth, and I would call it a day on my bull thesis.

Furthermore, keep in mind that GoDaddy operates in a highly competitive space, facing strong rivals like Wix (WIX) too. Recall, that Wix also offers hosting solutions.

Next, GoDaddy differentiates itself with a broader suite of bundled services, while Wix emphasizes design flexibility and ease of use. But also, there are many other peers in this space that are vying for market share. It’s a highly fragmented sector, and for the most part, they are forced to compete on pricing too, which would impact GoDaddy’s ability to deliver strong growth in 2025.

The Bottom Line

Paying 18x forward free cash flow for GoDaddy is a compelling investment because it offers a stable, cash-rich business with clear growth prospects.

With free cash flow expected to reach $1.6 billion in 2025 and EBITDA margins expanding towards 33%, GoDaddy demonstrates strong operational efficiency and profitability.

Despite its leveraged balance sheet, the company’s consistent revenue growth makes this valuation attractive for a business delivering durable cash flow generation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.