Summary:

- Banks are recession favorites due to their high exposure to advisory and lending activities during tough times.

- In the year so far, Goldman Sachs has netted earnings on par with all of 2023. However, the deal-making landscape going forward is likely to be very challenging.

- Goldman Sachs is working on shedding its exposure to the highly stressed credit card industry and transforming more into an advisor for businesses.

Pgiam/iStock via Getty Images

Banks are recession favorites for a number of good reasons: when rates stay high, lending activities generate greater revenue. When crunch times hit businesses, advisory services regarding restructuring, debt underwriting, et al. generate greater revenue. Banks tend to be “value” investments; there’s often very little by way of costly technology accruing obsolescence or over-planned facilities (beyond a handful of very nice HQs). The head honchos’ cleaver tends to run swift and true if “deadweight” needs to be shed deadweight, whatever said weight tends to be.

The Goldman Sachs Group, Inc. (NYSE:GS) stands very tall among all its peers numbering in the tens of thousands around the world: as per the Financial Stability Board established by the G20 intergovernmental forum, it’s currently deemed a “Global Systemically Important Bank” (G-SIB) and is widely considered to be a bellwether for what the industry’s outlook is likely to be going forward.

The company’s Q2 results announced on the 15th of July landed it some additional cheer. The company’s Earnings Per Share (EPS) for Q2 outperformed expectations by 30 cents, while revenues stood at $12.73 billion versus an expectation of $12.46 billion. While not as strong as the outperformance in Q1, wherein EPS stood at a whopping $11.58 versus an expectation of $8.56 and revenues of $14.21 billion versus an expectation of $12.92 billion, it was still a net positive. Outperformance against expectations isn’t altogether unusual, since bank analysts often tend to be somewhat conservative.

Trend Drilldown

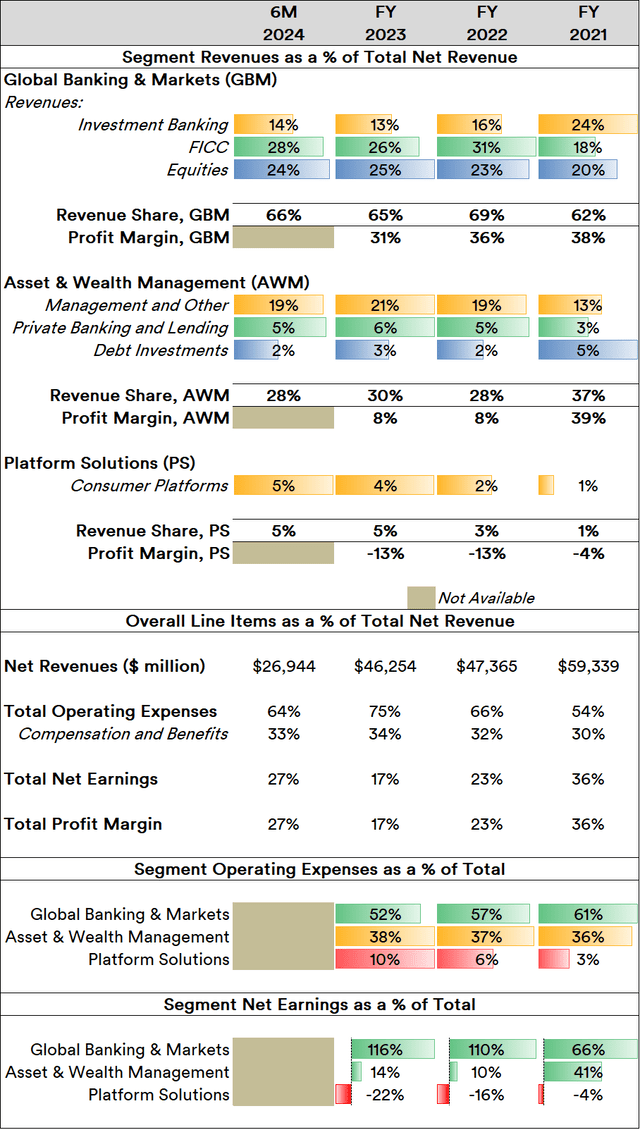

To understand long-term trends, the relationship between different line items within the company’s units and the bottom line needs an examination:

Source: Created by Sandeep G. Rao using data from Goldman Sachs’ financial statements

The company’s “Global Banking & Markets” (GBM) division is by far the most prominent breadwinner. Over the past three full Fiscal Years (FYs), GBM has progressively grown bigger in its contribution to total net earnings. Within GBM, the market-facing Equities and FICC (“Fixed Income, Currency & Commodities”) have taken the lead over the Investment Banking unit and are differentiated by relatively narrow margins. In fact, advisory-driven Investment Banking comes second to revenues generated via managing client assets in the “Asset & Wealth Management” (AWM) division – effectively moving from 4th place in FY 2021 to 3rd over the first six months (6M) of 2024. Within AWM, Private Banking runs steady in terms of contribution.

Overall, GBM drives nearly twice as much revenue as AWM does. The company’s “Platform Solutions” (PS) division is a consumer services division, which is primarily driven by credit card issuances and point-of-sale financing to consumers via GreenSky Holdings, LLC. Acquired at the end of Q3 2021, GreenSky has consistently been a negative earner for the company ever since its acquisition. GreenSky was sold to a Sixth Street-led consortium in Q1 2024, which would ordinarily imply that the forward-looking outlook for this division should improve. However, the language of the company’s annual report for 2023 seems to suggest that it’s possibly looking to exit consumer lending altogether: the company’s collaboration with General Motors Company (GM) for the issuance of credit cards will be transitioned to another bank to the satisfaction of the latter. Outside of this, the company also accepts deposits from Apple Card customers. Once the GM relationship is transitioned out, the company will “mostly” remain a bank for institutions and high-net-worth investors.

Quick Note: In this article, “net revenue” or “revenue” refers to what banks refer to as “Revenue Before Provision for Loan Losses”. Since banks are in the business of lending and/or holding market assets on their clients’ behalf, banks must arrange to cover for potential losses by effectively “putting aside” a certain proportion of earned revenues so that they’re readily available. Of course, actual losses incurred can sometimes exceed provisions made in certain circumstances.

While AWM does tend to run a little high in expenses relative to revenue and earnings contributions when compared to GBM, it bears remembering that the typical cycle of business dealings between clients and the company often runs between these two divisions. As Chairman and CEO David Solomon stated in print at the top of the Q2 earnings release:

Our One Goldman Sachs operating approach is allowing us to bring the whole firm to our clients, deepening our relationships and serving them in an improving, but complex environment.

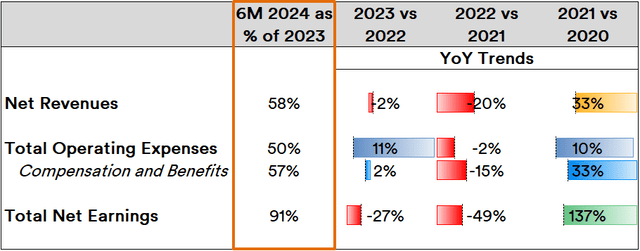

Division-wise earnings and expense breakdowns aren’t made available in quarterly earnings releases. However, on an overall basis, the company shows a number of encouraging trends:

Source: Created by Sandeep G. Rao using data from Goldman Sachs’ financial statements

Net revenues are trending up relative to 2023, which largely negates negative but consistently improving trends seen over the past two years. This is reflected even more strongly in net earnings: battling a similar negative yet improving trend, net earnings are now almost on par with that of the entire past year.

While net operating expenses are exactly at the halfway mark relative to last year, compensation and benefits are almost exactly aligned with that of net revenues. This is for good reason. While much ado is made about technology and platforms among investors seeking to pin competitive advantages for the typical “tech” stock, the majority of the technology employed by banks either tends to be vendor-supplied or tends to be developed in-house along largely similar lines across most major banks.

Banks’ core “technology” is people: be it the uniformed tellers of the branch frequented by a wage earner or the immaculate ‘Savile Row-draped’ advisor to a billionaire venture capitalist, people drive the business’ success of the business. While the technology to log trades, process balances, and communicate with regulators is crucial, it’s secondary to how well the people of the company can connect with clients. While the bulk of executive compensation is typically loaded into the second half of the year and there’s always the likelihood that certain banks might pay a number of executives well exceeding the company’s performance for that year, there’s usually an obtuse set of reasons behind this that isn’t directly related to year-wise earnings performance.

In Goldman Sachs’ case, at least for this year so far, the compensation uptick seems justified given the massive earnings bump.

Headwinds

While the company has been fairly upbeat about the company’s forward outlook for the rest of the year, other banks have offered a somewhat cautionary note despite strong performance. Over the past week, Citi CFO Mark Mason noted during Citi’s investor call that a surge in revenues came from debt markets in particular and mostly due to issuance being brought forward anticipating headwinds in the latter half (H2) of 2024. This was also generally true for Goldman Sachs: its Q2 earnings were boosted by higher fees from debt underwriting and a strong performance in its fixed-income trading business.

JPMorgan CFO Jeremy Barnum stated the same underlying factors as Citi’s as the driving force behind their Q2 performance, adding that refinancing rather than new financing for acquisitions was writ large in debt markets. Mr. Barnum also stated that the IPO market (which would be on the equity market side of the equation) wasn’t “quite as good as you would otherwise expect” as private equity companies don’t want to sell at current prices and because midcap tech stocks (which is where companies that are most likely to go public would end up) hasn’t matched the performance shown by “Big Tech”, notably the Magnificent Seven. In short, the “flight of capital” to a select number of companies as macroeconomic concerns remain prevalent dampens the prospect of listing success. While Goldman Sachs was fairly strong in its M&A (Mergers & Acquisitions) fee collection in the first half (H1) of the year, it also noted that M&A activity was running well below its 10-year average.

Macroeconomic concerns lay heavy on the Federal Reserve’s latest annual stress test for banks. Credit card loans, in particular, were considered to be a leading cause of problems for most banks’ financial health, with the potential loss on Goldman Sachs’ credit card loans marked as being among the worst under the central bank’s hypothetical scenario. This lends an increasing sense of urgency for the company to dispose entirely of its GM and Apple credit card portfolio.

Goldman’s stress test performance also resulted in a higher core equity capital requirement – from 13% to 13.9% of risk-weighted assets – due to the fact that it continues to have a number of volatile assets on its balance sheet that should ideally be farmed out to outside firms. New capital requirements being mulled, however, might favor the likes of Goldman Sachs more so than smaller banks.

In Conclusion

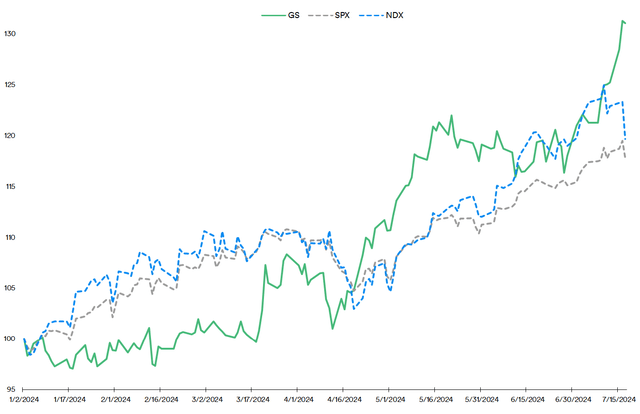

When considering market performance in the Year To Date (YTD), it bears remembering that the company has massively outperformed relative to the broad market S&P 500 (SPX in index form; SPY in ETF form) as well as the “tech-heavy” NASDAQ 100-Index (NDX in index form; QQQ in ETF form).

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

This was not the case until after the 12th of April, wherein an uptrend began that largely priced the company at a higher premium relative to both indices. Right around the time that Q2 earnings releases began in earnest and included a number of big banks, this uptrend strengthened even more.

An increased dividend payout, a potentially friendlier capital requirement environment coming soon, possible disposal of its credit card commitments, and a leadership position even among the best “Big Banks” are the pros for the company. On the downside, however, is the potential for the disposal of credit card commitments to be delayed and a lackluster client environment manifesting based on macroeconomic issues.

The company can reasonably be expected to continue to do comparatively better than many of its rivals, both big and small, even in challenging circumstances. The fact that banks tend to be “recession favorites” is, of course, another argument in favor of the stock.

Q3 results will likely prove to be an interesting read.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.