Goldman Sachs: Continues To Offer Enormous Valuation Opportunity

Summary:

- Earnings Surge: Goldman Sachs beat Q1 2024 EPS estimates by 33%.

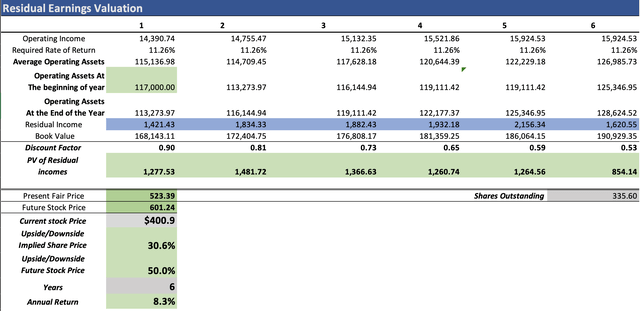

- Valuation: Using a residual earnings model, I concluded that the stock is undervalued by 30.6%, with a future price projection indicating an 8.3% annual return.

- Market Position: Holding second place in investment banking with a 6.7% market share, Goldman Sachs remains competitive against peers.

- Risks and Outlook: Market sentiment and industry growth pose risks, but with profitability improvement, Goldman Sachs offers a compelling investment opportunity, even with lower EPS estimates compared to consensus.

ATGImages/iStock Editorial via Getty Images

Thesis

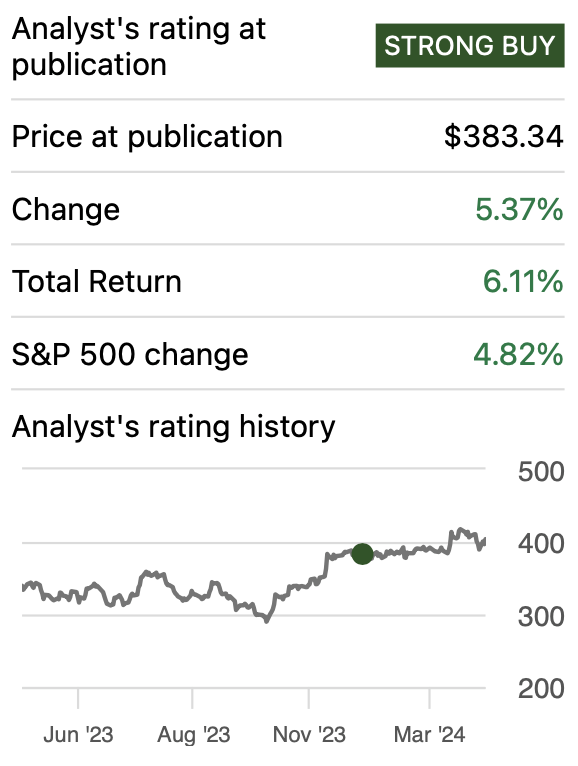

In my previous article on Goldman Sachs Group, Inc. (NYSE:GS), I presented two models that suggested a near-term upside in the range of 12.7-41.4%. Meanwhile, the potential annual returns throughout 2028 were in the range of 21.6-33.2%. For this reason, I rated the stock as a “strong buy”. Since that article, the stock has gone up by 5.37%.

Goldman Sachs released Q1 2024 earnings on April 15, 2024, where Goldman beat EPS estimates by an ample margin of 33%, and revenue by 9.89%. This surprise EPS beat was due to a strong trading and investment banking performance.

In this article, I re-evaluated the stock based on the previously mentioned earnings report. After that, I arrived at a fair price estimate of $523.39 which is 30.6% higher than the current stock price of $400.90. Then, I also calculated a future stock price for 2029, which came out at $601.24 which translates into annual returns of 8.3%, which underperforms the market. However, because of the 30.6% upside, I maintain my strong buy rating on the stock.

Seeking Alpha

Overview

Growth Plan

Goldman Sachs is projected to start retroceding from its failed retail banking experiment, the only thing the company can do to grow is M&As and increase the quality of their core services to attract new customers to which they can charge commissions.

How does Goldman Sachs Compare to Peers?

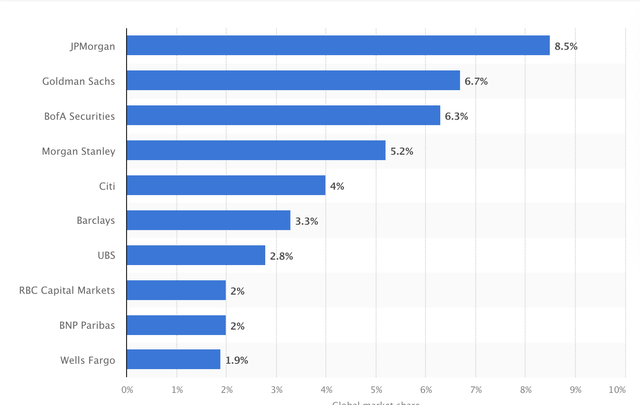

JPMorgan Chase & Co, (JPM) is the leading investment bank with its 8.5% market share. Goldman Sachs comes in second with 6.7% and Bank of America Corporation (BAC), comes in third with 6.3%, only 0.4% behind Goldman Sachs.

Industry Outlook

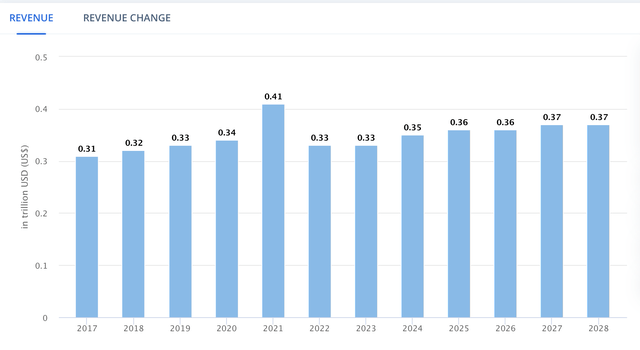

The global investment banking market revenue is expected to grow at a CAGR of 1.4% throughout 2028. In 2023, the market witnessed a collective revenue of $330B; for 2028, that revenue is expected to increase to $370B.

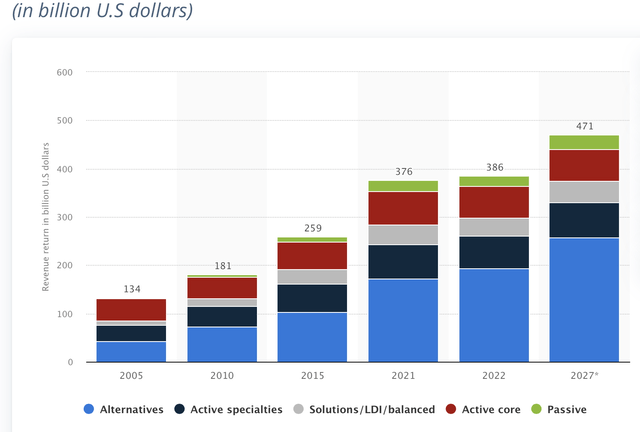

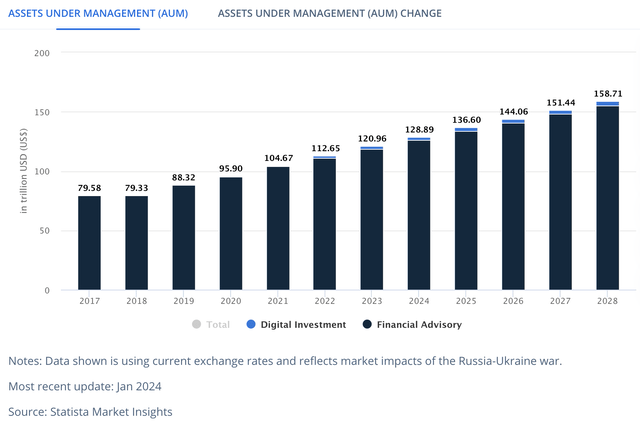

Meanwhile, Worldwide Asset Management and Wealth Management, are expected to grow at a pace of 4.40% and 5.90% respectively throughout 2027 and 2028 accordingly. The addressable market of asset management stands at$402.98B as of 2023, and that of wealth management stands at $120.96T in assets. For 2027, the addressable AUM for Wealth Management is projected to stand at $158.71T, and in 2028, the potential addressable revenue for Asset Management will go up to $471B

Valuation

To value Goldman Sachs I will use a residual earnings model. The first step is to calculate the discount rate. For this, I am employing a simple CAPM model. The beta is from Marketwatch. The result was a required rate of return of 11.264%.

| CAPM | |

| Risk-Free Rate | 4.634% |

| Beta | 1.14 |

| Market Risk Premium | 5.816% |

| Required Rate of Return | 11.264% |

Then, I need to calculate the net operating assets. To do this I subtracted cash reserves and current liabilities from total assets. The result was $117B. Then, I also need the book value, which came out at $173.67B. Lastly, I divide them by the 2024 TTM revenue of $46.72B to get margins tied to revenue that could help me project the value of both figures throughout the projection.

| Operating Assets | 117,000.0 |

| Book value | 173,674.0 |

| Operating Assets / Revenue | 250.40% |

| Book Value / Revenue | 371.69% |

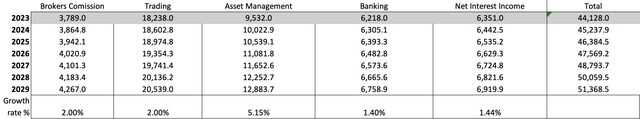

Then, I need to predict the possible revenue that each segment could earn. The first thing that you will note is that trading revenue will grow at a 2% rate annually. The reason why I chose this growth rate is that it’s impossible to predict how much Goldman would earn from trading in a specific year, however, they aren’t going to consistently lose money every year, so for that reason I choose 2% which is in-line with the FED’s inflation target. This will also be the growth rate for brokers’ commissions.

Then, asset management will grow in line with the asset management market at 5.15% annually. Meanwhile, Underwriting & Investment Banking will grow at 1.40% annually, in line with the worldwide investment banking market. Lastly, the net interest income from Goldman’s retail banking operations will grow at 1.44% annually as the US Traditional Banking Market.

Then, to calculate operating income, I need to first calculate net income. For that, I decided to use the 2018-2024 TTM average net income margin of 25.24%. Then I added the taxes that would be paid on a net income like that with the help of the current tax expense, which stands at 21.44%.

| Revenue | Operating Income | Plus D&A | Plus Interest | |

| 2024 | $45,237.9 | $14,390.7 | $19,092.09 | $26,097.67 |

| 2025 | $46,384.5 | $14,755.5 | $19,575.99 | $26,759.12 |

| 2026 | $47,569.2 | $15,132.3 | $20,075.98 | $27,442.58 |

| 2027 | $48,793.7 | $15,521.9 | $20,592.74 | $28,148.96 |

| 2028 | $50,059.5 | $15,924.5 | $21,126.96 | $28,879.21 |

| 2029 | $51,368.5 | $16,340.9 | $21,679.39 | $29,634.35 |

| ^Final EBITA^ |

Finally, I will also suggest which could be the stock price for 2029. To do this I used the future expected book value and the undiscounted residual incomes, which you can see in blue in the model below.

The fair price suggested by the model stands at around $523.39 which is a 30.6% upside from the current stock price of $400.90. Then, the resulting stock price for 2029 is $601.24, which translates into annual returns of 8.3% throughout 2029.

How do my estimates compare with the average consensus?

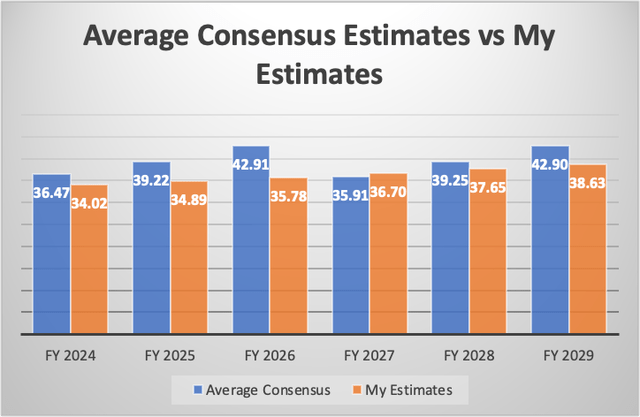

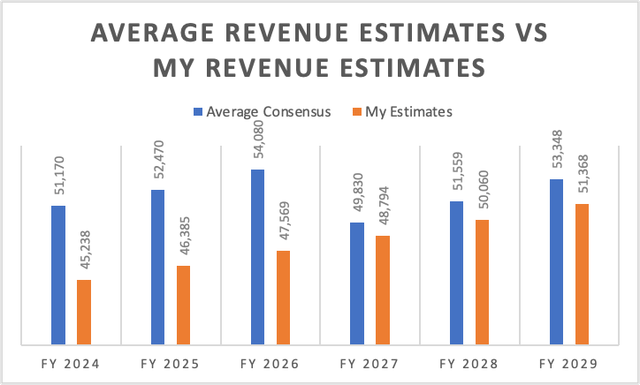

If I did a model based on the available analysts’ estimates, the yielded fair price per share would be $589.44, which is a 47% upside from the current stock price of $400.9. The future price for 2029 of this hypothetical model would be $622.95 which implies 12.2% annual returns.

It’s worth noting that my EPS estimates are overall 8.03% lower than the average EPS estimates. For instance, My EPS estimate for 2024 is 6.71% lower than the average EPS estimate of $36.47. For 2025 the difference is 11.05% and for 2026 it’s 16.63%.

The reason for this is that my revenue estimates are also lower, by around 7.38%. For 2024, 2025, and 2026, my revenue estimates are 11.59%, 11.60%, and 12.04% lower than the average revenue estimates. Furthermore, there isn’t much difference between my net income margins and those derived from the average EPS and revenue estimates, which is 25.39%.

| My Net income Margins % | Average Net IncomeMargins Estimates | |

| 2024 | 25.24% | 23.92% |

| 2025 | 25.24% | 25.09% |

| 2026 | 25.24% | 26.63% |

| 2027 | 25.24% | 24.19% |

| 2028 | 25.24% | 25.55% |

| 2029 | 25.24% | 26.99% |

Risks to Thesis

The main risk for my thesis is that Goldman Sachs needs to keep being competitive in deal-making, and asset management, and They needs to keep making positive returns in trading. The difference between these operations across many competitors is slim. Therefore it could be very easy for Goldman Sachs to go downhill.

The second risk is that investment banking, asset management, and brokerage fees are slow-growing industries. Retail banking was a big promise for Goldman Sachs as it could fill the company with cash if it was done right. Therefore, the most important growth engine Goldman Sachs has is the ability to improve profitability.

Lastly, there is the risk that market sentiment maintains the stock value suppressed because ultimately the stock can be undervalued by a significant percentage. Still, if the other investors don’t buy into the story, the stock could remain flat or display very little upside that would underperform the overall market.

Conclusion

In conclusion, according to my calculations, the stock remains considerably undervalued considering the future residual income it can generate. my calculations yielded a fair price estimate of $523.39, which is 30.6% above the current stock price of $400.90, and a future stock price of $601.24 which translates into 8.3% annual returns throughout 2029.

The only risk associated with this thesis is that Goldman Sachs relies on its ability to attract new clients to its investment banking, asset management, and brokerage services, and on its ability to generate consistent returns in the case of trading. Therefore, it’s easy for things to go wrong.

Nevertheless, because of the incredibly high upside potential and because Goldman has been a company that has operated for decades, I think that they can remain alive, and therefore deliver enough to achieve my estimates, which are 8.03% lower than the average consensus regarding EPS.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.