Summary:

- Goldman Sachs, one of the world’s largest institutions, just released its earnings.

- The company had a successful quarter with growth in investment banking, asset management, and operating efficiencies.

- Despite elevated rates and credit quality pressure, Goldman Sachs continues to take impressive steps for long-term growth.

naphtalina/E+ via Getty Images

Introduction

One of the reasons why I cover way more stocks than I have in my portfolio and on my watchlist is the fact that countless large corporations tell us so much about the industries they operate in and the economy as a whole.

The Goldman Sachs Group (NYSE:GS) is one of these companies. Not only is it a dividend growth stock owned by many of my readers, but it also is one of the world’s largest institutions, engaged in a wide variety of operations that go well beyond investment banking.

My most recent article on the stock was written on Jan. 16, when I went with the title “Breaking Down Goldman Sachs’ Q4 Triumph: What Investors Need To Know.”

The quote below is a part of the takeaway back then:

With all of this in mind, I like Goldman Sachs a lot. I continue to believe that management is taking the right steps to maintain elevated long-term growth and avoid some of the usual headwinds in “traditional” banking.

In this article, we get to discuss another blowout quarter, as Goldman just hit it out of the park. Despite elevated rates and pressure on credit quality, the company saw growth across the board, including investment banking, asset management, and a significant improvement in operating efficiencies.

Shares are up 3% after earnings while I’m writing this.

So, without further ado, let’s get right to it!

Here’s Why 1Q24 Was So Special

Allow me to start this part by throwing some numbers at you.

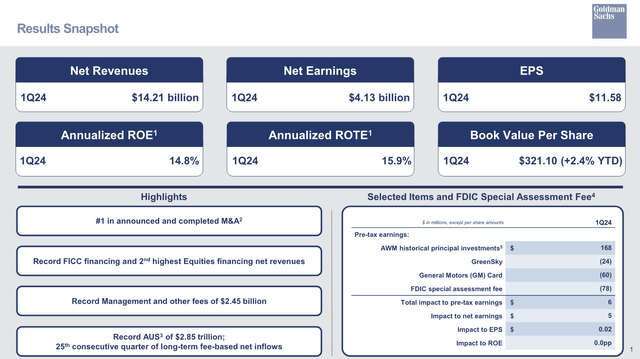

For starters, in 1Q24, the company reported net revenue of $14.2 billion and net earnings of $4.1 billion.

This translates to an earnings per share result of $11.58.

According to Seeking Alpha data, revenue came in $1.28 billion higher than expected. Earnings per share were $2.90 higher than expected.

Goldman Sachs

The company, which was the biggest player in the M&A space, saw strength across the board.

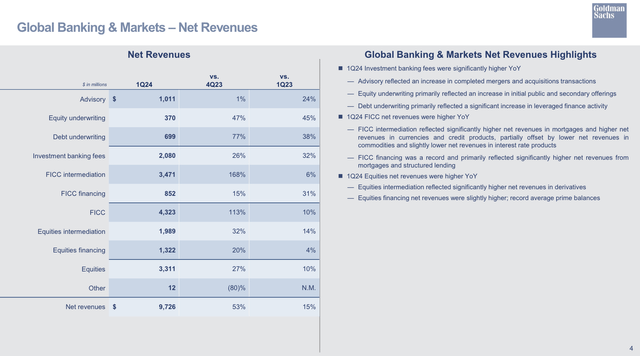

In the Global Banking & Markets segment, which accounted for 68% of total revenue in 1Q24, revenues reached $9.7 billion.

That’s 15% higher compared to the prior-year quarter and driven by a 24% increase in advisory revenue to $1.0 billion. This was driven by higher completed transactions, while equity and debt underwriting revenues also saw significant growth of 45% and 38%, respectively.

Goldman Sachs

Meanwhile, FICC net revenues stood at $4.3 billion, benefiting from strong performance across various market segments. Equities net revenues totaled $3.3 billion, with intermediation revenues rising 14% year-over-year. This indicates a strong performance in trading activities.

Bear in mind that FICC stands for fixed income, currency, and commodities.

FICC intermediation reflected significantly higher net revenues in mortgages and higher net revenues in currencies and credit products, partially offset by lower net revenues in commodities and slightly lower net revenues in interest rate products. – GS 1Q24 Earnings Presentation

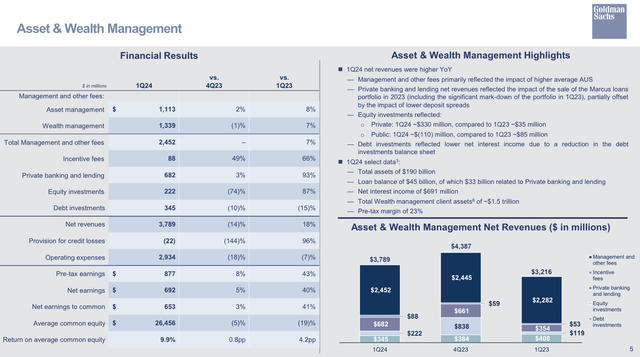

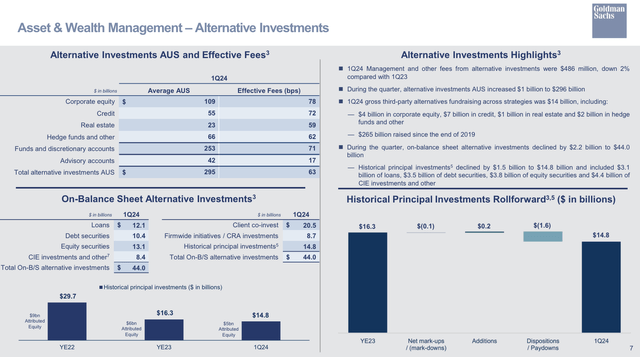

The good news continues in the Asset & Wealth Management segment, another focus of this financial giant.

As we can see below, this segment reported revenues of $3.8 billion, marking an 18% year-over-year increase.

Goldman Sachs

This growth was driven by record management and other fees, reflecting the company’s ability to attract and retain assets under management – especially in this challenging environment.

On a side note, this does not just impact “wealthy” clients but the market in general. BlackRock (BLK) also saw strong inflows, which I covered in this article.

Moreover, private banking revenues saw significant growth. As we can see in the overview above, revenue in this niche almost doubled, which was impacted by last year’s sale of the Marcus loan portfolio.

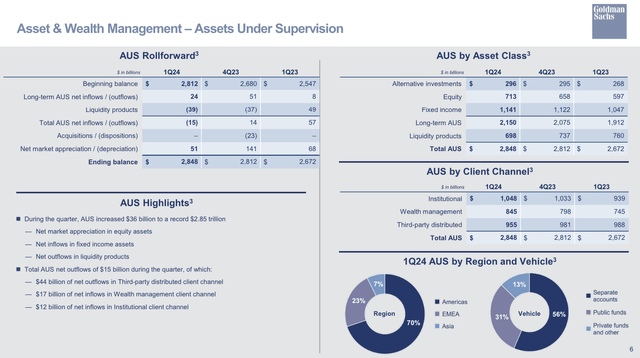

Meanwhile, total assets under supervision (“AUS”) reached a record $2.85 trillion.

Goldman Sachs

What’s interesting is that the company had 25 consecutive quarters of long-term fee-based inflows. In 1Q24, it saw $24 billion of long-term inflows, mainly consisting of fixed income. I’m not surprised by that given the attractiveness of locking in a high yield in this market.

Speaking of investments, in the alternative investment segment, AUS came in $4 billion shy of the $300 billion mark, with third-party fundraising of $14 billion.

Financial Times

Two weeks ago, the Financial Times reported a major deal for Goldman Sachs in this area:

Goldman Sachs’ asset management arm has bought a stake in private credit specialist Kennedy Lewis Investment Management, as it looks to expand its reach in a fast-growing corner of markets.

The bank’s Petershill Partners private equity unit on Tuesday agreed to buy more than 20 per cent of Kennedy Lewis, valuing the firm at more than $1bn, according to two people with knowledge of the matter.

Moreover, during its earnings call, the company showed a very eager plan to raise between $40 billion and $50 billion in alternatives across private equity and other strategies for the year.

Goldman Sachs

Additionally, Goldman Sachs aims to capitalize on the growing demand for private credit, with plans to increase its assets in this space from $130 billion to $300 billion over the next five years.

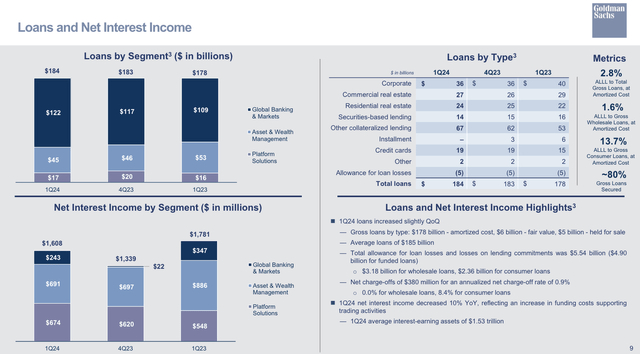

Furthermore, the New York-based firm reported a company-wide net interest income of $1.6 billion, with the loan portfolio remaining stable at $184 billion. It kept the allowance for loan and lease losses below 3%.

Goldman Sachs

Another thing that stood out to me is that total operating expenses came in at $8.7 billion, which resulted in an efficiency ratio of 60.9%. This indicates effective cost management as the efficiency ratio was close to 70% in the prior-year quarter.

Needless to say, this is a truly impressive development.

This is what Chairman and CEO David Solomon said regarding these efficiency gains during the Q&A session of the earnings call (emphasis added):

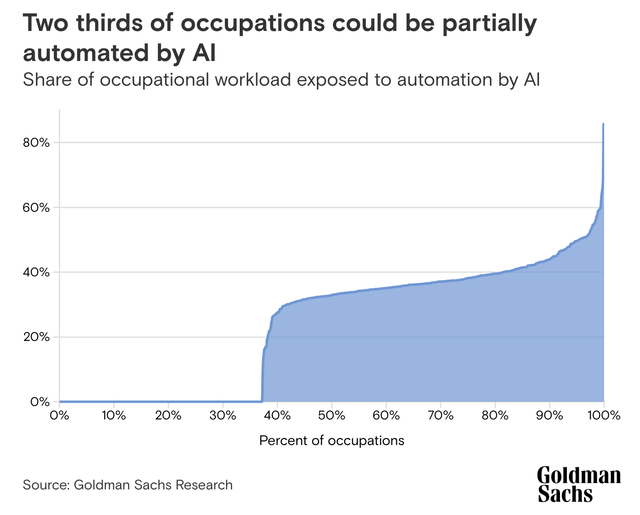

Double clicking and getting more narrowly focused on Goldman Sachs, I would just say we see enormous opportunities for productivity gains and also opportunities for efficiency. Our use cases that we’re testing and that we’re implementing focus on those two areas. But I’d really like to focus to be more on productivity and the ability to scale our smartest people to do more with our clients rather than expecting an efficiency gain that becomes very cost accretive.

So far, so good.

Looking Ahead

Speaking of David Solomon, during the earnings call, he also mentioned that the investment bank is in a great spot to benefit from the early stages of the reopening of capital markets.

Increased market activity, including major IPOs and strong debt issuance, indicates a growing investor appetite and a favorable environment for financial transactions.

As the company is a leader in its field, it’s poised to benefit from elevated transaction volumes.

Moreover, the company sees opportunities in artificial intelligence (“AI”) and is actively advising clients on its implications and applications.

As we look longer term, to the extent that this technology develops in line with expectations, there will be significant demand for AI-related infrastructure and as a result, financing, which will be a tailwind to our business. For our own operations, we have a leading team of engineers dedicated to exploring and applying machine learning and artificial intelligence applications. We are focused on enhancing productivity, particularly for our developers and increasing operating efficiency while maintaining a high bar for quality, security and controls. Like with any emerging technology, a thoughtful approach and keen eye on risk management will be crucial. – GS 1Q24 Earnings Call

In general, the company believes that two thirds of all jobs could at least be partially automated.

Goldman Sachs

Adding to that, the company commented on the health of the economy. While I may be a bit more bearish on the economy, the bank believes that despite macroeconomic uncertainties, including inflation concerns and geopolitical tensions, the health of the U.S. economy remains strong.

Mr. Solomon also commented on the market’s euphoria, which I found very interesting:

I’m also mindful that U.S. equity markets are hovering near record levels at a time when we see – when we continue to see headwinds, including concerns around inflation, the commercial real estate market and escalating geopolitical tensions around the world. – GS 1Q24 Earnings Call

I believe these comments are extremely important, as it’s about something I cannot stop talking about. Especially if the Fed is “forced” to keep rates higher for longer, we could see tremendous stress on the economy, especially in commercial real estate. I discussed this in a recent article.

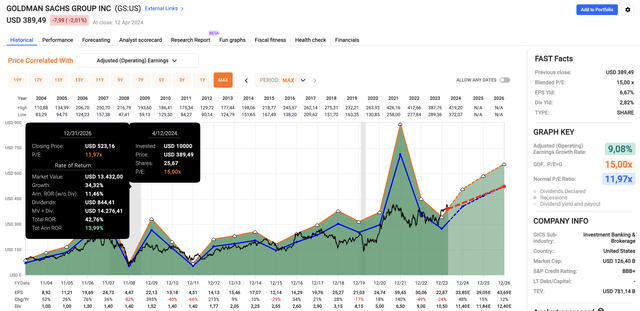

Valuation wise, we’re dealing with a company trading at a blended P/E ratio of 15.0x, which is a few points above its long-term normalized P/E ratio of 12.0x.

FAST Graphs

The good news is that analysts are extremely upbeat about the company’s future.

As we can see in the chart above (FactSet data), the company is expected to grow its EPS by 48% this year, potentially followed by 15% and 12% growth in 2025 and 2026, respectively.

While these numbers are prone to adjustments and down from 52%, 14%, and 18%, respectively, in my prior article, they indicate a path to 14% annual returns (including its 2.8% dividend).

That said, I have to stick to what I wrote in my prior article as I’m just not ready to buy Goldman with the market trading at 21x earnings. Especially with the realization that the Fed may have to apply a “higher-for-longer” approach, I believe we may be able to buy Goldman on a potential market dip down the road.

Although I wouldn’t even short the stock with my enemy’s money, a lot of success in the industry relies on the Fed achieving a soft landing. When adding that so much good news has been priced in during recent weeks, I continue to give Goldman Sachs stock a Hold rating.

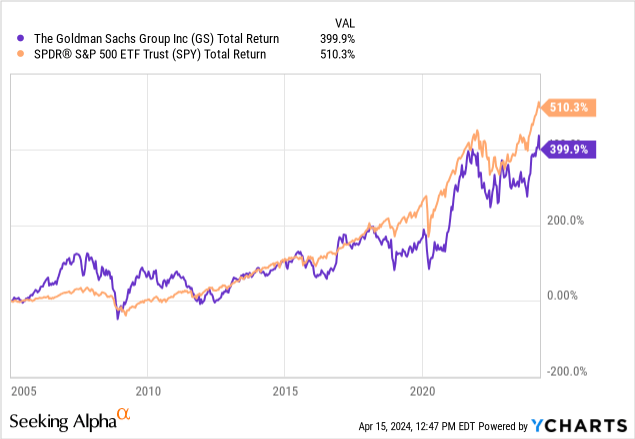

I’m saying this because Goldman tends to be prone to corrections and recessions. Due to a number of severe sell-offs, the bank has returned just 400% since January 2005.

Don’t get me wrong, 400% is decent. However, the market has returned more than 510% with much better diversification.

As much as I like how well Goldman is doing in this environment, I have to be careful in this market environment – especially when dealing with financial stocks.

I’m bullish on its long-term performance.

Takeaway

Goldman Sachs’ exceptional performance in 1Q24 shows its resilience and strategic advantage in navigating volatile markets.

With soaring net revenue and earnings beating expectations, the company showed strength across the board, including investment banking and asset management.

Notably, its focus on productivity gains and efficiency bodes well for sustained growth.

However, in light of market euphoria and macroeconomic uncertainties, caution is warranted.

While analysts expect elevated future earnings growth, I maintain a cautious stance due to potential market fluctuations and a big part of Goldman’s appeal relying on elevated growth expectations.

Pros and Cons

Pros:

- Strong Performance: GS has reported outstanding results in 1Q24, with impressive net revenue and earnings exceeding expectations.

- Diverse Revenue Streams: The company’s diversified operations, including investment banking, asset management, and private banking, mitigate risks and enhance stability.

- Efficiency Improvements: GS’s focus on productivity gains and cost management reflects a commitment to long-term growth and profitability.

Cons:

- Valuation Concerns: With a blended P/E ratio above its long-term average, GS has to turn elevated growth expectations into reality.

- Market Volatility: Given historical corrections and recessions, GS’s stock is prone to market fluctuations, which warrants caution in turbulent times.

- Macroeconomic Uncertainties: Amidst inflation concerns and geopolitical tensions, the health of the economy remains uncertain. This poses risks to GS’s performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.