Summary:

- Goldman Sachs shares have risen by 57% in the past year, outperforming the market, aided by solid trading, asset inflows, and a resilient business model.

- The company’s business model is less sensitive to interest rates and credit losses compared to traditional banks, providing downside protection.

- While Goldman’s core business is performing well, further multiple expansion may be difficult with shares already past 12x, leading to a “hold” rating from a buy previously.

v0v/iStock Editorial via Getty Images

Shares of Goldman Sachs (NYSE:GS) have been a very strong performer over the past year, rising by 57%. It has less direct interest exposure than other banks, with a greater emphasis on trading and investment banking services, which has aided results this year. I last covered Goldman in December, rating shares as a “buy,” and since that recommendation, the stock has returned about 32%, far ahead of the market’s 17% gain. While the outlook for lower interest rates may help increase deal activity, given shares’ large run, now is a good time to revisit whether Goldman is still a buy.

In the company’s second quarter, Goldman Sachs earned $8.62 on $12.7 billion of revenue as its business benefited from an improved trading environment as well as higher markets. In general, Goldman has less sensitivity to interest rates and to credit losses than peers. Unlike traditional banks which primarily make loans, loans are just 11% of its assets, with most assets being securities used in its trading business. These loans tend to be focused toward its private wealth and large corporate customers.

As a consequence, during periods of economic stress, Goldman should be somewhat more insulated from higher delinquencies and credit losses. Indeed, in Q2, it took just $282 million in provisions for credit losses, down by half from last year. I would expect credit costs to remain fairly low, considering its business model, as well as my view that the US is unlikely to enter a recession.

Similarly, while most banks make money by taking deposits and lending those funds out to earn a net interest spread, this is a relatively small piece of Goldman’s business, at about 25% of revenue. While declining interest rates could be a headwind for some bank’s net interest revenue over time as they earn less on assets, GS is somewhat insulated. In fact, while many banks have seen net interest margin (NIM) compression over the past year due to rising deposit costs, Goldman earned $2.2 billion of net interest income in Q2, up from $1.6 billion last year.

It has benefitted from reinvesting securities at higher all-in yields, and it has also begun to see a recovery in noninterest-bearing deposits after declining balances over the last year. GS has a smaller but fairly stable deposit base. It has $433 billion in deposits, which is up 1% from last year. This was down nearly 2% sequentially, which often happens in Q2 as its wealth customers make tax payments in April.

It is also important to note that not only does Goldman have a model relatively insulated from these challenges, but that its core business is also performing well.

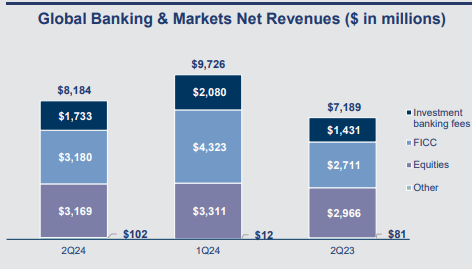

Global banking & markets is its biggest unit, and last quarter revenue rose by 14% to $8.2 billion. Investment banking fees were up a strong 21% from last year, led by much more debt underwriting activity as well as a more modest rise in advisory activity. Inside the investment bank, GS earned $815 million of net interest income. It carries $123 billion of loans out of $1.4 trillion of assets, given most of its assets support its trading business.

Goldman Sachs

Revenue tends to decline sequentially as there is less debt issuance, typically during Q2 than Q1. Importantly, I see reasons for optimism going forward. First, its trading business benefits from periods of higher volatility. More volatile markets create more opportunities, and lower liquidity increases the value of its intermediary activity, connecting buyers and sellers. Volatility has been higher in recent weeks, which should support better Q3 results. With the VIX having so much time near 10, volatility has likely been about as low as it can be, which supports solid trading activity into 2025.

I would also note that advisory rose by 7% to $688 million. This unit should benefit from increased advisory opportunities around M&A. Markets are now looking for 75-100bps of policy easing by the Federal Reserve this year, with a further ~100bps of cuts next year. Lower debt funding costs should make acquisitions more feasible. In fact, it already appears the dealmaking business may be exiting its thaw. Last week, Mars agreed to buy Kellanova (K), the largest food transaction in years. On Monday, Advanced Micro Devices (AMD) announced a bolt-on deal while Couche-Tard is seeking to buy the owner of 7-11 convenience stores (OTCPK:SVNDY). This should support more advisory and debt underwriting revenue in 2025, especially as Goldman was ranked first in M&A and second in equity and fixed income financing.

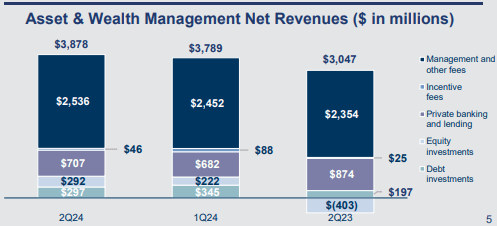

Additionally, asset & wealth management revenue rose by 7% to $3.9 billion. Asset management rose by 7% to $1.1 billion, with wealth management revenue was up 8% to $1.4 billion. While the majority of its revenue comes from recurring management fees, incentive fees rose by 84% to $46 million. It also made nearly $600 million from its own equity and debt investments, after taking losses related to commercial real estate last year. It has $40.7 billion of alternative assets on its balance sheet, down by $3.3 billion due to principal paydowns.

Goldman Sachs

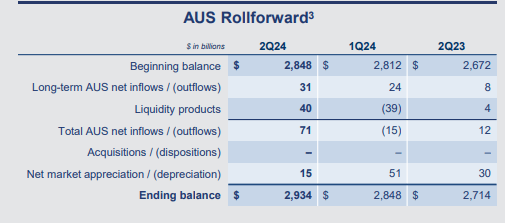

The unit has $2.9 trillion in total AUM, including $2.2 trillion in long-term products, which generate better economics than liquidity funds. It also has $1.5 trillion in wealth assets, which tend to earn higher fees than institutional accounts. While much of the industry has faced pressure from passive products, Goldman saw inflows from third-party distribution, institutions, and wealth management, totaling $71 billion total. Elevated markets and organic growth should support further revenue

Goldman Sachs

Goldman remains a very well capitalized bank with a 14.8% common equity tier 1 (CET1) ratio, up 40 bps year to date. Thanks to this capital position, it did $3.5 billion of buybacks in Q2 and also raised its dividend by 9% to $3, giving shares a 2.4% yield. Its share count is down about 3.5% over the past year, and I expect a similar pace of share count reduction over the next year.

Back in December, I saw the company earning about $37 this year, and the company is on track to earn about $37-$37.50 this year, aided by a bit stronger interest income and a somewhat smaller build in advisory revenue than I forecast. With the potential for somewhat more volatility and a more favorable Fed backdrop for its investment banking unit, I see the potential for the company to earn $40-42 next year, based on a higher average S&P in wealth management and a ~10% rise in M&A-related revenues. That gives shares a forward multiple of about 12.5x, in keeping with my fair value from December. Shares are also just past the 1.5x book value (book value is $327) I targeted.

Essentially, Goldman’s business is well positioned, but the market is better reflecting this. With about a 6% capital return yield and low single-digits long-term growth, shares appear fairly valued. Accordingly, I am downgrading shares to a “hold.” While it is insulated from some pressures facing the industry, further multiple expansion is likely to be difficult, and I expect GS to perform more in-line with the market, rather than continue outperforming.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.