Summary:

- Goldman Sachs Q1 earnings beating revenue and EPS expectations.

- The bank has benefited from strong market conditions supporting a rebound of dealmaking activity.

- We suggest caution toward the stock as the macro backdrop shifts with the potential that climbing interest rates pressures growth going forward.

simonkr/E+ via Getty Images

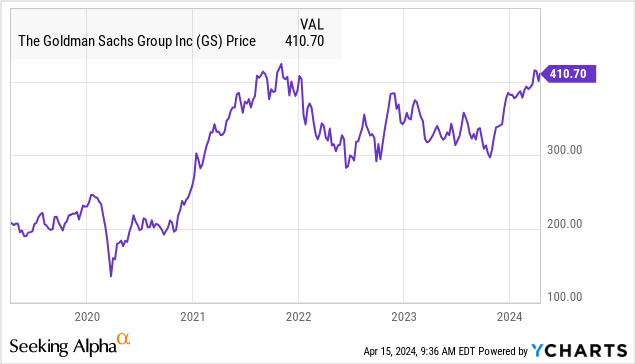

The Goldman Sachs Group Inc (NYSE:GS) reported its latest quarterly results, highlighted by a solid beat to Wall Street revenue and EPS estimates. The global investment bank has benefited from the strong market conditions to start the year, driving a rebound of activity across its key businesses compared to a more challenging 2022 and 2023.

The stock is up more than 20% over the past year, and back to within a few points of its all-time high. It’s clear to us that management efforts to improve operating and financial efficiency are paying off.

While we view Goldman as an industry leader with a positive long-term outlook, we also see some room for caution toward shares at the current level. A new round of macro uncertainty could represent headwinds for growth into the second half of the year.

GS Earnings Recap

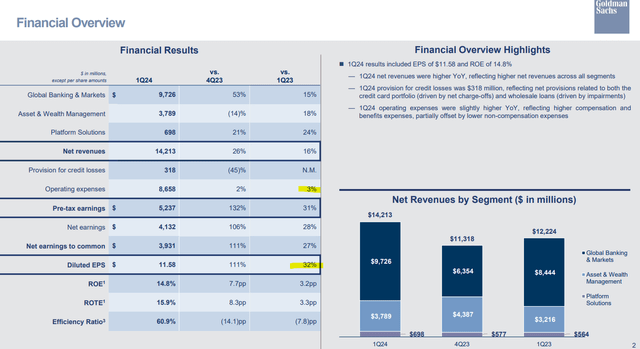

GS Q1 EPS of $11.58 was up an impressive 32% from Q1 2023, well above the $8.68 consensus. The result was achieved as net revenues climbed by 16% y/y, more than $1.4 billion higher than expected, even as operating expenses increased just 3% y/y. That dynamic is reflected in an improved efficiency ratio, reaching 60.9% compared to 75% in the period last year.

Earnings this quarter benefited from a lower provision for credit losses, declining by 45% from Q4 to $318 million. Here the company is assessing lower aggregate distress across its platform alongside what has been a resilient economy with otherwise stable lending charge-offs.

source: company IR

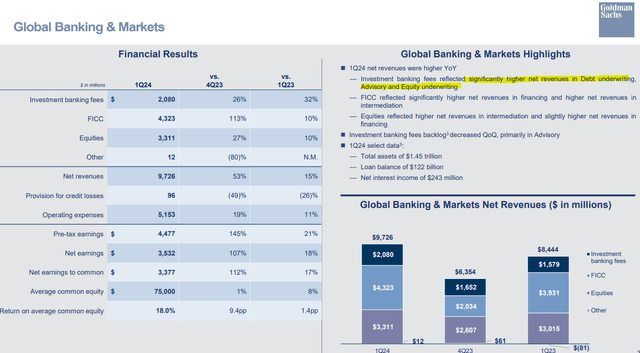

Within the Global Banking & Markets segment, revenues climbed by 15% y/y with investment banking fees even higher with a 32% y/y increase. In this case, Goldman is seeing strong debt and equity dealmaking and demand for advisory against a weaker 2023.

The appreciation of asset prices over the past year, accompanied by positive risk sentiment, has led to a recovery of M&A transactions, which is historically Goldman’s specialty.

Similarly, that same market momentum has supported the Asset & Wealth Management business where assets under supervision reached a quarterly record of $2.85 trillion, primarily driven by higher equity prices. Platforms Solutions, covering consumer products like credit cards, have also been a growth driver, with revenues up 24% y/y.

Goldman management is projecting confidence in its outlook, citing its interconnected franchises as keeping the company well-positioned to navigate the market environment.

source: company IR

What’s Next For GS?

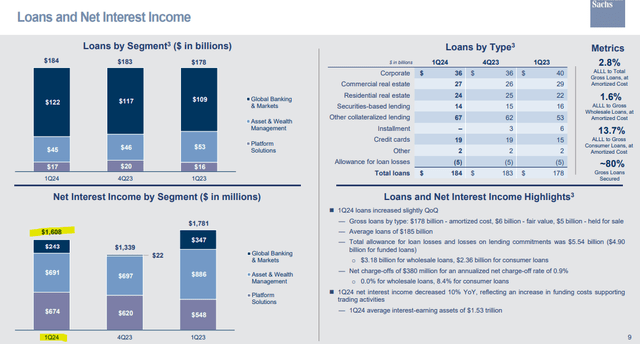

If there was a soft spot in Goldman’s Q1 earnings, we can point to the weaker trends in loans, roughly flat sequentially from Q4. As interest rates have climbed, this has pressured credit demand while also impacting the firm-wide net interest income, which fell by 10% y/y given higher funding costs.

As we see it, the concern here is that while the last several months have been defined by optimism that a restrictive interest rate environment would get some relief with looming Fed rate cuts, recent macro data including stubborn inflation readings has pushed back on that timetable.

Interest rates are back to near 2023 cycle highs as a somewhat surprising turn of events. By this measure, we can expect Q2 to continue presenting tepid loan growth and stagnant net interest income.

Entering the second half of the year, Goldman will face tougher comps from 2023 that could make it harder to significantly outperform, particularly if the economy starts to exhibit signs of a gradual deterioration in the labor market or consumer spending.

source: company IR

Is Goldman Sachs Undervalued?

Ultimately, Goldman needs risk sentiment to remain strong, powering asset prices higher as a tailwind for its global banking & markets business.

While that scenario can still play out, the question becomes how much of the apparent “goldilocks” expectations have been priced in, with the stock now above $400 per share.

Any setback to the macro narrative, also eyeing geopolitical developments could introduce some downside to growth over the next several quarters.

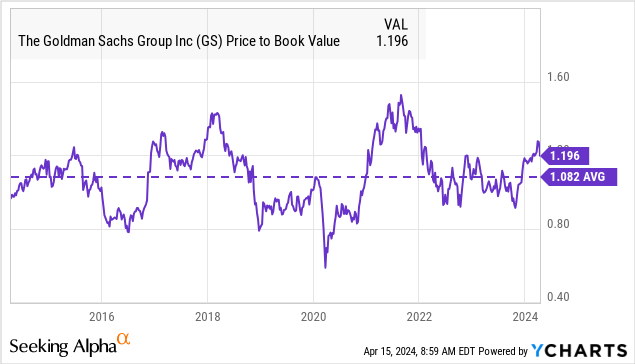

As it relates to valuation, the metric we’re looking at suggests shares are fairly valued, at least not standing out as exceptionally cheap or expensive. We can point to a current price-to-book multiple of 1.2x which is near the average over the past decade of around 1.1x.

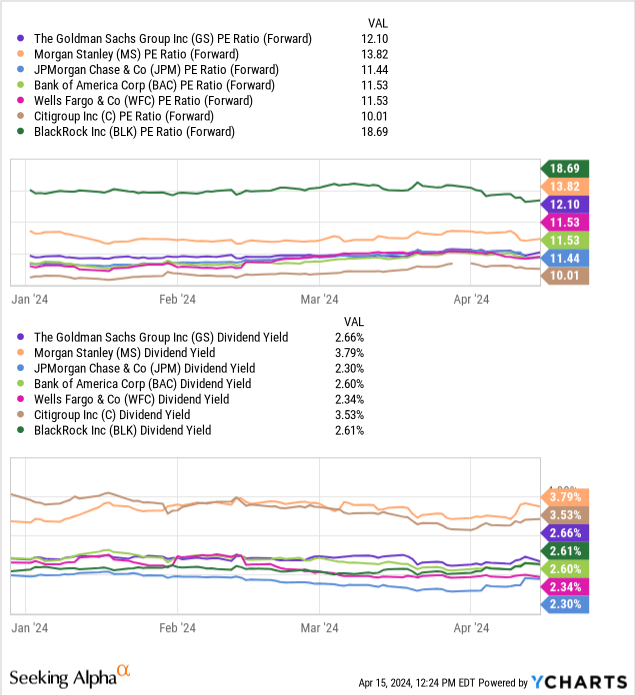

GS is trading at a 12x forward P/E, based on the 2024 consensus EPS of $33.35. Even with some room for estimates to be revised higher following the latest Q1 earnings strength, we’re not convinced the stock deserves a significantly higher multiple from here, already at a premium to names like JPMorgan Chase & Co (JPM) at 11x or Citigroup Inc (C) at 10X.

Compared to Morgan Stanley (MS) which is at 14x, Goldman has strategically moved to diversify its business into areas like consumer products including its credit card platform solutions in recent years.

While that effort has been positive toward top-line growth, the consequence is that the operation has shifted more towards a traditional bank like JPM or C, compared to MS or even BlackRock Inc (BLK) more concentrated in wealth management and investments. In other words, we think GS stock is accurately valued relative to the sector.

That line of thinking is also backed up by the stock’s dividend yield of 2.7% which is near a group average of around 3%, considering names like C closer to 3.5%, and JPM at 2.3%

Final Thoughts

We rate GS as a hold at $400, with an expectation that the second half of the year will be more difficult and shares will be challenged to break out higher in the current economic backdrop with rising uncertainties.

Monitoring points over the next few quarters include the evolution of provision for credit losses as an indicator of loan portfolio health, as well as financial performance metrics like the return on equity and efficiency ratio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.